Nordic Funder prop firm is a proprietary company that allows traders to pass one-stage evaluation and get funded on diverse funding accounts from 25k to 400k USD. The firm was established in 2021 and offers services via a regulated partner broker offering access to the advanced trading platform MetaTrader 4.

In our Nordic Funder review, we are going to evaluate the firm according to our advanced research methodology assessing the firm’s safety, assets, rules, funding options, and much more.

Pros & cons of Nordic Funder prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4

- Fast and digital account opening/verification

- Offers access to diverse markets including Forex pairs, cryptos, indices, and commodities

- Having Scandinavian Capital Markets as a regulated partner increases trustworthiness and reliability

- A higher maximum loss limit of 10%

- Offers up to 90% profit sharing for traders

- Good trader feedback on Trustpilot and a high score for reliability, with a noteworthy absence of 1-star reviews.

Cons

- Lack of educational resources

- The firm offers support primarily in English

- The fee structure, starting at $200 for a 25k account is slightly more expensive than competitors

- Certain trading rules, like the requirement for stop-loss orders and restrictions on weekend trading, require additional add-ons

Safety of Nordic Funder – 3

Nordic Funder reviews are lacking on the FPA platform, as the firm is relatively young. However, the trader feedback on Trustpilot is very positive, and the firm has managed to achieve a 4.6 score for its reliability. There are no 1-star reviews, which is always a good sign. The firm has a regulated partner broker Scandinavian Capital Markets which is a regulated Forex and CFDs broker overseen by several authorities. This is a critical part of prop firm valuation as a regulated partner broker increases the chance the firm is legit and reliable. Nordic Funder was established in 2021 giving it 3 and more years of experience which is another good point in the scorebook for this firm.

The firm gets a 3 score in this section for having 2+ years of experience and being a regulated partner broker.

Nordic Funder Funding and Maximum Capital Allocation – 4

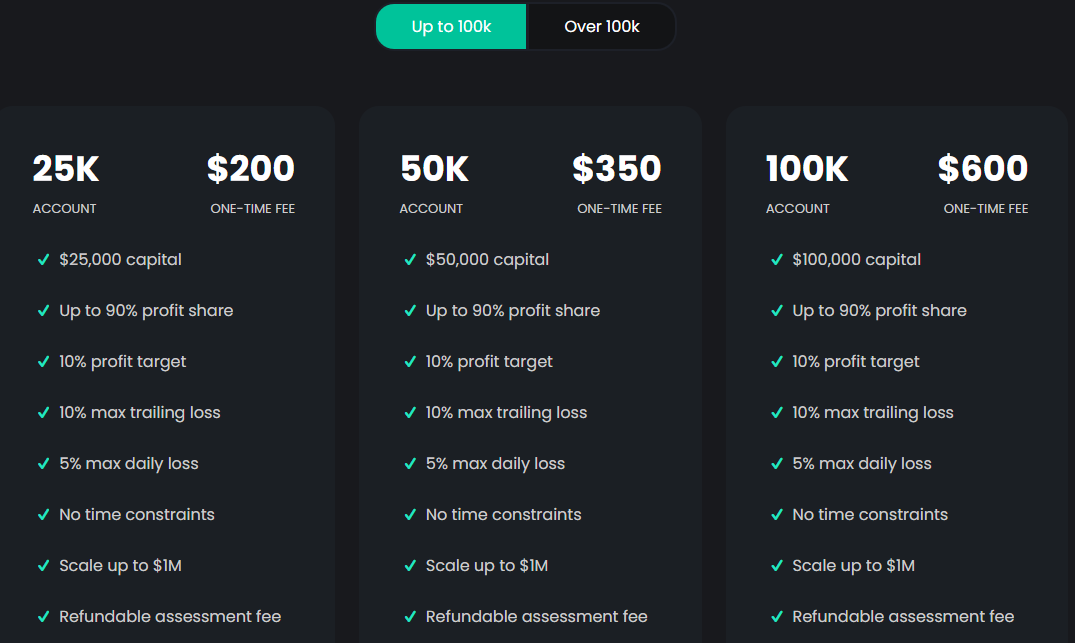

Nordic Funder funded programs are diverse, and fundings range from 25k to 400k USD. The fee structure is also very attractive as the firm only charges one-time fees for each funded account. Nordic Funder funding programs are divided into two groups, one is the accounts up to 100k, and the other is accounts from 200 to 400k.

Nordic Funder challenges are divided into the following funding options 25k, 50k, 100k, 200k, and 400k accounts. All the accounts are eligible for the Nordic Funder scaling plan that allows traders to increase the maximum funding amount up to 1 million USD. Here is how the Nordic Funder scaling plan works in practice, a trader has to hit the profit target of 10% on a funded account, he receives up to 90% of profits, and the firm closes funded accounts and opens new ones with increased capital. For example, if the trader was trading on 100k funded accounts after they reach 110,000 USD, the firm will give them 9,000 USD and open a 150k account for them. This scaling plan is super useful for profitable traders and allows them to increase their capital and potential profits every time they hit a profit target which is very good for becoming increasingly profitable prop traders.

The firm gets a 4 score in this section only for lacking lower funding options than 25k.

