Trade The Pool is the first stock trading prop firm founded in 2016. While most prop firms around the world offer CFDs on shares and other instruments, TTP allows clients to trade real shares using its funded accounts.

With a minimum audition fee of $97 and over 12,000 equities, Trade The Pool stands out in terms of its selection of instruments and streamlined trading challenges.

But how good is TTP and should you add it to your list of potential prop firms to try out in the future or is Trade The Pool a scam? – Let’s find out.

Pros and cons of Trade The Pool prop firm

Pros

- Access to over 12,000 instruments

- Ability to trade real shares

- 80% maximum profit split

- Ability to grow the daily loss allowance beyond 5%

- 14-day free trial for beginners

- Experienced team from The5ers.com

- One-time account fees

Cons

- Limited promotion opportunities on funded accounts

- Challenging evaluations

- Minimum 30 trade requirement

Safety of Trade The Pool – 3.5

Trade The Pool is a generally well-protected prop trading firm. While our Safety rating methodology typically includes reviews from ForexPeaceArmy.com, we have opted to rely on Trustpilot for reviews, as Trade The Pool is not a forex prop trading firm and is focused on stocks and ETFs.

TTP has a Trustpilot rating of 4.5/5 based on 73 reviews. While the rating is generally high, the number of reviews is quite low.

The firm also employs risk management measures to ensure the compliance of accounts with the general trading terms, as well as to maintain stable liquidity for the firm itself.

While the firm does not offer much in terms of licensing and regulation, it also does not show any glaring security concerns when it comes to handling client accounts and funds, which is why it gets a 3.5 out of 5 for safety features.

Trade The Pool funding and maximum capital allocation – 3

Trading challenges provided by Trade The Pool consist of an evaluation and a funding stage. The evaluation stage is done on a simulated account without real funds, while the funding stage gives traders access to real capital.

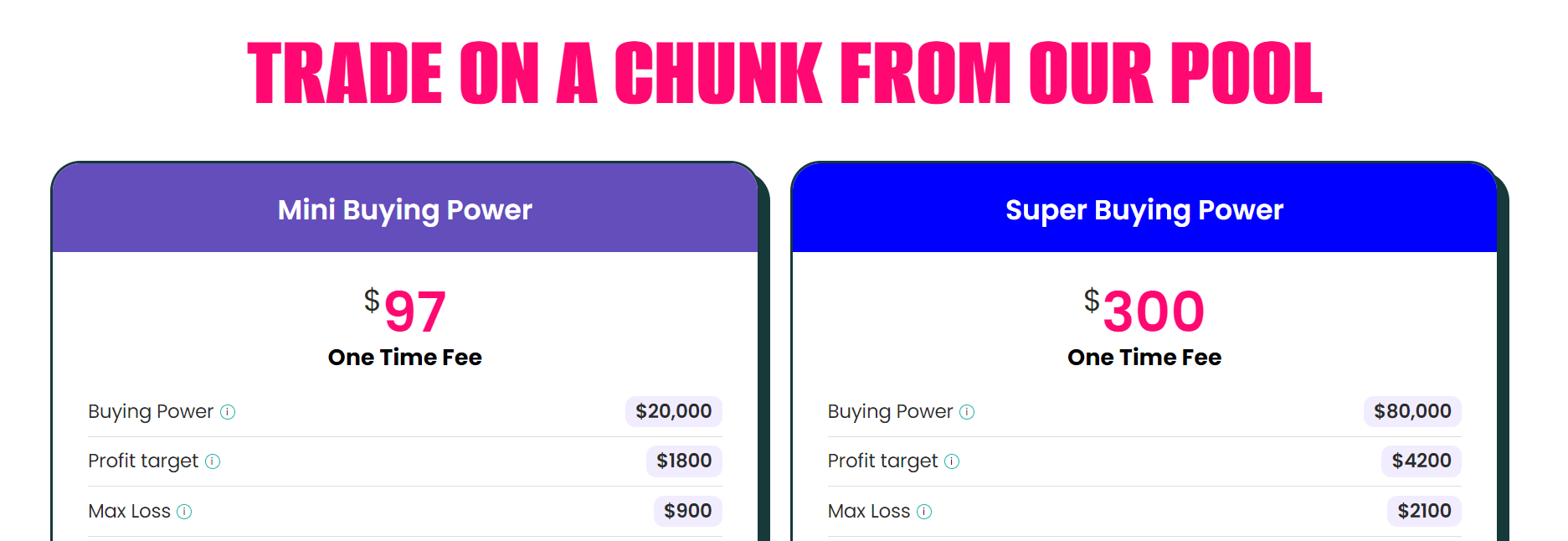

There are a total of 4 funded stock trading accounts offered by TTP and total funding levels range from $20,000 on the lower and, up to $260,000 for the Ultimate Buying Power account.

