Lux Trading Firm prop firm is a growing company that was recently launched and has traders from 160 countries globally. The range of funded amounts can be between 25,000 to 10 million USD with the scaling plan. All trading activities are conducted on the MT4 and the firm is working to offer MT5 soon. With diverse asset classes and competitive fees, the firm seems very intriguing to research and evaluate. This is even more so, as the firm offers mentoring from experienced traders.

In today’s Lux Trading Firm review, we are going to explore the firm’s value proposal and check its safety, fees, assets, platforms, funding options, and many more.

Pros & cons of Lux Trading Firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, TradingView

- Fast and digital account opening/verification

- Offers access to diverse markets such as FX, stocks cryptos, indices, metals, energies

- Lower profit target from 6%

- Balanced profit split at 75%

Cons

- 3-5 business days for withdrawals

- Not rated on the FPA

- The minimum funded account size is 25,000 USD

- Very young firm (established in 2023)

Lux Trading Firm Quick Overview

| FPA Score | Not yet rated |

| Year founded | 2023 |

| Headquarters | Dubai, United Arab Emirates |

| Minimum audition fee | 149 GBP |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 200,000 USD (up to 10 million using scaling) |

| Allowed daily loss | 5% |

| Profit target | 6-10% |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 75% |

| Trading Platforms | MT4, TradingView (MT5 will be added soon) |

| Available trading markets | Forex, indices, commodities, stocks, cryptos |

Safety of Lux Trading Firm – 1.5

The Lux Trading Firm reviews on the FPA are lacking. There is only one comment about the ever-changing rules of the firm, but the company is not yet rated. However, the trading service providers are both regulated brokers OX securities, GlobalPrine, and Cboe (formerly HotSpotFX). The firm has a 4.5 rank score on the Trustpilot. From the total of 503 reviews, 7% are evaluating the firm at 1 star, 9% at 4 start, and 82% at 5 stars. Although we do not include Trustpilot in our measuring calculations, it still offers useful insight into the firm’s legitimacy. The one consistent factor about Lux Trading Firm seems to be constantly changing rules and hidden risk limits. While there are no sufficient comments to support these claims, we decided it is a good idea to inform our readers about these details.

The firm gets a 1.5 score in this section for lacking experience and FPA reviews.

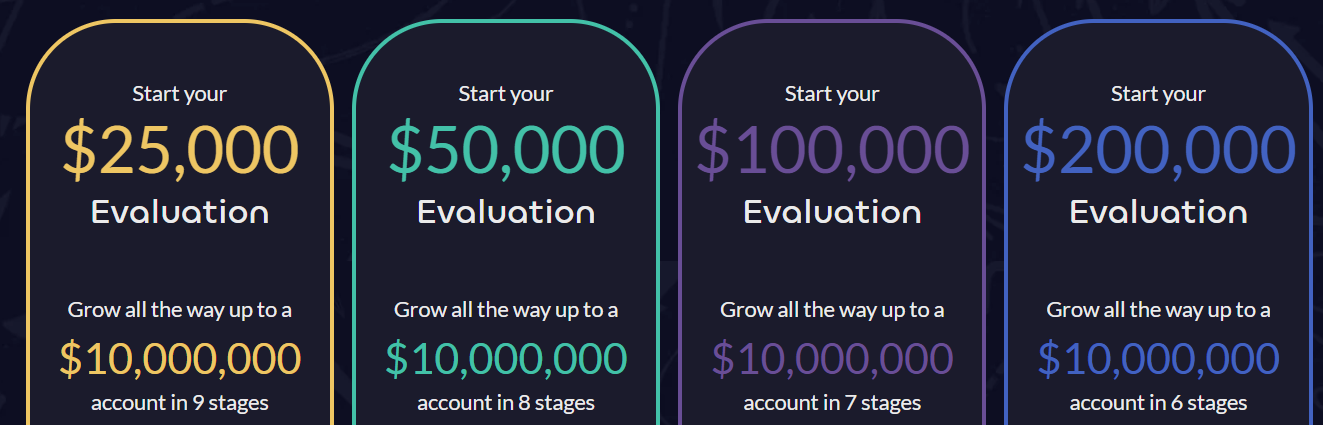

Lux Trading Firm Funding and Maximum Capital Allocation – 3

Lux Trading Firm funded programs consist of three different funded account types, CFD Account, Stocks Account, and Crypto Account. These accounts differ with only trading assets, but funding is similar. Lux Trading Firm funding starts at 25,000 USD which is the minimum-funded account that traders can get and goes up to 200,000 USD at max. Here is the list of funded amounts:

- 25,000 USD

- 50,000 USD

- 100,000 USD

- 200,000 USD

Each funded account is eligible for the Lux Trading Firm scaling plan, allowing traders to scale up accounts to 10,000,000 USD. The only downside is that the minimum funded amounts are high at 50,000 USD.

