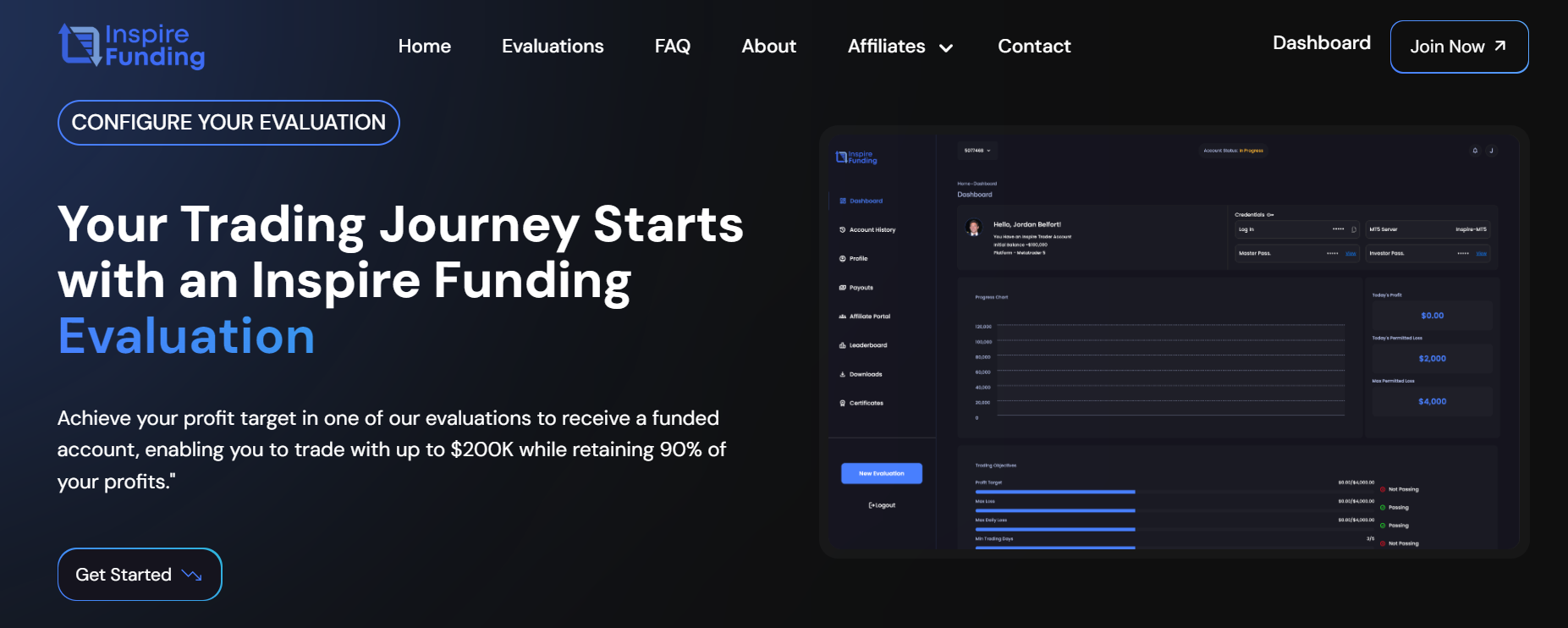

Inspire Funding is a new prop trading firm that offers funded accounts with values up to $200,000, with three different evaluation paths – Inspire, Swift and Premier trader programs.

However, clients are unable to access real funds and live trading accounts at Inspire Funding, as the firm is not a regulated broker.

Furthermore, certain security features are lacking, which can complicate the decision for prospective clients. This is due to the fact that most prop trading firms are entirely unregulated, which can make it difficult for prospective clients to assess the legitimacy of a particular firm.

In this detailed review of Inspire Funding, we will look at the trading terms and features of the firm to determine if it is a legitimate prop company and if you should give it a try.

Pros and cons of Funds for Traders prop firm

Pros

Scaling up to $2 million available

Access to MetaTrader 4

Decent customer support suite

Unrealistic profit promises

Lack of meaningful educational content

Cons

No real funded accounts and live trading

Limited selection of tradable instruments

Not rated by the FPA

Safety of Inspire Funding – 1.5

Due to the fact that prop trading firms are not subject to much regulatory scrutiny, many traders wonder whether such firms are legitimate and safe.

Inspire Funding is one such firm that lacks any meaningful licensing and regulation, as well as relevant reviews.

For example, the ForexPeaceArmy is the premier review and rating platform for FX brokers and prop trading firms. Unfortunately, Inspire Funding does not have a dedicated page on the website, as it has not yet been reviewed.