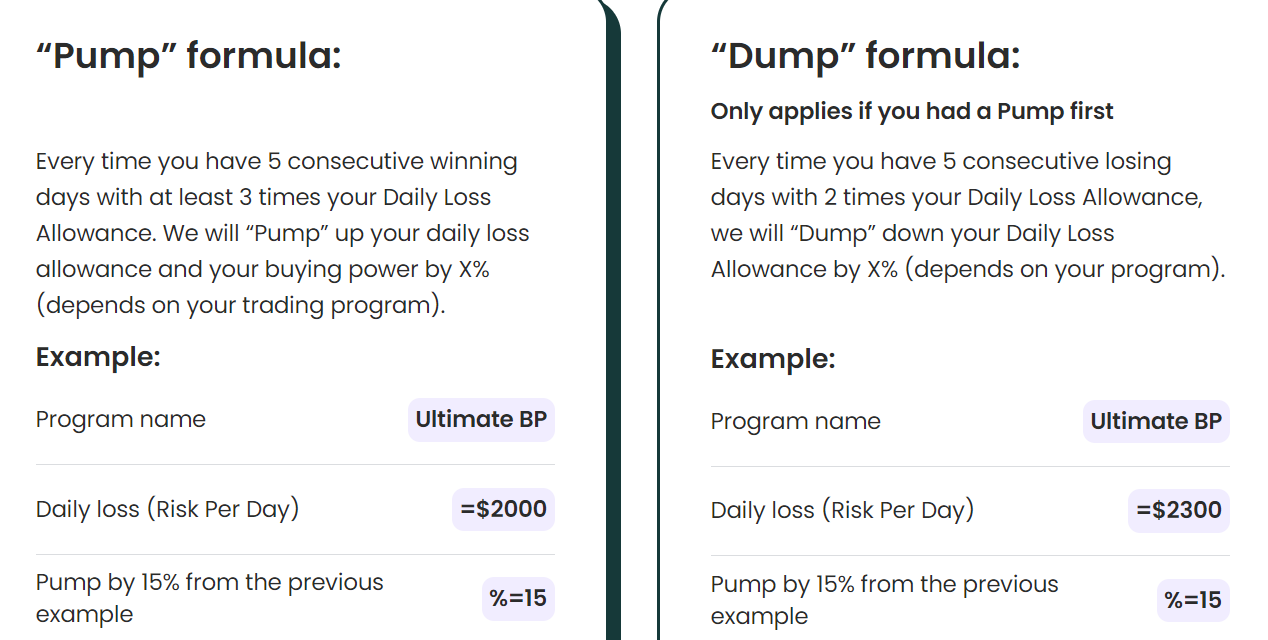

A drawdown scaling plan is also available and traders are able to increase their loss limits after continuously reaching the relevant growth target – 5% for the $20,000 account, up to 15% for the $260,000 account.

Traders can sign up for free and test the platform using the 14-day trial period.

The lowest possible account at TTP is $20,000, which is higher than the $10,000 average offered by many other prop firms. While the firm lacks a $100,000 account option, it does have a $80,000 option via the Super Buying Power account.

Overall, Trade The Pool gets a 3 out of 5 for funding and maximum capital allocation, only falling short due to a lack of account variety.

