The 5%ers is a proprietary trading firm founded in 2016 and based in Israel that offers some of the best funding terms to traders on the market.

The maximum funding amount offered by the firm is a whopping $4 million, which is considerably higher than the $1 million or less offered by most prop firms around the world.

The firm is primarily focused on equities, such as stocks, but also offers some currency pairs and metals as well.

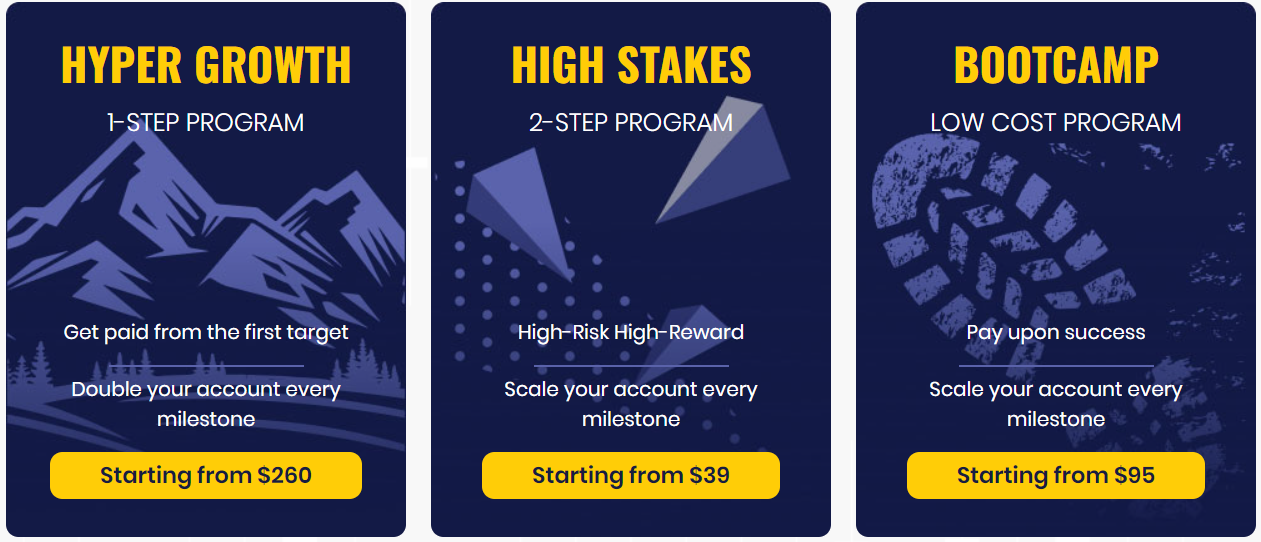

The 5%ers have three distinct funding programs that offer different terms and funding amounts to traders. These programs are – The Bootcamp, Hyper Growth, and High Stakes. These programs also differ in the number of phases it takes traders to get funded and start trading with a live account.

This review will look at the terms and services offered by The 5%ers and rate the firm based on a number of important criteria, such as fees, instruments offered, and customer support, among others.

Pros and Cons of The 5%ers Proprietary Trading Firm

Pros

- $4 million in maximum funding available

- Over 3,000 equities, forex and metals available

- For beginners, there is a paid training program and a demo account

- Free funding up to $6,000 available

- No limitations on trading strategy

- Standard leverage is 1:10, can be increased to 1:30. Maximum leverage is 1:100

- The platform provides trading tools, analytics, strategy ideas, and an economic calendar

