TopTier Trader is a US-based Forex proprietary firm that was launched by a team of experienced traders in 2021, making it a relatively young company. At least that’s what the company claims about its establishment. The firm offers funded accounts from 5k to 300k and a scaling plan for 600k max funding. The fees start from 55 USD, which is a very competitive offering for any prop firm. Providing diverse trading assets from Forex to the cryptos and advanced platforms of MT4 and MT5, the value offered by the TopTier Trader seems very attractive, and we decided to check their claims.

In our TopTier Trader review, we will discover if the firm is legit or not and whether traders can start trading on regulated platforms with fees these cheap.

Pros & cons of TopTier Trader prop firm

Pros

- Diverse Funded Account Options from 5k to 300k USD

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to diverse markets of FX pairs, indices, commodities, and cryptos

- Competitive Fees from 55 USD on 5k accounts

- Competitive profit split from 80% and up to 90%

- Excellent 24/7 customer support

Cons

- Does not offer stocks

- Limited safety: established in 2021, no ratings on FPA, unregulated partner broker (OspreyFX)

- Does not offer 1k or 1 million USD-funded accounts

- Limited educational resources

- Offers unclear profit-sharing rules for a 90% profit split

Quick rating of TopTier Trader and its features

| FPA Score | Not yet rated |

| Year founded | 2021 |

| Headquarters | United States |

| Minimum audition fee | 55 USD |

| Fees on withdrawals | Paid by traders |

| Minimum funded amount | 5,000 USD |

| Maximum funded amount | 300,000 USD (up to 600k with scaling) |

| Allowed daily loss | 5% |

| Profit target | 0-10% depending on the account and challenge phase |

| Maximum trailing drawdown | 8-10% |

| Profit sharing (Payouts) | 80% (up to 90% if trader is consistent) |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, commodities, indices, and crypto |

Safety of TopTier Trader – 0.5

TopTier Trader reviews are lacking on the FPA, there is only one super positive review, but It’s not enough to rate the firm on the platform yet. The firm is very transparent about its founders and top management team and is based in the USA. Phone support offered in 5 different languages adds to the firm’s legitimacy, as many prop firms lack this form of support. What this means is the firm is not hiding anyone or anything and shows its team and provides phone support. Being established in 2021, TopTier Trader is a young proprietary firm offering funded accounts for currency trading. The firm loses points in two components, being too young and having no evaluation on the FPA platform. Our third safety measurement metric is whether the firm offers services through a regulated broker. TopTier Trader’s partner broker is OspreyFX which is an unregulated broker based offshore. The firm is transparent and lists its founders on the About Us page, adding to its legitimacy.

The firm gets a 0.5 score in this section. We would usually give a 0 score when none of the three metrics are met, but the transparency of the TopTier Trader makes us believe that the firm might grow and become a legitimate prop firm with regulated brokers.

TopTier Trader Funding and Maximum Capital Allocation – 3

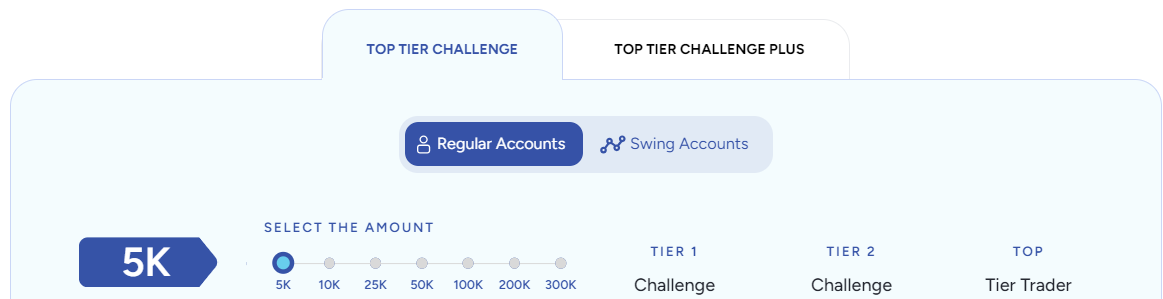

TopTier Trader prop firm offers two main funded account types, Top Tier Challenge accounts and Top Tier Challenge Plus accounts.

