Trader2B prop firm offers stocks for funded trading but has no other assets. The firm excels in providing plenty of educational resources, both free and paid. Trader2B has also developed an in-house trading platform that offers both manual and automatic trading capabilities and is accessible from all devices. Funded accounts range from 25k to 150k with monthly subscription fees.

In our unbiased Trader2B review, we will delve deep into the exact services and specs of this prop firm to help our leaders decide whether they can start earning profits. We will be focusing on crucial metrics to evaluate the safety, assets, funding options, platforms, customer support, and more.

Pros & cons of Trader2B prop firm

Pros

- Ability to withdraw with $0 fees

- Abundance of educational materials and games

- Fast and digital account opening/verification

- Excellent support including live chat, email, and phone support

- Most payment options are free and instant

- Does not partner with regulated brokers and has no rating on the FPA

Cons

- Low daily loss limit of 0.5%

- Does not offer MetaTrader 4, MetaTrader 5, or cTrader

- Low total loss limit of 4%

- Profit share is only up to 75%

- Limited trading assets, only stocks

Quick rating of Trader2B and its features

| FPA Score | Not yet rated |

| Year founded | 2015 |

| Headquarters | Miami, Florida, USA |

| Minimum audition fee | 198 USD per month |

| Fees on withdrawals | None |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 150,000 USD |

| Allowed daily loss | 0.5% |

| Profit target | 6% |

| Maximum trailing drawdown | 4% |

| Profit sharing (Payouts) | 75% |

| Trading Platforms | Haywood Trader Pro, trader2B WebTrader |

| Available trading markets | Stocks |

Safety of Trader2B – 1.5

Trader2B is not a broker nor is it partnering with any brokers, rather it just offers a simulated trading experience. In other words, traders will not be able to trade on live accounts even when funded. This is almost standard in prop firm space. However, the majority of legit prop firms offer trading services through regulated brokers, and in this case, Trader2B offers in-house simulated software. The firm loses points in this component of safety for not having a regulated broker partner. As for the experience in the industry, the firm has been around since 2015 offering trading education, and simulated trading capabilities ever since.

Trader2B reviews are lacking on the FPA, which also loses the firm some points. The only legitimacy the firm offers is it has been around for some time.

The firm gets a 1.5 score in this section, for only having been around for more than 3 years.

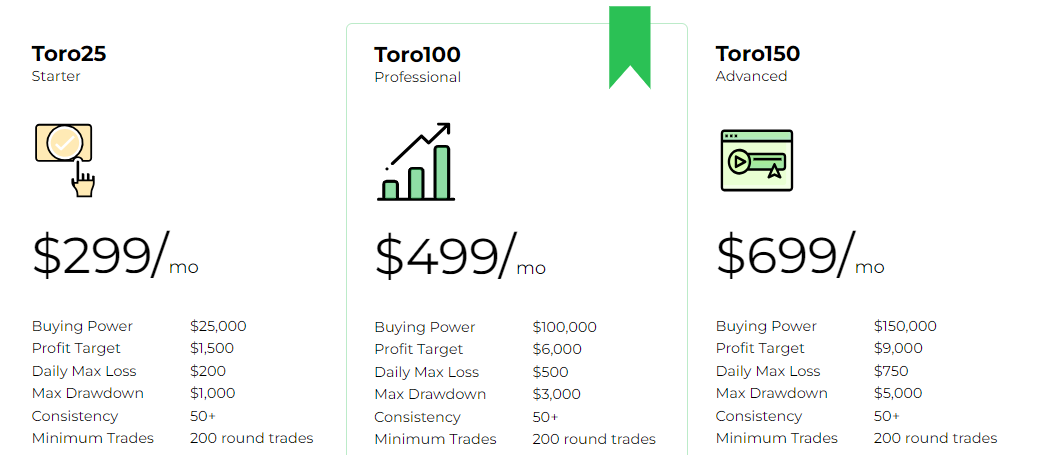

Trader2B Funding and maximum capital allocation – 2

Trader2B funded programs offer a minimum of 25,000 USD buying power funded accounts up to 150,000 USD. The names for these accounts are Toro25, Toro100, and Toro150 respectively.

