Sabiotrade prop firm is a proprietary trading company that offers traders a unique opportunity to purchase a funded challenge and achieve funded status with transparent and simple rules. The firm’s focus on transparency is very advantageous for traders, as they have an opportunity to always know exactly how much profits they need and how much risk to take.

In our Sabiotrade review, we are going to delve into the firm’s critical features such as safety, funding options, fees, assets, platforms, education, support, and more.

Pros & cons of Sabiotrade prop firm

Pros

- Ability to withdraw with $0 fees

- Offers up to 90% profit-split

- Fast and digital account opening/verification

- Excellent educational services for all funded traders

- Competitive fees from 99 USD for a 20k account

- Most payment options are free and instant

Cons

- No scaling plan

- Does not offer access to MT4, MT5, or cTrader

Safety of Sabiotrade — 3

Sabiotrade reviews are lacking on the ForexPeaceArmy platform, which deducts some points from the safety score of the firm. However, the firm has a 4.1 score on Trustpilot, with the majority of traders evaluating the firm positively. The only thing some traders were complaining about was high fees. These fees have been reduced lately, and the firm introduced discounts where the 20k funded account’s fee was reduced to 99 USD, making it one of the most attractive offerings in the industry right now. The firm was established in 2021, in Dublin, Ireland, giving it more than 2 years of experience in the industry. The firm is partnered with QuadCode to provide trading services and a trading platform to all its assessment accounts.

The firm gets a 3 score in this section.

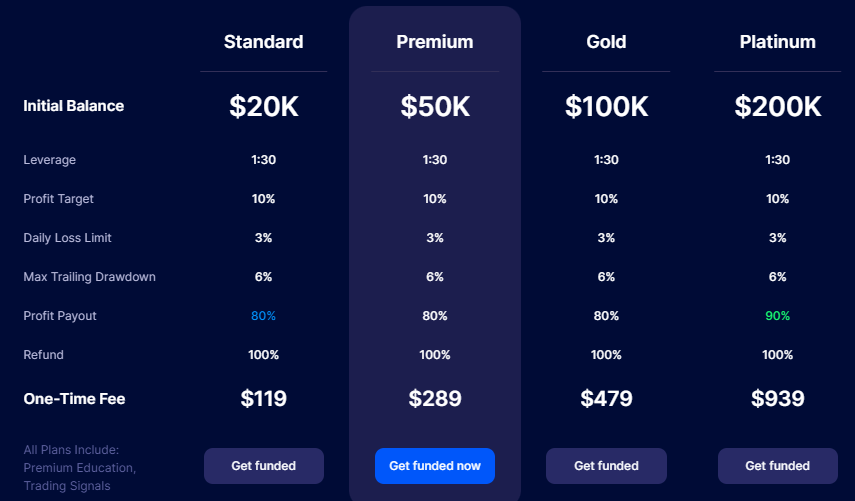

Sabiotrade Funding and maximum capital allocation — 2

Sabiotrade funded programs are diverse and range from 20k to 200k, allowing both beginners and advanced traders to find suitable funding options. There are also 50k and 100k options as well. Sabiotrade funding options lack only lower funded options, but with a 99 USD price point, a 20k account is more than enough for an average financial trader to make a living with 1:30 leverage. Sabiotrade challenges also offer very generous 80% profit splits with a maximum of 90% on 200k accounts, further solidifying this argument.

There is no Sabiotrade scaling plan at this moment, which is a slight drawback of the firm. Since we assess funding options based on the lowest and highest funding options, the firm gets only a 2 score in this category.

Sabiotrade Assets — 4

Sabiotrade provides traders with access to diverse asset classes including Forex pairs, commodities, indices, ETFs, and stocks.

The firm has a 1:30 leverage ratio, which is more than enough to speculate on any of the markets with substantial trading positions. This leverage level is also very conservative and prevents traders from overleveraging and breaching the daily risk limit rule easily. The firm loses only 1 point for not offering cryptos as well. Sabiotrade gets a 4 score in the assets category.

Sabiotrade Trading rules and limitations — 4.2

Sabiotrade rules are average when it comes to strictness. The firm allows traders to lose only 3% of their funded balance on any given day and has a maximum drawdown of 6%. The profit target is slightly higher at 10%. So, the question is: can you trade with these rules and achieve 10% profitability in 1 month with a 20k funded account? If the answer is yes, then Sabiotrade might be your next prop firm, but is it yes? In a month, there are 20 trading days on average. With a 20k account, you must not lose more than 3% on any day, which is a 600 USD maximum loss in a day. To make 10% in 20 days, traders have to make 100 USD daily on average (10% of 20k is 2,000 USD, which is 100 USD per day). So, to make daily 100 USD you can not risk more than 600 USD, which is more than enough risk to target just 100 USD. So, the rules are fair, and with any reasonable trading strategy, it is possible to easily hit 10% profit in 20 trading days (1 month). With 1:30 leverage, traders can control 20k×30= 600k USD buying power (6 trading lots), which is more than enough to target 100 USD daily. There are hard breach and soft breach rules. All the rules mentioned above were hard rules, meaning, violating them will end up in account termination. For the soft rules, all open trades that violate soft rules will get closed, but the trader can still continue trading on a funded account without issues. One of the soft rules is the open positions over the weekends. If traders leave open positions over the weekend, these positions will get closed automatically on Friday, 3:45 pm EST. However, traders can leave open positions for several days (holding overnight, news trading) without issues. For offering transparent and simple rules, the firm gets a 4.2 score in this section.

