Ment Funding prop firm is a company established in 2021, it offers a wide range of trading assets and a one-stage funded account. The funding varies between 25k to 2 million USD and offers the ability to trade on large funded accounts without the need to complete evaluation phases first. The firm offers trading services through the EightCap FX broker, which is a regulated entity.

In our Ment Funding review, we will research the firm in depth to determine if they are reliable and whether their services are worthy of consideration for our readers.

Pros & cons of Ment Funding prop firm

Pros

- No time limits and no minimum trading days

- All trading styles are allowed

- Fast and digital account opening/verification

- High maximum funded amount up to 2,000,000 USD

- No web trader variant for the MT4 trading platform

Profit-sharing starts at 75% and requires a paid upgrade to get to 90%

Cons

- The profit target is high at 10%

- The minimum funding amount is set at 25,000 USD and 250 USD fee

- Discord is the only support platform

- No free trial or repeat options

Ment Funding Quick Overview

| FPA Score | Not yet rated |

| Year founded | 2021 |

| Headquarters | United States |

| Minimum audition fee | 250 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 2,000,000 USD |

| Allowed daily loss | 5% |

| Profit target | 10% |

| Maximum trailing drawdown | 6% |

| Profit sharing (Payouts) | 75% (up to 90% with paid upgrade) |

| Trading Platforms | MT4 |

| Available trading markets | Forex, commodities, indices, stocks, and cryptos |

Safety of Ment Funding – 1.5

Ment Funding reviews are lacking on the FPA as the firm was established in 2021 making it a very young firm. The partner broker of Ment Funding is regulated broker EightCap. The firm gains points for having a regulated partner. Other than that, it is young, and we do not have a sufficient track record to determine if it’s reliable.

The firm gets a 1.5 score in the safety section.

Ment Funding capital allocation – 3

Ment Funding funded programs consist of diverse funding amounts varying from 25k to 2M USD. Traders can get any predetermined amounts including 25k, 50k, 100k, 200k, 400k, 1M, and 2 M USD to be exact.

Ment Funding funding is targeted at traders who can trade on medium to large trading accounts.

Ment Funding challenge consists of just one step and traders can achieve goals within 1 day if they achieve profit targets. Ment Funding scaling plan can be activated by emailing the firm support after achieving the profit target.

The firm gets a 3 score in this section for lacking 1,000 and 10,000 USD funded options.

Ment Funding Assets – 5

Traders can select between Forex pairs, commodities, shares, cryptos, and indices. The maximum lot sizes are different for each funded amount, and traders are free to select a comfortable amount as long as they do not exceed the limits. The maximum leverage is capped at 1:20 and can be increased once the trader selects a 1-step evaluation.

The max lot sizes are limited to:

- 25k USD funded accounts – 2.5 lots with risk

- 50k USD – 5 lots

- 100k USD – 10 lots

- 250k – 25 lots

- 500k USD – 50 lots

- 1 million USD – 100 lots

The firm gets a 5 score in the section for offering very diverse asset classes.

Ment Funding Trading rules and limitations – 2.2

Ment Funding is a one-step challenge prop firm, meaning there are no evaluation phases and requirements, traders can purchase the funded account and start earning profits right away.

