LEELOO prop firm started its career in 2021 when it was established and has evolved to offer diverse funded accounts ever since. The firm offers diverse funded account choices and has competitive one-time and monthly fees. Trading is done through the NinjaTrader and the only trading asset offered is futures contracts.

In our LEELOO review below, our readers can fully evaluate the prop firm and conclude if it’s worthy of considering as their main prop firm partner.

Pros & cons of LEELOO prop firm

Pros

- Impressive Trustpilot score of 4.9

- A diverse range of funded programs, including foundation accounts, bundles, entry accounts, and weekly accounts

- Weekly accounts allow for more frequent profit withdrawals

- Flexible trading rules with no daily drawdown limits

- Transparent fee structure for different account types

- Provides NinjaTrader platform with advanced features and support

Cons

- Lack of reviews on the FPA platform

- Unclear which broker is offering trading services

- Limited asset offering, with only futures contracts available

- Lack of detailed information on profit-sharing percentages

LEELOO Quick Overview

| FPA Score | Not yet rated |

| Year founded | 2019 |

| Headquarters | Montana, USA |

| Minimum audition fee | 26 USD per month |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 300,000 USD |

| Allowed daily loss | No limits |

| Profit target | 6% |

| Maximum trailing drawdown | 3-6% |

| Profit sharing (Payouts) | 50% |

| Trading Platforms | NinjaTrader |

| Available trading markets | futures contracts |

Safety of LEELOO – 1.5

There are no LEELOO reviews on the FPA platform, making it difficult to evaluate the safety of the firm. However, we checked the Trustpilot and the firm has a 4.9 superb score. Although it is much easier to leave fake reviews on Trustpilot than on FPA (it’s almost impossible to fake reviews on the FPA without getting it set to 0), a 4.9 score is still impressive and increases the legitimacy of the firm. Since we are not able to find out exactly which broker is the partner of the firm, we assume it is not regulated.

The firm gets a 1.5 score in this section.

LEELOO Funding and maximum capital allocation – 2

LEELOO funded programs are very diverse and divided into several account types including foundation accounts, bundles, entry accounts, and weekly accounts.

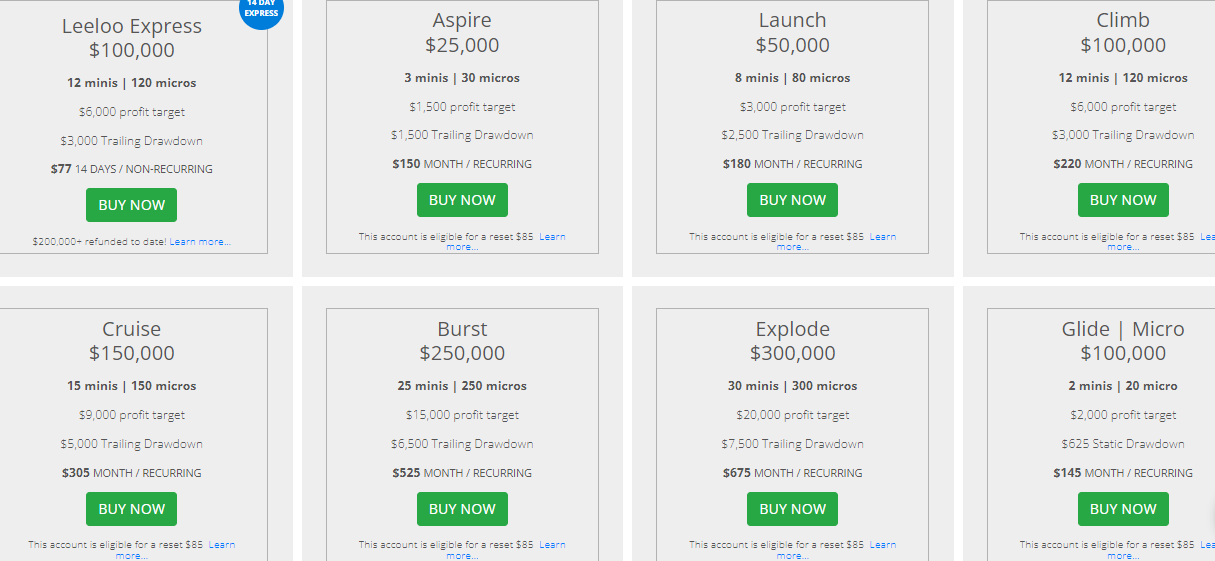

Foundation LEELOO funding accounts are divided into eight accounts with different funded amounts. Foundation accounts have unique names and the only difference is the funded amount and fees:

- LEELOO Express – 100,000 USD

- Aspire – 25,000 USD

- Launch – 50,000 USD

- Climb – 100,000 USD

- Cruise – 150,000 USD

- Burst – 250,000 USD

- Explore – 300,000 USD

- Glide | Micro – 100,000 USD

LEELOO bundles are the way for a trader to buy several accounts with one sweep and trade multiple funded accounts. The bundle funding amounts range from 25,000 USD to 300,000 USD, giving traders more flexibility.

The third funded account type from LEELOO is called entry accounts, and they come with similarly funded amounts ranging between 25k and 300k USD, but fees and profit payouts are lower.

Weekly accounts come with a limited range of funding between 25k and 50k USD and offer weekly payouts.

