Founded in 2020 in Orlando, Florida, TakeProfitTrader is a relatively new proprietary trading firm founded by former hockey player James Sixsmith.

The firm provides training courses and funded accounts to traders, with funding up to $150,000.

The firm is predominantly focused on futures trading, but has plans in place to gradually include other asset classes in its offerings as well.

The firm offers flexible terms, instant funding and fast withdrawals, which makes it easier for traders to plan ahead.

The Pro+ account tier offers the best perks and benefits available at the prop firm, with a profit split of 90% and no daily loss limits.

This review will look at the terms and services offered by TakeProfitTrader and rate the firm based on a number of important factors, such as fees, profit-sharing, and tradable assets.

Pros and Cons of TakeProfitTrader Proprietary Trading Firm

Pros

- Pro account unlocks after 5 trading days

- Affordable account fees

- Support available 12 hours a day

- 0 days until the first withdrawal

- Frequent discounts and promotions

- Up to 3 resets on Pro accounts

Cons

- Maximum funding is only $150,000

- No automated trading allowed

- Maximum position limitations on Pro accounts

- Very low daily loss limits

Quick Rating of TakeProfitTrader Prop Trading and Its Features

| FPA Score | NOT RATED |

| Year founded | 2020 |

| Headquarters | Orlando, Florida, United States |

| Minimum audition fee | $150 |

| Fees on withdrawals | None |

| Minimum funded amount | $25,000 |

| Maximum funded amount | $150,000 |

| Allowed daily loss | 2-2.2% |

| Profit target | 6% |

| Maximum trailing drawdown | 6% |

| Profit sharing (Payouts) | 80% (Pro) 90% (Pro+) |

Safety of TakeProfitTrader – 3

TakeProfitTrader is a futures-only trading, which means that it is not rated by Forex Peace Army, which is a reliable aggregator for forex broker and prop firm reviews.

The primary trading partner of TakeProfitTrader is NinjaTrader, which is a broker that is regulated by the CFTC.

Traders can use two-factor authentication to keep their accounts safe from third parties.

As a proprietary trading firm, TakeProfitTrader does not have many meaningful regulations and licenses traders can rely on.

The firm has been on the market for three years, which means that it does not have a very long performance record.

Overall, TakeProfitTrader gets a score of 3 in Safety.

