Founded in 2016 in Australia, NP Financials is a financial course provider and proprietary trading firm that offers traders funded accounts for CFDs trading.

Traders at NP Financials can trade CFDs on assets, such as cryptocurrencies, shares, indices, forex, and commodities.

The firm offers MetaTrader 4 and 5, while also being licensed by the Australian Securities and Exchange Commission (ASIC).

Traders who enroll in the prop trading program offered by NP Financials can get funding up to $1 million, with a 70% profit share in favor of the traders.

The proprietary trading program also offers trade ideas and educational content for traders to try out and use to get ahead on the market.

This review will evaluate and score NP Financials prop trading based on a number of key factors, from safety to customer support, deriving a final overall score for the firm.

Pros and Cons of NP Financials Proprietary Trading Firm

Pros

- Funding up to $1 million available

- No minimum trading days

- One-time payments, no monthly subscriptions

- News trading, copy trading and EAs are allowed

- No maximum trading days

- Trading courses for forex, futures, shares

- Maximum leverage is 10:1

Cons

- Stop-losses are mandatory

- 10% profit targets

- Maximum loss is 5%

- Profit-share is 70%

Quick Rating of NP Financial Prop Trading Firm and Its Features

| FPA Score | NOT RATED |

| Year founded | 2016 |

| Headquarters | Wheelers Hill, Victoria, Australia |

| Minimum audition fee | $240 |

| Fees on withdrawals | None |

| Minimum funded amount | $25,000 |

| Maximum funded amount | $1,000,000 |

| Allowed daily loss | 4% |

| Profit target | 10% |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 70% |

Safety of NP Financials – 3

NP Financials is licensed and regulated by the Australian Securities and Exchange Commission (ASIC), which makes it one of the few prop trading firms with official licenses and regulations.

Because the firm only offers CFDs trading, it is not rated by the Forex Peace Army, which is a reliable rating aggregator for forex prop firms and brokers.

NP Financials offer MetaTrader 4 and 5, which are some of the safest and reliable pieces of trading software available on the market.

The firm has also been around for 7 years, which gives prospective traders some performance history to research about the firm.

Overall, NP Financials gets a Safety score of 3 out of 5.

