PipFarm prop firm offers remote traders a chance to trade with the firm’s capital after passing the evaluation phase, which only has 1 stage. PipFarm is operated by ECI Ventures Pte. Ltd, a company providing investing and trading education services together with evaluation services. The firm follows the guidelines of the local regulator and does not provide any trading or investment advice. PipFarm was founded in 2023 and offers cTrader as the main trading platform.

PipFarm offers traders to become PipFarm’s external contractors, trade, and get up to 90% of profits. The firm is very clear about how it makes money from screening fees on evaluation phases, and prop trader’s profits.

In our PipFarm review, we are going to evaluate the firm with advanced review methodology and define whether you can trust this firm to become a successful prop trader. So, let’s begin.

Pros & cons of PipFarm prop firm

Pros

- Offers flexible funding options ranging from 10k to 500k with a scaling plan

- Offers access to cTrader

- Fast and digital account opening/verification

- Access to a variety of markets including Forex, cryptocurrencies, metals, energies, and indices

- Profit-sharing scheme offers a competitive 90% split

- Requires only one-time fees for every funding challenge program

- Allows all kinds of trading strategies except HFT and copy trading

- News Trading allowed

Cons

- Tighter daily loss at 3%

- High profit target of 12%

- Customer support at PipFarm is limited to English and lacks phone support

- Offers minimal educational resources

Quick rating of PipFarm and its features

| FPA Score | Not yet rated |

| Year founded | 2023 |

| Headquarters | Singapore (The parent company is based in Singapore) |

| Minimum audition fee | 50 USD |

| Fees on withdrawals | Unknown |

| Minimum funded amount | 5,000 USD |

| Maximum funded amount | 200,000 USD (up to 1.5m with scaling) |

| Allowed daily loss | 3% |

| Profit target | 12% |

| Maximum trailing drawdown | 12% |

| Profit sharing (Payouts) | 90% |

| Trading Platforms | cTrader |

| Available trading markets | Forex, commodities, indices, cryptos, metals |

Safety of PipFarm — 3.5

PipFarm reviews are lacking on the FPA platform, which is understandable as the firm was recently established. We checked the Trustpilot page of PipFarm, and most of the evaluations are positive. After contacting the support, we got some details about trading services. PipFarm is partnered with TopFx, a regulated broker, allowing it to provide quality price data on its cTrader platform, but they are not offering trading services directly, which is always a good thing when selecting a prop firm.

