Try2BFunded prop firm was established in 2018 by Score Priority Prime Ltd, which is a Singapore-based financial services provider company that was part of the Whotrades Traders community. The firm has some 5 years plus experience in the industry, which adds to its legitimacy. The firm has processed some staggering amounts of 195 million withdrawals since its establishment and has a total of 31,000 accounts created. Try2BFunded offers hotline support among other options, which is always a good sign as many suspicious prop firms do not offer phone support. The range of funded options is from 30k to 100k USD trading capital which can be scaled up to 250k with a scaling plan.

In our comprehensive Try2BFunded review, we are going to employ an advanced review methodology and conclude whether you can trust the firm and if its offerings are attractive to our readers. So, let’s start.

Pros & cons of Try2BFunded prop firm

Pros

- Ability to withdraw with $0 fees

- No daily loss limits

- Fast and digital account opening/verification

- Offers access to two US stock exchanges, NASDAQ and NYSE

- Lower profit targets of 0% on pro and 6% on the classic accounts

- Over 5 years in the industry, with a significant volume of withdrawals and accounts

- Most payment options are free and instant

- Allows overnight and over-the-weekend open trading positions

- Fewer trading rules and limitations

Cons

- A maximum drawdown limit of 4% might be restrictive for some trading strategies

- While very flexible, the no daily loss could also increase risk for undisciplined traders

Quick rating of Try2BFunded and its features

| FPA Score | Not yet rated |

| Year founded | 2018 |

| Headquarters | Hong Kong |

| Minimum audition fee | 100 USD per month + 300 USD one-time fee |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 30,000 USD |

| Maximum funded amount | 100,000 USD (250,000 with scaling) |

| Allowed daily loss | None |

| Profit target | 6% (0$ on pro) |

| Maximum trailing drawdown | 4% |

| Profit sharing (Payouts) | 80% |

| Trading Platforms | Custom platform |

| Available trading markets | Indices, stock markets (NYSE, NASDAQ) |

Safety of Try2BFunded – 3

Try2BFunded reviews are lacking on the FPA, as there is not even an entry about the prop firm in the platform database. On the Trustpilot, however, Try2bfunded managed to get a 4.1 rating, with the majority of votes being 5-star reviews. The firm is registered in Hong Kong, meaning it falls under the regulations of the Securities and Futures Ordinance (SFO). The SFO requires prop firms and brokers to register and hold a license, meaning Try2BFunded is a regulated entity offering financial simulated trading services.

Try2BFunded has two partner brokers, Just2trade which is regulated in Cyprus, and Lime Broker regulated in the USA.

The firm gets a 3 score in this section, losing points for not being reviewed and rated on the FPA platform while offering a certain level of safety through its regulated services and 5+ years of experience in the industry.

Try2BFunded Funding and maximum capital allocation – 3

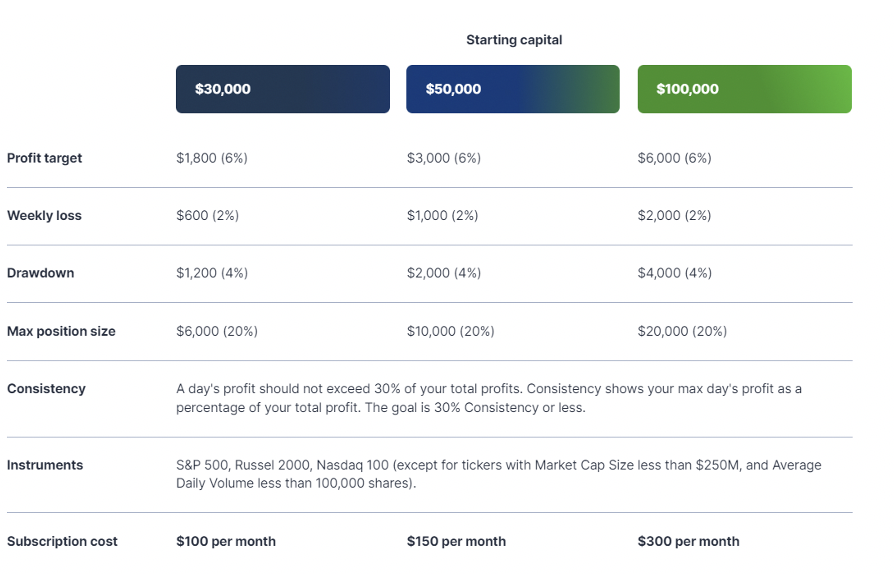

The Try2BFunded funded program allows traders to manage large accounts including 30,000, 50,000, and 100,000 USD. There is no option for lower amounts of capital, which is understandable as the firm selects traders for NYSE and NASDAQ exchanges and stock trading requires larger capital than Forex and other markets. Try2BFunded challenges consist of two main programs, a qualification program and a straight funding program with up to 250,000 USD stock trading accounts.