Funding and Maximum Capital Allocation – 2

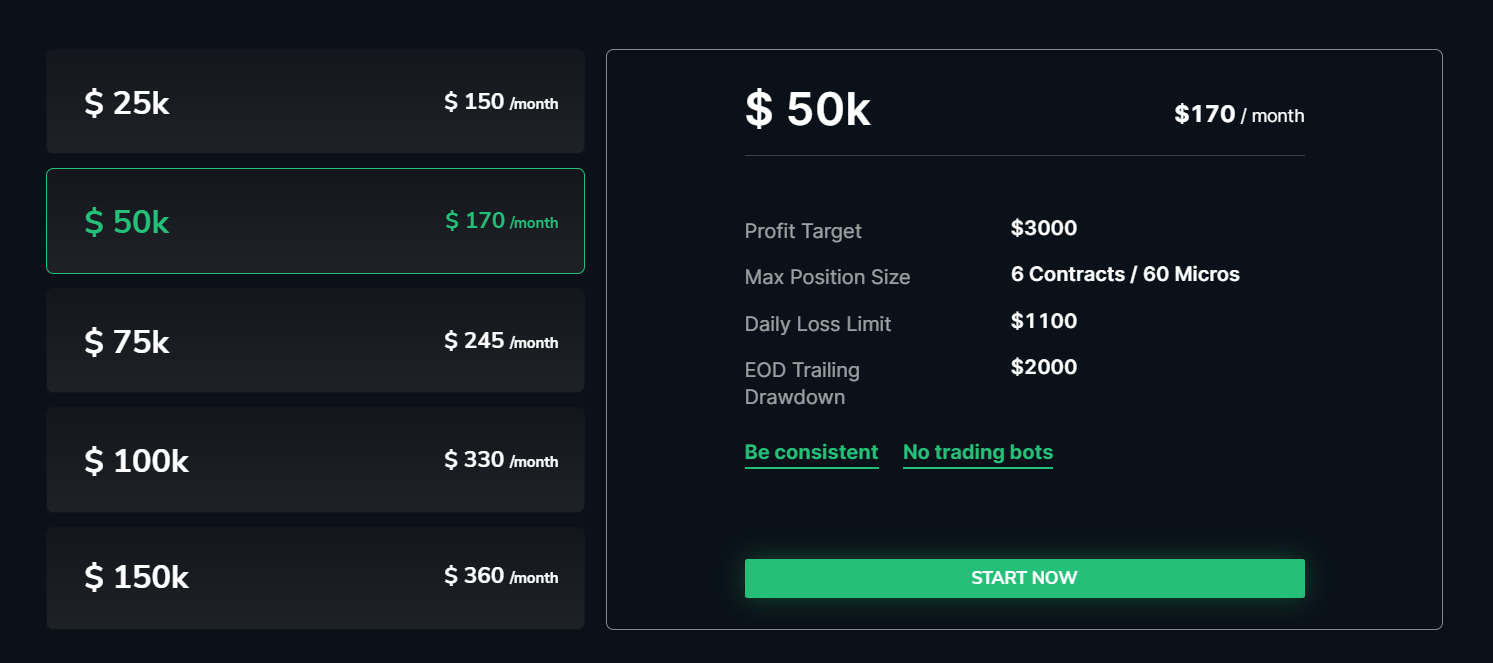

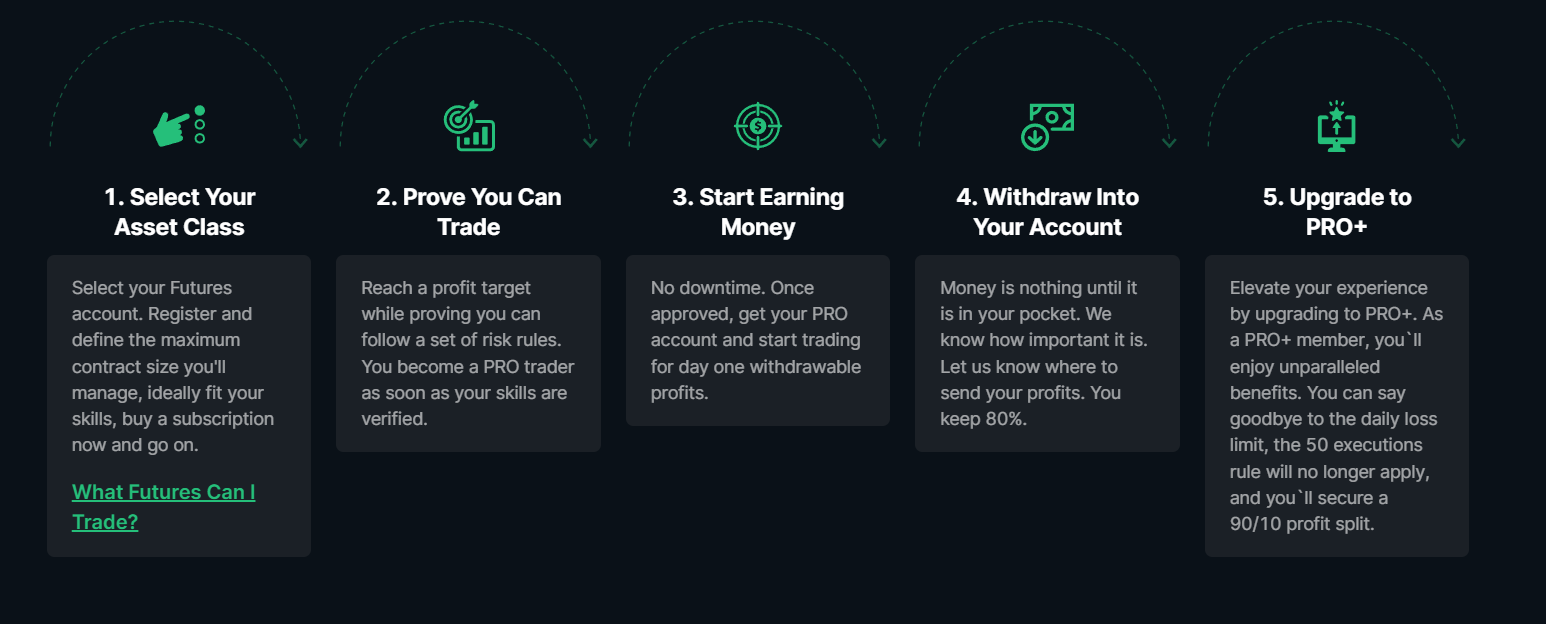

Funding at TakeProfitTrader is divided into 5 account tiers, which give traders the opportunity to fund their accounts up to $150,000. The funding amounts for the 5 account tiers are the following: $25,000, $50,000, $75,000, $100,000, and $150,000.

The major downside of TakeProfitTrader is the maximum available funding, which is considerably lower than other prop trading firms.

Due to low maximum funding amount and no funding below $25,000, TakeProfitTrader gets a score of 2 out of 5.

Assets – 1

The assets offered by TakeProfitTrader are rather limited at the current time, as the frim only offers futures trading. While the firm covers all the bases when it comes to offering futures contracts, the lack of stocks, forex, and crypto docks points in terms of variety.

COMEX, NYMEX, CME, and CBOT futures are all available.

