Traderseed prop firm was launched in 2019 and has been offering unique products ever since. The firm differentiates itself from other prop first by offering higher maximum loss limits of 15% and personalized support, although there is no live chat. Fees paid for each challenge are refunded after the trader passes the first challenge. Traderseed also promises flexible and quick payouts and lower fees from 75 USD. Free restarts are unlimited for funded accounts. Since the firm’s value proposition seems among the best in the prop firm world, we decided to take a closer look at their services and products.

Our Traderseed review will cover all the crucial details about the firm such as safety, assets, funding options, fees, rules, and many more.

Pros & cons of Traderseed prop firm

Pros

- Ability to withdraw with $0 fees, and offers 0 pips spreads

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to Forex pairs, cryptos, indices, and commodities

- Unique Funding and Payout Structure

- Fees are competitive, with a range from $75 to $250

- Most payment options are free and instant

- 15% maximum drawdown limits

- A low fee of 100 or 75 USD for 100k accounts

Cons

- Profit target is 10% which is high

- Lacks FPA score

- The maximum leverage is capped at 1:6

Quick rating of Traderseed and its features

| FPA Score | Not yet rated |

| Year founded | 2019 |

| Headquarters | Birkirkara, Malta |

| Minimum audition fee | 75 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 100,000 USD |

| Maximum funded amount | 1,600,000 USD |

| Allowed daily loss | 4% |

| Profit target | 10% |

| Maximum trailing drawdown | 15% |

| Profit sharing (Payouts) | Fixed |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex pairs, indicted, commodities, cryptos |

Safety of Traderseed – 3

Traderseed reviews are lacking on the FPA, which is a major downside of the firm. The firm has an experience of more than 3 years in the industry, adding to its legitimacy. Its partner broker is EightCap which is a regulated Forex and CFDs broker. Offering trading services through a regulated broker is one of the major components for defining if a prop firm is a legitimate company.

The firm gets a 3 score in this section.

Traderseed Funding and maximum capital allocation – 3

Traderseed funded programs are three 20Challenge, 30X Quest, and Aggressive 20X Challenge. 20X Challenge offers a 15% maximum drawdown, which is almost unheard of in the prop firm industry, and account size doubles after the trader passes each level. After the trader passes the first challenge, their fees are refunded, making trading a risk-free endeavor.

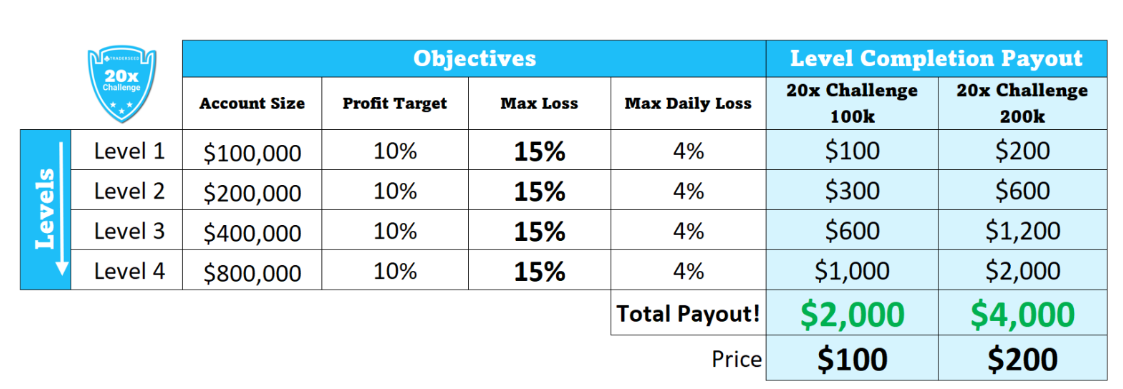

Traderseed funding for the 20X challenge is 100,000 USD demo accounts. After a trader signs up for the challenge and pays fees, they receive credentials. The trader receives a payout after completing each level. The account balance is doubled to 200,000 USD after the trader follows the rules and passes the level 1 challenge. Level 3 offers a 400,000 USD account and 800,000 USD is given for the level 4 challenge.

Traderseed challenges of 30X Quest, and Aggressive 20X Challenge also come with similar starting funded accounts of 100,000 USD but have higher maximum funding at level 5 of 1,600,000 USD. There are minor differences between the three funded account types, which we will discuss in the next sections of the rules.

Overall, Traderseed prop trading funding and payout policies are different and unique than what prop firms generally offer, as they have a fixed payout structure after completing each challenge.

Traderseed scaling plan is activated whenever the trader passes the challenge, the account size is doubled up to 1.6 million USD and payouts are also increased.

The firm gets a 3 score in this section for not offering 1k and 10k accounts.

Traderseed Assets – 3.5

Traders can choose between Major and minor Currencies, Equity Indices, Commodities, and Crypto markets. The conditions are very attractive on EightCap platforms with 0 pips spreads and commissions at 3 USD per lot round turn. Unfortunately, there are no other asset classes like stocks or futures, which makes the firm lose some points in this section.

The leverage is capped at 1:6 which is very low. If the trader wants to increase the maximum leverage, they can take an aggressive 20X challenge, which offers 1:100.

The firm gets a 3.5 score in this section.

