The Funded Trader prop firm was founded in 2021 by a team of experienced veterans who aimed to disrupt the prop trading industry by offering top-notch support and customer-centric challenges. In 2022, the firm started offering free challenges, allowing traders to show their trading skills and get funded without paying anything. The firm has also launched a rapid challenge event in the past year. With the rapid challenge, traders can become funded traders in as little as 3 days.

In our unbiased The Funded Trader review, we will test all the claims by the firm and analyze its safety, funding options, asset diversity, fees, rules, limits, support, and more.

Pros & cons of The Funded Trader Program prop firm

Pros

- Ability to withdraw with $0 fees, and spreads from 0 pips

- Offers access to MetaTrader 4, MetaTrader 5, cTrader

- Fast and digital account opening/verification

- Offers access to diverse financial markets such as Forex pairs, cryptos, indices, and commodities

- Lower fees for 5,000 USD (65 USD)

- Up to 90% profit split possibility with event

- Most payment options are free and instant

- Offers trading through 3 different regulated brokers (EightCap, ThinkMarkets, Purple Trading)

- Flexible funding options from $5,000 to $400,000 with 25% scaling

- Multiple support options (email, hotline, live chat)

Cons

- Lacks reviews on the FPA and experience in the industry

- Offers limited educational resources

- Only four languages are supported

Safety of The Funded Trader Program – 1.5

The Funded Trader Program reviews are lacking on the FPA. There are only two reviews and both of them are negative, mentioning support quality issues and large spreads. The firm loses points in the FPA component for not having sufficient comments and for negative comments. As for the experience in the industry, The Funded Trader Program was founded in 2021 giving it less than 3 years of experience, resulting in 0 points in this metric as well. Another important safety metric is if the firm is offering trading through a regulated broker. The partner broker, Purple Trading, is a well-regulated brokerage under CySEC oversight and holds a respectable rating on the FPA, indicating its status as a reliable and reputable broker. Other partner brokers include EightCap and ThinkMarkets, and all of them are very well-regulated and reliable options. The firm gets points as a result.

The Funded Trader Program gets a 1.5 score in safety thanks to the partner broker being regulated.

The Funded Trader Program Funding and Maximum Capital Allocation – 3

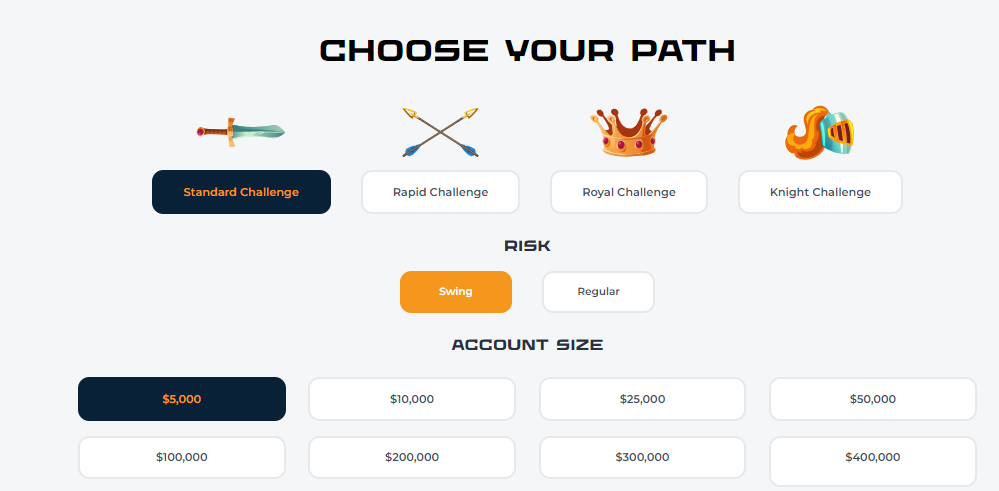

The Funded Trader Program funded programs consist of three account types Standard, Rapid & Royal Challenge, and Knights Challenge.

The Funded Trader Program funding options range from 5,000 USD to 400,00 USD depending on the account selected. The Funded Trader Program challenges are usually two-phased challenges except the Knights Challenge which consists of just one phase.

Let’s see the funding range for each account type to see the options more clearly. The standard challenge has the following funded options for both swing and regular accounts 5k, 10k, 25k, 50k, 100k, 200k, 300k, and 400k. The Rapid Challenge has slightly different funding ranges of 5k, 10k, 25k, 50k, 100k, and 200k. The Royal Challenge consists of 50k, 100k, 200k, and 300k USD accounts. The final Knights Challenge account has funding options of 25k, 50k, 100k, and 200k.

The Funded Trader Program, prop trading, offers a trader the unique ability to get to a funded account in just 3 days if they follow rules and hit the profit target.

The Funded Trader Program scaling plan can be employed to increase the starting funded balance by 25%. The firm’s scaling plan is moderate, unlike many other firms that offer much higher scaling options.

The firm gets a 3 score in this section for not offering a minimum of 1k and a maximum of at least 1 million USD funded options.

The Funded Trader Program Assets – 3.5

The firm offers a diverse selection of assets including 40 Forex pairs, 2 metals, 9 indices, 4 cryptos, and 2 more commodities. Only four popular crypto pairs are offered for trading:

- BTCUSD

- BCHUSD

- LTCUSD

- ETHUSD

The four commodities are:

- UKOUSD (Spot Light Crude Oil)

- USOUSD

- XAGUSD (silver)

- XAUUSD (gold)

The firm offers the exact list of tradable instruments on its help page.