Lux Trading Firm challenge consists of two stages and additionally, 5 more growth stages where trading accounts are scaling after hitting profit targets.

Lux Trading Firm prop trading stages and funding are as follows:

- 1 Evaluation Account (Demo) – 200,000 USD

- 2 Advanced Account (Demo) – 200,000 USD

- 3 Professional Account (Live) – 200,000 USD

- 4 Professional Account (Live) – 500,000 USD

- 5 Professional Account (Live) – 1,000,000 USD

- 6 Expert Account (Live) – 2,500,000 USD

- 7 Fund Manager Account (Live) – 10,000,000 USD

There is a special account called the 1-Stage Evaluation account with 1,000,000 USD funding. This account starts evaluation on a 1 million USD funded demo account and traders can scale it via 4 4-stage process.

We give the firm a 3 score in this section. It lost 1 point for not offering lower funding from 1,000 and 10,000 USD.

Lux Trading Firm Assets – 4.5

Lux Trading Firm offers probably one of the most diverse and rich trading asset classes among prop firms. The firm provides traders access to Forex pairs, indices, commodities, stocks, and cryptos. There are over 12,000 US stocks provided on the Stock Account, over 500 digital currencies on the Crypto Account, and a multitude of FX, indices, and commodities on the CFD Account. Unfortunately, it is not possible to open one unified account and trade several assets together like stocks and cryptos, or cryptos and Forex. Other than that, the firm is excellent in the assets department. As for the leverages, Forex, indices, and commodities can be traded with 1:30 leverage; Stocks, and cryptos at 1:5.

We give the firm a 4.5 score in this section.

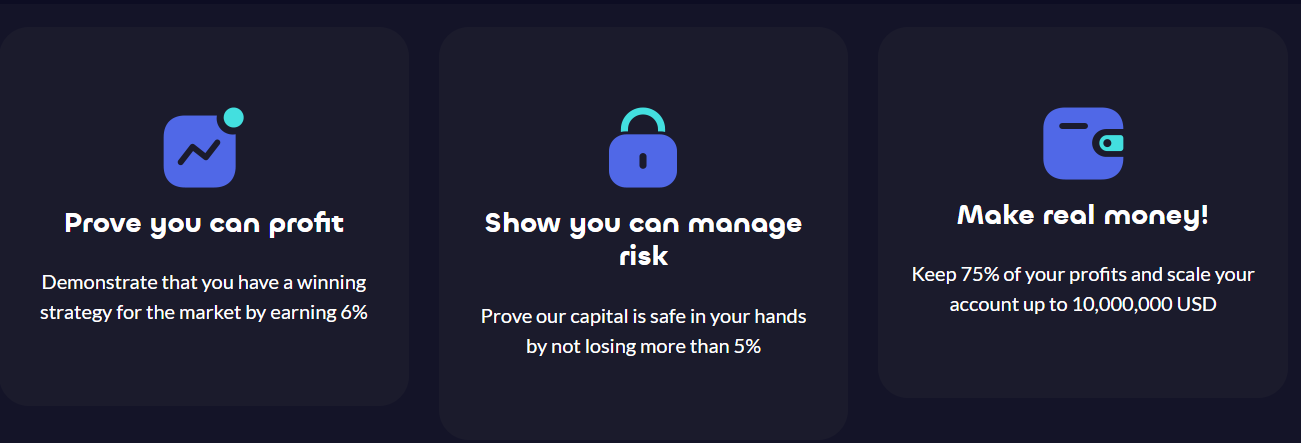

Lux Trading Firm Trading rules and limitations – 2.1

Lux Trading Firm rules are similar to other prop firms. The firm explicitly warns traders to carefully read all the rules and limitations. The profit target is 6%, but after reaching the professional account level the target is increased to 10%. The maximum relative drawdown is at 5%. The daily loss limit is 5%. The stop loss is required at must not exceed 5% of the total available risk at a trade opening time. The minimum stop loss is 5 pips for FX pairs and 0.1%-0.3% for stocks. There are no time restrictions to ensure traders are not under excessive stress. However, it is required that traders have traded for at least 29 days on the evaluation accounts before they can trade on the funded accounts.