Cons

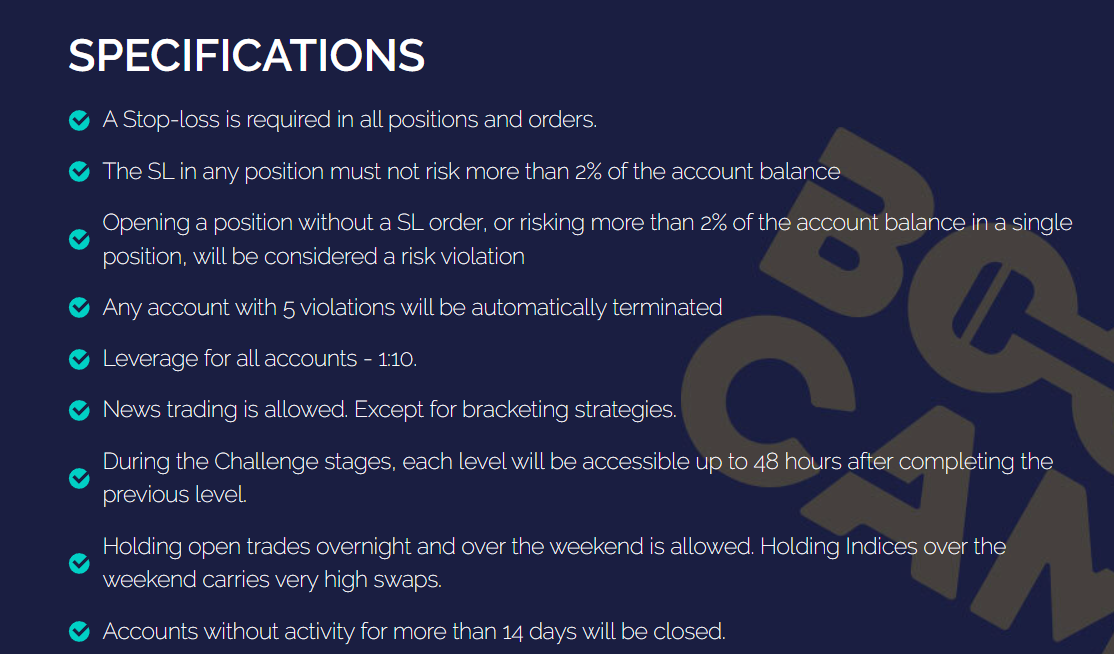

- Stop-loss orders are required for every trade and the risk ceiling is only 2% of the account balance

- Accounts that are inactive for more than 21 days are terminated

- Traders cannot have more than 3 accounts simultaneously

- Limited forex and commodities offering

- Copy trading is not allowed

Quick Rating of The 5%ers Prop Trading and Its Features

| FPA Score | NOT RATED |

| Year founded | 2016 |

| Headquarters | Raanana, Israel |

| Minimum audition fee | $39 |

| Fees on withdrawals | None |

| Minimum funded amount | $5,000 |

| Maximum funded amount | $4,000,000 |

| Allowed daily loss | 5% |

| Profit target | Varies (5-10% for most accounts) |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | Up to 90% (75% at Bootcamp) |

Safety of The 5%ers – 1.5

The 5%ers was founded in 2016 as a prop firm that focuses on stocks, therefore, it is not rated by the Forex Peace Army, which is a reliable source of forex broker and prop firm ratings.

The company has been around for 7 years, which gives traders a decent track record to evaluate the legitimacy of the firm.

The firm has partnerships with ECN liquidity providers and not regulated brokers, which may be a cause for concern for some traders.

As for the security measures available on the platform, traders can use two-factor authentication to add a layer of security to their accounts.

Overall, a lack of meaningful regulations and licenses gives The 5%ers a Safety score of 1.5 out of 5.

Funding and Maximum Capital Allocation – 4

As already mentioned, the accounts offered by The 5%ers are divided into three funding programs, which offer different terms and funding options. The amount of funding provided by each of the three programs is the following:

- The Bootcamp – $25,000, $50,000, and $75,000 for the Challenge stage, $100,000-$4,000,000 for the live accounts through scaling

- Hyper Growth – $10,000, $20,000, $40,000 for Level 1, can also scale up to $4 million after moving through levels

- High Stakes – $5,000, $20,000, $60,000, and $100,000, with an option to scale up

The funding options provided by The 5%ers can be a bit confusing for first-time traders, but the variety of funding tiers is a welcome addition. Traders can start as low as $5,000 and work their way up the ladder through consistent profits, all the way up to $4 million.

Overall, The 5%ers gets a 4 out of 5 for Funding and Capital Allocation.

Assets – 3.5

The instruments offered by The 5%ers are mostly focused on stocks, but the firm also offers forex pairs and metals, as well as equity indices.

The total number of instruments offered is over 3,000 for stocks, gold and silver, and major forex pairs.

The major indices offered by The 5%ers includes the likes of:

- The S&P 500 and its constituents

- The Nasdaq-100 and its constituents

- The Nikkei 225 and its constituents

- The Dow Jones and its constituents

- The FTSE 100 and its constituents, and more

The minimum lot size for forex, metals, and indices is 0.01, which is in line with many other prop trading firms.

