TradeDay prop firm offers funded accounts for futures trading ranging from 10 to 250 thousand USD. The firm is transparent and is based in Chicago, Illinois, with information about its founders clearly given on the website. All the information is given on the website and the firm offers its address and phone number, adding to its legitimacy. Traders can start the challenge and become funded futures traders for as low as 99 USD per month for the 10 grand accounts.

In this TradeDay review, we will focus on the main aspects of this prop firm including safety, assets, funding options, fees, education, profit split, free trial, and many more.

Pros & cons of TradeDay prop firm

Pros

- Ability to withdraw with $0 fees

- Offers diverse funding options from $10,000 to $250,000

- Fast and digital account opening/verification

- Provides market commentary, research, trading courses, webinars, and seminars

- Charges small monthly fees for funding accounts, giving traders superior flexibility

- High profit split at 90% (after 100% for the first 10,000 withdrawal)

- Provides access to TradingView, Ninjatrader, tradovate, and Jigsaw Trading

- Most payment options are free and instant

Cons

- Trading assets are limited to only futures contracts

- Supports only English language for all support options

- It is a relatively new firm, founded in 2021

- Lack of reviews on the FPA

Quick rating of TradeDay and its features

| FPA Score | Not yet rated |

| Year founded | 2021 |

| Headquarters | Chicago, Illinois, United States |

| Minimum audition fee | 99 USD monthly fees |

| Fees on withdrawals | None |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 250,000 USD |

| Allowed daily loss | None |

| Profit target | 10% (decreases for higher funding to 4.5% at 250k funding) |

| Maximum trailing drawdown | 10% (2% on 250k account) |

| Profit sharing (Payouts) | 90% (100% for the first 10k USD withdrawals) |

| Trading Platforms | TradingView, Ninjatrader, tradovate, and Jigsaw Trading |

| Available trading markets | Futures for Forex, indices, and commodities |

Safety of TradeDay – 1.5

TradeDay reviews are lacking on the FPA, which makes it lose some points in safety. Generally, we put a high emphasis on the safety of prop firms, as this is the most important component for any funded trader. TradeDay offers trading through the CME Group is a derivatives marketplace and operates the following exchanges of CME, CBOT, NYMEX, and COMEX. It is well-regulated in the USA and is a legitimate organization.

The firm gets a 1.5 score in this section for being young and having no rating on the FPA platform.

TradeDay Funding and Maximum Capital Allocation – 3

TradeDay funded programs range from 10k to 250k USD funding options and provide sufficient capital for trading on futures products. Day trading futures on US exchanges require substantial balance, and these options are understandable.

TradeDay funding is diverse and fees are paid monthly, allowing profitable traders to trade with cheap expenses. This offer is undeniably attractive for futures traders.

The TradeDay challenge consists of an evaluation phase where traders have to show their performance by being consistently profitable without breaking any of the rules.

TradeDay scaling plan is not available at the moment, but the firm offers the opportunity to get free funding after completing a 14-day free trial.

TradeDay prop trading firm gets a 3 score in this section for lacking 1k and 1 million USD funding options.

TradeDay Assets – 0.5

TradeDay only permits users to trade futures products. These futures include diverse underlying asset classes:

- Equity index futures

- Forex futures pairs

- Bond futures contracts

- Energy futures

- Metals and agriculture futures

Supported futures exchanges include CME, CBOT, NYMEX, and COMEX.

As a result, the firm only gets a 0.5 score in this section.

TradeDay Trading rules and limitations – 2.3

TradeDay rules are similar to other prop firms, as TradeDay wants to be sure the trader is not a gambler and has consistency. Here are the basic rules that all funded traders must follow at TradeDay:

- Minimum trading days – 10 days

- Maximum daily profit – 30% (evaluates that trader is not lucky, but consistent)

- Time limits for evaluation – None

- News trading – Not allowed

- Over the weekend trading, overnight positions are not allowed

- Maximum trailing drawdown – 10% (decreases for higher funding amounts, 2% for 250k accounts)

- Daily drawdown limits – None

There is a smart drawdown policy active: when the trader makes profits, the maximum drawdown trailing follows the balance and freezes at the funded account starting balance. This way, the firm ensures traders do not lose the firm’s capital when trading funded accounts.

If a trader breaks these rules, their account is blocked and is freely reset for the next monthly fee. To reset the account immediately, traders will have to pay a 99 USD reset fee.

TradeDay gets a 2.3 score in the rules department.

