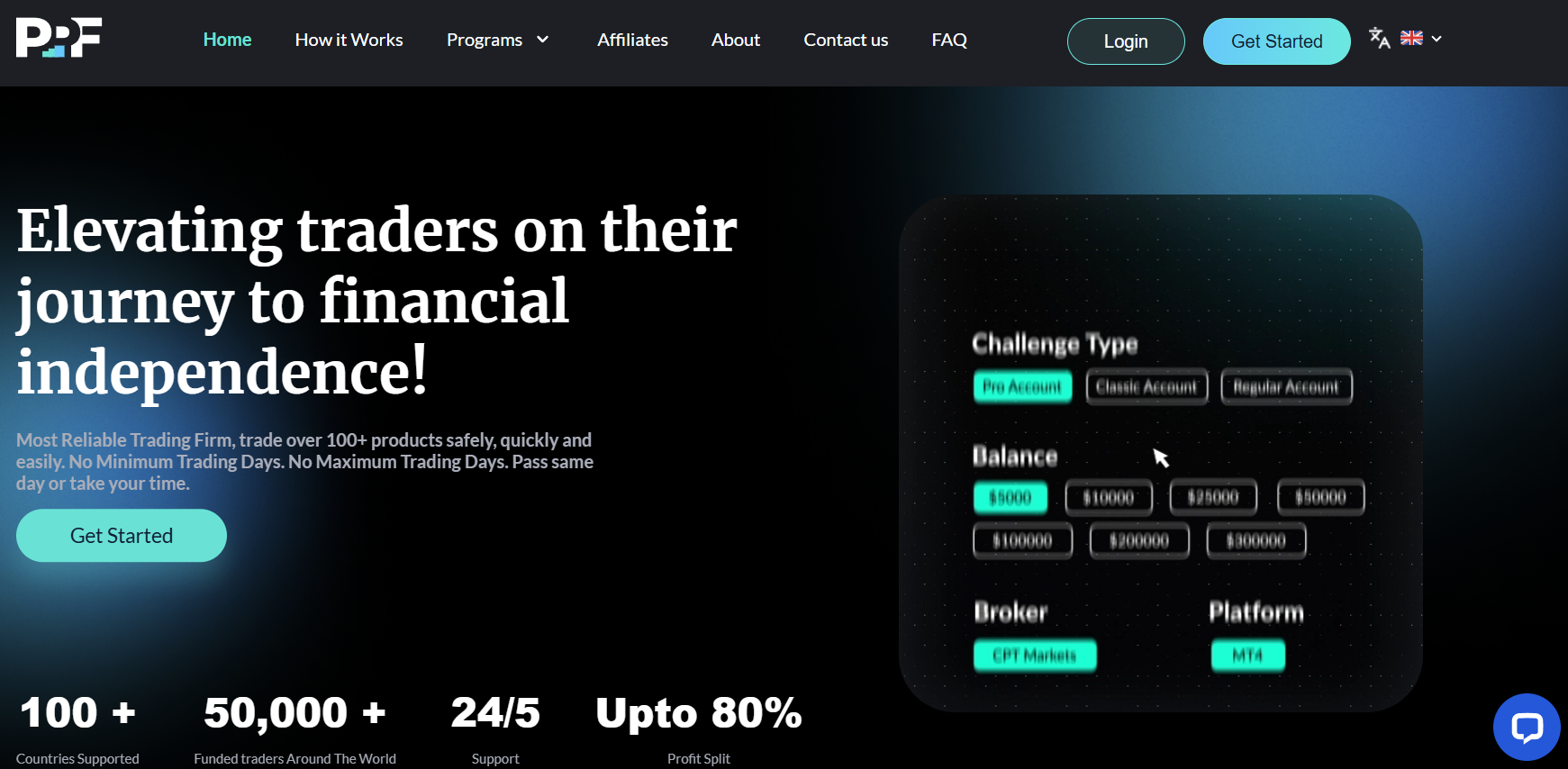

PPF Trader prop firm is a proprietary trading company launched in 2024 that offers funded accounts with options ranging from 5k to 200k USD. The firm provides 1-step, 2-step, and 3-step account challenges, which are flexible. This offering is very diverse and allows traders at all experience levels to start trading on a suitable challenge. The pricing starts at 60 USD for the 5k 3-step challenge, and other types of evaluations are also cheap. The firm allows access to an advanced MT4 platform, and traders can access multiple asset classes like Forex and commodities.

In this unbiased PPF Trader review, we will review and evaluate the firm’s safety, rules, assets, platforms, funded options and types, pricing, support, and more.

