Founded in 2019, OspreyFX is a forex broker registered in St Vincent and the Grenadines that also offers prop trading services to its users.

The firm’s offerings are not solely limited to currency pairs and also offers select U.S. and European stocks, as well as commodities futures and cryptocurrencies.

The prop challenge gives traders the opportunity to participate in a three-stage evaluation and keep up to 70% of the generated profits.

OspreyFX offers MetaTrader 4 and 5 to its clients, with available funding up to $200,000.

This review will look at the terms and services offered by OspreyFX and rate the prop trading challenge based on a number of important factors, such as safety, platforms, and fees.

Pros and Cons of OspreyFX Proprietary Trading Firm

Pros

- Offers both prop trading and brokerage

- Offers forex, stocks, commodities, and crypto

- MetaTrad 4 and 5 available

- Web platform + Mobile app offered

- All account fees are refundable. No monthly fees

- TradeLocker platform with plenty of functionality

Cons

- Profit share of only 70%

- The broker is not internationally regulated

- Minimum 10 trading days required

- Maximum funding of $200,000

Quick Rating of OspreyFX Prop Trading and Its Features

| FPA Score | NOT RATED |

| Year founded | 2019 |

| Headquarters | Majuro, Marshall Islands |

| Minimum audition fee | $220 (refundable) |

| Fees on withdrawals | $25 for bank withdrawals up to $5,000 |

| Minimum funded amount | $25,000 |

| Maximum funded amount | $200,000 |

| Allowed daily loss | 5% |

| Profit target | 8% over 60 days |

| Maximum trailing drawdown | 12% |

| Profit sharing (Payouts) | 70% |

Safety of OspreyFX – 1.5

OspreyFX is a forex broker and prop trading firm at the same time. However, the firm is not licensed and regulated by any of the top-tier ratings agencies.

The firm was launched in 2019, which means that it does not have an extremely long history of operations to use as reference. Still, the firm was founded more than 2 years ago.

OspreyFX offers two-factor authentication for traders to keep their accounts secure. Other than the two-factor and KYC procedures, the firm has little in the way of extra security features.

As a forex broker, OspreyFX is rated by the Forex Peace Army, which gives the firm 1.65 stars out of 5, based on 20 reviews. FPA states that the firm’s offshore regulations are not enough to give it a higher security rating.

Overall, OspreyFX gets a Safety score of 1.5 out of 5.

