Instant Funding prop firm was launched in 2023 from London, UK. The firm was mentioned even in Bloomberg, but we do not get hyped unless we research the firms ourselves. The firm offers relatively attractive trading conditions with flexible funding choices and diverse account types. ThinkMarkets, which is the main partner of the firm, is a regulated Forex broker with competitive trading conditions. The firm has funding programs ranging from 1,250 to 200,000 USD that can be scaled up to 1,250,000 USD with the scaling plan.

In our Instant Funding review, traders will get all the crucial details to define if the firm is safe and offers real value.

Pros & cons of Instant Funding prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to Forex, cryptos, indices, and commodities

- Offers a low minimum funding requirement starting at $1,250

- The Instant Funding account does not impose a daily loss limit

- Profit-sharing percentages of 70-80%, with the potential to increase up to 90%

Cons

- The firm is relatively new, founded in 2023, and lacks reviews on the FPA platform

- While there is an FAQ section, it primarily focuses on the firm’s products and lacks comprehensive trading education

Instant Funding Quick Overview

| FPA Score | Not yet rated |

| Year founded | 2023 |

| Headquarters | London, United Kingdom |

| Minimum audition fee | 79 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 1,250 |

| Maximum funded amount | 200,000 (Up 1.25 million USD with scaling plan) |

| Allowed daily loss | None |

| Profit target | 0-3-5% |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | 70-80% (up to 90% with scaling) |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, indices, commodities, cryptos |

Safety of Instant Funding – 1.5

Instant Funding reviews on Trustpilot are excellent, but the firm has not reviewed yet the FPA platform, which is our main metric for safety. The firm was founded in 2023 which makes it a very young prop firm. Instant Funding prop trading is done through ThinkMarkets which is a regulated Forex and CFDs broker.

The firm gets a 1.5 score in this section.

Instant Funding Funding and maximum capital allocation – 5

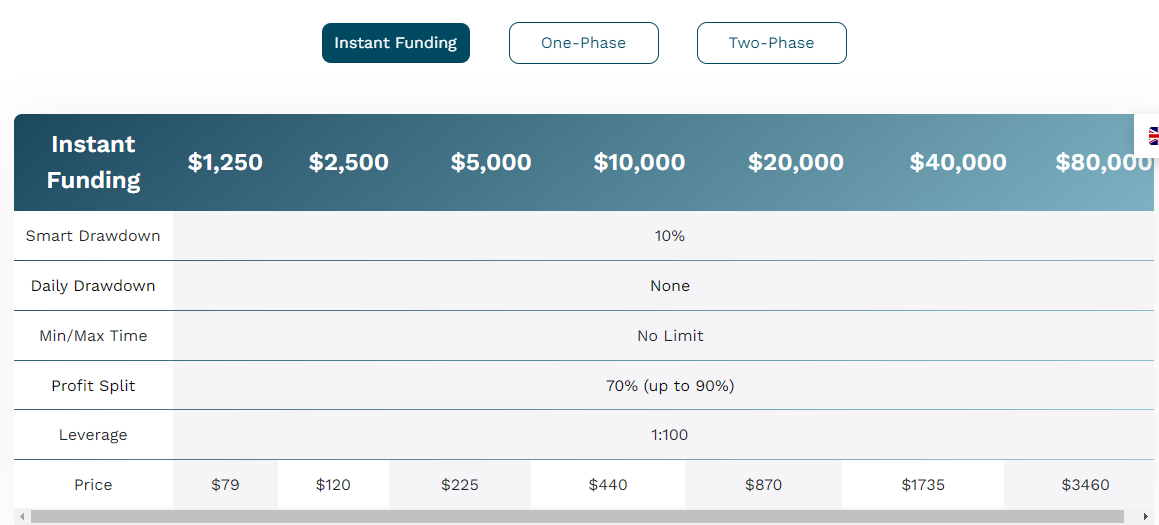

Instant Funding programs are three Instant Funding, One-Phase, and Two-Phase. For the Instant Funding accounts, the lowest minimum funding starts from 1,250 USD and reaches the maximum funding of 80,000 USD. Traders can get instant funding by paying certain one-time fees. The exact list of funding amounts for instant funding accounts is:

- $1,250

- $2,500

- $5,000

- $10,000

- $20,000

- $40,000

- $80,000

The funding amounts for the One-Phase and Two-Phase Instant Funding challenge are:

- $12,500

- $25,000

- $50,000

- $100,000

- $200,000

The range is richer for the instant accounts and fees are also surprisingly low, making it very attractive for traders. Instant accounts allow traders to get funded accounts and start trading for profits without a need to show a performance beforehand, which is common for funded accounts in general.