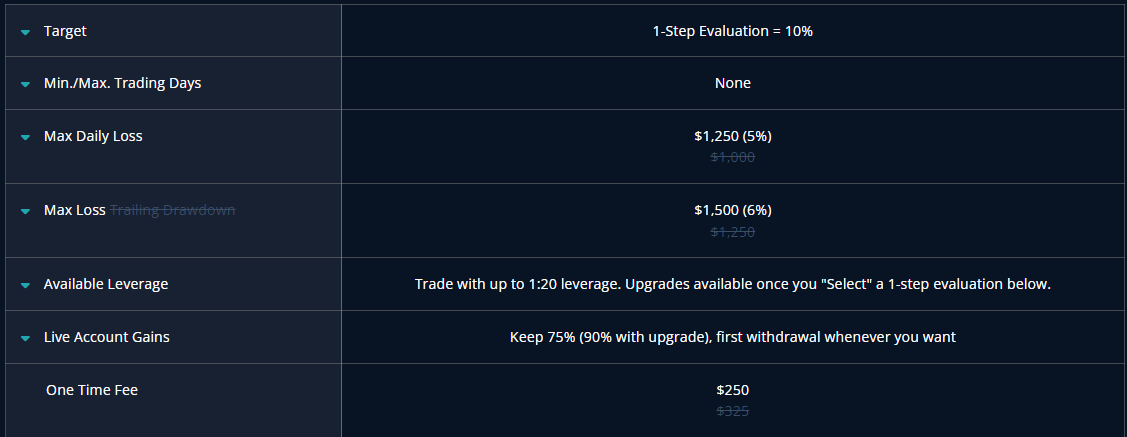

Ment Funding rules are competitive:

- Profit target – 10%

- Minimum and maximum trading days – None

- Maximum daily drawdown – 5%

- Maximum drawdown – 6%

- Available leverage – 1:20

- Profit share – 75% (90% with upgrade)

There are two types of rule breaches, soft and hard. Hard breach includes violating daily or maximum drawdown limits and the funded account is taken away. However, if a trader violates soft rules, the positions with the soft breach are closed, but a trader can continue trading on the funded account. The stop loss is required, but is considered a soft breach.

All traders are required to close open positions by 3:45 pm EST on Friday. Any trades that are left will be closed automatically. This is a soft breach and traders can continue trading on Monday. Traders must place at least one trade every 30 days. Inactivity is considered a hard breach. So, there are only three hard breaches that every trader should be careful not to break: 5% Max daily drawdown, the 6% max overall loss, and inactivity. Traders are free to open or hold open positions during major news releases.

Both hedging and EAs are allowed.

The firm gets a 2.2 score in this section.

Ment Funding Fees – 3.5

Forex trading bears 6 USD round-turn commissions for each lot traded. Commodities and indices have no commissions, only spreads. The broker partner of Ment Funding, EightCap, offers spreads from 0 pips on FX pairs and low spreads on other trading instruments.

The one-time fees for each of the funded amounts start from 250 USD and can go up to 15,000 USD for 2 million accounts:

- 25,000 USD – 250 USD

- 50,000 USD – 450 USD

- 100,000 USD – 750 USD

- 200,000 USD – 1,500 USD

- 400,000 USD – 3,000 USD

- 1,000,000 USD – 7,500 USD

- 2,000,000 USD – 15,000 USD

Ment Funding free repeat is not available and traders will have to pay the on-time fees if they decide to start over again after breaching the hard rules set by the firm.

Ment Funding free trial is lacking as the firm has just one step of paying the fee and starting to trade on the funded account right away.

Overall, the firm gets a 3.5 score in this section.

Ment Funding Platforms – 4.1

Ment Funding offers trading possibilities using the EightCap MT4 trading platform. The platform is advanced and comes with all the standard features, including a multitude of inbuilt indicators and the possibility to install or develop EAs (Expert Advisors) or automated trading robots. However, there is no web trader variant offered as of now and traders will have to download and launch the MT4 from Desktop.

As a result, the firm gets a 4.1 score in this component.

Ment Funding Profit-Sharing – 3

Ment Funding profit split is generally set at 75%, but traders can get up to 90% with a paid upgrade.

If traders breach hard rules and have profits on their accounts, they can still withdraw these profits with the profit split percentage.

The firm gets a 3 score in this section.

Education and trading tools at Ment Funding – 5

From free education to dedicated advanced mentorship and trading courses, Ment Funding excels in trading education. There are a multitude of different sources for education such as articles, videos, and webinars. The firm has a dedicated YouTube channel where educational videos are uploaded constantly and offers traders a perfect point to start learning about financial trading’s main concepts.

The trader dashboard provides monitoring tools to check and assess trading performance. The metrics are calculated every 60 seconds.

Since Ment Funding offers both educational and performance measuring tools, it gets a 5 score from us in this section.

Customer Support at Ment Funding – 1.2

Support is provided using Discord, which is a similar platform to Telegram. As a result, if a trader does not have a discord, they will have to open an account and then contact the support team on the platform. No other support methods are available, and both support and website are in English language only.

The firm gets a 1.2 score in this section.

Frequently Asked Questions

Is Ment Funding Legit?

What Trading Platforms Does Ment Funding Offer?

How Does Profit Sharing Work at Ment Funding?