Funding and Maximum Capital Allocation – 2

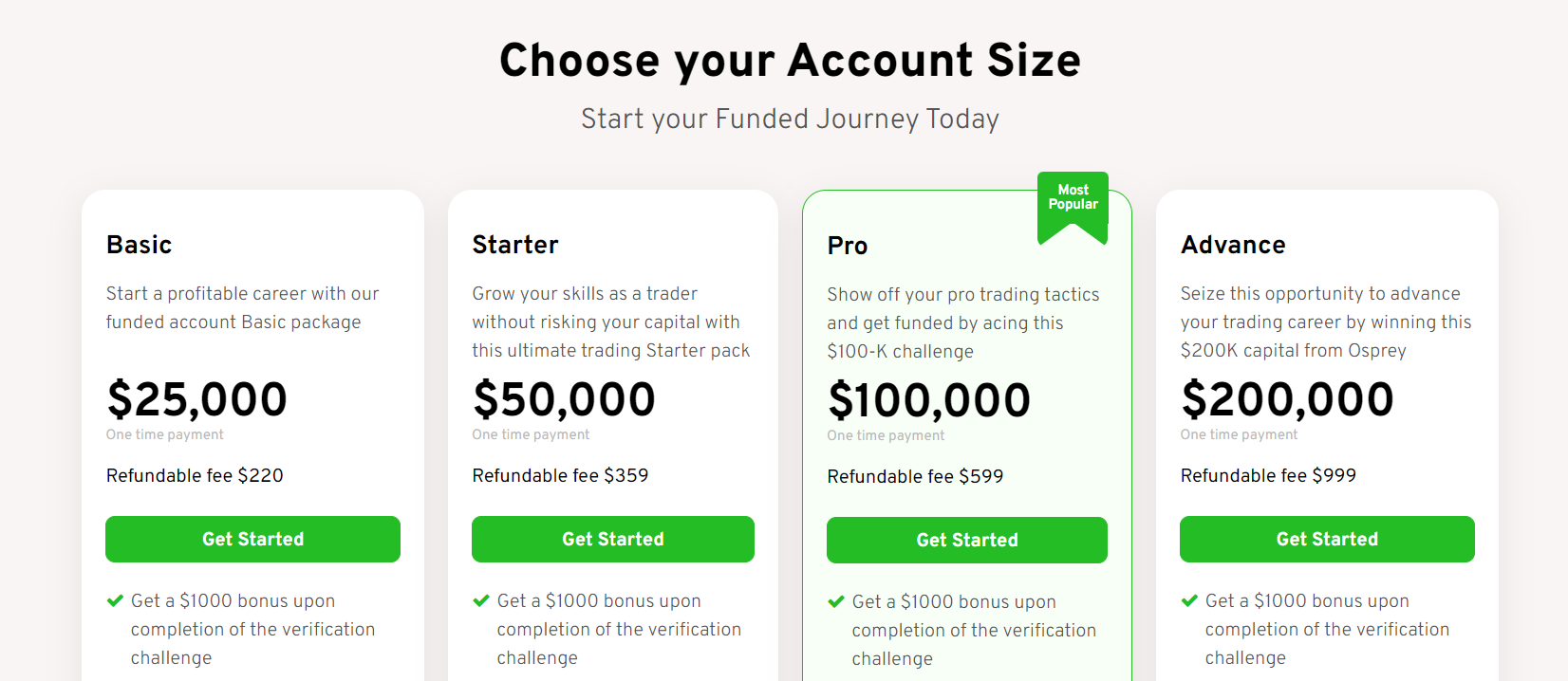

Funding at OspreyFX is divided into four distinct account types, which are: Basic, Starter, Pro, and Advance.

For completing each of these challenges, traders get a $1,000 bonus and keep 70% of the profits they generate.

Here is how much each of the four accounts offer in funding:

- Basic – $25,000 in funding

- Starter – $50,000 in funding

- Pro – $100,000 in funding (most popular option)

- Advance – $200,000 in funding

A downside of OspreFX’s offerings is that it does not offer a $10,000 account, or any option to scale up the $200,000 account to $1 million or beyond. This gives OspreyFX a Funding score of 2 out of 5.

Assets – 4.5

OspreyFX offers an impressive lineup of instruments that are available for trading. This includes forex, stocks, commodities, and cryptocurrencies.

In total, the firm offers majors, crosses, and exotics, with 57 currency pairs in total. As for stocks, OspreyFX offers 28 tickers, including the likes of AAPL, MSFT, MCD, TSLA, etc.

The crypto offering includes 23 cryptocurrencies, such as BTC, ETH, TRON, XRP, DOGE, and more.

Among the commodities offered by OspreyFX are metals and indices, as well as energies, such as oil and natural gas. The indices include equity indices, such as the S&P 500, Nasdaq-100, Euro Stoxx 50, etc.

Overall, OspreyFX gets a score of 4.5 out of 5 in Assets, thanks to the variety of its offered instruments.

Trading Rules and Limitations – 3

OspreyFX requires traders to remain consistent with their trades, which means that their best trading day cannot account for more than 30% of the total profits during the applicable period of 30 or 60 days.