One-Phase and Two-Phase Instant Funding funding offers the ability to show the performance first and then continue to trade for profits.

Instant Funding scaling plan is applied to all three funded accounts. The funding amount is doubled after every 10% profit gain and can reach up to 1,250,000 million USD. The scaling plan is active for all three accounts, but the firm only offers exact scaling conditions for the Instant Funding accounts. We assume the conditions are similar for One-Phase and Two-Phase funded accounts as well.

For offering funding from, 1250 to 1.25 Million USD, we give the prop firm a 5 score in this section.

Instant Funding Assets – 3.5

The firm offers a diverse choice of assets including Forex pairs, indices, commodities (metals only), and cryptos. There are no stocks which is the slight downside of the firm. From the cryptos, traders can select between BTCUSD, ETHUSD, LTCUSD, and BCHUSD.

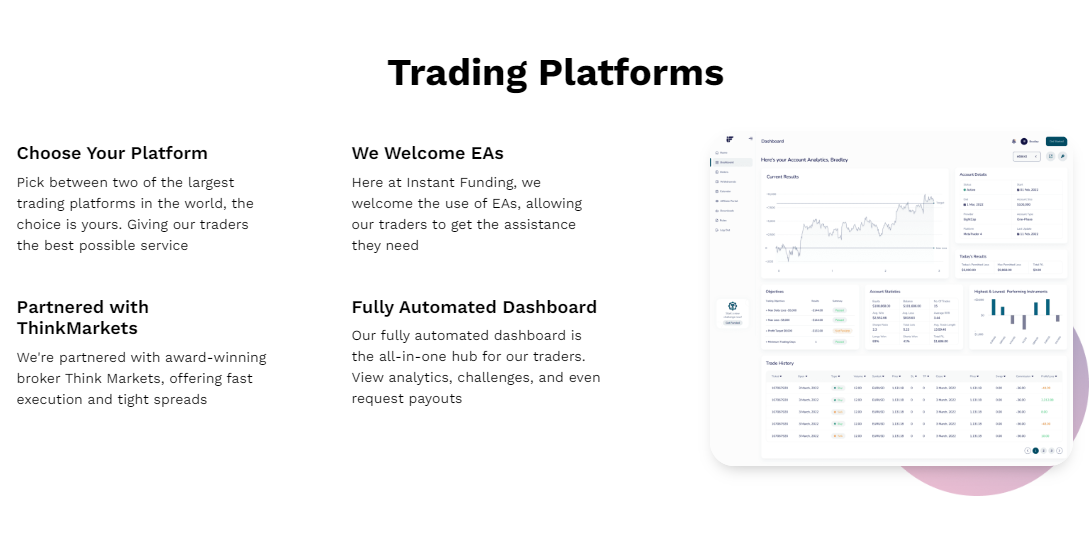

There are more instruments to trade for MT5 when compared to MT4, so traders will have to decide which platform they want according to their trading needs.

Since stocks and other assets are lacking, we evaluate the firm with a 3.5 score in this section.

Instant Funding Trading rules and limitations – 4.8

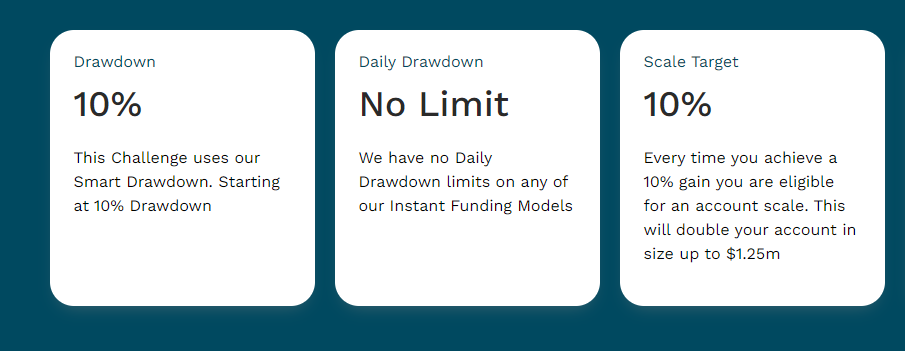

Instant Funding account comes with the following rules:

- Smart Drawdown – 10%

- Daily Drawdown – None

- Min/Max Time – No Limit

- Profit Split – 70% (up to 90%)

- Leverage – 1:100

For the One-Phase funded accounts, the rules are slightly different:

- Smart Drawdown – 10%

- Daily Drawdown – 3%

- Min/Max Time – No Limit

- Profit Split – 80% (up to 90%)

- Leverage – 1:100

Two-phase funded accounts consist of the following rules:

- Smart Drawdown – 10%

- Daily Drawdown – 5%

- Min/Max Time – No Limit

- Profit Split – 80% (up to 90%)

- Leverage – 1:100

One-Phase and Two-Phase accounts are similar in requirements, and the differences are in the phases that traders have to complete before they can start trading on a funded account and get profit withdrawals.

The Instant Funding account has a huge advantage over other accounts, it does not come with daily loss limits. Without a daily loss limit, it is possible to have a large daily drawdown and still continue trading without breaking rules.

Instant Funding rules are strict, like many other prop firms. There are some suspicious entries into the terms and conditions of the firm. Instant Funding prop firm prohibits the scalping method, meaning traders can not open and close trades “within close proximity”. What exactly “within close proximity” means is for the firm to decide, raising a serious red flag about their intentions.

We give the firm a 4.8 score in this section.

Instant Funding Fees – 5

The smallest fee for a 1,250 USD instant funding account starts from 79 USD. This may seem super cheap, but is actually very expensive, as the industry standard for a 10,000 USD account is somewhere around 150 USD. But the difference is traders can start trading on this 1,250 USD without the need to go through the evaluation process first.

The smallest fee for the 12,500 USD funded account is 99 USD, which is very cheap when compared to industry standards.

There is no Instant Funding free repeat, and traders will have to pay every time they break the rules and want to start from the beginning again.

Instant Funding free trials are not available at the moment, meaning all the funded accounts require payments. We hope the firm develops challenges to allow traders without budget to start trading and get funding after showing their results.

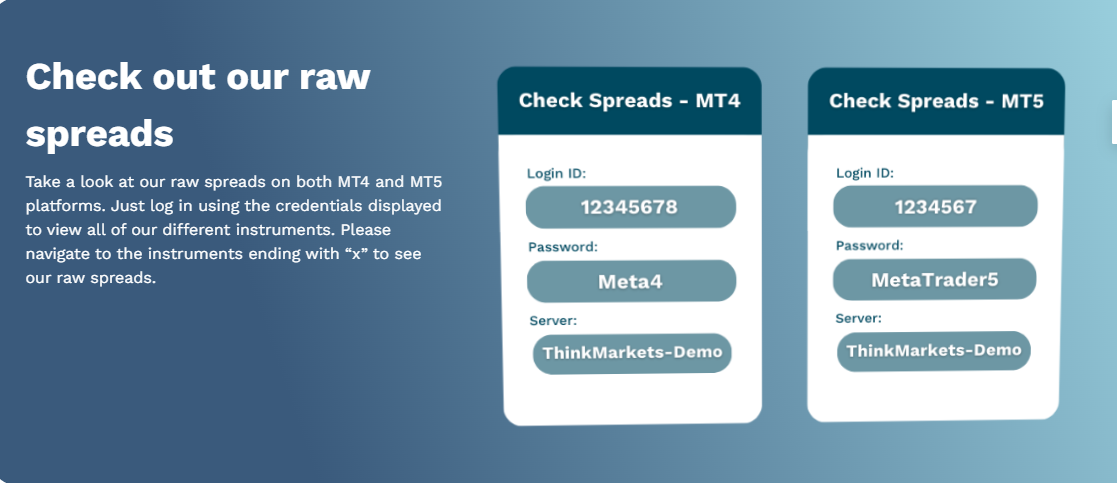

Since Instant Funding funding trading is done through the ThinkMarkets platforms, we checked their spreads and fees. So, there are two account types offered by the broker, one with 1.2 pips spreads and another with spreads from 0.1 pips but trading commissions at 3.5 USD per side per lot. Since the broker does not allow scalping, we assume the spreads start from 1.2 pips on funded accounts as well. These spreads are completely normal and should not affect performance by a large margin.

A well-deserved 5 score in this section, for sure.