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4

- Fast and digital account opening/verification

- Most payment options are free and instant

- Offers diverse funded account types (1-step, 2-step, and 3-step)

Cons

- Lacks trader reviews on the FPA and Trustpilot

- Does not offer cryptos or stocks

- Lacks educational resources

Safety of PPF Trader – 1.5

There are no PPF Trader reviews on the Forex Peace Army (FPA) platform, which is a red flag. On Trustpilot, the firm has no account yet, and therefore, there are no reviews. Lacking trader feedback is a major red flag and makes the firm very risky as there is no evidence to conclude it is truly a reliable firm and traders have a good experience with it. When it comes to experience, the firm was launched in 2024, which makes it very inexperienced in the prop trading industry. The firm is backed by CPT Markets, which is a regulated forex and CFDs broker. However, traders report the broker is shady and removed profits on one occasion.

The firm gets a 1.5 score in this section for being backed by a regulated broker.

PPF Trader Funding and Maximum Capital Allocation – 3

PPF Trader funded programs are diverse and include 1-step, 2-step, and 3-step funded account types. The list of PPF Trader funding options is the same for all three funded accounts and includes 5k, 10k, 25k, 50k, 100k, and 200k USD. There are no smaller or bigger PPF Trader challenges offered beyond 100k USD, which is a downside for experienced traders.

PPF Trader scaling plan is not available, which is a serious downside as traders can not grow their accounts to get access to larger funded accounts beyond 100k.

As a result, the firm only gets a 3 score in this section.

PPF Trader Assets – 2

PPF Trader prop trading is possible by speculating on a range of markets, including Forex pairs, commodities, and indices. There are no stocks or cryptos offered for trading, which is a noticeable downside for the firm, especially the lack of crypto pairs. When it comes to spreads, the firm offers low spreads from 0.1 pips but charges trading commissions of 6 USD per lot round turn. The leverage is up to 1:100:

- Forex: 1:100

- Metals: 1:30

- Indices: 1:20

- Energies: 1:10

As we can see, the leverage levels are pretty decent, especially for FX pairs and metals.

Overall, the firm gets a 2 score in this section.

PPF Trader Trading rules and limitations – 1.5

PPF Trader rules are slightly different for each funded account type. Let’s compare them to see how competitive the firm’s requirements are.

The Pro PPF Trader challenge (1-step) has the following requirements:

- Profit target – 10%

- Daily loss limit – 3%

- Maximum drawdown – 6%

- Minimum trading days – 1 day

- Trading limits – Unlimited

- Leverage – 1:100

The Classic PPF Trader challenge (2-step) account requires the following:

- Profit target – 10%, 5% (phase 1 and 2)

- Daily loss limit – 5%

- Maximum drawdown – 10%

- Minimum trading days – 1 day

- Trading period – Unlimited

- Leverage – Up to 1:100

The Regular PPF Trader challenges (3-step) have the following rules:

- Profit target – 7%, 6%, 5% (Phases 1,2, and 3)

- Daily loss limit – 4%

- Maximum drawdown – 8%

- Minimum trading days – 1 day

- Time limits – No limits

- Leverage – Up to 1:100

As we can see, the firm has mediocre requirements as it has slightly strict rules on 1-step accounts, while other challenges have lower profit target requirements. The firm allows Expert Advisors (EAs), which is flexible.

Overall, the firm managed to get a 1.5 score in this section.

PPF Trader Fees – 3.5

The pricing is competitive at PPF Trader. The smallest 5k USD challenge costs 60 USD, a one-time on 3-step challenge, 70 USD on a 2-step, and 75 dollars on the 1-step evaluation. The pricing is very good and cheap. Spreads are low at 0.1 pips, but commissions are charged at 6 USD per lot round turn.

PPF Trader free trial is not available, and the PPF Trader free repeat is not offered either, which is a considerable downside. There are no discounts offered, which is also a drawback.

As a result, the firm gets a 3.5 score in this section.

PPF Trader Platforms – 5

When it comes to trading platforms, the firm allows access to an advanced trading platform, MetaTrader 4 (MT4). The platform allows custom indicators and Expert Advisors, which enable traders to deploy their own indicators or fully automate trading systems. The firm allows EAs as well. Mobile trading is available via a mobile app.

Overall, the firm gets a 5 score in this section.

PPF Trader Profit-Sharing – 2

PPF Trader profit split is up to 80%. This is constant for all three accounts, and traders can not increase it via scaling plans or paid upgrades, which is a minor drawback. There are no commissions charged for profit withdrawals, but processing is slightly lengthy.

As a result, the firm only gets a 2 score in this section.

Education and trading tools at PPF Trader – 0

The firm does not offer educational resources like webinars, video guides, or trading courses, which is a serious downside. There are no tools offered either. Traders can not evaluate their performance or increase their trading accuracy. There is no trading blog either.

Overall, the firm gets a 0 score in this section as a result.

Customer Support at PPF Trader – 2.4

When it comes to customer support experience, the firm offers live chat and email options. There is no phone support available, which is a red flag. The firm offers its website and support in two languages, which is not enough to call it a multilingual prop firm.

As a result, the firm only gets a 2.4 score in this section.

Frequently Asked Questions on PPF Trader

Is PPF Trader legit?

Is PPF Trader a good prop firm?

What is the minimum Sieg Fund fee?