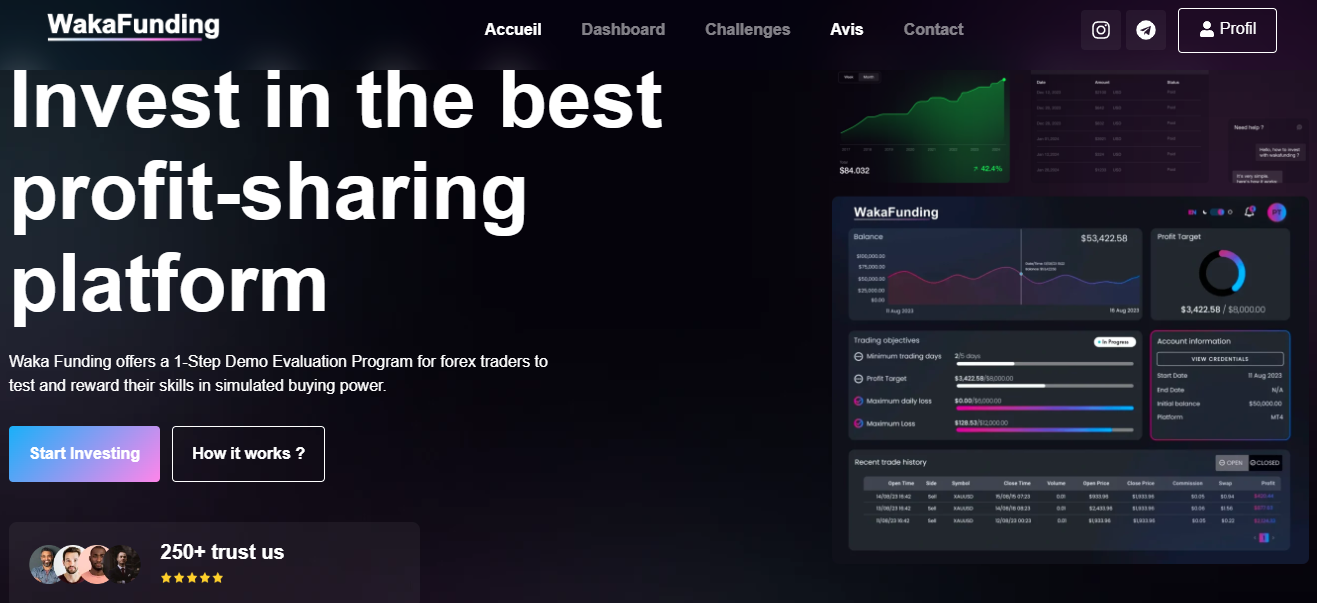

WakaFunding prop firm offers funded account challenges ranging from 25k to 200k US dollars. The firm is not beginner-friendly, as it does not offer lower funded accounts. It has somewhat strict rules with a 4% daily risk limit and a 10% profit target, leaving a very small window for risk-taking. The firm falls short in offering a decent customer support service as it lacks live chat, which is the most efficient way to contact prop firms. To ensure we assess the firm professionally, we decided to take a closer look at its services.

In this WakaFunding review, we are going to closely assess the firm’s critical features including safety, funding options, fees, assets, support, platforms, and more.

Pros & cons of WakaFunding prop firm

Pros

Ability to withdraw with $0 fees

Offers access to MetaTrader 4

Fast and digital account opening/verification

Most payment options are free and instant

Starts with a low 50% profit split, increasing slowly over time

Does not offer access to live markets

Lacks legitimacy and safety

Cons

Low daily loss limit of 4%

Only offers Forex, metals, and indices for trading

Lacks proper live chat and hotline support, relying solely on Telegram and email, available only in English

Offers no webinars, courses, or comprehensive educational materials

Quick rating of WakaFunding and its features

| FPA Score | Not yet rated |

| Year founded | 2023 |

| Headquarters | Unknown |

| Minimum audition fee | 275 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 200,000 USD |

| Allowed daily loss | 4% |

| Profit target | 10% |

| Maximum trailing drawdown | 8% |

| Profit sharing (Payouts) | 50% (up to 80%) |

| Trading Platforms | MetaTrader 4 |

| Available trading markets | Forex, metals, indices |

Safety of WakaFunding — 0

There are no WakaFunding reviews on the FPA, which makes it difficult to confirm the firm is legitimate and safe. On the Trustpilot, the firm has just around 30 views where 32% are 1-star evaluations, which is already a pretty bad start for any prop firm that aims to dominate the sphere. The firm seems not competent enough to allow traders to withdraw profits freely. This indicates that WakaFunding might be a scam, and it can not be trusted for the moment being. The firm also only offers simulated accounts and traders can not access real markets and real funding, which is another serious red flag. No regulated broker backs the firm’s trading services, meaning WakaFunding acts as a broker itself, which is a direct conflict of interest and is a huge red flag that can not be underestimated. The absence of a regulated broker and the fact that WakaFunding offers its own price feed on simulated accounts confirms that the firm is highly risky, and we do not advise our traders to do business with such proprietary firms.

