The Trading Pit is an award-winning proprietary trading firm founded in 2022. The Trading Pit is majority-owned and forms part of Pinorena Capital, a fintech-focused private equity firm founded by financial industry entrepreneur Illimar Mattus. The prop firm provides access to the largest selection of asset classes, including Futures, metals, shares as CFDs, FX pairs, indices, commodities, crypto, and energies. Traders have access to these markets through reliable and regulated brokers that they partnered with.

Pros & cons of The Trading Pit

Pros

- Wide range of asset classes including Futures, metals, shares as CFDs, FX pairs, indices, commodities, crypto, and energies

- Advanced trading platforms such as ATAS, Quantower, R/Trader, and standard trading platforms for CFDs

- No fees for withdrawing funds

- The high profit-sharing ratio for CFDs (80%)

- Comprehensive educational resources including blogs, eBooks, webinars, podcasts, videos, infographics, glossaries, and press releases

- Providing dedicated support and website in various language

- Allows overnight and weekend trading except Prime Futures products

- Offering a variety challenges for CFDs and Futures

Cons

- Not yet rated by the Forex Peace Army (FPA)

Safety of The Trading Pit – 1.5

As already mentioned, The Trading Pit was founded in 2022 and the company lacks experience. Furthermore, the prop firm hasn’t earned a rating from the FPA (Forex Peace Army) yet. On the other hand, The Trading Pit partnered with regulated brokers that offer standard CFDs trading platforms to all their clients.

Funding and Maximum Capital Allocation – 3

The Trading Pit offers various challenges for CFDs and Futures. The firm not only offer Classic products for both CFDs and Futures, but also newly launched Prime products for CFDs and Futures. For CFDs, there are 4 types of Prime and Classic challenges. As for Futures, there are 3 types of Prime and 4 types of Classic challenges. These allow clients to choose any challenge according to their preference and needs.

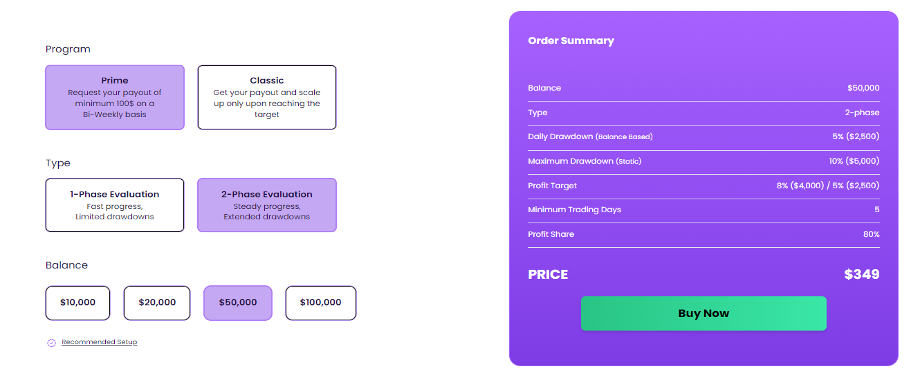

For CFDs, there are Prime and Classic products, each has 4 types of challenges. Prime products have 1-phase and 2-phase challenge options. Whereas Classic products have only 1-phase challenges. All accounts in the CFDs challenge have the same range of account balance, including 10k, 20k, 50k, and 100k USD.