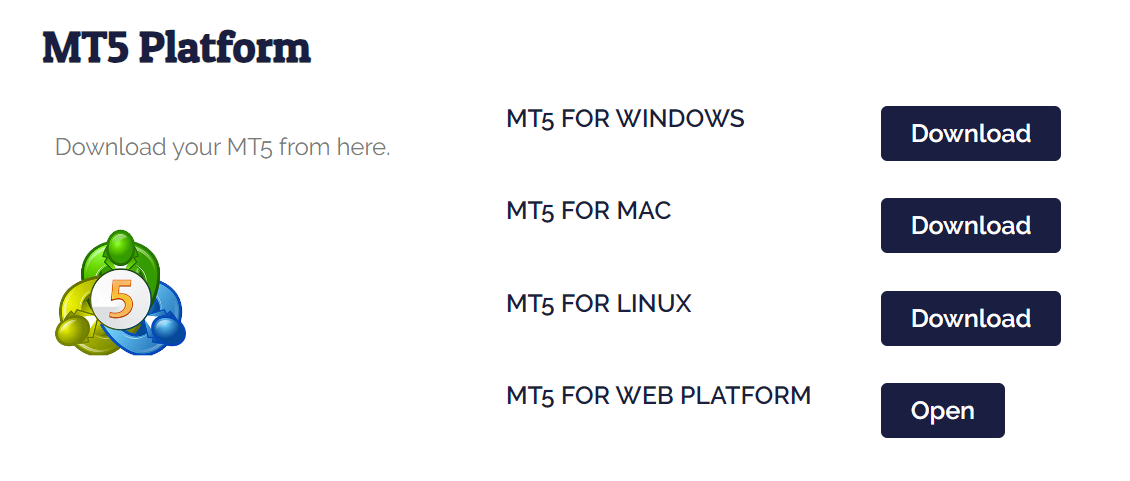

All of the assets offered by The 5%ers can be traded using the MetaTrader 5 platform.

Overall, The 5%ers gets an Assets score of 3.5 out of 5, as it is missing cryptocurrencies and a large number of futures and CFDs.

Trading Rules and Limitations – 3

The trading rules enforced by The 5%ers are mostly relevant to the specific funded accounts selected by traders and can vary significantly, although some aspects remain the same.

The general provision of the firm allows traders to hold positions overnight and trade over the weekend, while copy trading is not allowed on any of the accounts.

The maximum number of accounts a trader can have is 3, which is another measure taken against copy trading.

A 3% daily loss pause is in place to protect traders from significant losses. Once the pause level has been reached, trading is paused and all trades are closed until the next trading day.

Traders can use different currencies to fund their accounts and execute trades, such as: EUR, USD, GBP, JPY, CAD, AUD, NZD and CHF.

As for the specific rules and limitations related to each of the three accounts, they are the following:

- Bootcamp – traders will need to pass three challenge stages. No minimum completion time and no minimum trade requirements during the challenge. The leverage offered is 1:10. Account expiration after 14 days of inactivity. No copy trading allowed. A stop-loss is required for all trades. Termination after 5 violations. Maximum number of active accounts per trader is 3. 75/25 payout ratio

- Hyper Growth – no time limits. Leverage up to 1:30. 10% profit target, 6% stop-out level. Doubling of account target per each level, up to $4 million. News trading is allowed. First payout 14 days after receiving the funded account

- High Stakes – no maximum trading period. Minimum 3 profitable trading days. 5% maximum daily loss and 10% maximum overall loss. 8% profit target for Step 1 and 5% for Step 2, 10% after funding. Leverage of 1:100. 80-100% profit split. One $5,000 account and one other account allowed. Can be scaled up to $500,000

As we can see, the demands for each of the funded accounts can vary and are somewhat complex. However, this variety also means that there is something for everyone at The 5%ers.

Overall, The 5%ers gets a Rules and Limitations score of 3 out of 5.

Platforms – 5

The primary trading platform offered by The 5%ers is MetaTrader 5, which is the most popular platform among forex and futures traders.

The stock trading platform is offered by Trade The Pool, which is the first fully-fledged stock prop trading firm.

The firm also offers readily available indicators, as well as Autochartist for advanced charting.

Expert Advisors are also available and can be downloaded from The 5%ers’ official website.

Mobile apps for iOS and Android devices are also offered.

Overall, The5%ers gets a rating of 5 out of 5 for its Platforms.

Profit-Sharing and Withdrawals – 3

Profit-sharing agreements vary between the three funded programs. The maximum profit share traders can obtain is 100%, with the minimum being 75%.

The profit shares for the three accounts are as follows:

- 75% for the Bootcamp program

- Up to 100% for the Hyper Growth program

- 80-100% for the High Stakes program

Traders can request withdrawals on a bi-weekly basis and the withdrawable amount must be a minimum of $150. Withdrawal methods include bank transfers and electronic payment systems, such as e-wallets.

Overall, The firm gets a score of 3 out of 5, as withdrawals can take more than 2 business days.

Fees – 4

The entry costs for funded accounts can vary and trading fees in the form of spreads are also applicable at The 5%ers. The entry fees for each of the challenges and funded accounts are:

- $95 for the $100,000 and $225 for the $250,000 Bootcamp challenges

- $260, $450, and $850 for the Hyper Growth programs of $10,000, $20,000, and $40,000, respectively

- $39, $165, $300, and $495 and for the High Stakes programs, with bonuses of $10, $35, $55, and $95, respectively

Aside from the general account fees, there are commission charges for each trade, the specifications of which are readily available on the “Asset Specifications” page of the FAQ section. Affordable fees and low spread on trades give The 5%ers a score of 4 out of 5 for Fees.

