Offering over 700 different tradable instruments with up to 3 million USD funded account and 80% profit split, Traders With Edge prop firm seems to offer undeniable value to potential funded traders at first glance. The company is registered in Hong Kong and was established in 2022 which makes it a young company. Traders With Edge prop trading firm offers diverse funded accounts for both aggressive and moderate trading strategies, but we have found several issues with this firm.

In our unbiased Traders With Edge review, we will research the firm’s safety, fees, rules, assets, funding options, support, and many more.

Pros & cons of Traders With Edge prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to more than 700 tradable instruments across FX pairs, commodities, cryptos, stocks, and indices

- Has minimum and maximum time limits

- Payouts are given every 14 days

- Support is limited to only email

Cons

- Lower 2.5% daily loss limit

- Withdrawals are processed between 5-10 working days

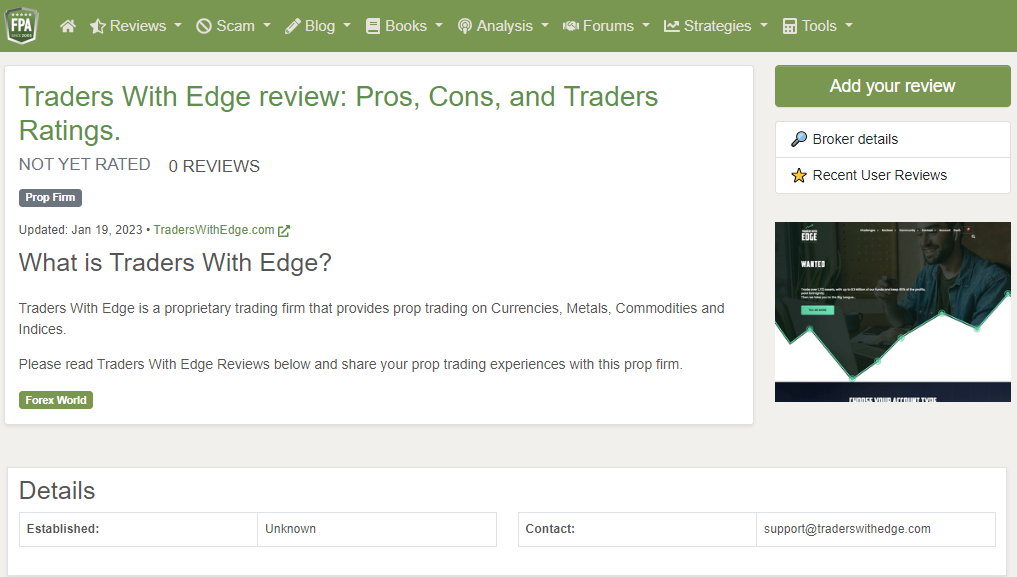

- Not yet rated on the FPA

- Has several obscure trading rules about market manipulation which can be used subjectively

- Website has issues

Quick rating of Traders With Edge and its features

| FPA Score | Not yet rated |

| Year founded | 2022 |

| Headquarters | Sheung Wan, Hong Kong |

| Minimum audition fee | 69 USD |

| Fees on withdrawals | None |

| Minimum funded amount | 2,500 USD |

| Maximum funded amount | 1,000,000 USD |

| Allowed daily loss | 2.5% |

| Profit target | 10% |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 80% |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, commodities, indices, cryptos, stocks |

Safety of Traders With Edge – 1.5

Traders With Edge reviews are lacking on the FPA, losing firm some points in this component. The trading services are provided through the regulated partner broker, EightCap. After searching through the Hong Kong companies registration website, we found out the company was registered as an LTD in Feb. 2022 Feb. This makes it a very young prop firm.

The firm gets a 1.5 score in this section, for lacking FPA reviews and experience in the industry.