Traderseed Trading rules and limitations – 3.9

Traderseed rules are better than most prop firms, with higher loss limits and no lot size limitations. Although the rules are mostly the same for all three accounts, there are minor but important differences.

20x Challenge objectives are defined as follows:

- Starting funding amount – 100,000 USD

- Maximum loss – 15%

- Maximum daily loss – 4%

- Time limits – 60 days

- Trading days – None

- Lot size restrictions – None

- EAs allowed – Yes

- Weekend trading – Allowed

- News trading – Allowed

- Copy trading – Allowed

- Restarts – Free

- Consistency rules – None

- Profit target – 10%

As soon as the trader hits the profit target of 10% they complete the challenge. There are no minimum trading days, but traders have 60 days to achieve goals without breaking rules. When the trader achieves a level 1 profit target of 10,000 USD (10% of 100k account) they immediately get a payout of 100 or 200 USD for 20X challenge 100k and 20X challenge 200k respectively. The firm gives them credentials and a 200,000 USD account with the same rules and a profit target of 10% and so on.

30X Quest has a slightly different requirements structure for each level of challenge. Profit targets for levels 1,2,3,4 and 5 are as follows: 7%, 8%, 10%, 11%, and 12%. Maximum allowed loss starts at 11% for level one and decreases to 10%, 9%, 8%, and 7% on higher levels. Max daily loss starts at 5% for level 1 and changes to 4%, 4%, 4%, and 3% at higher levels. Other rules are the same with allowed EAs, news trading, copy trading, and weekend trading.

The Aggressive 20X Challenge comes with fixed requirements for all levels. The maximum loss is 15%, the profit target is 10%, and daily loss is 4%.

After a trader completes the level 4 challenge, they can restart the challenge for free and start completing challenges again and take payouts.

Traders can only trade on one single challenge at any given time.

The firm gets a well-deserved 3.9 score in this section, which is a very good evaluation.

Traderseed Fees – 4

The fees start from 75 USD to 100,000 USD for 30X Quest accounts and go up to 250 USD at max.

The EightCap broker offers spreads from 0 pips on major pairs, and commissions are below the industry average. This makes it really attractive to trade with this broker.

The Traderseed free trial is not available as all the challenges require a one-time fee, which is later refunded after completing the level 1 challenge.

Traderseed free repeat is unlimited, meaning traders can restart the challenge as many times as they want for commission-free.

The firm gets an excellent 4 score in the fees section.

Traderseed Platforms – 5

Traderseed offers MT4 and MT5 advanced platforms through its regulated broker partner, EightCap. Both platforms offer both manual and automated trading, and the firm allows EAs or Expert Advisors. MT4 and MT5 are exceptional platforms for using EAs and other custom trading software.

Account Metrix Dashboard is a specifically designed dashboard to assist traders in controlling their challenges and tracking performance. Traders will be able to monitor their deadlines for the current challenge, objectives, and daily loss limits. The Metrix updates every minute, ensuring up-to-date live data on the trading account.

The firm gets a 5 score in this section for offering advanced platforms and performance measure tools.

Traderseed Profit-Sharing – 2

Traderseed profit split works uniquely. There is no profit split in a traditional sense, but a fixed payout for completing each trading challenge level. There are 4 or 5 levels and the trader gets a fixed payout for completing each level.

The 20X Challenge consists of 4 levels and the trader gets payouts for 100k accounts and 200k accounts as follows:

Level 1 – 100k payout: 100 USD, 200k payout: 200 USD

Level 2 – 300 USD, 600 USD

Level 3 – 600 USD, 1,200 USD

Level 4 – 1,000 USD, 2,000 USD

As we can see, there are no profits based withdrawals, which has its pros and cons. The biggest advantage is that traders have easier rules and are guaranteed to get a certain payout, the downside being that potential profits for experienced traders are extremely limited.

For other account types, payouts range from 100 to 7,500 USD depending on the starting funded amount and level completed.

It was tricky to evaluate the firm’s profit share policies using our current methodology, as there are no percentage-based withdrawals. We assume the ability to withdraw just 100 USD on the 100k account after making 10,000 USD profits is below even 60% profit share, and the firm loses points in this component.

The firm only supports a Deel payment option.

So, we give the firm a 2 score in the profit share section for offering quick withdrawals but lacking higher payout options.

Education and trading tools at Traderseed – 1.7

Educational resources are limited to only tutorial videos on how to use each of the funded accounts. There are no additional trading courses or webinars, and the firm loses points in these components.

The firm also has a weekly newsletter service that offers an expert glance into the financial markets and can be used by traders to make more informed decisions. Subscription is free and anyone can sign up for their weekly newsletter which is delivered every Monday.

We give the firm a 1.7 score in this section for lacking educational resources but providing performance measure tools.

Customer Support at Traderseed – 1.4

As for customer support options, there is only email support available and both the website and support are only provided in English language. This lack of other support options like live chat and phone support makes it a difficult and lengthy process for traders to contact the firm in case something goes wrong.

The firm gets only a 1.4 score for email support in this section.

Frequently Asked Questions

Is Traderseed legit?

How long does it take to complete a Traderseed trading challenge?

Can I trade assets other than Forex and CFDs with Traderseed?