PipFarm Funding and maximum capital allocation — 4

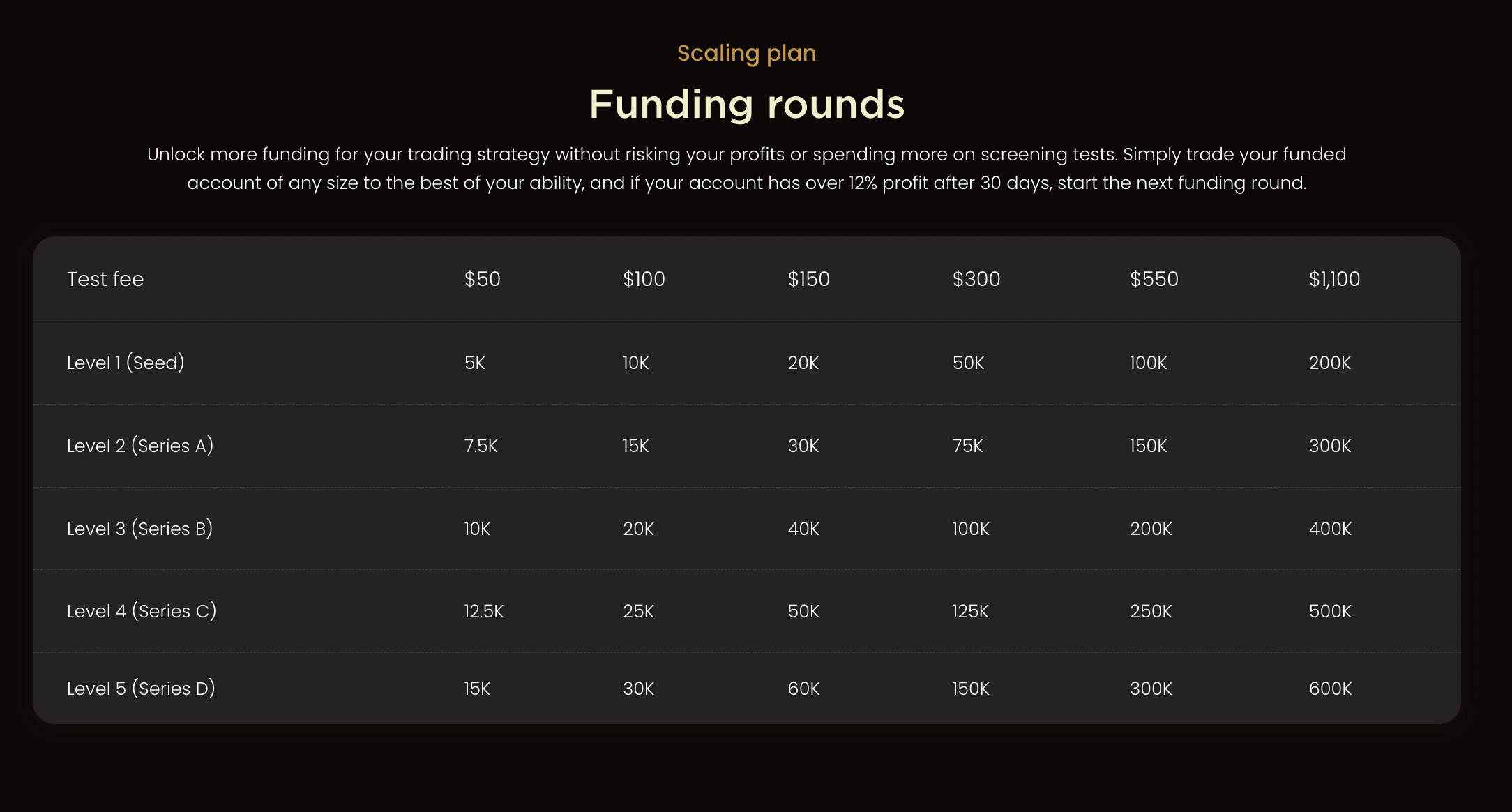

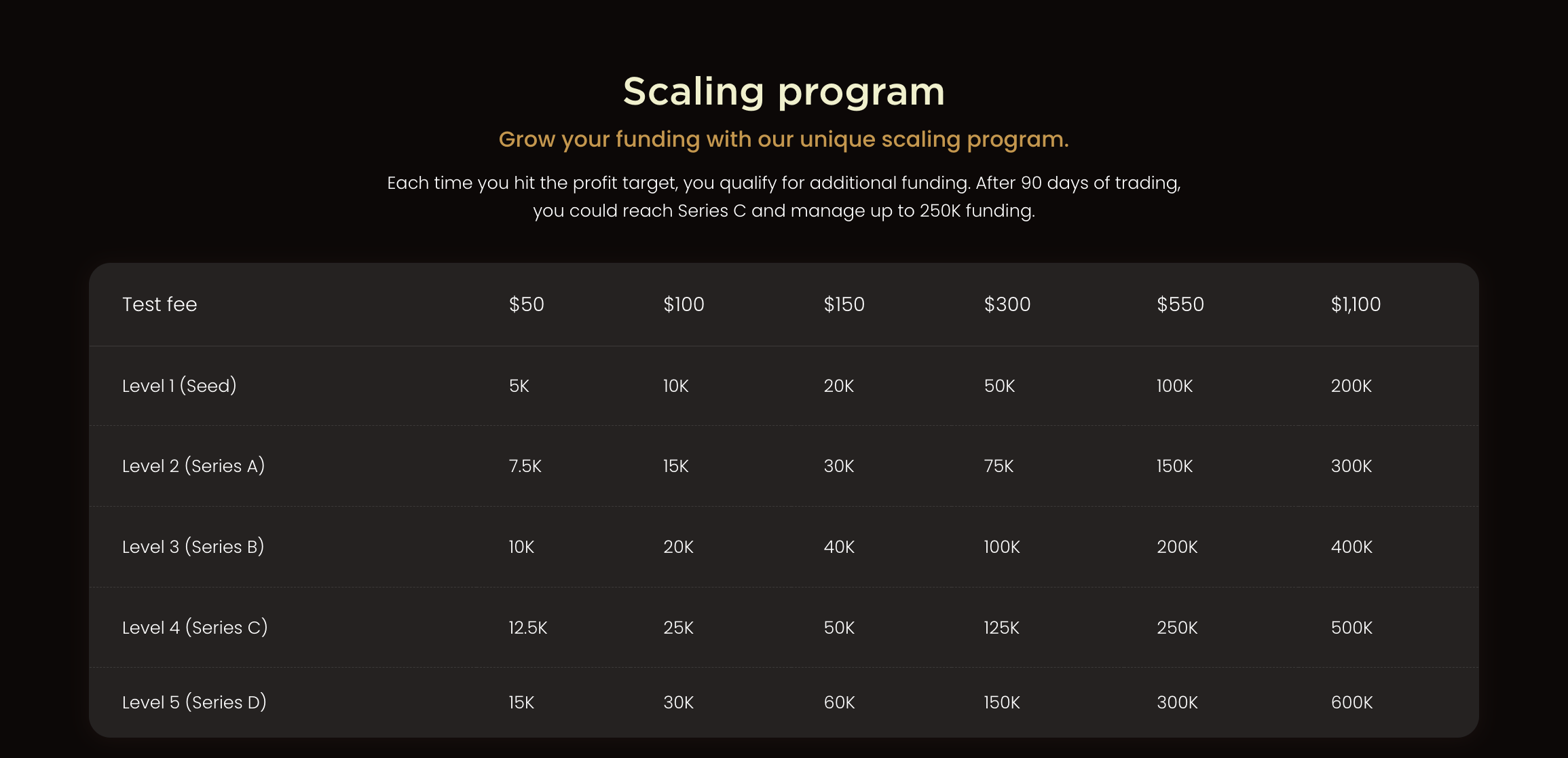

PipFarm funded program consists of one evaluation phase, which is always a good offering. Traders can start with a small account of 5,000 USD. PipFarm funding ranges from 5k to 200k USD. There is also a scaling plan allowing prop traders to raise their trading capital to 500k.

PipFarm challenge is a simple contest with very few requirements and there is also a free demo account which support is happy to offer any user who contacts them directly. Traders can also register an account from the website as well. A different maximum scaling ceiling is provided depending on the starting funding amount. For 10k accounts, the maximum achievable scaling is 30k, while for 20k it can be 60k USD. A minor detail to know if you are planning to aim for a prop trading career. This scaling plan is something to check out for sure, as it offers value to all traders by starting low and increasing trading capital slowly at your own pace.

The PipFarm scaling plan is activated every 30 days.

The firm gets a 4 score in this section.

PipFarm Assets — 3.5

PipFarm allows traders to access diverse markets of Forex pairs, cryptos, metals, energies, oil and indices. There are no stocks for trading. There are around 4 metals including the XAUUSD pair, 3 energies including oil, 14 indices, 6 cryptos from the most popular projects including Bitcoin and Ethereum, and a variety of FX pairs.

The spreads on Forex major pairs are low, with 0.1-0.2 pips for EURUSD, but the firm charges a trading commission for FX of 6 USD round turn per lot. The leverage is 1:30. All these specs make PipFarm very competitive for intraday strategies.

