This prop is not considered safe

We do not advise you to start a prop trading challenge with this firm.

Founded in 2021 in Naples, Floridian, SurgeTrader has quickly become one of the most popular proprietary trading firms on the market.

The firm offers funded accounts where traders can access a wide variety of asset classes, such as forex, stocks, commodities, and crypto.

SurgeTrader is partnered with a licensed broker and provides funded accounts up to $1 million.

Traders go through two-phase auditions in order to obtain funding on SurgeTrader. Each of the funded accounts come with a non-refundable fee, which must be paid before the evaluation.

1-Phase evaluations are also available, with different fees, profit targets, and loss limits.

This review will look at the terms and services offered by SurgeTrader and rate the prop firm based on a number of crucial factors, such as safety, assets, and fees.

Pros and Cons of SurgeTrader Proprietary Trading Firm

Pros

- A wide range of assets, with over 100 instruments

- If the maximum loss and drawdown are reached, SurgeTrader covers the difference

- Affiliate broker ThinkMarkets is licensed by the ASIC

- No restrictions on trading strategies

- MetaTrader 4 and 5 available

- No commissions on withdrawals

- Up to $1 million in available funding

Cons

- High evaluation costs, starting at $200

- Strict drawdown and loss limitations

- Not rated by Forex Peace Army

- Audition fees are non-refundable

Quick Rating of SurgeTrader Prop Trading Firm and Its Features

| FPA Score | NOT RATED |

| Year founded | 2021 |

| Headquarters | Naples, Florida, United States |

| Minimum audition fee | $200 |

| Fees on withdrawals | None |

| Minimum funded amount | $25,000 |

| Maximum funded amount | $1,000,000 (1-Phase evaluation) |

| Allowed daily loss | 5% |

| Profit target | 10% (1 Phase) 8% (Phase 1) 5% (Phase 2) |

| Maximum trailing drawdown | 8% |

| Profit sharing (Payouts) | 90% |

Safety of SurgeTrader – 3

SurgeTrader is a proprietary trading firm with a relatively short history of operations. Founded in 2021, the firm uses ThinkMarkets as its primary broker partner, which enables the use of MetaTrader 4 and 5 for SurgeTrader clients.

Despite offering forex as one of the available asset classes, SurgeTrader is not rated by the Forex Peace Army, which is a reliable database of forex broker and prop firm reviews.

EightCap is licensed and regulated by the Australian Securities and Investment Commission.

The firm offers two-factor authentication to all of its traders to add an extra layer of security.

Overall, SurgeTrader gets a Safety rating of 3 out of 5.