Instant Funding Platforms – 4.1

Instant Funding provides MT4 and MT5 advanced platforms through their partner broker, which is ThinkMarkets. Both platforms are very popular, the firm allows EAs or automated trading robots. There are slightly more assets that can be traded using MT5, but other than that both platforms are almost equally powerful. Trading can be conducted using mobile apps or desktop software for both MT4 and MT5. Since there is no mention of web traders, we assume it is not possible to access web versions of these platforms.

As a result, we give the firm a 4.1 score in this section.

Instant Funding Profit-Sharing – 3

Instant Funding profit split is at 70% for the instant funded accounts and 80% for the One-Phase and Two-Phase accounts. The company claims the profit share can be increased to up to 90%, but does not provide details about conditions. We assume the profit share can be increased after applying a scaling plan.

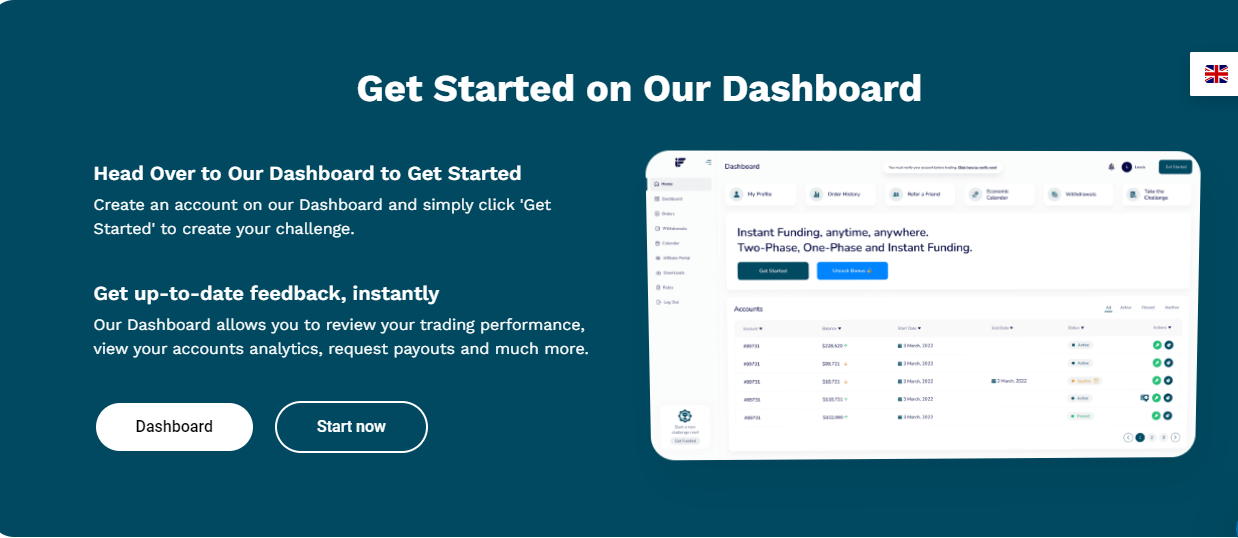

Payouts are done weekly after the first payout is made.

We assess this section as a solid 3 score. The lack of quick processing for withdrawals at any time is the firm’s biggest con when it comes to profit share and withdrawals.

Education and trading tools at Instant Funding – 3

When it comes to education and beginner assistance, the firm offers an extensive FAQ section that acts as both a help center for education and support. The help center consists of educational videos and tutorials. However, it has to be noted that this section is mostly aimed at guiding the firm’s products rather than trading training. Meaning, that traders will get some information about reading, but it will not be enough to start from zero and become experienced traders. So, this help center lacks basic concepts and important information for beginners. Despite the lack of trading educational resources, there are tools like dashboards and economic calendars to help traders make informed decisions and monitor their performance and trading activities.

As a result, we evaluate the education of the Instant Funding at 3 score.

Customer Support at Instant Funding – 3.8

Instant Funding offers several support channels to resolve any issue and answer traders’ questions. Both the website and support forms are available in multiple languages, which is very advantageous for traders. The live chat is provided with an advanced plugin and is the quickest way to connect with customer representatives. From other support forms, there is only email support available at the moment. The extensive FAQ section consists of both educational resources and helping explanations for various firm policies and rules.

The firm is also represented on the social media of Instagram, Facebook, and Telegram channel.

We assess the firm’s support with a solid 3.8 score, as the lack of phone support is not tolerated.

Frequently Asked Questions

Is Instant Funding Legit?

What are the funding options at Instant Funding?

What assets can I trade with Instant Funding?