Top Tier Challenge account type is itself divided into two accounts called Regular Accounts and Swing Accounts.

All accounts come with funding ranging from 5,000 USD to 300,000 USD and require two challenging phases before the trader can become a funded trader. The exact funding options for all accounts are 5K, 10K, 25K, 50K, 100K, 200K, and 300K USD.

TopTier Trader funded program offers traders the ability to pass the 2 phases of evaluation and start trading.

TopTier Trader funding is very diverse, and we assume the TopTier Trader challenge is in line with popular prop firms’ offerings.

TopTier Trader scaling plan can be activated when a trader is consistent and is capped at 600,000 USD by doubling the funded accounts, but the exact rules are not clear.

For not offering lower funded accounts of 1k, and maximum amounts of at least 1 million USD, we give the firm a 3 score in this section.

TopTier Trader Assets – 3.5

TopTier Trader prop trading firm offers diverse training assets such as Forex, commodities, indices, and crypto. The spreads are competitive from 1 pip which is the industry standard and the firm offers demo account credentials to check exact spreads on MT4 and MT5 platforms.

The exact number of trading assets is as follows:

- Forex – 55

- Commodities – 9

- Indices – 9

- Cryptos – 31

Despite the OspreyFX having stocks for trading, TopTier Trader does not allow stock trading.

We evaluate the firm’s asset section with a 3.5 score for lacking stocks and any other assets.

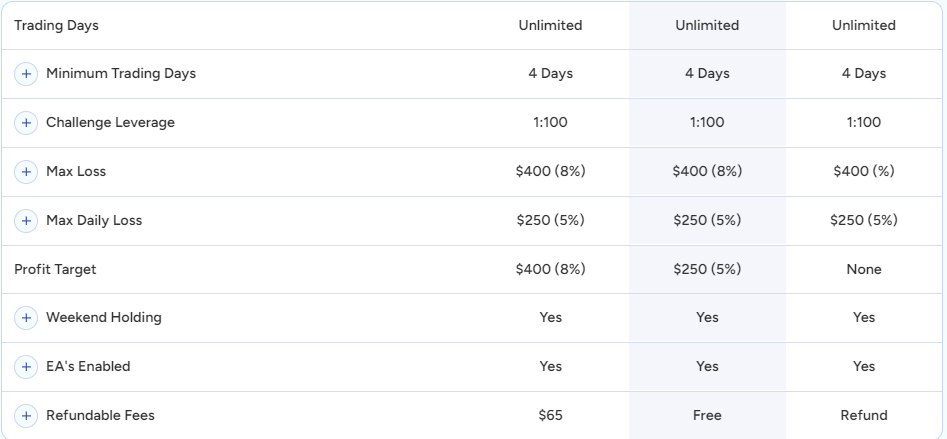

TopTier Trader Trading rules and limitations – 2.8

TopTier Trader rules are perfectly aligned with the industry standards and what other popular prop firms have to offer. The three different accounts offer slightly different limitations and rules. The Top Tier Challenge accounts that consist of Regular Accounts and Swing Accounts offer the following rules for tier challenge, tier 2 challenge, and funded trader phase:

- Minimum trading days – 4,4, none (4 days for swing accounts)

- Maximum trading days – unlimited for all accounts

- Maximum leverage – 1:100 for regular and 1:30 for swing accounts

- Maximum loss – 10% for all accounts

- Maximum daily loss – 5% for all accounts

- Profit target – 10%, 5%, None

- Weekend holding positions – No (yes for swing accounts only)

- EAs allowed – No

The rules are given for the tier 1 phase tier 2 phase, and funded phase. The main rules for the Top Tier Challenge Plus accounts are not very strict:

- Maximum daily drawdown – 5%

- Maximum all-time drawdown – 8%

- Profit split – 80%

- Maximum leverage – 1:100

- Minimum trading days – 4 days

- Evaluation phases – 2 phases

- Profit target – 8%, 5%, None

- Open trades over the weekends – Allowed

Any trading style and approach is allowed, giving traders superior flexibility to use their preferred systems.