Nordic Funder Assets – 4

Nordic Funder prop trading firm allows traders to access Forex pairs, crypto assets, indices, metals, and oil. There are no stocks available at this time which is a minor drawback for the firm. The trading leverage and conditions are flexible. The firm allows traders to use a maximum of 1:10 or 1:20 leverage and it can be selected during the funding account purchase. The minimum spread starts from 0 pips on EURUSD and the average is 0.3 pips. The maximum leverage for Forex pairs is set to 1:20 which is more than enough to open large trading positions with funded accounts. Since the daily loss limit is 5% it is wise to plan position sizing and avoid going with full leverage so as not to breach rules and get disqualified. Since the firm lacks stocks and other asset classes like futures and options, we give it a 4 score in the assets section.

Nordic Funder Trading rules and limitations – 3.6

Nordic Funder rules are fair and square as the firm focuses on essentials and tries to attract profitable traders. The stop-loss order is a must on MetaTrader 4 and quick buy and sell functions don’t work by default. However, traders can purchase the add-on to remove the stop-loss requirement and use quick trade buttons (one-click trading).

Nordic Funder does not allow traders to hold trading positions during weekends, but it can be upgraded via an add-on. However, the partner broker of the firm does not allow over-the-weekend trading. The daily loss limit is 5%, the maximum drawdown is 10%, and the profit target is also set at 10%. Traders are not limited by time constraints and can freely take their time and trade at their usual phase. The rules are simple and the firm tries to eliminate all unnecessary terms to allow traders to be more flexible. Depending on the leverage traders have different maximum lot size exposure to the markets. For example, for 25k accounts with 1:10 leverage traders can only trade with a maximum of 2.5 lots and 5 lots with 1:20 leverage of the same accounts.

Stop loss is required by Nordic Funder, but traders can purchase an add-on with a 10% surcharge to open positions without stop loss orders. Holding trading positions over the weekends is not allowed by default, but traders can purchase an add-on to eliminate this rule for a 10% surcharge during the evaluation-building process. Crypto trading is also not allowed during weekends. If a trader is not opening trading positions for 30 days the firm will close the funded account. If a trader breaches any of the rules, they can still receive profits if any remains after all positions get liquidated. Trading during the major news releases is allowed. Traders have 6 months to pass the evaluation period. Automated trading algorithms are allowed, as well as trade copiers. However, HFT (High-Frequency Trading) algorithms are not permitted. Holding positions overnight is permitted.

Nordic Funder gets a 3.6 score for offering less stringent rules and focusing on allowing profitable traders access to funding.

Nordic Funder Fees – 2.5

Nordic Funder allows traders to access markets via its partner broker, Scandinavian Capital Markets. The broker has a trading commission on Forex pairs and metals, 7 USD per lot. oil, cryptocurrencies, or indices come with 0 USD commissions. The spreads are competitive and start from 0 pips on major pairs including EURUSD.

Nordic Funder free trial is not available at this point as the firm only allows you to buy certain funded challenges.

Nordic Funder free repeat is also not available as traders have to purchase the challenge if they breach any rules.

There are no fees for withdrawals and purchasing challenges are also commission-free from the firm’s side.

Here is the fee list for each of the funded amounts:

- 25k account – 200 USD one-time fee

- 50k account – 300 USD one-time fee

- 100k account – 600 USD one-time fee

- 200k account – 1,500 USD one-time fee

- 400k account – 3,000 USD one-time fee

The firm gets a 2.5 score as it has slightly higher prices from 200 USD for funding challenges.

Nordic Funder Platforms – 4.1

Nordic Funder provides its prop traders with MetaTrader 4 (MT4) advanced trading platform which is hosted by the regulated partner broker, Scandinavian Capital Markets. Nordic Funder MT4 comes with full functionality of its advanced features and it requires traders to open all trading positions using stop-loss orders. To remove this requirement, traders can purchase add-ons. Nordic Funder allows automated trading and custom indicators. Traders can also use various trade copiers. The firm gets a 4.1 score in this section for offering an advanced platform with advanced functionality.

Nordic Funder Profit-Sharing – 4

Nordic Funder profit split starts from 50% and traders can upgrade it to 70% and 90%. Depending on the funding amount the maximum profit share is different. For funded accounts up to 100k USD the maximum profit split is at 90% and for up to 100k accounts the maximum profit sharing is capped at 70%. The default profit split is set at 50% and is upgradable to higher percentages. As we can see, the firm provides almost 90% profit share with certain add-ons and conditions. Nordic Funder gets a 4 score for offering excellent profit-sharing policies.

Education and trading tools at Nordic Funder – 1.8

The firm lacks educational resources but offers a very detailed explanation of its rules and trading conditions. There is an extensive FAQ section to address all important questions traders might have. Because of lacking educational resources, Nordic Funder gets a 1.8 score as it only offers trader performance tools.

Customer Support at Nordic Funder – 2.4

Nordic Funder provides several support channels including live chat, email support, and Discord channel for hotline support. The firm does not offer multilingual support and the website is also only in the English language. As a result, Nordic Funder gets a 2.4 score in this section.

Frequently Asked Questions

Is Nordic Funder a good prop firm?

What can I trade at Nordic Funder?