Funding and Maximum Capital Allocation – 3

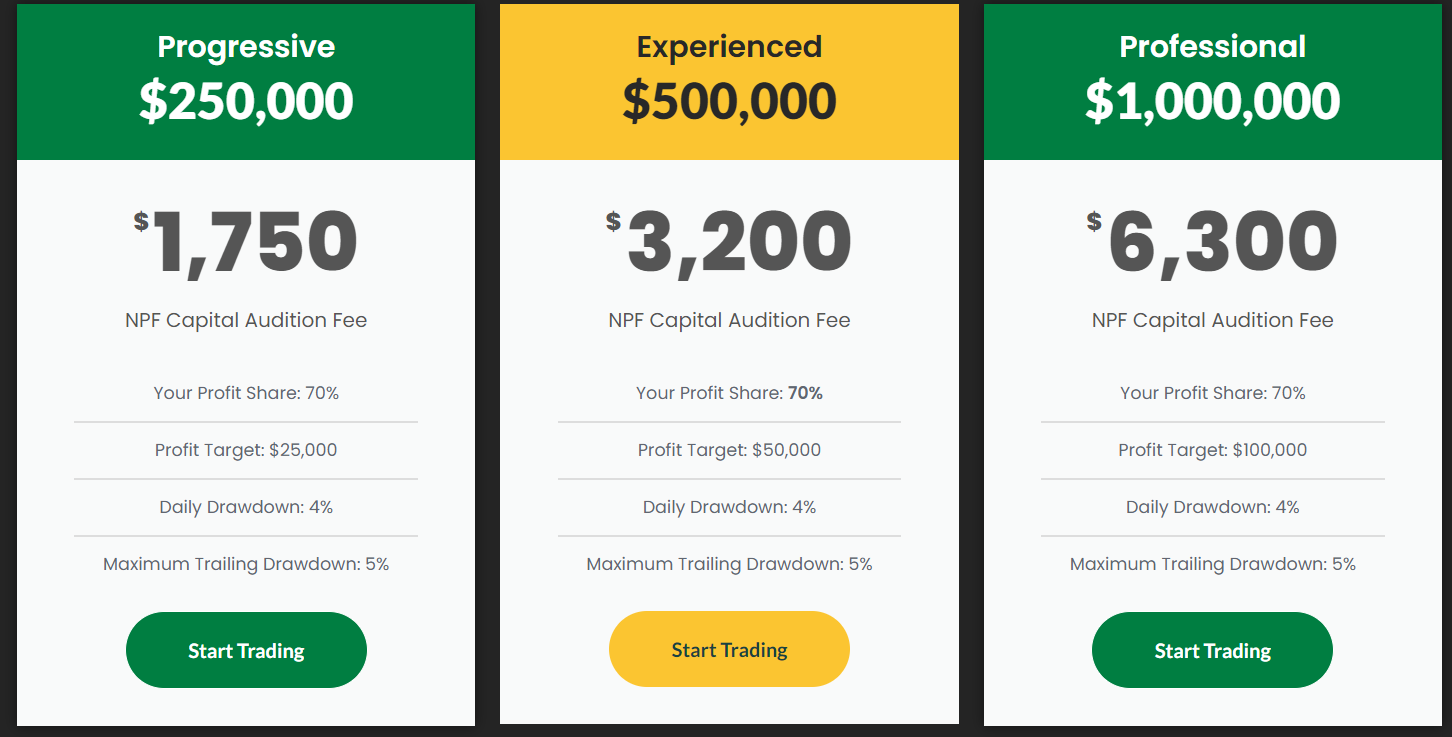

Funding at NP Financials is divided into 6 different account types, which all come with a set of different profit targets and maximum allowable loss limits.

The accounts based on provided funding are the following:

- Start-Up – $25,000 in funding, $2,500 profit target

- Transition – $50,000 in funding, $5,000 profit target

- Competent – $100,000 in funding, $10,000 profit target

- Progressive – $250,000 in funding, $25,000 profit target

- Experienced – $500,000 in funding, $50,000 profit target

- Professional – $1,000,000 in funding, $100,000 profit target

While the smallest account size offered by the firm is $25,000, which can be inconvenient for some traders, it also offers a $1 million account, which is some of the largest possible funding amount available on the prop trading market.

Overall, NP Financials gets a score of 3 out of 5 in Funding and Maximum Capital Allocation.

Assets – 1.5

NP Financials is a CFDs-only platform. Traders can trade CFDs on a wide variety of asset classes, such as stocks, commodities, crypto, and forex.

The firm also offers trade ideas to its users, as well as an overview of common CFDs trading strategies they can use to trade profitably.

The website includes trading courses for each of the asset classes users can trade CFDs on.

However, despite a fairly comprehensive lineup of CFDs, this is the only asset class offered by NP Financials, which gives the firm a low Assets score of 1.5/5.

