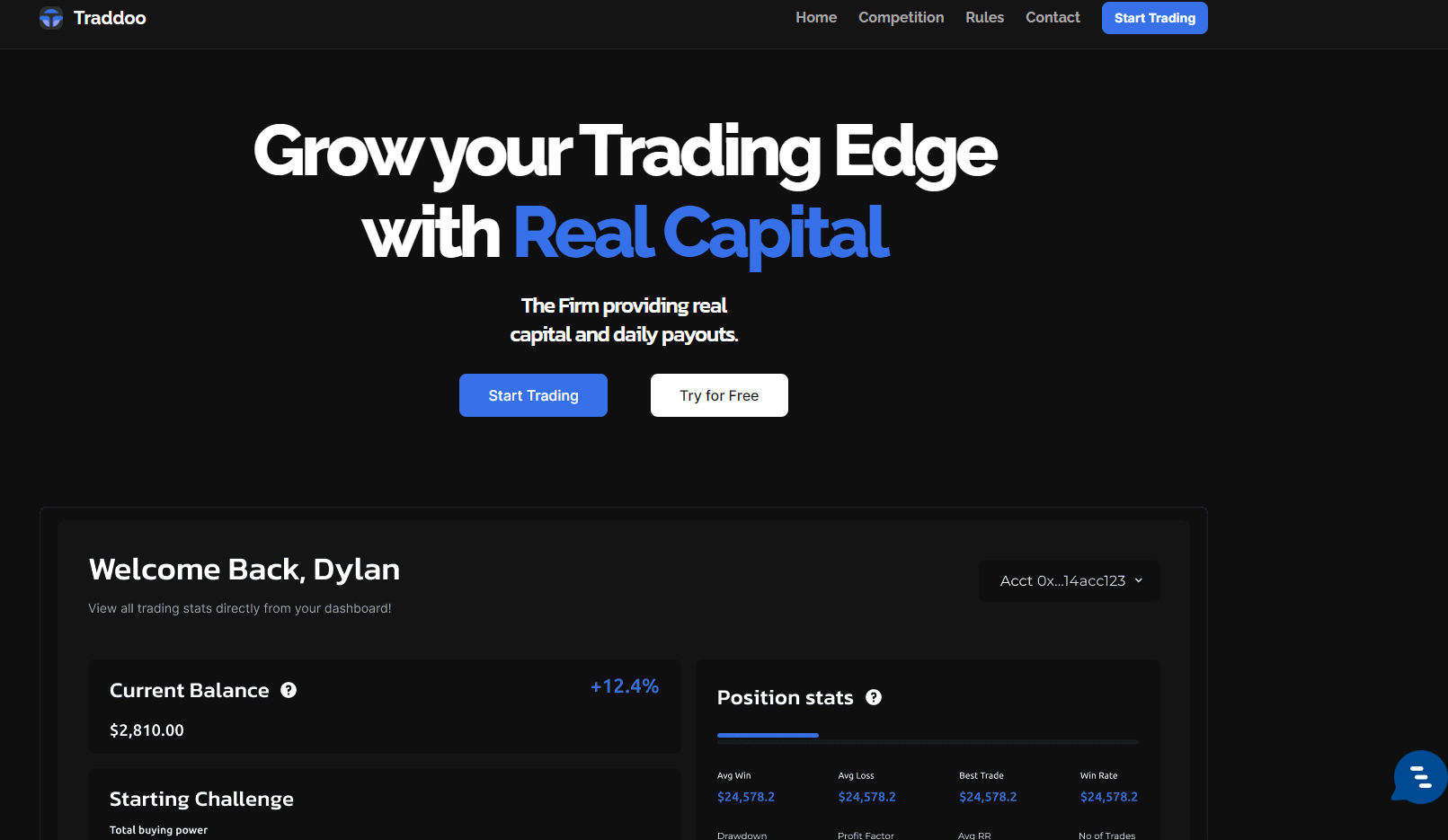

Traddoo is a Forex Proprietary trading firm launched in 2023. The firm has been around for a little time, but its website seems simplistic, with every crucial detail of each challenge given on the first page. The firm has an 80% profit split, allows automated trading and its scaling plan is also attractive at 5 million USD. However, we have detected some red flags, which we will discuss in this full review. In our Traddoo Trading review, we are going to assess the firm’s safety, assets, funding options, scaling, spreads, fees, education, support, and much more.

Pros & cons of Traddoo prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to TradeLocker with TradingView integration

- Fast and digital account opening/verification

- Offers access to Forex, cryptos, indices, commodities

- Supports a wide range of payment options including cryptos and e-wallets

- Most payment options are free and instant

Cons

- Profit target is high at 14% for 1-step accounts

- Lacks regulation and a partnership with a known broker, increasing risk

- Poor customer feedback with issues in withdrawals and customer support

- Not rated on FPA, with a high percentage of poor reviews on Trustpilot

- Offers no educational materials

- Fees and minimum funding options are high

Safety of Traddoo – 0

Traddoo reviews are lacking on the FPA, which is natural for a firm that is such young. However, from 50 reviews on Trustpilot, 36% are 1-star evaluations with traders reporting bad customer support experiences, struggles with withdrawals, and more. While Trustpilot alone is not enough for us to fully understand the true safety of the firm, it surely indicates the overall tendency of the firm. The firm also has very little experience in the prop trading industry, deducting some points from its safety score. After contacting the live chat, which is an AI chatbot, we confirmed that the firm does not have any partner broker. Having a regulated partner broker is crucial in our evaluation of firms’ safety, and Traddoo loses points here as well.

The firm gets a 0 score in this section for offering poor safety levels with its little experience, no partner broker, and no FPA evaluations.