Funding and Maximum Capital Allocation – 4

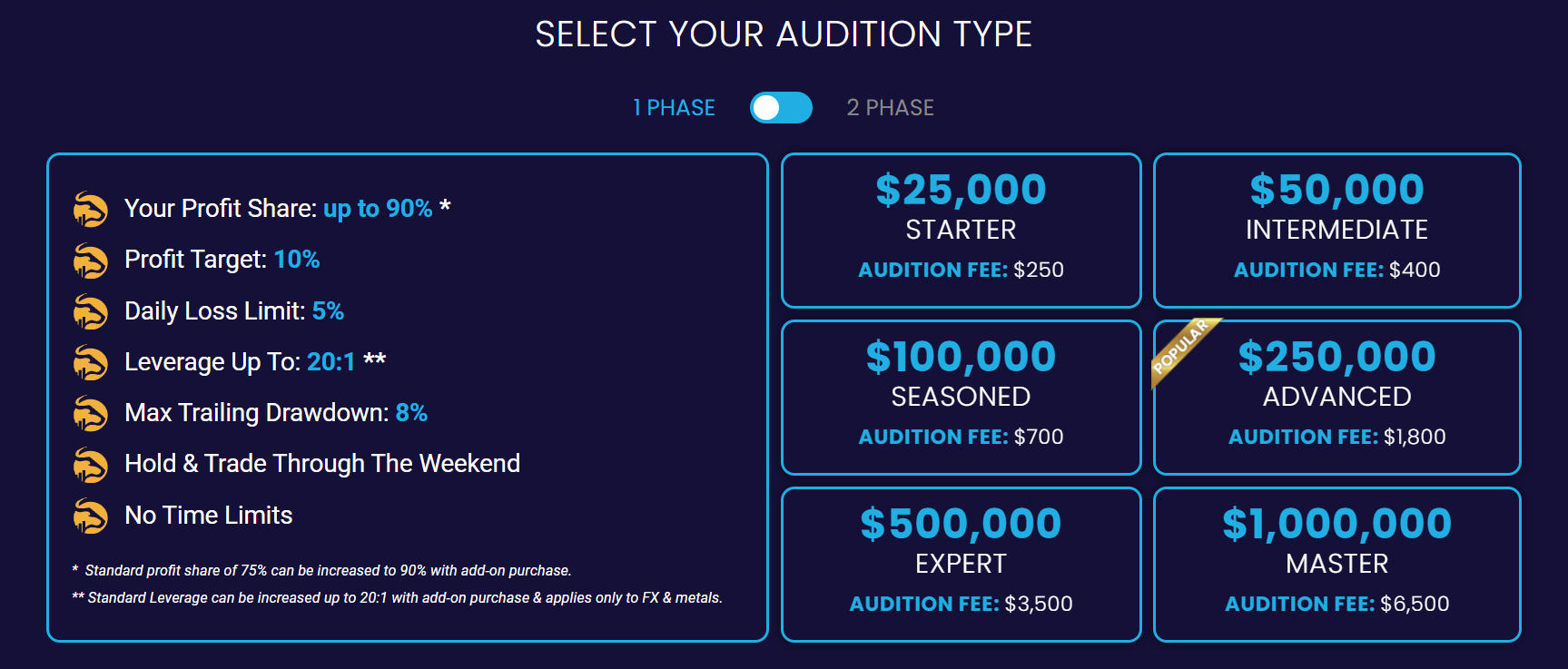

Funding at SurgeTrader is divided into two packages, which involves 1-Phase and 2-Phase evaluations. Funding amounts and fees differ between the two packages.

1-phase evaluations are divided into packages of $25,000, $50,000, $100,000, $250,000, $500,000, and $1,000,000.

The 2-phase evaluation does not offer a $1 million account, with the rest of the funding packages being equal.

While SurgeTrader does not offer a $10,000 funding option, it does offer $100,000 and $1 million accounts, which are especially popular among traders.

Overall, SurgeTrader gets a score of 4 out of 5 for Funding and Maximum Capital Allocation.

Assets – 4.5

The lineup of tradable assets on SurgeTrader is comprehensive. The firm offers currency pairs, real shares, indices, commodities, such as oil, soft commodities, metals, as well as cryptocurrencies.

The official SurgeTrader website also includes an Excel spreadsheet of all of the assets offered by SurgeTrader.

Due to a rich lineup of assets, SurgeTreader gets a score of 4.5 out of 5 in Assets.

Trading Rules and Limitations – 2.9

The trading rules and limitations on SurgeTrader can be categorized into general and specific terms. The general rules apply to all funded accounts and are the cornerstone of the trading experience at the firm.

Some of the general rules and provisions at SurgeTrader include:

- Trading hours are set by ThinkMarkets. Hours for CFDs trading are available 9:30am to 4pm EST Monday thru Friday

- The only time limit at SurgeTrader is at least one trade per 30 days

- Placing stop-losses are required for every trade

- Expert Advisors and bots are allowed

- 0.01 lot size limit is enforced

Aside from these general provisions, the 1-phase and 2-phase evaluations offer different limitations on trading activity:

- 1-Phase Evaluations – 10% profit target, 5% daily loss limit, 20:1 maximum leverage, 8% maximum trailing drawdown, weekend trading is allowed, no time limits apply

- 2-Phase Evaluations – 8% profit target for Phase 1, 5% for Phase 2, 5% daily loss limit, 50:1 maximum leverage, 8% maximum fixed drawdown, weekend trading is allowed, no time limits apply

While the overall rules and limits are not very strict, low daily loss limits and high profit targets can limit opportunities for traders.