The funded options are severely limited with this firm. Except for 25k and 150k, there is only a 100k USD account(Toro100). Trader2B prop trading is mostly focused on the educational diversity of options and tutorials and offers a virtual funded account as a bonus, at least that’s how we see it after research.

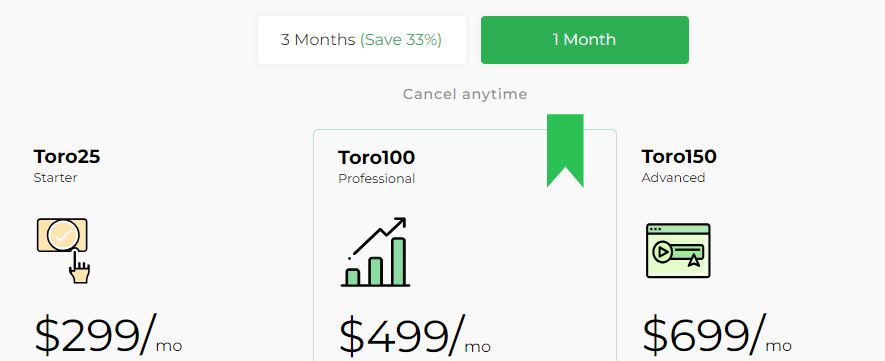

Trader2B funding is also costly, starting from 198 USD per month if a trader buys 3 3-month subscriptions all at once. This makes it unattractive to buy and operate a simulated funded account on trader2B. The firm is only useful to get educational courses and games, which we will explore in more detail in the below chapters.

There is no Trader2B scaling plan, making it impossible to increase account size and potential profits.

Trader2B challenges only a 2 score in this section as they are severely limited.

Trader2B Assets – 1

All Nasdaq and NYSE listed stocks are offered using real-time data from these exchanges in a simulated trading environment. There are no other asset classes available, and the firm also offers trading simulated games and educational resources exclusively for stock trading.

Trader2B gets a 1 score in the assets department for offering limited assets.

Trader2B Trading rules and limitations – 1.5

Trader2B rules are strict with a tight daily drawdown limit of 0.5%, a maximum drawdown of 4%, and a minimum of 200 round trades. There is a consistency score system and all traders are required to have at least 50 scores. This score is calculated by analyzing the trader’s performance using maximum drawdown, daily net profit, total balance, and trading period. However, the firm is not showing the exact formula for how it calculates the final consistency score. With this approach, it is hard for a trader to control their consistency score and get to a point to withdraw profits. The profit target is 6% for all three trading accounts.

Overall, the firm gets a 1.5 score in this section.

Trader2B Fees – 2.5

The minimum monthly fee for 50k accounts is 299 USD per month, except if a trader buys 3 3-month subscriptions, which is 198 USD per month. Even 198 USD per month is expensive, as the majority of prop firms offer much cheaper funded options. Here is the list of fees:

With discount (when buying 3 months at once):

- Toro25 25,000 USD – 198 USD per month

- Toro100 100,000 USD – 333 USD per month

- Toro150 150,000 USD – 466 USD per month

Fees when buying without discount:

- Toro25 25,000 USD – 299 USD per month

- Toro100 100,000 USD – 499 USD per month

- Toro150 150,000 USD – 699 USD per month

There are discounts for students up to 25% as well for all funded accounts.

In case the trader requests a refund of their monthly subscription, there is a 50 USD fee.

Trader2B free trial is available;e for anyone to register and start learning and trading. Using this service, some free stuff is unlocked for learning.

Trader2B free repeat is not available as even refunding costs 50 USD, so traders should be extremely careful to meet the tight risk limit rules set by Trader2B.

The firm gets a 2.5 score in this section.