The formula for risk calculation is:

- % risk per trade = ($ risk per trade / total available risk capital at that moment) * 100

- Total available risk capital = current balance – drawdown limit

- Drawdown limit = highest achieved balance – 5%

EAs, news trading, and holding positions over the weekend are all allowed.

The firm gets a 2.1 score in this section.

Lux Trading Firm Fees – 1

A Stage 1,000,000 USD account comes with a 1,499 GBP one-time fee. Here is the list of funded accounts:

- 15,000 USD account – 149 GBP

- 50,000 USD – 299 GBP

- 100,000 USD – 449 GBP

- 200,000 USD – 599 GBP

The fees are refunded after the completion of the evaluation stages, 50% after stage one and the remaining 50% after stage 2 is completed. Withdrawals are paid out once per month, and traders are allowed only once per month to request payouts. Withdrawals will be processed within 3-5 business days.

Lux Trading Firm’s free trial is active and traders can start testing their skills.

Lux Trading Firm free repeat is not available as traders will have to pay fees if their account gets suspended because of breaking the rules.

The firm gets only a 1 score in this section for lacking quick withdrawals, promotions, and minimum fees from 150 USD (149 GBP is more than 150 USD).

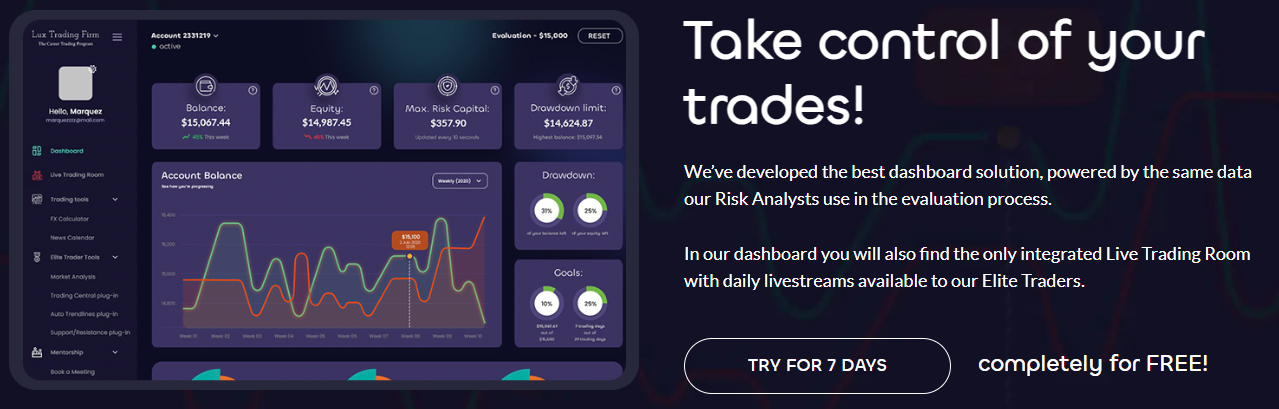

Lux Trading Firm Platforms – 5

Lux Trading Firm currently offers MT4 and in-house developed The Lux Trader, which is similar to TradingView. These platforms offer full automated and manual trading functionality. The firm promises to add MT5 soon and allows EAs. MT4 is available on all devices, and the proprietary platform is also available on multiple platforms.

Overall, we give the firm a 5 score in the platforms department.

Lux Trading Firm Profit-Sharing – 1

Lux Trading Firm’s profit split is at 75% for all types of funded accounts. While the industry golden standard is up to 90%, 75% can still be very attractive if a trader manages to reach a 10,000,000 USD funded account. Since it takes 3–5 days to withdraw profits and there is no option for a 90% profit split, we give the firm a 1 score in this section.

Education and trading tools at Lux Trading Firm – 2.8

The firm offers advanced trading courses and mentorship provided by their expert trader trainers. A private mentor is also available. There are plenty of tools for market research and trader performance measurement, and some of these tools are available also as mobile apps. The stock screener app will help stock traders quickly scan through stocks and select their preferred ones. Unfortunately, there are not many educational resources available to download or watch, which makes the firm lose some points.

All in all, we give the firm a 2.8 score.

Customer Support at Lux Trading Firm – 3.6

Customer support is conducted using a live chat which is 24/7 active on the website and allows traders to connect with the firm’s representatives. All forms of support are available including email, phone, and even physical offices to support Lux Trading Firm clients. Both support and website are only in English, losing the firm 1.4 points in this section.

Frequently Asked Questions

Is Lux Trading Firm legit?

What are Lux Trading Firm's fees?

How is profit-sharing structured at Lux Trading Firm?