Traddoo Funding and maximum capital allocation – 2

Traddoo funded programs are diverse and include regular 1-step evaluation, regular 2-step evaluation, and 2-step swing evaluation accounts. The website is not working correctly and requires time to get used to its navigation to check each Traddoo funding account, which is inconvenient. The range of funding options is between 25k and 200k USD with the exact options being 25,000 USD, 50,000 USD, 100,000 USD, 150,000 USD, and 200,000 USD options.

The regular 1-step Traddoo challenge has a high 14% profit target, unlimited duration, 5 minimum trading days, 4% max daily drawdown, and 7% maximum drawdown limits.

Traddoo scaling plan allows traders to increase their funded account size to up to 5 million USD which is one of the highest in the industry right now.

Overall, the firm gets a 2 score for not offering lower funding options below 25k and at least 1 million USD default upper scale.

Traddoo Assets – 3.5

Traddoo provides access to several trading asset classes including Forex pairs, indices, commodities, and crypto assets. The leverage is dynamic depending on the funded account type and varies from 1:30 to 1:200.

The leverage is up to 1:50 for one-step evaluation accounts, two-step evaluations come with 1:200 maximum leverage, and the two-step swing accounts come with a stricter 1:30 maximum leverage allowance.

The firm gets a 3.5 score in the assets section for lacking futures, stocks, and other assets.

Traddoo rules and limitations – 2.1

Traddoo rules are strict as the firm does not allow to hold positions overnight or over the weekends. The rules are a bit stricter in the case of regular 1-step evaluation. Traders can purchase an add-on to allow them to trade during the news. Minimum trading days are 5, profit target is strict at 14% which is not easy to achieve with a strict 4% daily drawdown and 7% maximum drawdown.

Rules are a bit easier when a trader acquires an STP funded account and increases the daily risk to 5% and the overall risk limit to 10%.

The daily risk limit is 5% at all steps for the regular two-step accounts, and the maximum drawdown is 10%. The profit target is also 10% which decreases to 8% for the second phase of evaluation and the funded phase has no profit target. The rules are similar for two-step swing accounts just like for the two-step accounts but the leverage is lower at 1:30 for swing funded accounts.

For providing a choice for more flexible risk limits but overall stringent requirements, Traddoo receives a 2.1 score in the rules section.

Traddoo Fees – 1.5

Traddoo offers several funded account types with different fees. The one-step regular accounts have the following fees for each funded option:

- Funding amount 25,000 USD – one-time fee 249 USD

- 50,000 USD – 349 USD

- 100,000 USD – 549 USD

- 150,000 USD – 819 USD

- 200,000 USD – 1099 USD

The fees are the same for the regular two-step accounts. However, the regular swing trading funded challenge with 2-step evaluation has slightly higher fees:

- Funding amount 269 USD

- 100,000 USD – 599 USD

- 150,000 USD – 899 USD

- 200,000 USD – 1199 USD

Traddoo free repeat is not available at the moment as traders are not eligible for a refund if they fail the challenge and there is no discount either.

Traddoo free trial is available for all funding options offered by the firm. Traders can select between 5,000 to 200,000 USD free trial accounts and trade on free accounts on the TradeLocker platform. This is an excellent chance for both beginners and seasoned prop traders to try out Traddoo’s services for free and define whether they want to go for the actual thing. The profit target for the free trial is 12%, the trial duration is 7 days, the account currency is USD, and the leverage is capped at 1:50. Maximum drawdown is 7% and the daily loss limit is 4% for trial accounts, which enables traders to experience almost the same conditions as paid funding challenges.

The firm gets a 1.5 score in the fee structure for expensive commissions.

Traddoo Platforms – 3.4

Traddoo prop trading platform is TradeLocker. TradeLocker is a next-generation trading platform with a multitude of advanced features. It is the first web-based trading platform to natively integrate the popular TradingView platform. The platform allows traders to quickly and safely access the world of financial markets and has downloadable iOS and Android apps. It is user-friendly and has a modern design which adds to its convenience. While the broker is not offering advanced MT4 and MT5 platforms which traders are used to, TradeLocker is still a decent platform for general FX trading.

The firm gets a 3.4 score in this section for offering a decent trading platform.

Traddoo Profit-Sharing – 5

Traddoo profit split starts at 80/20 allowing traders to withdraw 80% of their profits in trading. There is an option for 90% profit sharing as well with paid add-ons. Traders can withdraw profits when it is higher than 100 USD. Withdrawal processing times are different for each payment method. For cryptos, the withdrawals will take 1-3 hours (as the firm claims via its AI chatbot), for bank transfers it is 1-5 business days, and e-wallets like PayPal or Skrill require 1-2 business days.

Overall, Traddoo takes a 5 score in the profit split section if their claims are true.

Education and trading tools at Traddoo – 0.5

Traddoo prop firm lacks educational resources and only provides an FAQ section which is not enough to get an education for financial trading. The firm provides a good platform and some tools to monitor trader’s progress, but there are no educational resources at all.

As a result, Traddoo gets a 0.5 score in the education section.

Customer Support at Traddoo – 1.9

Traddoo provides the fastest AI-powered chatbot in the industry, for sure. The AI seems competent to detect the main idea of the question and provides answers within milliseconds after asking it anything. This is very convenient for quickly gaining any important information and can act as a FAQ section. However, the lack of ability to contact live personnel and resolve any issues during trading makes this live chat a half-functioning product. We will be using the firm in this aspect half the point. There is email support. The firm lacks phone or hotline support, which is yet another disadvantage. The website and support are both available only in the English language.

The firm gets a 1.9 score for its poor support options and lack of multilingual support.

Frequently Asked Questions

Is Traddoo legit?

Is Traddoo a good prop firm?