Trader2B Platforms – 3.5

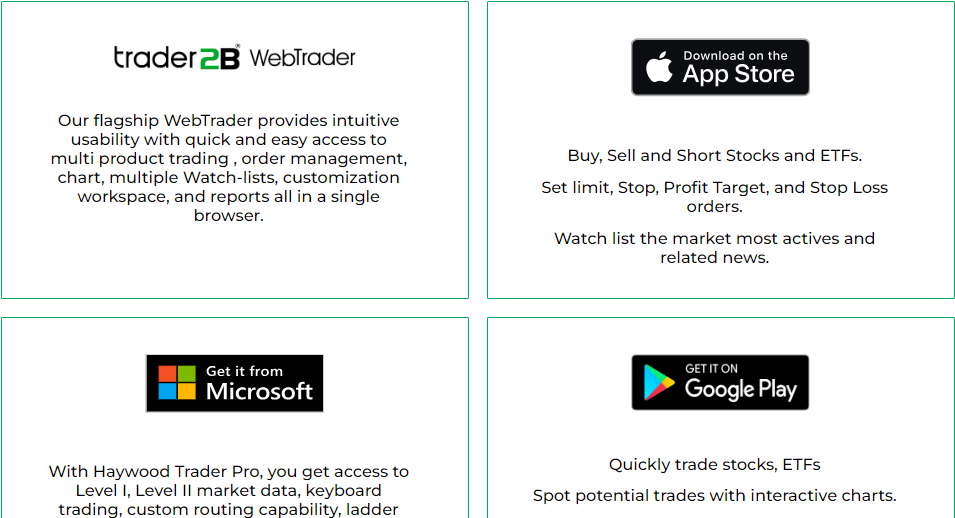

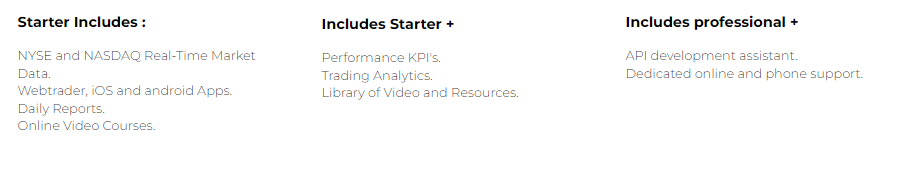

Trader2B offers two main trading platforms, one of which was developed in-house Haywood Trader Pro and trader2B WebTrader. These platforms are available for desktop, web, and mobile and offer advanced functionality including automated trading. The firm also has an API to test strategies on the platform. The only downside we could find for Trade2B platforms is the lack of popular trading software such as MT4, MT5, or cTrader. Except for these, the platforms department gets a maximum score.

We evaluate the Trade2B with a 3.5 score in this section.

Trader2B Profit-Sharing – 3

Trader2B profit split is at 75% at Trader 2B and profits are paid out twice per week. Traders are free to control the exact days when they want payouts.

As a result of offering only a 75% profit share, but flexible withdrawal policies, we give the firm a 3 score in this section.

Education and trading tools at Trader2B – 5

There are diverse and advanced trading educational resources available on the website in multiple sections. Video tutorials, webinars, and trading courses are offered, although some of them are paid courses and some of them can be accessed through a free trial.

The trading game TraderFi allows beginners to learn stocks, Cryptos, Futures, and Forex short-term trading entertainingly. There are also memed challenges and personalized daily goals. This is a unique way of teaching trading to beginners. It also has a multiplayer mode to have fun while learning to trade with friends.

Another educational source is Sim2Trade, which is a stock market simulator with advanced functionality and performance tracking that allows testing stock trading skills and learning new strategies. There are plenty of courses and tutorials to familiarize with the simulator, and it mimics real-life trading scenarios and environments. Traders will have to subscribe to the service of Sim2Trade to get access to educational videos and courses. It also has an API functionality to forward test trading algorithms. The sim2Trade subscription service will cost 99 USD per month.

Customer Support at Trader2B – 3.6

Support is provided through all popular channels and includes phone support, email support, and live chat. The firm is also represented on multiple social media platforms including Instagram, X app, Facebook, YouTube, and more. The only downside is that both the website and support of Trader2B are only available in the English language.

As a result, the firm had a 3.6 score in the support section.

Frequently Asked Questions

Is Trader2B legit?

Are there any free trial options available at Trader2B?

Does Trader2B offer a scaling plan?