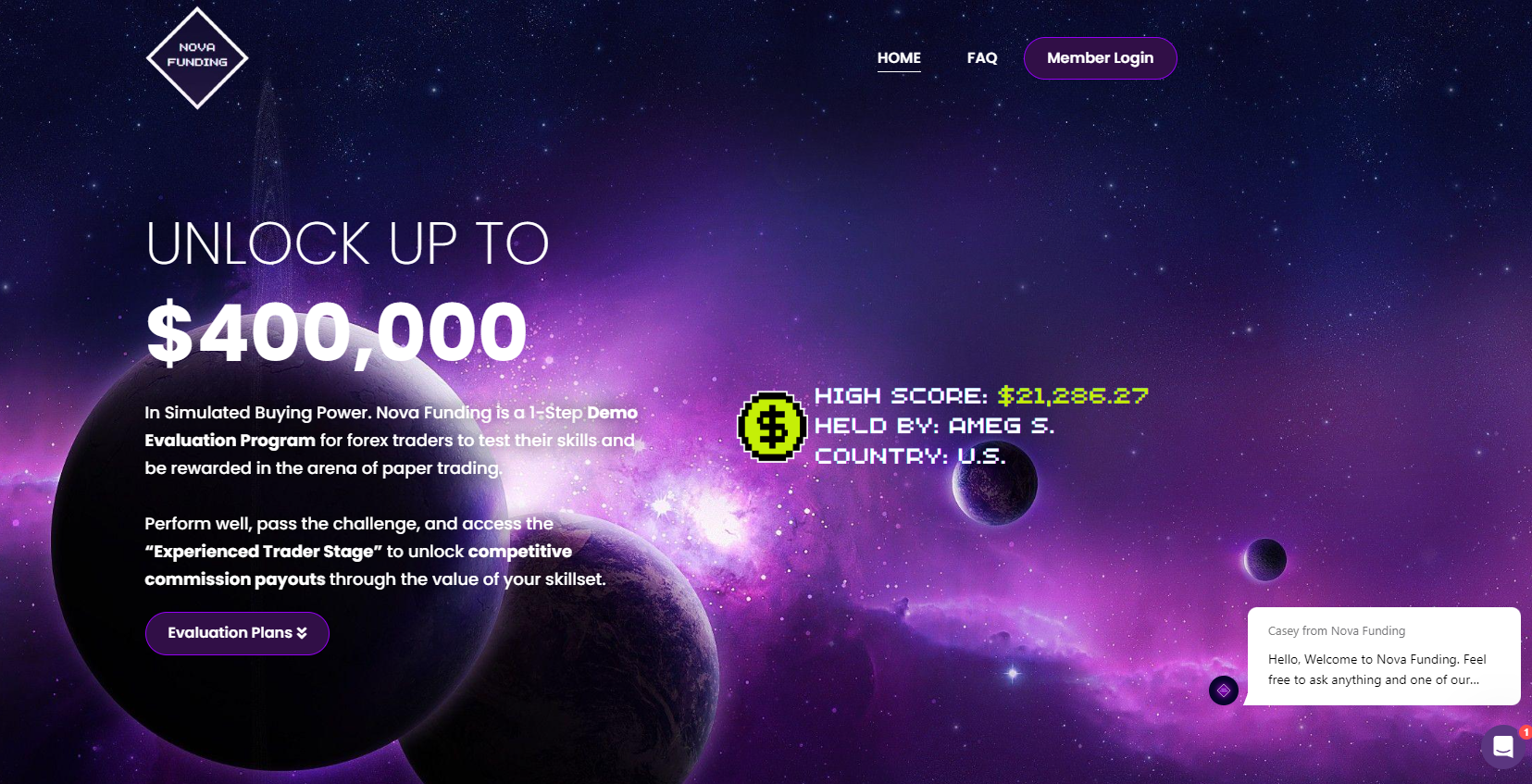

Nova Funding prop firm is a Forex proprietary company that was launched in 2023 in the United States. The firm focuses on a simplistic approach and has a very simple but informative design. The firm provides virtual funding accounts from 25k to 200k with the possibility to merge accounts to get a maximum of 400k USD in funding.

In today’s Nova Funding review, we are going to fully assess the firm’s safety, assets, funding options, rules, fees, platforms, and more using our professional research methodology. After reading their review, readers will have an understanding of whether they can trust Nova Funding prop firm.

Pros & cons of Nova Funding prop firm

Pros

- Ability to withdraw with $0 fees

- Advanced Trading Platforms: Offering both MetaTrader 4 and MetaTrader 5

- A good range of assets including FX pairs, commodities, indices, and cryptos, with varying leverage levels up to 1:100

- Profit-sharing up to 80%

- Simple one-step evaluation challenge

- Supports quick crypto withdrawals

Cons

- Low daily loss limit of 4%

- High profit target of 10%

- Young firm, no FPA reviews, no regulated partner broker

Safety of Nova Funding – 0

Nova Funding reviews are lacking on the FPA platform and the firm has a 3.2 score on Trustpilot from 2 700 reviews. 37% of the reviews evaluate the firm with a 1-star and 48% with a 5-star. So, the firm by the look of the trader feedback on Trustpilot seems to be an average firm. The account was created in 2023, and we assume the firm was launched in the same year. There are little to no details about the firm on its website, which is always a bad sign. All trading services at Nova Funding are provided via the Foreign Exchange Clearing House broker which is an entity focused on prop firms and companies of the same type. The broker seems unregulated broker and provides very few details on its website. Nova Funding gets a 0 score in safety for not offering services through a regulated broker, being too young, and having no evaluations on the FPA platform.

