Topstep prop firm is based in Chicago, Illinois, and has been on the scene since 2012. The firm is an experienced company that offers solely futures assets. Despite this limitation, the firm requires the lowest monthly fees for 50k funded accounts and excels in educational resources and simplicity of trading rules.

In our Topstep review, we will focus on details such as funding options, safety, fees, assets, platforms, education, and many more.

Pros & cons of Topstep prop firm

Pros

- Ability to withdraw with $0 fees

- Does not have a daily loss limit

- Fast and digital account opening/verification

- The profit target is just 3%

- Offers diverse educational resources

- Has one of the best profit-sharing policies of 90% (100% split for the first 10k withdrawals)

- Most payment options are free and instant

Cons

- Provides access to Futures products only

- Trading assets are limited to only futures

- Lacks reviews on the FPA

Quick rating of Topstep and its features

| FPA Score | Not yet rated |

| Year founded | 2012 |

| Headquarters | Chicago, United States |

| Minimum audition fee | 49 USD per month |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 50,000 USD |

| Maximum funded amount | 150,000 USD |

| Allowed daily loss | None |

| Profit target | 3% |

| Maximum trailing drawdown | 4% |

| Profit sharing (Payouts) | 90% (100% for the first 10,000 withdrawals) |

| Trading Platforms | NinjaTrader, Quantower (a multitude of other platforms can be used, see platforms below) |

| Available trading markets | Futures products only |

Safety of Topstep – 1.5

The firm operates three websites including TopstepTrader.com, TopstepFX.com, and topstep.com with the same visual interface.

There are no Topstep reviews on the FPA platform, which is disadvantageous and makes the firm lose safety points. We could not find the partner broker of the Topstep, there is no information, so we assume there is none. All accounts therefore are virtual and simulated.

The firm gets a 1.5 score in this section.

Topstep Funding and maximum capital allocation – 2

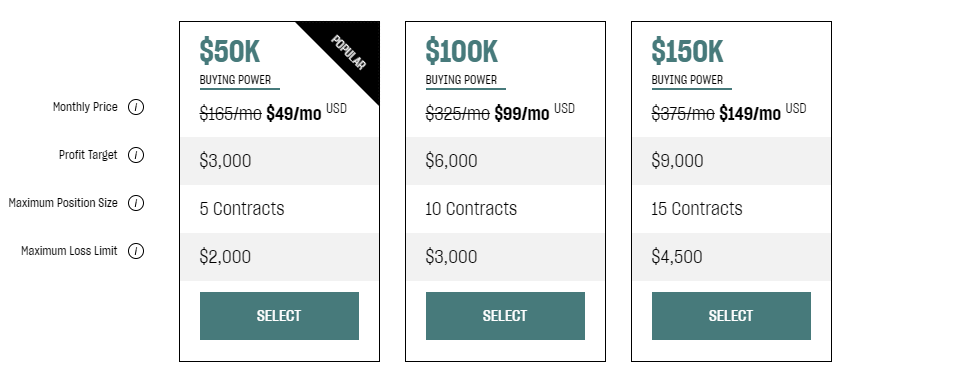

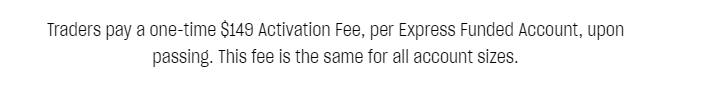

Topstep funded programs are offered through diverse funded account types of Trading Combine, Express Funded Account, and Live Funded Account. All three accounts have similar funding options of 50k, 100k, and 150k USD. For the Trading Combine accounts, trailers pay monthly fees, while the Express Funded Account and Live Funded Account require a one-time activation fee upon passing the evaluation.

Topstep funding is competitive for futures trading in the USA. It is required for day traders in the United States to have at least 25 grand in their trading accounts. In this context, a 50k funded account for a monthly fee of 49 USD is a super attractive offer.

In order to pass the Topstep challenge, traders have to follow several simple rules. We will focus on them in the following section in more detail, but the list is few.

Topstep prop trading firm seems to offer great value with its ongoing discounts and the only rule is to be profitable with at least 3%.

The Topstep scaling plan can be activated by doubling the account size after reaching the profit goals, but the company does not mention the highest amount traders can get through scaling.

Since the firm is not offering lower funding and there is no higher cap at least 1 million USD, we give it a 2 score in this section. However, the minimum funding of 50k costs just 49 USD per month, which makes it on par with other firms’ 10k accounts.

Topstep Assets – 1

The firm only offers futures assets, but these futures can have diverse underlying asset classes including Forex, metals, interest rates, and more. The operational costs are low, and contract sizes are 5,10, and 15 for 50k, 100k, and 150k USD accounts respectively.