Try2BFunded funding offers the opportunity to get funded in two ways, using a straight funding account option, or a qualification account challenge. Traders can start withdrawing profits after reaching a 6% profit margin.

Try2BFunded scaling plan is for traders offering up to 250,000 USD trading capital on funded accounts. Since stock trading requires significantly more capital than FX trading, the minimum 30k account is understandable, and we slightly changed our approach in this section.

However, the firm still loses points for not offering a higher maximum funding amount.

For offering a decent range of funding options for stock trading, Try2BFunded gets a solid 3 score in this section.

Try2BFunded Assets – 2

The firm allows traders to speculate on equity and indices markets. The popular trading instruments offered by Try2BFunded include S&P 500, Russel 2000, and NASDAQ-100. As for stock trading, any ticker can be traded, except for shares with a market cap size below 250 million USD and an average trading volume per day below 100,000 shares. With these offered assets, we can say that Try2BFunded is a stock trading prop firm focusing on one market and offering diverse funding options. These restrictions on market cap size and daily volume ensure traders only deal with high-quality shares and are exposed to much less volatility and financial risks during trading. For offering only two asset classes, the firm gets only a 2 score in this section.

Try2BFunded Trading rules and limitations – 4.2

Try2BFunded rules are straightforward without hidden rules, allowing traders to get what they see on the website.

While the firm allows positions to be held overnight, it is not recommended that traders run open trades overnight or over the weekends, allowing traders superior flexibility. The time needed to get funded depends on the trader’s performance, but minimum trading days are set to 10, meaning traders have to trade at least 10 trading days to get funded.

Daily loss is not restricted, but we have got weekly and maximum drawdown levels of 2% and 4% for the classic account. The profit target is 6% and the maximum position size is set at 20% (6,000 USD for 30k, 10,000 USD for 50k, and 20,000 USD for 100k accounts.

Pro accounts come with even fewer restrictions, as there are no profit targets or weekly loss limits. The maximum drawdown limit is 4% and the position size is 20%.

Here is the list of notable rules by Try2BFunded:

● Daily loss limit — None

● Maximum drawdown — 4%

● Weekly drawdown — 2%

● Maximum position size — 20%

● Profit target — 0% for pro, 6% for classic

● Minimum trading days — 10

● Overnight positions — Allowed

● Open positions over the weekends — Allowed

Weekly and overnight positions are allowed and there are no other restrictions set by the firm, so it gets a 4.2 score in the trading rules and limitations section.

Try2BFunded Fees – 4

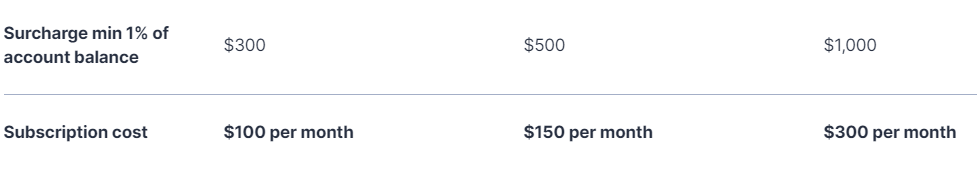

The fee structure is flexible and cheap at Try2BFunded. The smallest funded account of 30,000 USD comes with a 100 USD monthly subscription fee, while 50k and 100k will cost 150 and 300 USD per month respectively.

The firm offers one of the cheapest fees for setting up and trading on a substantial funded account, giving it higher points in this section.

Try2BFunded free repeat is available as traders can always start anew if they fail. All the other specs seem very promising and legitimate. Also, the trader will have to pay the drawdown limit to skip the evaluation phase and start trading right away. Try2BFunded gets a 4 score in the fees section.

There is also a demo account to test the firm’s services and offerings for free.

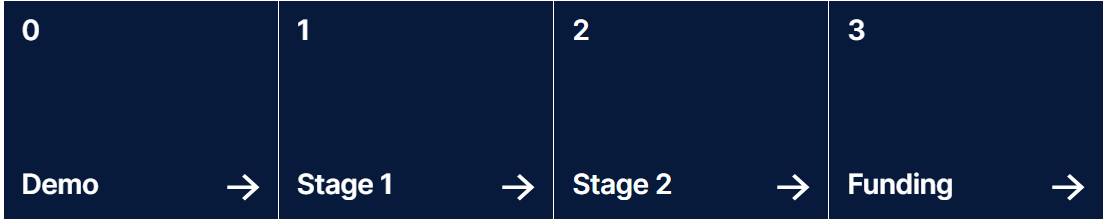

The firm right now offers demo -> Stage 1 -> Funding. It is possible to skip the challenge and start trading on a funded account right away for a fee.

