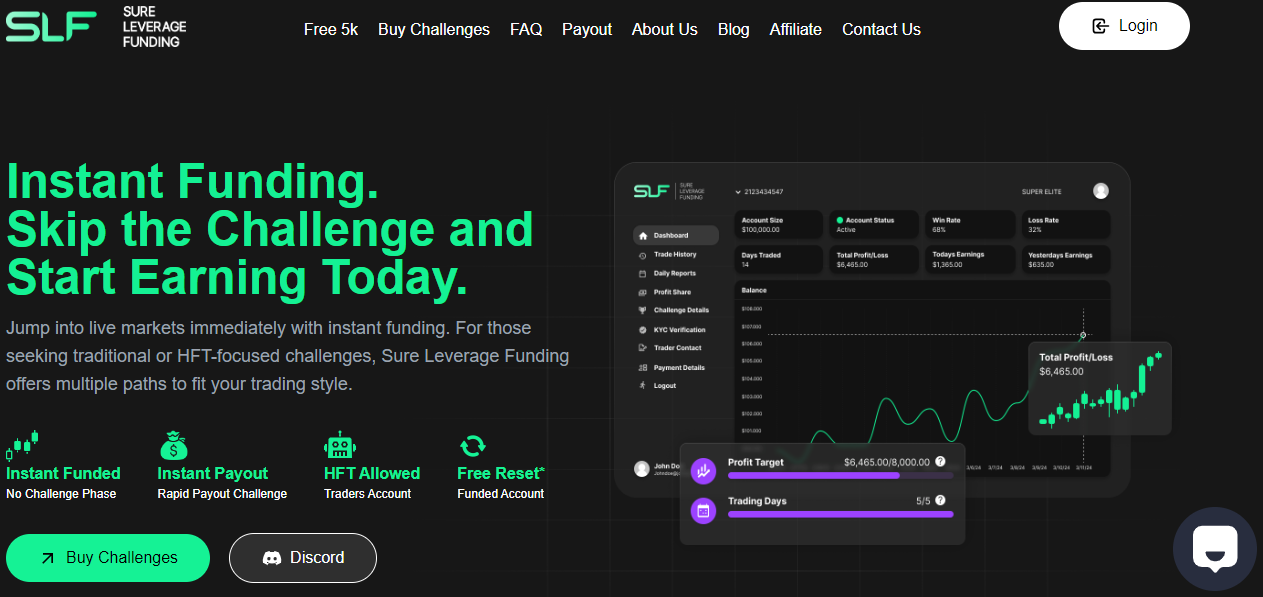

Sure Leverage prop firm offers funded accounts which are four including instant, HFT, and more. The funding ranges from 5k to 200k USD, which is pretty standard in the prop trading scene nowadays. The firm presents diverse funding accounts as it offers 1-step, 2-step, and instant challenges which is attractive. However, we have erected several red flags and issues with the firm, which we will analyze in more detail below.

In today’s Sure Leverage review, we will assess the firm’s most crucial aspects like safety, fees, rules, funding options, assets, platforms, support, and much more. After reading this review, you will define whether this firm is reliable.

Pros & cons of Sure Leverage prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 5 and Match-Trader

- Fast and digital account opening/verification

- Diverse funded account types and funded options

- No hotline or multilingual support

Cons

- Low total loss limit of 4%

- Lacks safety: very few trader reviews, lacks experience, and only offers demo trading

- Lacks funding options below 5k USD

- The highest funded account is 200k with no offering of 1 million USD funding

- Lacks comprehensive educational resources

Safety of Sure Leverage – 0

Sure Leverage reviews are lacking on both the FPA and Trustpilot. There are sub-100 reviews on Trustpilot, where 10% are 1-star evaluations. The firm’s previous account was suspended on the Trustpilot due to a breach of guidelines. This is not a good sign and indicates potential ethical issues with the firm. When it comes to experience in the industry, Sure Leverage was launched in 2023, making it very inexperienced in its industry. Additionally, all the accounts are virtual funding accounts, meaning traders only access demo trading even after getting funded. This lack of access to live accounts is pretty common in the prop trading space, and Sure Leverage is not an exception.

The firm gets a 0 score in this section, for lacking all important safety features presenting potential security issues.