We give the firm a 1 score for only offering futures asset classes for trading.

Topstep Trading rules and limitations – 3.5

Topstep rules are simple: traders have to manage their risks according to rules and show profitability. The rules are as follows:

- Profit target – 3%

- Maximum Position Size – 5,10, and 15 contracts for 50k,100k, and 150k funding

- Maximum Loss Limits – 4%

The maximum loss limit is calculated using the following formula: Account balance high – maximum drawdown. It is reset at the end of each trading day.

Traders are allowed to trade up to 3 Express Funded accounts simultaneously.

As a result of strict maximum loss policies, the firm gets a 3.5 score in this section.

Topstep Fees – 4

We have yet to see lower monthly fees for futures funded accounts than what Topstep has to offer. The Trading Combine account type has monthly fees:

- 50,000 USD – 49 USD per month

- 100,000 USD – 99 USD per month

- 150,000 USD – 149 USD per month

For other accounts, traders must pay a one-time activation fee, per Express Funded Account, upon passing the evaluation phase. This fee remains the same for all account sizes.

Both default platforms of NinjaTrader and Quantower are free to operate.

The fees are charged for $0.53 per contract.

Topstep free trial is not available at the moment as traders will have to pay the fee for resetting the account.

Topstep free repeat is not possible either as the firm charges monthly fees for all accounts.

The firm gets a 4 score in this section, as it lacks only zero spreads and has ongoing discounts for monthly fees.

Topstep Platforms – 5

Although Topstep offers NinjaTrader as the main trading platform for futures trading, traders are free to use other platforms as long as they use the same data feed as the one during the purchase of the account. The list of supported platforms includes TradingView via purchasing the new Tradovate Trading Combine and enabling the TradingView add-on. Other platforms are Quantower, Tradovate, Sierra Chart, T4, Jigsaw Daytradr, MultiCharts, R|Trader Pro, VolFix, Trade Navigator, ATAS OrderFlow Trading, MotiveWave, Bookmap, and Investor/RT.

Allowed data feeds include CQG and Rithmic. Topstep gives the trader the freedom to select their favorite futures trading platform as long as the data feed is the same. The majority of these platforms come with all devices and all OS support and allow automated trading capabilities just like TradingView.

We give the firm a 5 score in this section despite lacking MT4, MT5, or cTrader as these many platforms deserve this high score.

Topstep Profit-Sharing – 5

The Topstep profit split is 100% for the first 10,000 USD payouts and is capped at 90% thereafter.

Withdrawals take up to 7 hours to be processed, which is very fast and comfortable. There is only one single rule to initiate a withdrawal request: trader must have 5 winning days of $200 plus earnings. Payouts are also given daily.

For offering quick withdrawals and a profit split of 90% the firm gets a well-deserved 54 score in the profit-sharing section.

Education and trading tools at Topstep – 5

When it comes to education the firm excels by providing a multitude of materials such as Free coaching, TopstepTV, Blog, Weekly Levels, and trader’s community. As we can see the firm offers all types of education including webinars, trading courses, video tutorials, and blogs.

Futures Trading 101 is provided through an educational video series and has a dedicated section apart from the educational resources section. The education is top-notch from Topstep. There is no doubt the firm gets a full score in this regard.

However, we also check for tools and trader performance measure apps to ensure firms support traders to easily monitor their progress and abidance with the rules. Topstep offers several tools including an economic calendar, the latest news, and market analysis every week. Apart from the trader’s dashboard, there is a dedicated app called COACH T, which helps traders monitor and check their performance.

For offering top-notch educational resources and trading tools, Topstep gets a solid 5 score in this section.

Customer Support at Topstep – 3.6

The customer support is done through various channels. The AI chatbot called Windy will provide users with help on predetermined scenarios and FAQs. The chat has an inbuilt help center where traders can quickly browse through details of the Topstep services with a search bar. Despite being very useful and helpful, Windy is not a live chat. For this purpose, the firm offers a Discord channel where traders can get help. Discord is a separate software similar to Telegram and WhatsApp and will require additional installation and account creation, making it a bit uncomfortable. We still assume the firm offers a live chat despite these challenges. So Topstep does not lose a score in this component. As for other forms of support, there is email support provided, which is built into Windy and lets users send a message to the firm’s customer representatives. There is no phone support at this moment as the firm is not large and consists of a handful of employees as the firm states on its About page. Both the website and support are available in four different languages including English, Japanese, French, and Spanish.

We evaluate the firm with a 3.6 score for lacking multilingual support in at least 5 languages.

Frequently Asked Questions

Is Topstep legit?

What Types of Assets Can I Trade with Topstep?