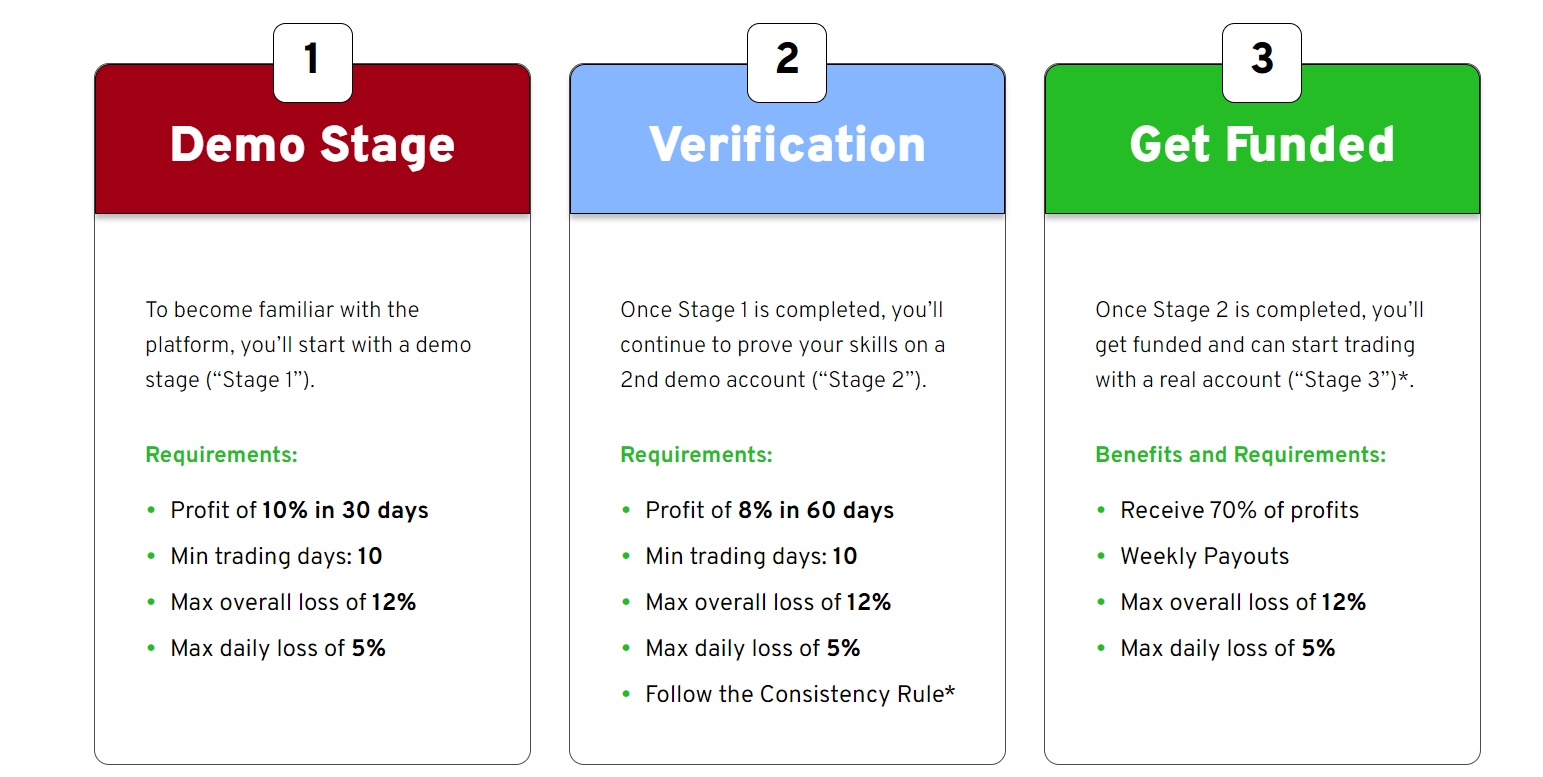

The general rules that apply to the three audition phases are as follows:

- Demo stage – profit of 10% in 30 days, a minimum of 10 trading days, maximum daily loss of 5% and a maximum overall loss of 12%

- Verification stage – profit of 8% in 60 days, a minimum of 10 trading days, maximum daily loss of 5% and a maximum overall loss of 12%

- Funding stage – maximum daily loss of 5% and a maximum overall loss of 12%

Aside from the general requirements during the three audition stages, traders are given some freedom in the way they structure their strategies, with the use of automated trades and Expert Advisors being permitted by OspreyFX.

Trading during economic news is also permitted, as well as copy trading. Overnight holdings are also allowed.

Overall, OspreyFX gets a Rules and Limitations score of 3 out of 5.

Platforms – 5

OspreyFX offers MetaTrader 4 and 5 platforms through its TradeLocker system, which is a trading platform that offers in-app trading and advanced charting from TradingView.

MetaTrader allows the use of EAs and automated trading strategies, which can easily be backtested by traders, which allows for more flexibility.

Some of the features of the TradeLocker platform are:

- Customizable charts and additional technical tools

- One-click trading with reduce execution times

- Optimization for all devices

- Smart stop-outs to lock stop-losses and take-profits

- A minimum lot size of 0.01 lots

The trading platforms are available as desktop apps, web platforms and mobile apps as well.

With access to MetaTrader and highly responsive practical features, OspreyFX gets a score of 5 out of 5 for its platforms.

Profit-Sharing and Withdrawals – 3

Traders at OspreyFX have the opportunity to keep 70% of their generated profits. This threshold remains the same for all four funded account types.

Traders fund their accounts and withdraw profits via cryptocurrency, which may be inconvenient for some traders that are less interested in trading and using crypto.

When it comes to withdrawing funds from the account, traders can use crypto or wire transfers, as well as credit/debit cards. When withdrawing to a bank account, a $25 charge is applicable for withdrawals below $5,000.

OspreyFX gets a Profit-Sharing and Withdrawals score of 3 out of 5.

Fees – 2.5

The fees charged for funded OspreyFX accounts are charged once and are fully refundable. This makes the accounts highly affordable for most traders. Here are the costs of each of the four accounts:

- Basic – $220 refundable fee for the $25,000 account

- Starter – $359 refundable fee for the $50,000 account

- Pro – $599 refundable fee for the $100,000 account

- Advance – $999 refundable fee for the $200,000 account

It must be noted that the $220 entry fee is a bit steep when compared to some other proprietary trading firms. However, OspreyFX does compensate for this by offering a wider selection of instruments. Withdrawals made in crypto are also completely free of charge. No additional fees are charged for other OspreyFX services.