Trade The Pool assets – 1.5

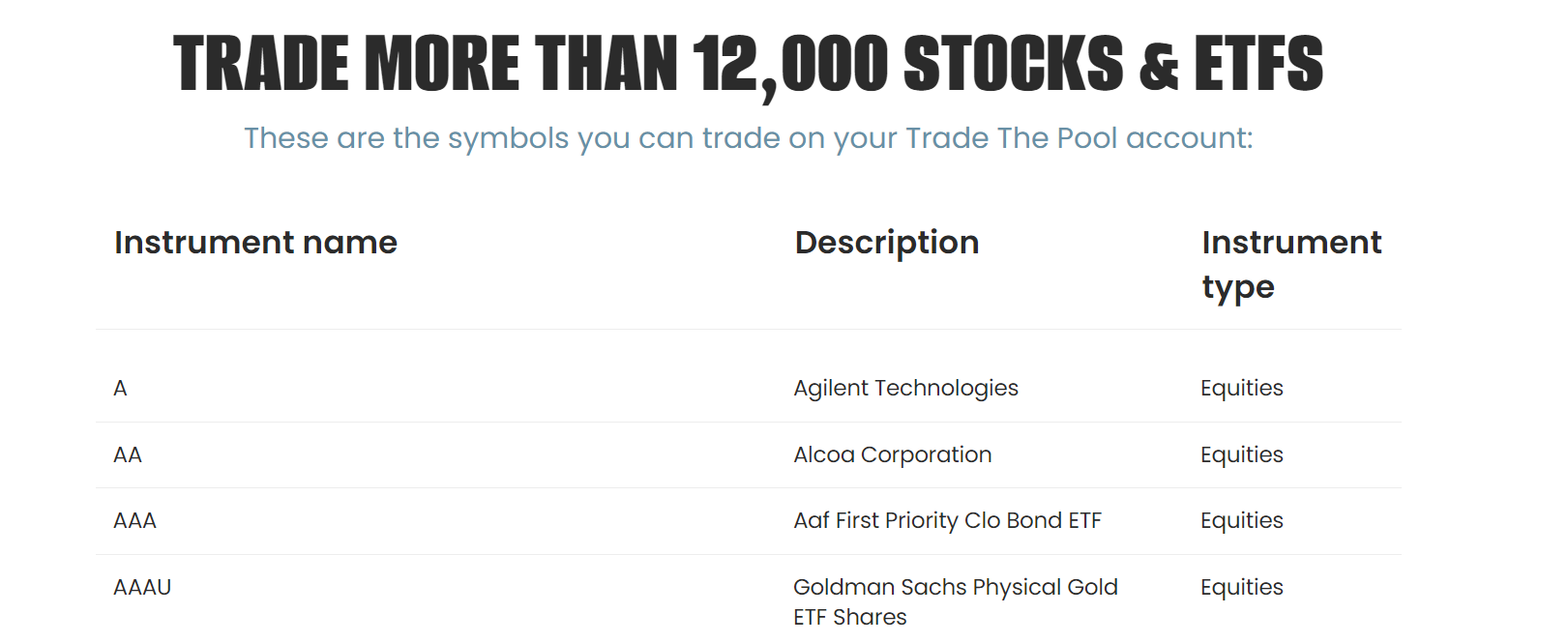

While the overall number of available instruments offered by Trade The Pool stands at an impressive 12,000, it is also limited to only one asset class – equities.

Stocks and ETFs make up all the instruments available at TTP, which can be a major disadvantage for traders seeking some variety in what they can trade.

Most prop firms on the market offer a combination of forex, CFDs, metals, energies, indices, and more, which is where the firm falls short.

Trade The Pool has access to Cboe and Nasdaq market data, which traders can use in real-time to make informed trading decisions and increase their chances of success.

While the number of available instruments is quite large, the lack of variety hurts TTP’s Asset score, where it gets a 1.5 out of 5.

Trade The Pool rules and limitations – 2.1

The rules and limits enforced by Trade The Pool tend to be quite strict when it comes to daily loss and overall drawdown limits.

When traders sign up with Trade The Pool, they must comply with the terms and conditions of the prop firm, otherwise, they risk losing their accounts.

The general trading terms and restrictions in place for TTP clients across the four funded accounts are the following:

- Mini Buying Power – 50% profit split, 9% profit target, 4.5% maximum loss limit, minimum 30 trade requirement, 45-day trading period, $300 daily loss allowance, 5% loss limit growth opportunity

- Super Buying Power – 60% profit split, 5.25% profit target, 2.62% maximum loss limit, minimum 30 trade requirement, 45-day trading period, $700 daily loss allowance, 5% loss limit growth opportunity

- Extra Buying Power – 70% profit split, 4.87% profit target, 2.44% maximum loss limit, minimum 30 trade requirement, 45-day trading period, $1,300 daily loss allowance, 8% loss limit growth opportunity

- Ultimate Buying Power – 80% profit split, 4.62% profit target, 2.31% maximum loss limit, minimum 30 trade requirement, 45-day trading period, $2,000 daily loss allowance, 15% loss limit growth opportunity

In conjunction with the general trading terms and limitations, Trade The Pool also offers real-time market data and trading boosters, which also come with trading analysis and performance statistics platforms. Overnight and weekend trading are also available.

However, the strict loss limits and minimum trading day requirements make it difficult for traders to freely construct a trading strategy and get ahead on the market.