Offering diverse asset classes enables The Funded Trader Program to get a 3.5 score in the assets section.

The Funded Trader Program Trading rules and limitations – 2.6

The Funded Trader Program rules are different depending on the account type and phase of the challenge. Virtual profit target rules are:

- Standard challenge phase 1 profit target – 10%

- Standard challenge phase 2 profit target – 5%

- Rapid Challenge Phase 1 profit target – 8%

- Rapid Challenge Phase 2 profit target – 5%

- Royal Challenge Phase 1 profit target – 8%

- Royal Challenge Phase 2 profit target – 5%

- Knights Challenge Phase 1 profit target – 10%

Standard, Rapid, and Royal challenges have a virtual daily loss limit of 5% while the Knights challenge comes with 3% daily loss limitations. The overall drawdown for the Standard and Royal accounts is capped at 10%, Rapid has an 8 % overall drawdown, and Knights challenges will allow only 6%.

The minimum trading days for all accounts:

- Standard Challenge – 3 days

- Rapid Challenge – 0 days

- Royal Challenge – 5 days

- Knights Challenge – 0 days

The maximum allowed daily drawdown resets every day, and traders are advised not to take any positions during reset times (4:57 PM – 5:03 PM EST).

News trading is allowed. Trading cryptos over the weekends is allowed for simulated phases and not for the funded phase. The firm does not allow holding any positions for other assets over the weekends except for, Standard Challenge – Swing Account, Rapid Challenge – Swing Account, Royal Challenge, and Knight’s Challenge. EAs are prohibited.

For offering competitive rules and limitations, The Funded Trader Program receives a 2.6 score in this section.

The Funded Trader Program Fees – 5

The lowest fee starts at 65 USD for 5,000 USD accounts, which is a competitive fee. However, we have seen prop firms with lower fees for 10 and 15k accounts. The Standard Challenge accounts come with the same fees for both regular and swing funded accounts:

- Funding amount: 5,000 USD – One-time fee: 65 USD

- 10,000 USD – 129 USD

- 25,000 USD – 199 USD

- 50,000 USD – 299 USD

- 100,000 USD – 499 USD

- 200,000 USD – 939 USD

- 300,000 USD – 1,469 USD

- 400,000 USD – 1,879 USD

Rapid Challenge account also comes with the same on-time fees for both regular and swing funded accounts:

- Funding amount: 5,000 USD – One-time fee: 79 USD

- 10,000 USD – 129 USD

- 25,000 USD – 229 USD

- 50,000 USD – 299 USD

- 100,000 USD – 499 USD

- 200,000 USD – 899 USD

Royal Challenge has only one funded account with the following fees:

- 50,000 USD – 289 USD

- 100,000 USD – 489 USD

- 200,000 USD – 939 USD

- 300,000 USD – 1,399 USD

- 400,000 USD – 1,869 USD

Knights Challenge has more limited funding options:

- 25,000 USD – 189 USD

- 50,000 USD – 289 USD

- 100,000 USD – 489 USD

- 200,000 USD – 939 USD

The Funded Trader Program free repeat is not possible, as traders will have to purchase challenges from the beginning if they break any hard rules.

The Funded Trader Program free trial is also unavailable at the moment, despite the firm starting its business with several free trial challenges.

EightCap offers 0 pips spreads on major pairs, which is great for scalpers and the firm gets a point in this component of fees.

Overall, The Funded Trader Program gets a 5 score in the fees department for excellent policies and discounts.

The Funded Trader Program Platforms – 3.9

Since the firm has partnered with 3 different regulated brokers, the platforms offered include MT4, MT5, and cTrader. All three are among the most popular and advanced platforms with full functionality. However, the firm limits its use for automated trading which is a downside as, MT4, MT5, and cTrader all support trading algorithms. Despite the platforms having automatic trading functions, the firm prohibits it, losing points in this component.

Overall, The Funded Trader Program gets a 3.9 score in this section.

The Funded Trader Program Profit-Sharing – 5

The Funded Trader Program profit split is 80% standard from the first withdrawal and beyond. There is an exception, if the trader buys a 90% promotion profit share they will be eligible for a 90% profit split for an unlimited time.

Withdrawals can be requested after 7 days from placing the first order on the funded account. Payouts are paid once per week.

The firm gets a 5 score for offering 90% withdrawals and quick processing times.

Education and trading tools at The Funded Trader Program – 1.5

There is a blog section on the website under the media button, providing posts and articles about various trading and company-related topics. These articles and blog posts can give traders some general information about trading but are not sufficient to start from zero and become successful. There are a multitude of videos, but only about the company’s news, services, and similar matters. No video tutorials for trading and concepts are given. There are posts about trading psychology, trading systems, trader interviews, and industry news. So, the firm gives traders general guidance and also offers market analysis, which is advantageous.

Overall, The Funded Trader Program gets a 1.5 score in the educational section.

Customer Support at The Funded Trader Program – 3.6

The support options offered by the firm are numerous and include advanced live chat, email support, and phone support. The live chat has several inbuilt tabs for offering help centers, FAQs, news, and the live chat itself. This potentially allows traders to resolve all issues and get all news and information from one plugin, which is comfortable and responsive. Both the website and support come in four different languages. We only give firms a point in this component when they offer at least 5 different languages, meaning The Funded Trader Program does not get a point in this metric.

The firm gets a 3.6 score in the support section.

Frequently Asked Questions

Is The Funded Trader Program legit?

What are the funded options range in The Funded Trader Program?

How long does it take to become a funded trader with The Funded Trader Program?