For not offering stocks, options, futures, or bonds, the firm gets a 3.5 score in this section.

PipFarm Trading rules and limitations — 4.0

PipFarm rules are easy to follow as there are only a few important rules and no hidden rules. All rules are clearly given on the website, which is always a positive sign. The profit target for both the screening phase and the funded trading phase is set at 12%. After the screening test, traders can activate the scaling plan by hitting the 12% target. The daily drawdown limit is set to 3% and is calculated based on the previous day’s balance. The maximum drawdown is 12%, meaning traders can have two days of losing 4% at maximum. The scaling is possible every 30 days and requires achieving the profit target.

If a trader is not trading for 14 days or is not capable of achieving a profit target within 365 days, they are disqualified for inactivity, which is fair.

There are no restrictions for trading during the news or holding open positions during weekends and overnight. The crypto market is active 24/7 and PipFarm allows traders to trade cryptos during weekends as well. If the trader breaks the rules, they can keep profits.

cTrader bots are allowed and all kinds of automated trading strategies are allowed except for HFT (High-Frequency Trading) bots, as it is not easy to replicate HFT strategies. Overall, PipFarm rules are very flexible and attractive.

PipFarm gets a 4.0 score in this section.

PipFarm Fees — 4.0

If a trader wants to start a funding challenge they will have to purchase one of the funded accounts. PipFarm has a bit of cheaper fees when compared to industry flagship props and offers the lowest 10,000 USD account for a 50 USD one-time fee. Here is the list of funding options available together with their audition fees:

- 5,000 USD – 50 USD

- 10,000 USD — 100 USD

- 20,000 USD — 150 USD

- 50,000 USD — 300 USD

- 100,000 USD — 550 USD

- 200,000 USD — 1100 USD

Overall, PipFarm prop trading fees for challenges are not much more expensive than its competitors, and all of these audition fees are one-time.

As for trading commissions, PipFarm charges 6 USD per lot traded for FX trading and offers low spreads in return.

PipFarm gets a 4.0 score in this section for offering a competitive fee structure.

PipFarm Platforms — 5

PipFarm offers one of the most advanced trading platforms, cTrader. This platform offers a wide range of market analysis tools and supports even copy trading signals. PipFarm allows traders to use any trading strategies including cBots, except for HFT and copy trading. So, if you are a good trader and have even a cBot the firm allows you to profit from markets.

PipFarm cTrader comes for all devices both desktop and mobile and is available for web browsers as well.

The firm gets a 5 score in this section for fully allowing traders to take advantage of cTrader’s advanced features.

PipFarm Profit-Sharing — 5

PipFarm profit split is excellent at 90% which is always preferable when trading on a funded account. The 90% mark is super competitive in the prop trading industry.

PipFarm gets a 5 score in this section for offering quality services and high profit-sharing at 90%.

Education and trading tools at PipFarm — 3.2

There are no educational resources except the blog, which has articles about the firm’s rules and why its accounts are superior. We can not assume this blog is a replacement for trading education, as it lacks useful information for beginners. The tools include a trader’s dashboard which gives stats and other information to assess the trader’s performance and when the withdrawal is possible. An interesting tool available to traders is the Kill Switch which allows them to automatically close all their positions when they hit an equity level. PipFarm has also partnered up with companies that provide trading tools like VPS servers and trade copiers to give their traders exclusive discounts on these products.

PipFarm gets a 3.2 score in this section for providing performance and market analysis tools.

Customer Support at PipFarm — 3.6

Customer support is provided using several channels including live chat, Telegram, Discord, and email support. Both the website and support are only available in the English language. There needs to be phone support, which is common among new prop firms. As a result, while offering the live chat, the firm still loses points in this section.

The firm gets a 3.6 score for lack of phone support and multilingual support.

Frequently Asked Questions

Is PipFarm legit?

Can I trade cryptocurrencies with PipFarm?

Does PipFarm have hidden rules?