Traders With Edge Funding and Maximum Capital Allocation – 4

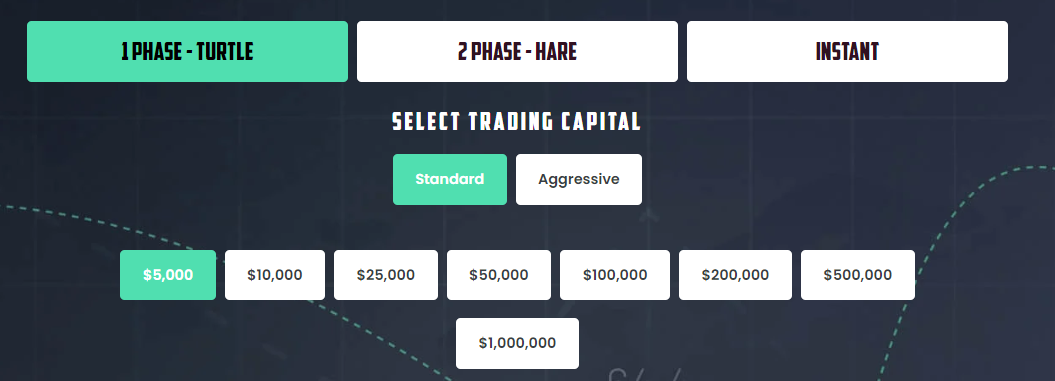

Traders With Edge funded programs consist of three funded account types, 1-Phase Turtle, 2-Phase hare, and Instant. It is possible to avoid the Traders With Edge challenge by purchasing instant accounts.

1-Phase Turtle is divided into standard and aggressive accounts with the same funding options of 5k, 10k, 25k, 50k, 100k, 200k, 500k, and 1 million USD.

The 2-Phase Hare account offers funding options of 5k, 10k, 25k, 50k, 100k, 200k, and 400k USD and is also divided into standard and aggressive types.

Similarly to the other two, Instant accounts also come in standard and aggressive types and offer funding options of 2.5k, 5k, 10k, 20k, and 40k USD. As we can see, the firm offers much lower funding options for the instant account as it requires no additional challenge phase and traders can start trading on live accounts right from the beginning.

Traders With Edge funding options are diverse and enable traders to select the most comfortable option according to their experience and trading strategies.

Trading competitions with 0 fees are periodically offered, which is a great opportunity for traders to test their trading skills and get a funded account.

Traders With Edge scaling plans can be activated by traders and are of two types, organic and rapid. The organic scaling plan is for traders who want to get payouts soon and increase slowly, while the rapid scaling plan offers larger scaling levels. The condition for being eligible for scaling is to be profitable at least 2 months out of 4 months and hit a 10% profit target.

The firm gets a well-deserved 4 score in this metric for offering diverse funding options.

Traders With Edge Assets – 4.5

Over 700 tradable instruments are available on EightCap MT4 and MT5 platforms including assets such as FX pairs, metals, global market indices, commodities, digital currencies, AU, and US stocks. There are 20 crypto pairs in total and all are CFDs, meaning it is possible to instantly buy or sell them to make profits. Forex pairs are also numerous, around 51 in total. Commodities are 5 in total, including oil and metals. Stocks are more than 600 and include many popular companies, enabling stock traders to speculate on a multitude of companies’ prices. There are no other assets offered, such as futures or bonds, and the firm loses a mild point in this component.

We give the firm a 4.5 score in the assets section.

Traders With Edge Trading rules and limitations – 1

Traders With Edge rules are slightly different depending on the funded account type. There are soft rules and hard rules. Breaking hard rules will result in the immediate termination of the funded account. Traders With Edge funded accounts come with the following limitations:

- Profit target – 10%

- Daily drawdown (hard rule) – 2.5% (is balanced based and resets every day)

- Maximum drawdown (hard rule) – 5%

- Minimum time (hard rule) – 10 days

- Maximum time (hard rule) – None

- No manipulation (hard rule) – Not allowed

Market manipulation includes limits on trading strategies such as scalping. Traders are not allowed to hold trading positions for less than 30 seconds. Arbitrage is not allowed. Hedging is prohibited from using several challenge accounts. Delayed or frozen data feeds. This rule is very speculative as the freezing could be caused by the broker’s side and there is probably no objective way to define if a freezing and bad data feed were caused by the trader. Copy trading is prohibited, nor is anyone else allowed to trade on the funded account. This last one is ridiculous, how can the firm find out who is really trading on the funded account?