Education at The 5%ers – 5

Education is one of the strongest suites of The 5%ers, as the firm offers a wide selection of educational content for beginners and existing traders, such as:

- Trading tools for performance tracking, including indicators

- A free trading course for forex, stock, and commodity traders

- A comprehensive blog with dozens of interesting articles about trading

- The 5ers classes for complete beginners

- Psychology coaching

- Webinars and other video content

Due to a comprehensive list of educational content and trading courses, The 5%ers gets a score of 5 out of 5 in Education.

Customer Support at The 5%ers – 3.6

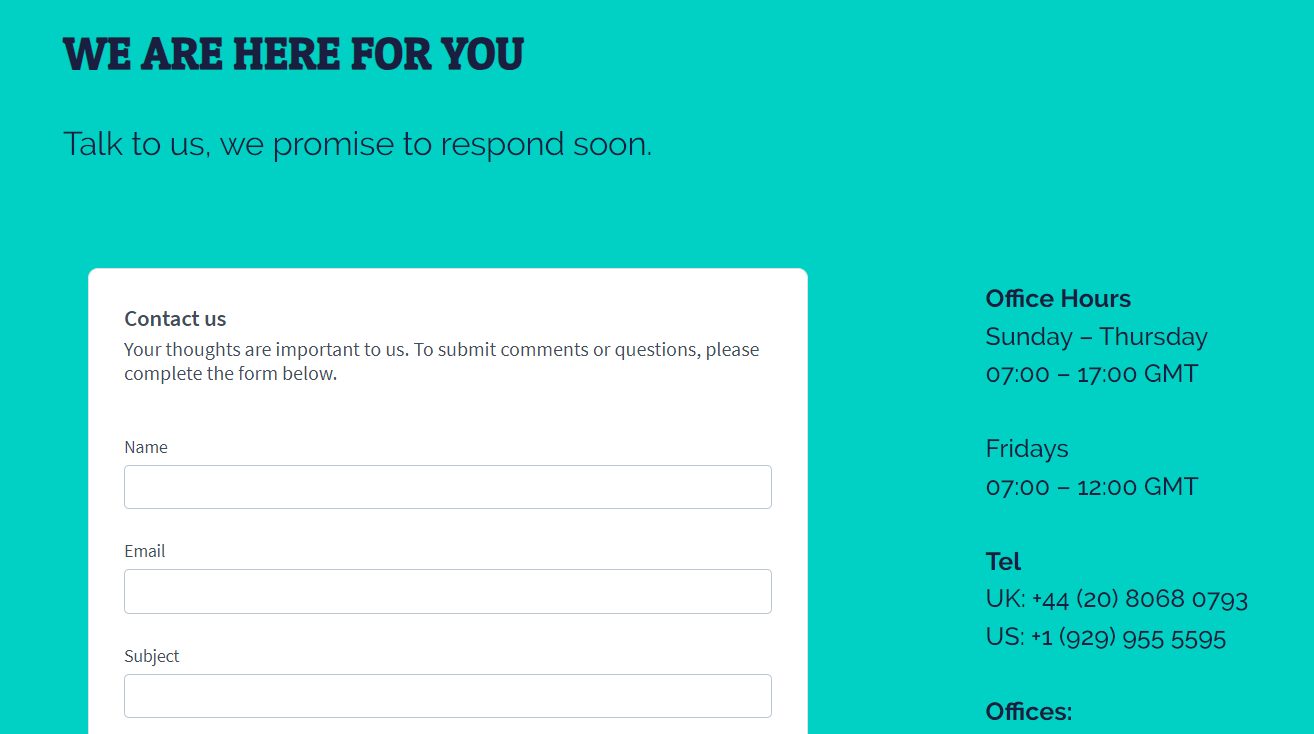

Customer support at The 5%ers consists of a hotline, a support email, and a live chat function.

Office hours at The 5%ers start at 07:00 and end at 17:00 GMT from Sunday to Thursday. On Fridays, the firm is open from 07:00 to 12:00 GMT.

The hotline has a UK, as well as a U.S. telephone number. The firm has physical offices in Raanana, Israel, and London, UK.

The website is available in English, Spanish, and Arabian. Overall, the firm gets a score of 3.6 out of 5 in Customer Support.

Frequently Asked Questions

Is The 5%ers a broker?

How much funding can I get at The 5%ers?

What can I trade at The 5%ers?