Overall, SurgeTrader gets a score of 2.9 out of 5.

Platforms – 5

ThinkMarkets is the primary broker partner of SurgeTrader and offers access to MetaTrader 4 and 5. Traders can use the platform to trade a wide range of asset classes, while using additional functionale, such as economic calendars, market analysis tools, VPS hosting, and more.

ThinkMarkets is available as a web platform, as well as a mobile application, which adds convenience to traders.

Technically sound trading platforms, availability of automated trading and ample functionality give SurgeTrader a Platforms score of 5 out of 5.

Profit-Sharing and Withdrawals – 3

When it comes to profit-sharing, SurgeTrader offers a generous 90% profit cut to its traders. This threshold is constant between different funded accounts.

This is one of the highest profit shares among prop trading firms. However, it must be noted that some firms also allow traders to keep 100% of their profits up to a certain profit threshold (typically the first $10,000 generated).

When it comes to withdrawals, traders can request a withdrawal of profits at any time, right from their trader dashboard, but no more frequently than once per 30 days.

Traders at SurgeTrader can request withdrawals as soon as they generate profits on their live accounts. Conversely, they can choose to leave their profits and use them to scale up their accounts.

SurgeTrader gets a Profit-Sharing and Withdrawals score of 3 out of 5, as the number of withdrawals are limited to one per month.

Fees – 2.5

SurgeTrader does not charge monthly fees for its funded accounts. On the other hand, the firm charges one-off fees that are non-refundable and grant access to funded accounts once traders successfully complete the evaluation phases.

The fees for the 1-phase funded accounts are the following:

- Starter ($25,000) – $250 audition fee

- Intermediate ($50,000) – $400 audition fee

- Seasoned ($100,000) – $700 audition fee

- Advanced ($250,000) – $1,800 audition fee

- Expert ($500,000) – $3,500 audition fee

- Master ($1,000,000) – $6,500 audition fee

Conversely, the fees for the 2-phase evaluations are the following:

- Starter ($25,000) – $200 audition fee

- Intermediate ($50,000) – $300 audition fee

- Seasoned ($100,000) – $500 audition fee

- Advanced ($250,000) – $1,200 audition fee

- Expert ($500,000) – $2,300 audition fee

As we can see, the 2-phase auditions are considerably more affordable. However, the cheapest audition costs $200, which is relatively high compared to other prop firms on the market.

Furthermore, forex spreads start at 1 pip. Withdrawals are free of commission charges. Accounts often go on sale at SurgeTrader, which is an added bonus for traders.

Overall, SurgeTrader gets a score of 2.5 out of 5.

Education at SurgeTrader – 2.8

The Trader’s Corner Blog is the primary source of trading-related content on SurgeTrader. The blog offers dozens of articles about various strategies and setups traders can use, as well as definitions of key trading terms.

The website also includes an ebook titled “25 Rules to Becoming a Disciplined Trader”, which is available for free for SurgeTrader users.

The firm also offers a free email newsletter where traders can keep up with service updates and receive complementary educational materials from SurgeTrader.

Unfortunately this firm is less active on other platforms, such as Youtube, and does not provide video content, such as webinars and trading courses.

Overall, SurgeTrader gets a score of 2.8 out of 5 for Education.

Customer Support at SurgeTrader – 3.6

Customer support at SurgeTrader comes in the form of a hotline, a live chat function, and email support.

The hotline is available as toll-free and direct numbers, which active and prospective clients can use to get comprehensive information about the firm’s offerings and terms, as well as any technical issues they may need to resolve.

SurgeTrader’s FAQ section provides ready answers to some of the most commonly asked questions from existing and prospective clients.

Overall, SurgeTrader’s customer support suite gets a score of 3.6, as the support is not available in more than 5 languages.

This prop is not considered safe

We do not advise you to start a prop trading challenge with this firm.

Frequently Asked Questions

Is SurgeTrader a brokerage?

What can I trade at SurgeTrader?

What is the maximum funding at SurgeTrader?