The firm also has a rule of maintaining a certain range between minimum lot size and maximum lot size used by the trader.

Although the profit target is 10% for the evaluation phase, once a trader becomes a funded trader there are no profit target rules.

For offering overcomplicated rules and limitations, we give the firm a 1 score in this section.

Traders With Edge Fees – 3.5

Fees are competitive for funded accounts and vary depending on the account types. Aggressive account variations have higher fees, while standard accounts are cheaper.

Turtle standard and aggressive accounts have the following fee structure for respective funding options:

- Funded amount: 5,000 USD – Standard: 55 USD, Aggressive: 88 USD

- 10,000 USD – 100 USD, 160 USD

- 25,000 USD – 250 USD, 400 USD

- 50,000 USD – 450 USD, 720 USD

- 100,000 USD – 750 USD, 1,200 USD

- 200,000 USD – 1500 USD, 2,400 USD

- 500,000 USD – 3,500 USD, 5,600 USD

- 1,000,000 USD – 7,500 USD, 12,000 USD

Hare account comes with the lowest fee of 69 USD on the 5,000 USD account and goes up to a 1,994 USD fee on the 400k USD funded accounts.

Instant accounts are the most expensive as they offer direct trading opportunities for profits rather than passing challenges or evaluations. The minimum fee on the 2,500 USD account is 125 USD and goes up to 2,000 USD on the 40k USD funded account.

The fees are low and competitive, as the lowest fee of 69 USD is way below the industry standard of 150 USD, making the prop firm’s offering very competitive. However, there is a catch, there are several rules that can be abused by the firm to terminate any trader’s funded account. This is probably why the fees are this competitive, as it is impossible to withdraw profits.

There is a possibility to trade with exceptionally low spreads of 0 pips because of EightCap’s low commissions and spread policies.

Traders With Edge free trial is not available and traders will have to pay the fees again after breaking rules, which will be very easy to break considering the firm’s rules.

Traders With Edge free repeat is not active at the moment.

The firm gets a 3.5 score in this section.

Traders With Edge Platforms – 1.5

Trading platforms are provided by the regulated broker EightCap. Both MT4 and MT5 are available with a multitude of functions, but the firm does not allow EAs or hedging, rendering much of this functionality useless. There are plenty of inbuilt indicators on both platforms. The firm does not offer any tools to assist traders. Both of these platforms are available for both Android and iOS, but the firm does not allow mobile trading.

We give the firm a 1.5 score in this section for artificially limiting platforms’ capabilities.

Traders With Edge Profit-Sharing – 1

Traders With Edge profit split is set at 80% for all accounts and all funding options.

The firm allows traders to request withdrawals after 10 active trading days. Payouts are possible every 14 days and payment options accepted include Fasapay, Payeer, Payoneer, PayPal, Perfect Money, Wise, BTC, USDT, and Bank Transfer. Payments require 5 working days after the request is approved and will take another 5 working days to reach the trader’s account. We can not determine why it would take 10 working days to withdraw profits. This raises serious concerns about the firm’s legitimacy. We advise extreme caution when dealing with this prop firm.

The firm gets a 1 score in this section.

Education and trading tools at Traders With Edge – 1.5

There are educational articles about different prop trading topics and CFTC regulations. However, there are no courses or video tutorials for beginners to start from a zero level and become a funded trader, only general tips and ideas are provided.

View your account metrics is a feature of the website that allows traders to see full metrics of their performance on their funded accounts. Monitoring exact rules and their relevance to the rules is probably the most important thing when trading on the funded account, and the firm gets a point in this component.

The firm gets a 1.5 score in this section for lacking any educational courses, videos, or webinars.

Customer Support at Traders With Edge – 2.8

Both the website and support are multilingual, provided in more than 5 different languages. However, the number of support options is limited to email support and live chat, which is actually a chatbot. Even though there is a live chat, it is merely a chatbot and can only help with predetermined FAQs and help resources. So, there is only email support available.

The website has some issues indicating a lack of proper maintenance from the firm.

As a result, we give the firm a 2.8 score for providing multilingual email support.

Frequently Asked Questions

Is Traders With Edge Legit?