Nova Funding Funding and maximum capital allocation – 2

Nova Funding funded programs provide funded accounts within a range of 25k to 200k USD with 50k and 100k accounts, in between. There is no Nova Funding scaling plan, but traders can merge two funded accounts to get a maximum of 400k USD in total funding accounts. One trader can not control more than 400k USD funding and all accounts are virtual.

Nova Funding challenges are scarce as there is only one one-step evaluation challenge. This downside is also the firm’s advantage as it offers a simple and convenient approach. One-stage evaluations are easy to pass. The firm gets a 2 score in this section for not offering lower than 25k and higher than 400k funding options.

Nova Funding Assets – 3.5

The maximum leverage for both evaluation and funded trading phases are same at 1:100 for all assets provided by the firm. However, different asset classes come with different leverage levels:

- 1:100 for all currency pairs.

- 1:30 for Indices

- 1:18 for Metals

- 1:2 for Crypto

Nova Funding prop trading is possible through several trading assets including FX pairs, commodities, indices, and popular cryptos. The firm gets a 3.5 score in this section.

Nova Funding Trading rules and limitations – 2.4

Nova Funding rules are straightforward as the firm allows traders to be eligible for the funded trader phase right after they hit the profit target. There are no time limits of any sort, which is flexible. There is no time restriction for funded accounts and traders can reach the 10% profit target in any amount of time. Here is the list of trading methods that are not allowed at Nova Funding funded accounts:

- Grid Trading or Grid Trading Software

- Martingale Trading Or Martingale EA’s

- Latency Arbitrage

- Hedging Orders Across Multiple Accounts

- Abusing The Volatility Of News By Placing Guaranteed Limit Order Fills

- Any Use Of Delayed Data Feeds For Risk-Free Profit

- Copy Trading Among Multiple Users On Our Platform

- Account Management By A 3rd Party

The daily loss limit is 4% and the maximum drawdown is set at 8%, EAs are allowed, and News trading is also allowed. The firm gets a 2.4 score mainly losing evaluation points for not offering a higher daily loss limit and lower profit target.

Nova Funding Fees – 2.5

The spreads are raw, meaning very low allowing for scalping strategies to be effective.

Nova Funding free trial is not available at the moment as all the accounts charge fees depending on the virtual funding amount. Nova Funding free repeat is not possible at the moment as traders will have to start over if they breach any rule. Here is the list of one-time fees for each funding option the firm offers:

- 25,000 USD – 297 USD

- 50,000 USD – 397 USD

- 100,000 USD – 597 USD

- 200,000 USD – 997 USD

The firm gets a 2.5 score in the fees section for offering average conditions.

Nova Funding Platforms – 4.1

Nova Funding provides access to advanced MetaTrader 4 and MetaTrader 5 trading platforms through Foreign Exchange Clearing House which is a clearing platform and not a regulated broker. The firm allows traders to use diverse trading strategies and EAs, allowing traders to use both advanced platform features very efficiently. The firm gets a 4.1 score in this section for offering popular advanced trading software.

Nova Funding Profit-Sharing – 1

Nova Funding profit split is capped at 80%, but the firm has a lower starting point. 80% is still a very decent profit share, but many popular and reliable prop firms provide 85% and higher payouts, and the firm lacks in this section for sure. The 1st payment trader can get start from 50% and increase to 70% on 2nd withdrawal and is capped at 80% on all consecutive withdrawals.

All payments and withdrawals are processed through cryptocurrencies with supported currencies, including BTC (Bitcoin Network) or USD-T (ERC-20 Network). Withdrawals can take 1-5 business days, which is a long time when compared to other popular firms. However, the accounts can be purchased using BTC, USDT, ETH, or USDC. So, the firm really lacks in payment quality. The firm gets a 1 score in this section for lacking 90% payouts in 1-2 business days.

Education and trading tools at Nova Funding – 0.5

The firm does not provide any educational resources or trading courses. It has only one website with only one tab or section where all the information and FAQ are given. There are no sections to provide any other details, which is a drawback. Trader dashboard might provide some additional tools but overall the firm lacks severely in thee educational department. Nova Funding gets a 0.5 score in the education section for lacking almost everything related to trading education.

Customer Support at Nova Funding – 2.4

The support of Nova Funding only consists of a live chat and email channels. Both the website and support options are only provided in the English language, which is also a drawback. There are no other support options available at the moment, but the live chat is usually sufficient. The live chat of Nova Funding has an inbuilt help center and FAQ section with a search bar allowing prop traders to search any subject and find answers to all general questions.

The firm gets a 2.4 score in this section for offering an average level of support, lacking phone support, and not being multilingual.

Frequently Asked Questions

Is Nova Funding a good prop firm?

Is Nova Funding legit?

Can I trade on mobile at Nova Funding?