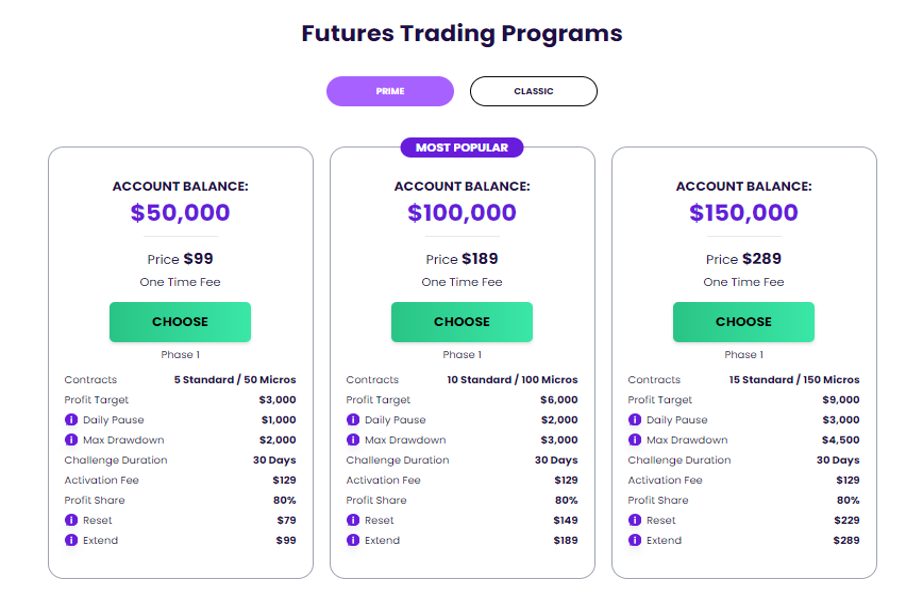

For Futures, there are 3 types of challenges for Prime and 4 types of challenges for Classic.Prime products offers 1 phase challenges and the account balances offered are $50k, $100k, and $150k.

Classic products offer 1 phase and 2 phases challenges. The account balances are $20k, $150k, $200k, $250k. The Trading Pit offers scaling plans for all the challenges and allows traders to progress on several levels to reach the maximum amounts. The firm gets a 3 score in this section for providing diverse account balance options but lacking smaller account balance options.

Assets – 5

What sets The Trading Pit apart from other prop firms is that the company offers a wide range of asset classes for trading, including Futures, metals, shares as CFDs, FX pairs, indices, commodities, crypto, and energies.

Trading Rules and Limitations – 3.3

For CFDs Prime products, the daily drawdowns are 4% for 1-phase and 5% for 2-phase, the maximum drawdowns are set at 7% for 1-phase and 10% for 2-phase, and the profit targets are 10% for 1-phase and 8% / 5% for 2-phase. For CFDs Classic products, the daily drawdown is 4%, the maximum drawdown is set at 7%, and the profit target is 10%.

For Futures Prime products, the daily drawdowns are $1K, 2K, & 3K, the maximum drawdowns are set at $2K, 3K, & 4.5K, and the profit targets are $3K, 6K, & 9K. All these are depending on the account type you choose. For Futures Prime products, the daily drawdowns are from $250 to $2.5K, the maximum drawdowns are from $500 to $5K, and the profit target is $1K and 5K for 1-phase, $3K for 2-phase. All these are depending on the account type you choose.

News trading and copy trading are allowed for Prime Future products. EAs and hedging are allowed for all challenges. For offering the rules that allow traders to deploy many different trading styles, it gets a 3.3 score in this section.

Fees – 5

Challenge Fees depends on your account choice. For Prime CFDs products, $10K account balance is $99, $20K account balance is $199, $50K account balance is $349, and $100K account balance is $569. For Futures Prime products, $50K account balance is $99, $100K account balance is $189, and $150K account balance is $289.

For Classic CFDs products, the minimum fee is $99 ($10K account) and the highest fee is $999 ($100K account). For Futures Classic products, the minimum fee is $99 ($20K account) and the highest fee is $999 ($250K account).

Platforms – 5

The firm provides several advanced trading platforms depending on the trading asset. The Trading Pit offers a wide range of trading platforms for Futures trading as well. For Futures trading – ATAS, Quantower, and R/Trader.

MetaTrader platforms are the most popular globally and they are available.

The firm offers a range of diverse trading platforms and gets a 5 score in this section.

Profit-Sharing and Withdrawals – 3

For all the Prime products (CFDs and Futures), the profit sharing is 80% during the scaling plan. For all the Classic products, the profit sharing starts from 50% up to 80% during the scaling plan. Despite this difference, the 80% profit-sharing on CFDs and Futures (Prime products) is decent and competitive. Overall, the firm gets a 3 score in this section.

Education at The Trading Pit – 5

The Trading Pit offers diverse educational resources available for both beginners and seasoned traders. These comprehensive resources include blogs, Ebooks, Webinars, Podcasts, Videos, Infographics, Glossary, and Press Releases. With all these content and trading tools the firm surely is one of the best firms out there. The Trading Pit receives a well-deserved 5 score in this section.

Customer Support at The Trading Pit – 5

The Trading Pit offers great customer support, having offices in Liechtenstein, Cyprus and Spain. Clients of the prop firm can contact the company via email, live chat, or over the phone. Clients can also find supports in various languages, including English, Spanish, Polish, Mandarin, Portages, German, Italian, Malay, Arabic, and Vietnam.

Frequently Asked Questions

Is The Trading Pit a broker?

What can I trade with The Trading Pit?

Can I trade Futures with MetaTrader platforms?