The firm gets a 0 score in this section for being young, having bad reviews, and not offering trading services through a regulated broker.

WakaFunding Funding and maximum capital allocation — 2

WakaFunding funded programs are not diverse as the firm only offers 25k, 50k, 100k, and 200k USD funded options. There are no lower accounts for beginners, which is a downside for the firm. WakaFunding funding accounts all are 1-stage programs where traders need to hit the profit target once to achieve the funded status and start trading a simulated or demo account.

All WakaFunding challenges are demo accounts and traders can not access live markets, which is a red flag and drawback. Traders are given unlimited days to achieve the 10% profit target while maintaining super strict risk control. After they hit the profit target, they are eligible to become experienced traders or start trading on a funded account within 72 hours. So, after the trader hits the profit target, they have to wait 3 more days to start trading on a demo account for profits. This is frustrating and makes it a lengthy process to start trading for profits at WakaFunding and can be considered a red flag.

WakaFunding scaling plan is not active yet and traders have to combine accounts if they want to increase their funding, which means more costs for them. Overall, WakaFunding receives a 2 score in this section.

WakaFunding Assets — 1.5

WakaFunding prop trading assets are few as the firm only allows Forex pairs, indices, and commodities. From commodities, there are only metals available at the moment. We can only hope the firm improves both its safety and asset diversity soon. Overall, WakaFunding receives a 1.5 score in the assets section for offering few instruments.

WakaFunding Trading rules and limitations — 1.1

WakaFunding rules are tough to follow, as traders are required to maintain daily risks below 4%. The maximum drawdown is 8% and the profit target is also high at 10%. The firm has no trading days limiter and traders can complete this profit target at their own pace. Automated trading through Expert Advisors is allowed, and news trading is also possible. Traders can hold open positions overnight, which is good. The minimum trading days are 5, meaning traders must trade at least 5 trading days before they can be eligible for a funded phase. Together with strict daily risk rules, the firm requires a high-profit target, and all this trading is done on simulated accounts, which is never a good thing. Combining these rules and simulated accounts, we have a firm that can not be recommended to our readers. Overall, the firm receives a 1.1 score in this section for strict rules.

WakaFunding Fees — 1

WakaFunding fees are expensive as the firm only offers funded challenges from 25k USD, which is a high minimum funding amount. The fees for each of the funded options are 275 USD for the 25k account, 375 USD for 50k, 575 USD for 100k, and 975 USD for the 200k accounts. There is also a commission for trading based on a trading volume. The commission is 6 USD per lot traded, and the firm promises very low spreads in return, but we could not confirm it is near 0 pips.

WakaFunding free trial is not offered at the moment, and traders should buy accounts to test the firm’s conditions. WakaFunding free repeat is not active either, making it impossible to start over without paying fees when traders fail the evaluations. The firm gets a 1 score in this section for only offering low spreads near 0 pips and having expensive fees.

WakaFunding Platforms — 3.5

The firm provides its traders with an advanced MetaTrader 4 platform and allows the use of EAs and custom indicators. The platform offers advanced features and traders can use these tools to comprehensively analyze markets with technical analysis. However, they need to download and install the platform to use its capabilities. The firm also has a trader dashboard and trading platform built-in, but the MT4 is much more useful for conducting proper trading activities and analysis.

Overall, WakaFunding gets a 3.5 score in this section for offering average trading experience with MT4.

WakaFunding Profit-Sharing — 1

WakaFunding profit split starts from 50% for the first withdrawal. The payout increases by every consecutive profit withdrawal, it increases and reaches up to 80%. These incremental increases happen every 2 weeks, and we could not find out the exact percentage the profit sharing is increased. To become eligible for profit withdrawals, traders need at least 30 days of trading, which is a very lengthy time and the only reason the firm would elongate the withdrawals is if it makes money from fees. This is further confirmed when we add the simulated accounts to the picture. All trading even after getting funded is conducted on demo accounts, which directly indicates the firm makes money by collecting trader fees and has no capital of its own to support prop trading. Overall, for offering poor withdrawal policies, WakaFunding receives a 1 score in this section.

Education and trading tools at WakaFunding — 0.5

WakaFunding falls short of educational resources. It does not offer webinars, trading courses, or video materials, which is a huge drawback for this firm. The firm does not offer a trading blog either to support traders with insights and interesting posts with trading tips. There is a trader dashboard that offers a trading journal to Its traders, which is not sufficient but still useful. Overall, the firm gets a 0.5 score in this section.

Customer Support at WakaFunding — 1.4

Although the firm has a Telegram support channel, it still lacks a proper live chat, which is a huge disadvantage. While Telegram is popular, it still requires installation and account creation to just contact the firm, which is very inconvenient. There is an email support option offered, but both the support and website are only available in the English language, which is disadvantageous as well. There is no hotline or contact us page, which is a red flag in itself. The firm gets a 1.4 score in this section for lacking crucial support channels like live chat and hotline.

Frequently Asked Questions on WakaFunding

Is WakaFunding legit?

Is WakaFunding a good prop firm?