However, it is important to note that the company has plans to add every asset class in the future. Despite this, the current offerings of TakeProfitTrader get an assets score of 1 out of 5.

Trading Rules and Limitations – 2

When it comes to the trading rules and limits enforced by TakeProfitTrader, the firm upholds general rules, as well as account-specific limitations that traders need to adhere to in order to keep their accounts.

The general rules at TakePrfoitTrader include:

- No automated trading is allowed

- SIM, Pro, and Pro+ accounts available

- The number of trading days to the Pro account is 5

- Up to three resets for Pro accounts

- Consistency rule for the SIM account, no consistency rule for the Pro and Pro+

- No scaling plan available

- 50 trade limitation on demo days

As for the individual funded accounts, the rules and limitations that apply are the following:

- $25,000 account – $1,500 profit target, $500 daily loss limit, $1,500 EOD trailing drawdown, maximum 3 contracts (30 micros)

- $50,000 account – $3,000 profit target, $1,100 daily loss limit, $2,000 EOD trailing drawdown, maximum 6 contracts (60 micros)

- $75,000 account – $4,500 profit target, $1,600 daily loss limit, $2,500 EOD trailing drawdown

- $100,000 account – $6,000 profit target, $2,200 daily loss limit, $3,000 EOD trailing drawdown

- $150,000 account – $9,000 profit target, $3,300 daily loss limit, $4,500 EOD trailing drawdown

Overall, low drawdowns can be an issue for some traders, and while profit targets are also quite low at 6%, other prop firms offer higher drawdown limits. TakeProfitTrader gets a 2 out of 5 for Rules and Limitations.

Platforms – 2

The trading platforms offered by TakeProfitTrader are NinjaTrader and Tradovate, which are CFTC regulated trading platforms. Aside from this, the firm is also partnered with TradingView to provide advanced charting features for its users.

TakeProfitTrader offers a web-based platform, which comes with all the features of a standard trading platform, such as market news, an economic calendar, a dashboard, etc.

In total, the firm has over 30 trading partners and users can choose between two data feeds – CQG and Rithmic.

Overall, TakeProfitTrader gets a score of 2 out of 5 for Platforms. It is important to note, that while its trading partners do offer automated trading, the firm itself does not allow for EAs and other automated trading tools.

Profit-Sharing and Withdrawals – 5

Profit-sharing agreements at TakeProfitTrader are divided between the Pro and Pro+ accounts. The Pro account pays out 80% of the generated profits, while the Pro+ pays 90%.

The firm often offers promotions, when the payout rate is 100% for new members for a limited time.

Withdrawals at TakeProfitTrader are available instantly after funding. There are no payout windows or maximum payout restrictions. Withdrawals are done through the ‘Wallet’ feature of the website.

Overall, TakeProfitTrader gets a score of 5 out of 5 in Profit-Sharing and Withdrawals.

Fees – 4

TaekProfitTrader’s fees can be divided into two categories – account and trading fees.

The trading fees for SIM and Pro accounts for futures trading are $5 for mini and $.0.50 for micro instruments.

As for the account fees, they are charged on a monthly basis and are the following:

- $150/month for the $25,000 account

- $170/month for the $50,000 account

- $245/month for the $75,000 account

- $330/month for the $100,000 account

- $360/month for the $150,000 account

Overall, the account fees charged by TakeProfit are affordable when compared with some competing prop trading firms, but the funding amounts are also rather limited.

The Pro+ account is subject to fees charged by the broker, on which the prop firm has no influence. Therefore, the fees applicable to traders will depend greatly on the trading platform of their choice. TakeProfit gets a Fees score of 4 out of 5, thanks to low entry fees and frequent discounts/promotions.

Education at TakeProfitTrader – 2.3

TakeProfitTrader offers a free ebook for those that sign up with the firm, with the book covering the basics of futures and prop trading and providing some possible trading strategies for complete beginners.

The firm also includes a knowledge base where traders can get information about the various aspects of prop trading, as well as how to set up their accounts and the general questions they may need answered.

However, the firm lacks any meaningful video content and webinars, which is a downside for traders that want to learn more in bite-sized pieces as they trade.

Overall, TakeProfitTrader gets an Education score of 2.3 out of 5.

Customer Support at TakeProfitTrader – 3.6

TakeProfitTrader’s customer support suite comes with all the basic features – a hotline that is available 12 hours a day, a live chat function on the website, and a support email where users can send specific questions regarding the firm’s services and terms.

The website also includes a FAQ section in the Knowledge Base, which answers some of the most common questions prospective and current users have about the firm and its trading terms.

The support, as well as the content on the website, is available in English and Spanish.

Overall, TakeProfitTrader gets a customer support score of 3.6 out of 5.

Frequently Asked Questions

Is TakeProfitTrader a broker?

How much funding does TakeProfitTrader offer?

What can I trade at TakeProfitTrader?