TradeDay Fees – 4

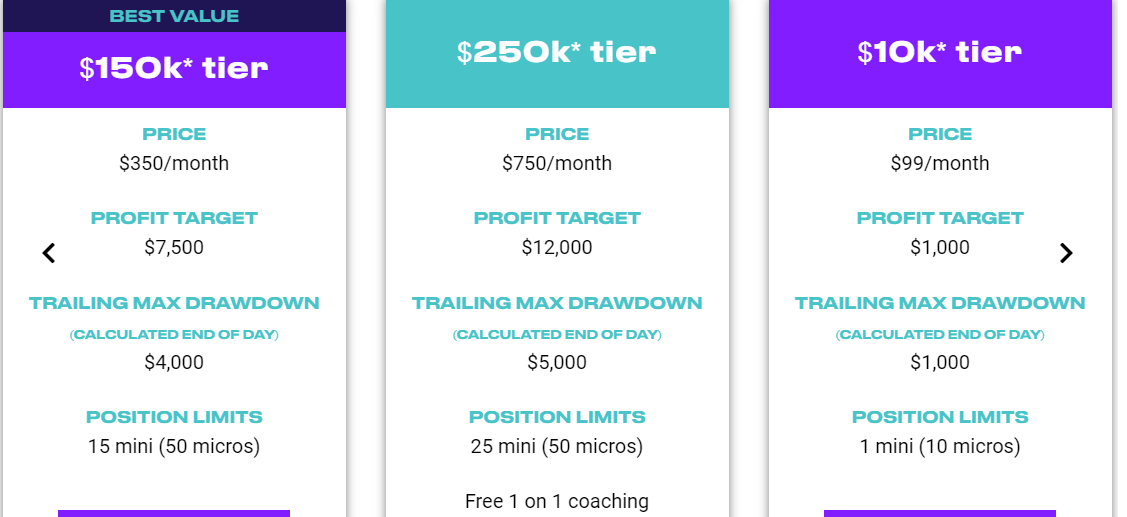

Here is the exact monthly pricing for each funded amount:

- 10,000 USD – 99 USD monthly

- 25,000 USD – 125 USD monthly

- 50,000 USD – 165 USD monthly

- 100,000 USD – 275 USD monthly

- 150,000 USD – 350 USD monthly

- 250,000 USD – 750 USD monthly

There are no hidden fees and additional charges once the trader starts trading and making profits. No activation fees when a trader passes the challenge, they immediately start trading on the funded account.

There is a TradeDay free trial available for 14 days when traders can show their performance and get funded if they pass the challenge. This free trial is targeted at finding real talent and offers an excellent opportunity to start trading on a large funded account for free.

TradeDay free repeat is available, as trailers will not have to pay fees if they decide to reset the subscription.

The best way is to start a 14-day free trial, as all the purchases are non-refundable.

We give the firm a 4 score in the fees section, as it only loses 1 point for not having FX 0 spreads.

TradeDay Platforms – 5

The firm excels in trading platform diversity and offers all the popular platforms for the best futures trading experience. TradingView, Ninjatrader, tradovate, and Jigsaw Trading will offer full functionality to trade from anywhere with any strategy be it manual or automated. All mobile operating systems are supported, including iOS and Android. TradingView is an especially advanced platform for all devices and thousands of indicators from its rich community. It is available for web, desktop, and mobile.

We give the firm a well-deserved 5 score in this section.

TradeDay Profit-Sharing – 5

TradeDay profit split is 90% and the firm offers superior flexibility. Traders can get 100% of profits for the first 10,000 USD withdrawals and 90% after that. No other requirements restrict withdrawals.

We evaluate this section with a 5 score for excellent profit split policies and quick withdrawals.

Education and trading tools at TradeDay – 5

The firm provides 24-hour market commentary and news and also offers MarketChartist’s award-winning research daily. There are a multitude of trading courses, webinars, and seminars offered for a small fee of 39 USD per month. These fees enable the firm to support its professional trainers to offer high-quality educational resources.

There are plenty of tools to measure a trader’s performance and additionally a trader’s dashboard. TradeDay seems to be the firm that teaches and helps traders to become consistent and profitable futures traders. The cost for training courses and resources at 39 USD per month is a super cheap offer and allows traders to start from zero and become heroes.

We evaluate the education and tools of TradeDay with a 5 score.

Customer Support at TradeDay – 3.6

The support is provided using all popular options including live chat, email, and phone support. However, the live chat is limited to virtual assistants, and it’s not possible to contact the support personnel of the firm. The firm is available on Discord and several other social media platforms. Both the website and support services are offered solely in the English language, which is the only downside of the firm.

We give TradeDay a 3.6 score in this section.

Frequently Asked Questions

Is TradeDay legit?

What are the funding options and fees at TradeDay?

What trading platforms and profit-sharing options does TradeDay offer?