It has to be noted that the majority of prop firms only allow profit withdrawals once or twice a month, and the weekly accounts offer a tighter time range for withdrawals.

LEELOO challenges are relatively complex to select as there are a multitude of different accounts with different rules and conditions. We will describe these rules for each of the account groups in the below sections.

LEELOO scaling plan is not active, which is natural as there are so many trading accounts it is difficult to select between them in the first place, let alone to activate a scaling plan.

There is a monthly competition with cash prizes from 150 to 500 USD and requires a 15 USD sign-up fee.

We give the firm a 2 score in this section for lacking funding of 1k, 10k, and 1 million USD.

LEELOO Assets – 0.5

The LEELOO firm only offers futures contracts for trading. These assets are provided by the 3rd party data feed provider called Rithmic. However, it is totally unclear which broker is offering trading services.

As the lack of any other asset classes, we give it a 0.5 score.

LEELOO Trading rules and limitations – 4

The general LEELOO rules claimed by the firm seem super attractive with no daily drawdown limits, the ability to trade during holidays and news, multiple accounts with one log-in, no maximum trading periods, and many more. Let’s research the exact rules and limitations for each funded account type.

Foundation accounts rules and limitations:

- Profit target – 6%

- Contracts – up to 12

- Maximum trailing drawdown – 3%

- Maximum daily drawdown – None

LEELOO bundle accounts have the following rules:

- Profit target – 6%

- Contracts – 3 mini, 30 micro

- Maximum trailing drawdown – 6%

- Maximum daily drawdown – None

The maximum trailing drawdown is 3% for the 100k USD bundle accounts.

Weekly accounts have slightly different specs:

- Profit target – 6%

- Trailing drawdown – 5%

- Maximum daily drawdown – None

- Contracts – from 3 mins and 30 macros

Since the firm offers flexible rules, we give it a 4 score in this section. LEELOO lost 1 point for not giving at least a 10% maximum drawdown.

LEELOO Fees – 4

Foundation accounts come with respective fees for each funded account:

- Foundation LEELOO Express: 100,000 USD – 77 USD (non-recurring)

- Aspire: 35,000 USD – 150 USD per month

- Launch: 50,000 USD – 180 USD per month

- Cruise: 150,000 USD – 305 USD per month

- Burst: 250,000 USD – 525 USD per month

- Explore: 300,000 USD – 675 USD per month

Bundles funded accounts:

- LB Bundle $25,000 Aspire – 250 USD per month

- LB Bundle $50,000 Launch – 280 USD per month

- LB Bundle $100,000 Climb – 320 USD per month

- LB Bundle $250,000 Burst – 625 USD per month

- LB Bundle $300,000 Explode – 775 USD per month

Entry accounts funding and fee structure:

- LEELOO Entry LE Aspire $25,000 – 26 USD per month

- LEELOO Entry LE Launch $50,000 – 38 USD per month

- LEELOO Entry LE Climb $100,000 – 58 USD per month

- LEELOO Entry LE Burst $250,000 – 126 USD per month

- LEELOO Entry LE Explode $300,000 – 169 USD per month

- LEELOO Entry LE Glide Micro $100,000 – 75 USD per month

Weekly accounts funding and fee structure:

- Aspire WK $25,000 – 250 USD per month

- Launch WK $50,000 – 295 USD per month

After the trader activates the LEELOO Performance Account, the subscription fee is refunded.

LEELOO free repeat can be done by paying 85 USD for foundation accounts, entry accounts, and weekly accounts.

LEELOO free trial is offered for 14 days and is called a rhythmic free trial. Traders will need to log in to their LEELOO accounts to use this service.

We evaluate the fees of the LEELOO with a 4 score.

LEELOO Platforms – 5

LEELOO prop trading is conducted through the NinjaTrader platform. The firm offers a multitude of tools and keys to ensure traders can fully use the platform’s functionality. NinjaTrader, similarly to MT4 and MT5, advanced platform that offers advanced functionality, including automated trading robots and inbuilt indicators. NinjaTrader is more suitable for futures trading because it offers a dedicated interface for showing market data, which futures traders need.

We give the firm a 5 score in this section as the platform has advanced features and is supported on all devices and operating systems.

LEELOO Profit-Sharing – 0

LEELOO profit split is obscure, and the firm does not offer any details of profit share percentage levels. We assume they either offer just simulated trading, and it’s not possible to withdraw profits, or it is just around the 50% mark at best.

Because of this reason, we evaluate the profit share of the firm with a 0 score.

Education and trading tools at LEELOO – 1

LEELOO offers no education to traders, only tutorials and guides on how to use its services and trading platforms. However, there is a shop on the website where traders can buy a multitude of tools to increase their performance.

We give the firm a 1 score in this section.

Customer Support at LEELOO – 1.4

There are several channels available for support, but the live chat does not offer a connection with the actual representatives. There is an inbuilt help center in the live chat, offering little assistance but lacking much crucial information. So, this may resemble a live chat visually, but it’s not possible to get support from firm representatives. Email support is provided, and we give a point in this metric to the firm.

All in all, the firm gets a 1.4 score in this section.

Frequently Asked Questions

Is LEELOO legit?

What assets can I trade with LEELOO?

Does LEELOO provide educational resources?