Another key limitation is that the most profitable trade must not account for more than 30% of the overall profits generated by the client, which incentivizes trading frequency, as opposed to profitability.

Overall, Trade The Pool gets a 2.1 out of 5 for trading rules and limitations.

Trade The Pool fees and commissions – 4

When it comes to account fees and other related charges, Trade The Pool offers reasonable price points for its four funded accounts. It is also worth noting that account fees are one-time only and there are no recurring charges at TTP.

Here are the account fees charged by the firm:

- $97 one-time fee for the Mini Buying Power account ($20,000)

- $300 one-time fee for the Super Buying Power account ($80,000)

- $475 one-time fee for the Extra Buying Power account ($160,000)

- $1,240 one-time fee for the Ultimate Buying Power account ($260,000)

When it comes to payouts, Trade The Pool clients can only request a payout after generating a minimum profit of $300.

The firm does not charge any other miscellaneous fees, which is an added convenience for traders and withdrawals are also done free of charge.

Overall, Trade The Pool gets a score of 4 out of 5 for fees and commissions.

Trade The Pool platforms – 4

Trade The Pool offers a few different platforms to its clients, which come with a host of useful features for traders, including advanced charting, watchlists, and more.

The platforms available to TTP clients include:

- Trade Ideas – an AI-driven stock scanning and charting traders can use to generate stock trading ideas and signals

- TrendSpider – a smart charting software for stock and ETF traders, with a wide range of technical indicators and customizable price charts

- Bookmap – a live stock futures trading software with a heatmap, volume, and volatility indicators

- TraderSync – a stock trading journal to track and analyze stock trading performance and compare the biggest winners/losers, average returns, and more

- TraderVue – a stock trading journal to track performance, with three different subscription tiers

- Stock Traders Daily – a trading advice and indicator platform for stock traders that want to stay ahead of the curve and consistently outperform the market

Each of these platforms allow traders to access much-needed information and technical features free of charge, which is a major advantage of Trade The Pool.

Automated trades and a mobile app are also offered by the firm and clients can choose between a web and desktop application when trading.

Overall, TTP gets a score of 4 out of 5 for trading platforms. As a stock-focused prop firm, Trade The Pool does not offer MetaTrader.

Profit-sharing at Trade The Pool – 3

Each of the Trade The Pool accounts offer different profit-sharing agreements. The maximum profit share available at TTP is 80% after the trader successfully completes the evaluation program.

Below we can see the profit shares available to TTP traders on each of the four funded accounts:

- 50/50 profit split for the $20,000 Mini Buying Power account

- 60/40 profit split for the $80,000 Super Buying Power account

- 70/30 profit split for the $160,000 Extra Buying Power account

- 80/20 profit split for the $260,000 Ultimate Buying Power account

While the profit splits for Trade The Pool accounts may be lower than those offered by forex prop firms, there is an unlimited loss limit scaling plan for those that can consistently generate profits on their funded accounts, which is a unique proposition for traders to take advantage of.

Payouts are typically quite fast and take no more than 2 business days to process.

Trade The Pool does lose some points for not offering an industry standard 90% profit share and gets a score of 3 out of 5 for profit-sharing.

Education and trading tools at Trade The Pool – 2.5

Traders expecting to see some advanced trading education materials will be disappointed by Trade The Pool, as the firm does not offer any such auxiliary services as of this writing.

However, it must be noted that there are plans to introduce educational articles for first-time and inexperienced stock traders.

The Education section on the firm’s official website currently reads “Coming Soon” and which exact features the new content will include remain to be seen.

The firm does include a blog about various stock and prop trading topics that might interest first-time clients, such as articles about stop-losses, technical indicators, stock screeners, and more.

Overall, due to the current scarcity of educational content, Trade The Pool gets a score of 2.5 out of 5, thanks to the economic calendars and other tools included in the offered platforms.

Trade The Pool customer support – 3.6

The customer support at Trade The Pool is generally quite responsive and prospective and active clients can reach out to the support team via the hotline, email support, and live chat.

The live chat connects clients to a real customer support representative who can answer questions and help resolve any issues clients may have.

The customer support hotline and email support are both responsive and representatives are able to quickly address any issues.

The official website of Trade The Pool also includes a FAQ section that answers some basic questions new clients may have about the firm and its offerings.

TTP gets an overall customer support score of 3.6 out of 5, losing some points due to limited language options.

Frequently Asked Questions

Is Trade The Pool legit?

Does Trade The Pool offer real shares?