XLTRADE prop firm has been operating in the prop firm industry since 2014 but severely lacks transparency and quality customer support. There is no live chat available and information given about their services is lacking. The firm offers funding from 50k to 1 million USD and then an unlimited amount using a scaling plan. We do not believe it is possible to offer unlimited funded accounts unless there is something shady going on there. Another red flag is the firm has a 1.74 FPA score and has submitted numerous fake and positive reviews to the platform. To get exact details regarding rules, limits, and other important conditions, it is required to sign up for a guest account.

We went through all the procedures to offer unbiased and objective details in our XLTRADE review below. Reading this review is a faster way to get all the details about the firm.

Pros & cons of XLTRADE prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to diverse assets such as Forex pairs, indices, commodities, stocks, and cryptos

- Support for automated trading

- High profit sharing (90%)

- Most payment options are free and instant

Cons

- Expensive fees from 250 USD

- Minimum funded amount starts at 50k USD

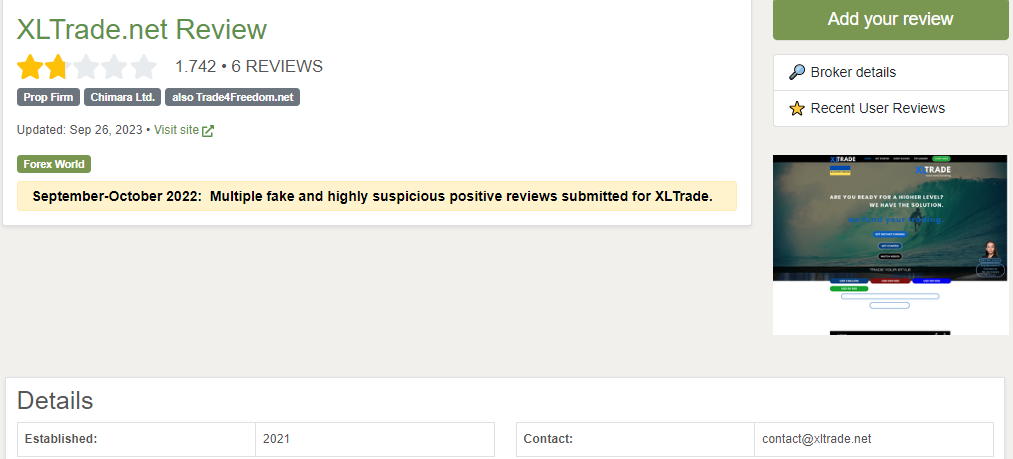

- Has a 1.7 score on the FPA with multiple fake reviews notice

- Limited educational resources

- Lack of live chat support

Quick rating of XLTRADE and its features

| FPA Score | 1.742 |

| Year founded | 2014 |

| Headquarters | London, United Kingdom |

| Minimum audition fee | 250 USD (with 20% discount) |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 50,000 USD |

| Maximum funded amount | 1,000,000 (unlimited with scale) |

| Allowed daily loss | No limits |

| Profit target | 10% |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 90% (weekly payouts) |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, indices, commodities, cryptos, and stocks |

Safety of XLTRADE – 1.5

XLTRADE reviews are not satisfactory on the FPA as there are only 6 reviews and the total score is 1.7. The FPA administration has noticed multiple suspicious positive fake reviews on the platform, indicating the firm may not be an honest actor. In our review methodology, we take FPA notices and scores very seriously, and this is probably a major red flag for any prop firm. We advise our readers to exercise extra caution with this firm. The firm has some decent experience in the industry, having been around since 2014 giving it a huge experience. Despite this experience, they still did not manage to get high review scores from traders. Despite this, it still gets a score for having more than 3 years of experience in the industry. Looking for the next component of our safety evaluation, XLTRADE does not disclose the exact details about its partner brokers. We assume they do not offer trading through a regulated broker. As a result, the firm loses points in this component.

The firm gets a 1.5 score in this section.

XLTRADE Funding and maximum capital allocation – 3

XLTRADE funded programs start at 50k and go up to 1 million USD. The funding options are not diverse and only include 50k, 100k, 500k, and 1 million USD.

XLTRADE funding scheme has no lower options beyond 50k, which is unfortunate.

The XLTRADE challenge is not difficult to achieve, but the fees are very expensive. Getting funded will require 60 days of trading on any funded accounts from 50 to million USD.

XLTRADE prop trading firm offers an unlimited ceiling for funding when the trader becomes elite, meaning passing their 1 million USD challenge. We find this claim very suspicious as no prop firm offers unlimited maximum account balance as long as they are fair and reasonable. So, a minor red flag here for sure.