Sure Leverage Funding and maximum capital allocation – 3

Sure Leverage funded programs include a diverse range of different funded challenges, including Express (free repeat 1-step), Rapid payout (instant payout 2-step), HFT (1-step), and instant funding (no challenge phases). All Sure Leverage funding account types have the same range of funding options including, 5k, 10k, 25k, 50k, 100k, and 200k USD amounts. The diversity is pretty good with the firm, as it allows traders to select suitable challenges and proceed at their own pace. The 2-step challenge requires trailers to hit profit targets twice to get funded, 1-step only needs one profit target hit, while the instant allows instant access to funded status.

Sure Leverage challenges lack smaller accounts below 5k USD which makes them not very attractive for beginners. There are no 1 million USD challenges for expert traders, which is also a downside.

Sure Leverage scaling plan is available and allows for quarterly scaling of the base funding amount. The profit sharing also decreases when the trader activates a scaling plan and can reach up to 100% which is a red flag.

Overall, the firm gets a 3 score in this section for offering diverse funding options but still lacking smaller funding amounts for beginners.

Sure Leverage Assets – 3

Sure Leverage prop trading is only possible by speculating on FX, FX Exotics, Indices, Gold, Commodities, and select Cryptocurrencies. There are few cryptos and no support for stocks or futures, which is a downside for the firm. All funded accounts come with 1:50 leverage, except for HFT accounts, which allow up to 1:100 leverage.

In the end, Sure Leverage gets a 3 score in this section for lacking popular asset types.

Sure Leverage Trading rules and limitations – 1.2

Sure Leverage rules slightly differ for each funded account type. Let’s compare them for more clarity.

Express (free repeat 1-step) challenge requires the following:

- Profit target – 8%

- Daily loss limit – 4%

- Maximum drawdown – 8%

- Minimum trading days – 5 days

- Consistency Rule – Yes

Rapid payout (instant payout 2-step) rules:

- Profit target – 10%, 5%

- Daily loss limit – 5%

- Maximum drawdown – 10%

- Minimum trading days – 5 days

- Consistency Rule – Yes

HFT (1-step) rules:

- Profit target – 6%

- Daily loss limit – 4%

- Maximum drawdown – 8%

- Minimum trading days – 5 (0 during evaluation)

- Consistency Rule – Yes

Instant funding (no challenge phases) rules:

- Profit target – None

- Daily loss limit – 4%

- Maximum drawdown – 8%

- Minimum trading days – 5 days

- Consistency Rule – Yes

As we can see, the firm has slightly strict rules for all challenge accounts.

News trading is permitted during the evaluation phase. However, it is prohibited on funded accounts. Overall, the firm gets a 1.2 score in this section for requiring strict rules, especially after traders get funded.

Sure Leverage Fees – 3

The pricing at Sure Leverage is rather competitive, starting at 39 dollars for the 2-step 5k USD challenge (Rapid Payout).

Express (free repeat 1-step) challenge fees start from 49 dollars for its 5k USD evaluation and rise to 799 USD for a 200k USD challenge.

Rapid payout (instant payout 2-step) challenges fees range from 39 to 699 USD for 5k and 200k evaluations.

The HFT (1-step) challenge has the following range of fees for 5k and 200k accounts, 69 USD, and 1099 USD.

Instant funding (no challenge phases) accounts offer 5k and 200k accounts for 99 to 1899 USD one-time fees.

Sure Leverage free trial is not available at the moment and traders have to purchase the challenge of checking the trading conditions.

Sure Leverage free repeat is available for the Express (free repeat 1-step) challenge.

Overall, the firm gets a 3 score in this selection for offering competitive pricing.

Sure Leverage Platforms – 4

Sure Leverage allows access to MetaTrader 5 and Match-Trader advanced platforms, allowing both EAs and customs indicators. Mobile trading is available via mobile apps.

The firm gets a 4 score in this section for offering advanced platforms.

Sure Leverage Profit-Sharing – 2

Sure Leverage profit split is capped at 80% which is pretty standard in prop trading right now. Profit withdrawals are processed in around 2-4 business days. There are no commissions for withdrawing profits.

Overall, the firm gets a 2 score in this section.

Education and trading tools at Sure Leverage – 0.5

Sure Leverage lacks educational resources and only provides a blog. The blog is not a proper replacement for trading education. There are some tools offered via the trader dashboard. As a result, the firm gets a 0.5 score in this section.

Customer Support at Sure Leverage – 2.4

The support is provided via live chat and email options. The live chat is built into the website. There is no hotline support option available and both the website and support are only provided in the English language, which is a downside.

Overall, the firm gets a 2.4 score in this section for offering only two options.

Frequently Asked Questions on Sure Leverage

Is Sure Leverage legit?

Is Sure Leverage a good prop firm?

What is the minimum Sure Leverage fee?