Automated trading robots or Expert Advisors (EAs) are allowed only on the Top Tier Challenge Plus accounts.

We give the firm a 2.8 score in this section.

TopTier Trader Fees – 2.5

Here is the list of fees for Top Tier Challenge regular and swing accounts:

- Funded amount: 5,000 USD – Refundable one-time fees: 55 USD

- 10,000 USD – 130 USD

- 25,000 USD – 250 USD

- 50,000 USD – 350 USD

- 100,000 USD – 560 USD

- 200,000 USD – 979 USD

- 300,000 USD – 1,399 USD

55 USD for 5k and 130 USD for 10k USD accounts are very competitive pricing and below the industry standard of 150 USD for 10k accounts.

Top Tier Challenge Plus account comes with the following fees for funding options:

- 5,000 USD – 65 USD

- 10,000 USD – 140 USD

- 25,000 USD – 255 USD

- 50,000 USD – 375 USD

- 100,000 USD – 599 USD

- 200,000 USD – 999 USD

- 300,000 USD – 1,489 USD

As we can see, plus accounts are slightly more expensive than regular accounts.

All fees are refunded when the trader withdraws their first profits.

TopTier Trader free trial is not offered, but the firm gives back fees whenever the trader becomes a funded trader and withdraws profits for the first time. So, in a sense, these accounts can be earned freely when a trader is profitable and follows the firm’s rules.

TopTier Trader free repeat is also not available at the moment, and traders will have to pay one-time fees again if they break the rules and want to reset the funded account.

We give the firm a 2.5 score in this section for not offering 0 spreads and forcing traders to pay withdrawal fees.

TopTier Trader Platforms – 5

The trading platforms are two MT4 and MT5 and both are advanced and available for both mobile and desktop platforms. These platforms are provided via the unregulated partner broker of the firm OspreyFX. Traders can download MT4 and MT5 mobile apps and trade from their smartphones. Automated trading or EAs are also available, which is a great advantage.

All in all, we give the firm a 5 score in this section, as MT4 and MT5 offer greater flexibility through their advanced functionality.

TopTier Trader Profit-Sharing – 3

TopTier Trader’s profit split is 80% and when the trader is consistent the firm promises to upgrade it to 90%.

There are several conditions before a trader is eligible for payouts:

- No active trades must be open during withdrawal requests from the trader’s dashboard

- The first payout request can be submitted after 14–30 days after the first trade on the funded account

- Subsequent payouts can be conducted after 14 days from the first trade after the first withdrawal request has been processed

Payouts are processed within 24–48 hours after the firm has received a payout request from the trader.

The withdrawal methods accepted include:

- BTC

- LTC

- ETH

- USDC (ERC-20)

- Deel

- Visa/Mastercard

We evaluate the firm’s profit-sharing and withdrawal policies with a 3 score. The firm loses points as it does not provide a 90% split with clear conditions.

Education and trading tools at TopTier Trader – 2.3

The educational resources are limited on the firm’s website, and it only offers interesting and engaging articles on some concepts that are general. There are no specific guides or courses targeting beginners to teach them fundamental trading concepts.

However, there is an advanced dashboard offering some functionality. Trader’s dashboard has performance analysis and measures tools to support traders in controlling their risks and profitability.

We give the firm a 2.3 score in this section because there are no video guides or dedicated training courses.

Customer Support at TopTier Trader – 5

The firm takes support and transparency very seriously and offers all options for support including phone support, email, and live chat support. The live chat is the quickest way to contact the firm support and get all the help traders may need. Both the website and all support forms come in five different languages. Support is active 24/7 which is super helpful.

As a result of excellent support, we give the firm a 5 score in the support section.

Frequently Asked Questions

Is TopTier Trader legit?

Can I trade stocks with TopTier Trader?

Is there a free trial or demo account offered by TopTier Trader?