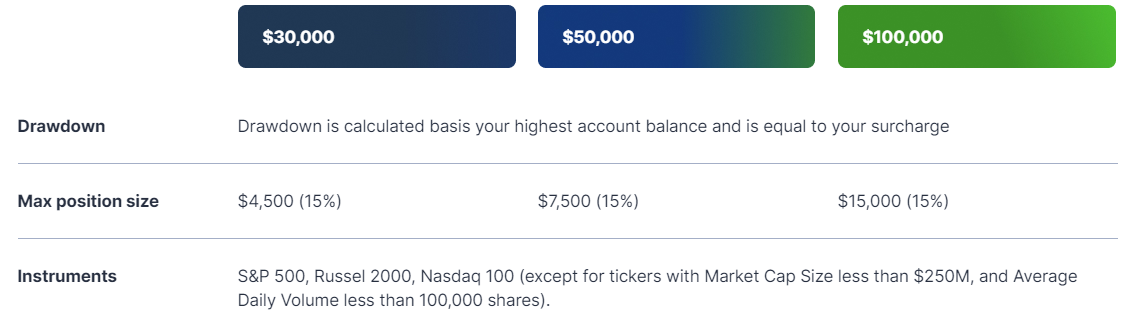

Try2BFunded has a very flexible system if a trader wants to start trading and skip the challenge phase they have to pay a drawdown as a surcharge on the account plus a monthly subscription fee. F.e. if a trader wants to get a 50,000 USD account with a 2% drawdown, they will need to pay a surcharge of 1,000 USD and this gives them a funded account right away with a 2% (1,000 USD) drawdown.

Try2BFunded Platforms – 2.4

Try2BFunded prop trading platform is an advanced web trading application that offers a full range of functionality while being easy to use for beginners and pros alike. The platform allows traders to access the U.S. stock markets including NYSE and NASDAQ, allowing traders to speculate on a wide range of stocks above 250 million market cap and 100,000 daily shares volume.

Try2BFunded trading platform offers customizable price charts and trading with orders, allowing traders to place orders directly from the chart, allowing a high level of convenience. The sidebar allows traders to choose preferable watchlist settings and even set alerts when trading with volatile stocks. Other top features include built-in live chat, light and dark themes, news and sector lists, alerts, and system notifications. There is a demo account available for beginners to check and test the trading platforms, features, spreads, and fees. All the pricing data on the demo account is in real time.

Traders can see their trading statistics to monitor their progress toward becoming funded traders. The platform is mobile-friendly and is accessible from both Android and iOS.

All in all, the firm gets a 2.4 score and loses minor points for not offering any popular desktop software like MetaTrader 4, MetaTrader 5, or cTrader.

Try2BFunded Profit-Sharing – 3

Try2BFunded profit split is set at 80%, allowing traders to withdraw a significant portion of their profits on up to 250k USD stock trading accounts. Withdrawals incur no fees and multiple payment options are available. The 80% profit-sharing is a current level and can change shortly as the firm gets more customers. If it is increased to 90% we will update our review and increase the firm’s score and vice versa.

The firm gets a 3 score, losing points for not offering a 90% payout level.

Education and trading tools at Try2BFunded – 5

The firm offers a mentoring program for beginner traders to learn from zero and become profitable prop traders. The lessons in this program are given by experienced traders with practical experience in the stock markets. The mentorship program is not only for mentees, as experienced traders can also sign up to become mentors, share their knowledge and experience, and earn money. This is a unique proposition from Try2BFunded, which allows both mentors and beginners to give and receive knowledge. Try2BFunded has a growing community where traders can share and receive resources, strategies, and market insights from a global trader’s network. The firm has a blog and is represented on a number of popular social media networks including Facebook, YouTube, LinkedIn, Instagram, and more. For offering a unique and wholesome educational experience, the firm gets a 5 score in this section, which is well-deserved.

Customer Support at Try2BFunded – 3.6

Try2BFunded offers excellent support via a number of options including live chat, email support, and hotline support. The presence of hotline support means the firm has nothing to hide, and it fully discloses both address and phone number on its website. The live chat from Try2BFunded is super convenient and allows traders to instantly connect with the broker representatives and solve any issue or get answers to any question regarding prop trading. Traders can also use other channels like email and hotline. Both the website and support modes are only available in the English language. The firm gets a solid 3.6 score in the support department, losing points only for not offering multilingual support and a website.

Frequently Asked Questions

Is Try2BFunded a good prop firm?

Can I trade cryptocurrencies with Try2BFunded?

Is there a demo account available at Try2BFunded for practice?