Sabiotrade Fees — 4

Sabiotrade fees are within the industry average levels, offering traders a cost-effective solution to start prop trading on a substantial account. Here are the accounts and corresponding fee structures:

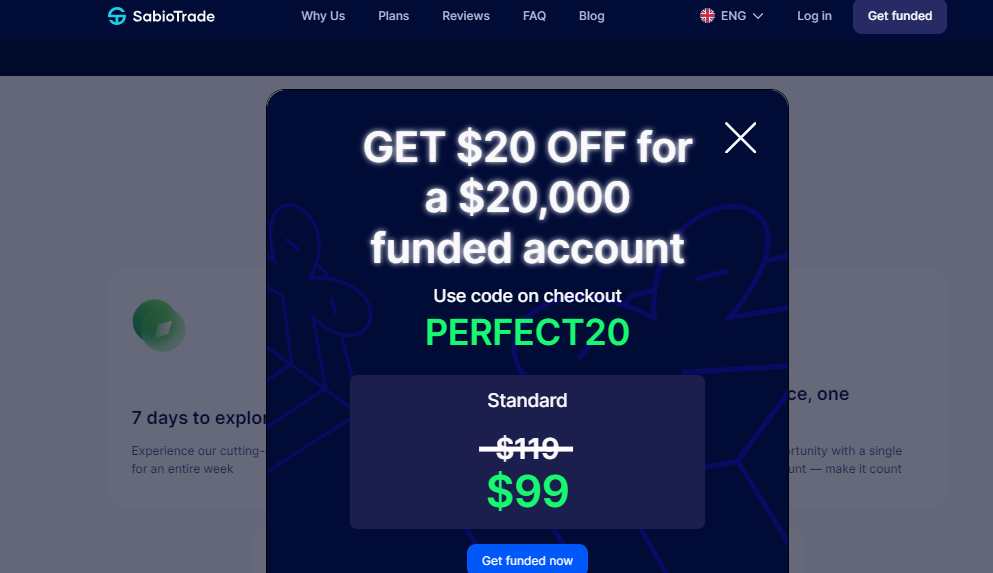

- Funding amount: 20,000 USD — One-time fee: 119 USD (99 USD with current discount)

- 50,000 USD — 289 USD

- 100,000 USD — 479 USD

- 200,000 USD — 939 USD

As we can see, the $20k account is an entry-level funded challenge that only requires 99 USD with ongoing sales. This is super competitive and a cheap way to start your funded trader journey. All these fees are 100% refundable at the time of getting a funded status, making Sabiotrade’s offerings even more attractive.

Sabiotrade prop firm has a very attractive offering of a 20% discount on a 20,000 USD funded challenge account, which makes the fee down to 99 USD, one-time. This will allow traders to start with just under 100 USD and get a 20k funded account, allowing them to generate substantial income if they have a well-developed trading strategy.

Sabiotrade free repeat is not available at the moment, and traders will have to purchase funded challenge if they fail to comply with the firm’s rules.

Sabiotrade free trial is available for all traders to test their skills and the firm’s rules and conditions. The free trial account offers 7 days of free access to a 10,000 USD virtual funded account and access to the same amount of tools and services as for funded traders who actually purchase the challenge. This is especially advantageous for beginners who gain the ability to test their trading skills and the viability of their trading strategy before actually investing real money in a funded account.

The firm gets a 4 score for offering a cost-effective trading environment with low fees.

Sabiotrade Platforms — 2.6

Sabiotrade prop trading platform is QuadCode, which is a multi-asset trading platform allowing traders to speculate on a range of markets. All the assets offered by Sabiotrade (FX, stocks, ETFs, indices, commodities) are accessible and tradable on this platform. The platform is modern and offers built-in technical indicators and alerts, making it advanced trading software. Traders can also open pending orders and set stop-loss and take-profit orders to all the trading positions both open and pending.

The firm offers traders more than 100 advanced tools including technical indicators, widgets, and alerts. There is also a free mobile app that provides free signals, that can increase trader’s accuracy even further. The firm gets a 2.6 score in this section for lacking support for MT4, MT5, or cTrader.

Sabiotrade Profit-Sharing — 5

Sabiotrade profit split is 80% for all funding options except 200k. The 200k funded accounts come with a 90% profit split. Withdrawals take 1-2 business days to process, which is the average time for withdrawals within the industry. With an 80% profit split, traders can withdraw a substantial portion of their profits, making it possible to make a living trading on Sabiotrade funded accounts. For offering up to 90% profit-split and quick withdrawals, Sabiotrade gets a 5 score in this section as well.

Education and trading tools at Sabiotrade — 5

The firm is dedicated to teaching its traders all the skills its expert team possesses with diverse educational resources. There are trading courses by pro traders of the firm, live weekly webinars, and an extensive base of educational videos by topic. Trading courses will teach all the necessary concepts to absolute beginners and allow them to get ready for weekly live webinars to start testing their abilities on funded challenge accounts. Video education will further improve trader’s understanding of market dynamics and trading platforms, with some added tips and interesting facts about financial trading. Add to these 100+ trading tools, economic calendar and other solutions, and mobile-friendly apps to check trader’s performance and Sabiotrade offers one of the best educational support in the industry. All the Sabiotrade funding challenges come with premium education and free trading signals.

The firm gets a 5 score in the education department for offering excellent support, tools, and advanced mobile-friendly solutions to track trader’s performance.

Customer Support at Sabiotrade — 2.8

Sabiotrade has an email support option and is available on Discord, where it has a community chat and often shares news and insights. The lack of a live chat is a drawback for a firm. However, both the website and the support of Sabiotrade are multilingual, and offered in more than 5 languages. The firm gets a 2.8 score for lacking live chat and hotline support options.

Frequently Asked Questions

Is Sabiotrade a good prop firm?

Is Sabiotrade legit

What is the Sabiotrade trading platform?