Overall, the firm gets a score of 2.5 out of 5 in Fees, thanks to its low spreads and frequent promotions.

Education at OspreyFX – 2.8

The primary educational resource at OspreyFX is the Forex Education section of the official website, which is a blog with articles around a range of forex trading-related topics and key terms. The educational continent is not limited to just forex and offers articles about every tradable instrument available at OspreyFX.

As for a more formal educational course, traders are better off with other options, as OspreyFX does not have such offerings.

There are no webinars and significant video content available, which is something many other prop trading firms offer.

Overall, OspreyFX gets an Education score of 2.8 out of 5.

Customer Support at OspreyFX – 3.6

Customer support at OspreyFX is represented via a hotline, support email, and online chat. Clients can also send inquiry tickets to OspreyFX to find out more about the firm and ask specific questions regarding their services and terms.

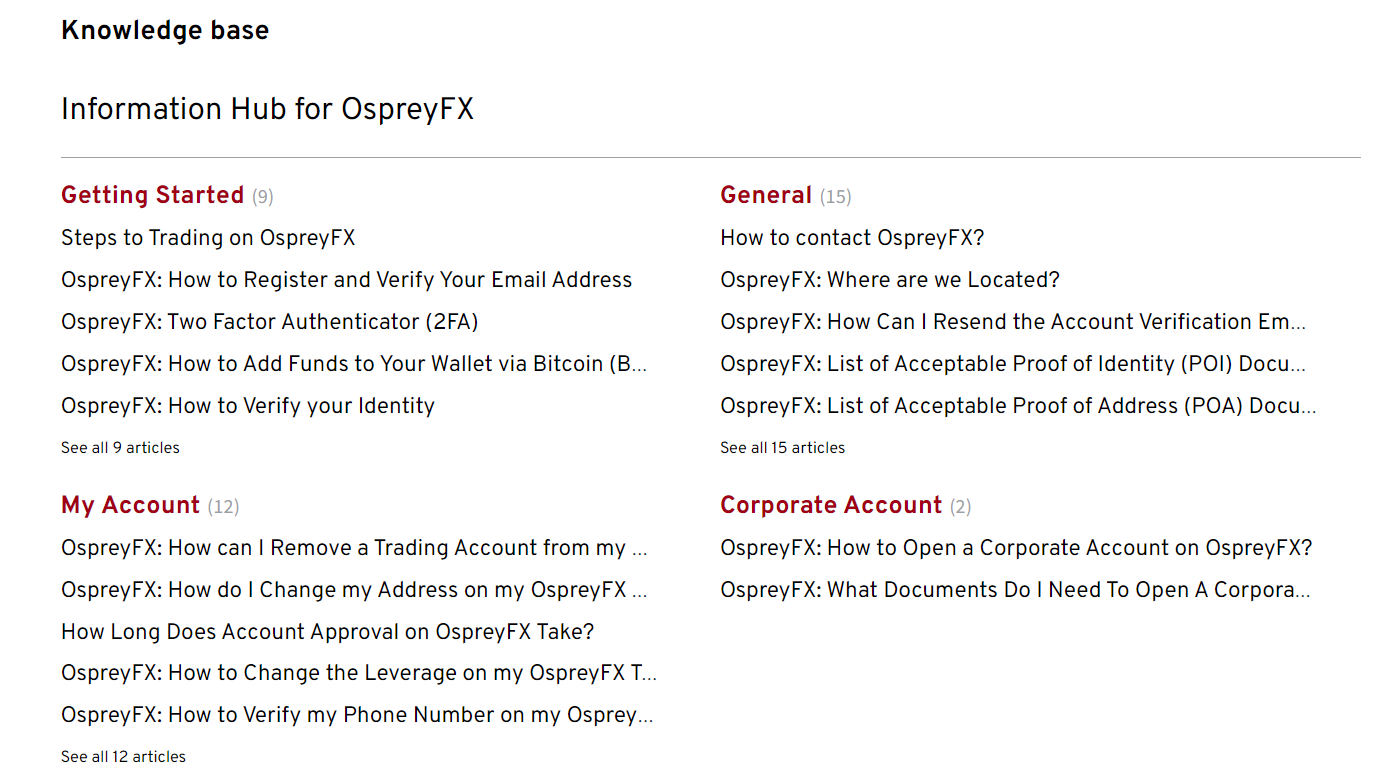

The firm also has a comprehensive FAQ section which answers some of the most common questions new clients may have.

The website also has a solutions page next to the ticket, where technical guidelines and ways of resolving some common issues are posted.

Overall, OspreyFX gets a Customer Support score of 3.6, as the support is not available in more than 5 languages.

Frequently Asked Questions

Is OspreyFX a broker?

What is the maximum funding at OspreyFX?

Does OspreyFX have MetaTrader?