Trading Rules and Limitations – 2.1

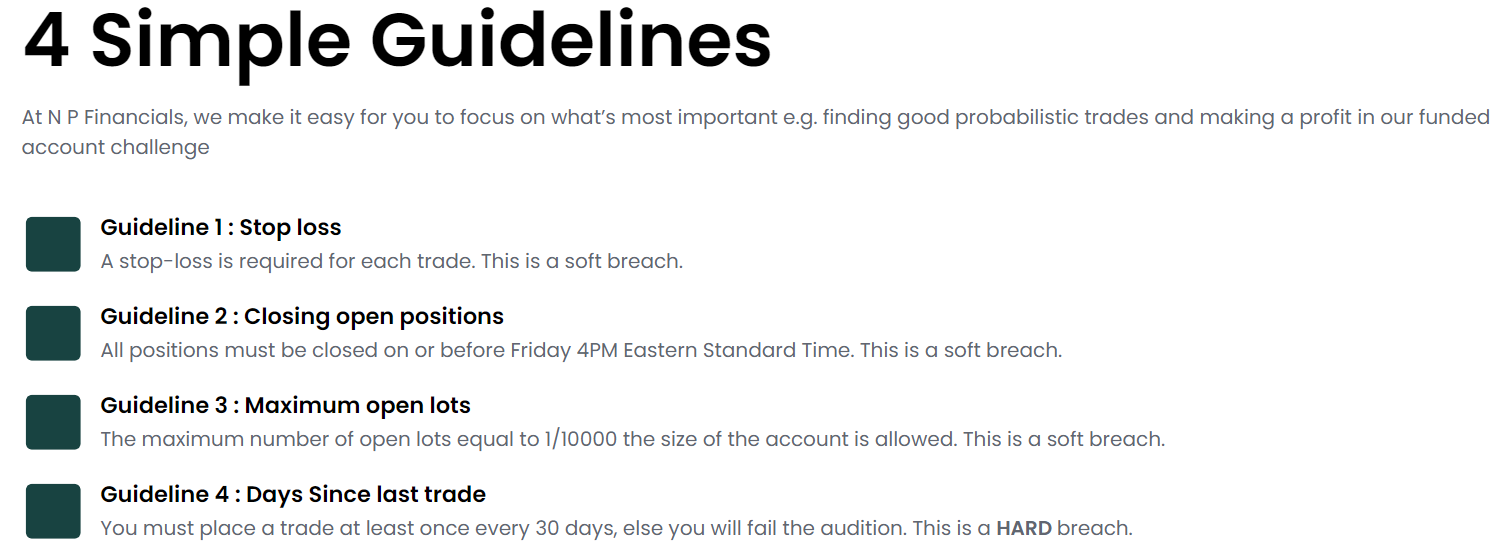

Trading on NP Financials comes with a set of general rules, as well as guidelines for specific accounts based on funding amount. These limitations include maximum total loss and profit targets.

The general provisions for NP Financials traders include:

- Stop-losses are required for every trade

- All positions must be closed on or before Friday 4PM Eastern Standard Time

- The maximum number of open lots equal to 1/10000 the size of the account is allowed

- Must trade at least once every 30 days, or else the audition will be canceled

As for the rules and limitations for each of the funded accounts, they are:

- Start-Up – 10% profit target, 4% daily drawdown, 5% maximum trailing drawdown ($25,000)

- Transition – 10% profit target, 4% daily drawdown, 5% maximum trailing drawdown ($50,000)

- Competent – 10% profit target, 4% daily drawdown, 5% maximum trailing drawdown ($100,000)

- Progressive – 10% profit target, 4% daily drawdown, 5% maximum trailing drawdown ($250,000)

- Experienced – 10% profit target, 4% daily drawdown, 5% maximum trailing drawdown ($500,000)

- Professional – 10% profit target, 4% daily drawdown, 5% maximum trailing drawdown ($1,000,000)

With high profit targets and low possible loss requirements, NP Financials offers stringent capital controls for its traders. For this reason, the prop firm gets a 2.1 out of 5.

Platforms – 3.5

NP Financials offers MetaTrader 4 and 5 to its traders, which is a major advantage in terms of trading platforms.

However, the firm does not have any in-house trading software, which may be inconvenient for traders who do not use MetaTrader frequently.

MetaTrader offers automated trading capabilities and NP Financials allows the use of EAs, which is an added convenience to traders.

Overall, NP Financials gets a score of 3.5 out of 5 in Platforms.

Profit-Sharing and Withdrawals – 3

The profit share for NP Financials traders is 70% for all funded accounts. When it comes to withdrawing funds, traders can do so once every 30 days.

When a withdrawal is requested, NPF will also withdraw its share of the profits. Hence it is advisable not to withdraw the entire profit as the max trailing drawdown will lock in at the starting balance.

In addition, upon withdrawal, the high-water mark for the maximum trailing drawdown is reset to the starting balance.

Due to a relatively low profit share, NP Financials gets a score of 3 out of 5.

Fees – 2.5

NP Financials does not charge monthly subscription fees. Rather, traders pay a fixed fee for funded accounts. The fees charged for each funded account are as follows:

- $240 for the $25,000 funded account

- $390 for the $50,000 funded account

- $670 for the $100,000 funded account

- $1,750 for the $250,000 funded account

- $3,200 for the $500,000 funded account

- $6,300 for the $1,000,000 funded account

The most affordable funding package starts at $240, which is relatively steep compared to other proprietary trading firms. NP Financials gets a score of 2.5 out of 5 in Fees.

Education at NP Financials – 4

NP Financials offers a comprehensive selection of educational materials, from a blog to trading courses for stocks, forex, and commodities.

The firm also has a day trading course and provides valuable insight about trading psychology and various strategies.

The training programs are also another product offered by NP Financials and go for a $170 price tag.

The educational materials offered by NP Financials get a score of 4 out of 5, as they come with economic calendars, training courses and other educational articles and video content included in the training programs.

Customer Support at NP Financials – 3.6

Customer support at NP Financials comes in the form of a hotline, support email, and live chat function.

The support hotline is available from 9 am to 7 pm Monday-Friday. The hotline is not available on the weekends.

The live chat is responsive and fast, but requires users to file a contact form to apply for an audition.

Overall, NP Financials gets a 3.6 out of 5 in Customer Support, as the support is not available in 5 or more languages.

Frequently Asked Questions

Is NP Financials a brokerage?

What is the maximum funding at NP Financials?

What can you trade at NP Financials?