There is a unique XLTRADE scaling plan, allowing traders to reach up to 5 million USD in funding by combining multiple 1 million accounts. Account gets an extra 25% funding every three months, so it is a painfully lengthy process to start and grow big. This means traders need to purchase the large account funding right from the beginning to grow it reasonably.

The firm gets a 3 score in this section.

XLTRADE Assets – 4.5

XLTRADE offers a diverse set of asset classes such as Equity Indices, Stocks, Forex, Cryptos, Metals, and Commodities. As we can see, the range of assets is diverse and allows traders to easily select their preferred instruments for trading.

The firm gets a 4.5 score in this section.

XLTRADE Trading rules and limitations – 1.9

XLTRADE rules measure if a trader can achieve profit targets within certain risk parameters consistently and give traders funded accounts from 50k USD.

The only way to see the exact rules and limitations is to get a guest password, meaning you will need to enter information including email and phone number. After the guest password is given, you can log in and see all the condition details. This is very inconvenient for the firm’s side and forces its users to give private information details to the firm.

The rules for completing the evaluation and becoming a funded trader are:

- Trading period – 60 days (divided into two 30 days cycles)

- Profit target for each cycle – 10%

- Maximum drawdown – 5%

- Daily loss limit – Unlimited

- Minimum trading days – None

- Lot size restrictions – None

- Trading Strategies Restrictions – None

- Maximum leverage – 1:500

- Automated trading – Allowed

It is possible to shorten the evaluation period from 60 to 30 days in case the trader shows exceptional performance:

- Risk exposure – 1% or less

- Maximum drawdown – 2%

These rules are not easy to achieve without decent experience in trading and are probably targeted at experienced traders.

The firm gets a 1.9 score in this section.

XLTRADE Fees – 2.5

The starting fee for the smallest account of 50k USD is 250 USD. While this is an acceptable cost for 50k, the firm does not offer any lower funding for lower fees, which is a downside.

XLTRADE free trial is not available for getting a live funded account and traders are required to pay the fees. 100k accounts require a fee of 630 USD, 1590 USD will be the cost for 500k accounts, and 1 million accounts will cost 2990 USD. These offerings are very competitive as they allow traders to manage large amounts of capital with small one-time fees. The current costs are low because there is a discount even going on with a 20% price cut, and the original costs will be high after the event.

XLTRADE free repeat is allowed if a trader’s balance stays higher than the starting balance, but does not achieve performance targets. In this case, no fees will apply for resetting the challenge.

XLTRADE Platforms – 4.1

The only information that is indicated on the website is that the firm offers MT4 and MT5 platforms. It allows all kinds of strategies including automated trading bots EAs. This is very advantageous for algo trading enthusiasts. Since there are no limitations, traders can use the full capabilities of both MT4 and MT5 platforms, and the firm gets a high score in this category. There is no web trader version of these platforms and the firm loses some minor points. There is a guest mode for both platforms and users can see the spreads and other details before jumping into the very advantageous evaluation process.

We evaluate the platforms of XLTRADE with a 4.1 score.

XLTRADE Profit-Sharing – 4

XLTRADE profit split is at 90% and payouts are processed weekly. There are no lower or higher options, which is very convenient. Weekly withdrawals ensure traders can make a living with their trading activities. However, there are several red flags mentioned above, and we advise extra caution with this firm.

Withdrawals are processed quickly and with zero commissions, at least that’s what the firm claims. We assume withdrawals are processed within 1-2 business days, as there is no live chat to contact the support and get exact details. So we will give the firm half the score for 1-2 business day withdrawals.

XLTRADE gets a 4 score in this section.

Education and trading tools at XLTRADE – 1

There are no educational resources available on the website except the blog. The blog has only posts about general trading topics and there are no trading courses, websites, or video tutorials. The video tutorials only teach how to use the firm’s services like trading account details and trading platform guides. Performance measure tools are limited as well together with any market research tools such as the economic calendar. So, traders have to track everything themselves and ensure they do not break any rules. The firm needs to work more on transparency and trading services quality if it plans to become competitive.

XLTRADE gets a 1 score in this section for offering only a blog.

Customer Support at XLTRADE – 2.6

There is no live chat, which is a huge downside for XLTRADE. From other forms, both email support and phone support are offered. Another downside is that both the website and support are only available in the English language.

The firm gets a 2.6 score

Frequently Asked Questions

Is XLTRADE legit?

Is XLTRADE cheap?

What trading platforms are available at XLTRADE?