Alternatively, Trustpilot reviews for Inspire Funding add up to an average rating of 4 out of 5, based on only 37 reviews, which does not paint a detailed picture for the firm and its features.

This lack of reliable data makes it difficult for prospective clients to choose Inspire Funding as their long-term partner.

Inspire Funding capital allocation – 3

Depending on the amount of capital a prop trading firm offers, prospective clients may choose or avoid a particular firm.

Inspire Funding offers $200,000 in maximum funding, with the ability to scale up to as much as $2 million in gross funding.

$200,000 is a considerably lower amount when compared to competing firms, which typically offer $500,000 or even $1 million and above in total funding.

Each of the three evaluation programs provided by Inspire Funding provide $200,000 accounts as the largest funding tier, which can then be scaled up after consecutive profitable months of trading.

Overall, the capital allocation terms provided by Inspire Funding are decent, thanks to its scaling capacity.

Inspire Funding assets – 3.5

The assets offered by prop trading firms play a key role in determining the specific trading strategies applicable to prop traders.

For example, trading on the forex market provides traders with a high degree of leverage and liquidity.

When it comes to tradable instruments, Inspire Funding gives clients access to currency pairs, metals, energies, equity indices and cryptocurrencies for trading – a total of over 100 instruments.

The selection of instruments available at Inspire Funding is decent and offers clients a number of options to choose from and structure their strategies around.

Inspire Funding rules and limitations – 3

Each prop trading firm offers funding accounts that come with certain rules and limitations traders need to adhere to in order to maintain their accounts.

Inspire Funding offers three funding routes, which means that each of the accounts come with different sets of rules and limits.

Inspire Trader

The rules and limitations that apply to the Inspire Trader 2-phase evaluation are the following:

- Unlimited trading period

- Minimum 5 trading days

- 9% profit target (Phase 1), 5% (Phase 2)

- 10% maximum overall loss limit

- 5% daily loss limit

- 90% profit split after Phase 2

- Up to 1:100 leverage

Swift Trader

The Swift Trader program consists of 1 phase and requires the following terms and limits:

- Unlimited trading period

- Minimum 5 trading days

- 10% profit target

- 7% maximum loss limit

- 4% daily loss limit

- 90% profit target after Phase 1

- Up to 1:100 leverage

Premier Trader

The Premier Trader program is a 2-phase program with the following terms and limits traders need to comply with:

- Unlimited trading period

- Minimum 5 trading days

- 8% profit target (Phase 1), 5% (Phase 2)

- 8% maximum loss limit

- 5% daily loss limit

- 90% profit target after Phase 2

- Up to 1:100 leverage

Overall, the terms offered by Inspire Funding gives traders plenty of choices when it comes to the specific approaches they can take when it comes to dealing with funding challenges.

Inspire Funding fees – 3

The fees charged for funded accounts are important revenue sources for proprietary trading firms and each of the three evaluation programs charge different fees for funded accounts.

We can look at the specific fees for each Inspire Funding account below:

Inspire Trader

The fees charged for each of the funded accounts in the Inspire Trader evaluation are the following:

- $88 for the $10,000 account

- $178 for the $25,000 account

- $278 for the $50,000 account

- $498 for the $100,000 account

- $848 for the $200,000 account

Swift Trader

As for the Swift Trader program, here are the fees charged for each funded account:

- $98 for the $10,000 account

- $168 for the $25,000 account

- $268 for the $50,000 account

- $519 for the $100,000 account

- $898 for the $200,000 account

Premier Trader

The Premier Trader program offers its funded accounts in exchange for the following fees:

- $88 for the $10,000 account

- $188 for the $25,000 account

- $278 for the $50,000 account

- $498 for the $100,000 account

- $898 for the $200,000 account

Overall, the fee structure of the Inspire Funding accounts are competitive when compared to other prop firms available on the market.

Furthermore, the three evaluation programs give traders plenty of selections when it comes to which trading terms to stick with and how much to pay for a particular amount of funding.

Inspire Funding platforms – 3.5

When it comes to which trading platform to choose, most forex and CFDs traders choose MetaTrader 4, thanks to its breadth of functionality and simplistic UI.

Luckily, Inspire Funding offers MT4 to its clients, thanks to its partner broker – GH Market.

However, Inspire Funding does not provide clients with any additional pieces of software that tracks their performance and measures their success and a mobile app is also lacking, which is a major downside for those that prefer to trade on the go.

The reliance on MT4 also means that Inspire Funding offers little in terms of advantages and extra features to provide added value to its clients.

Overall, the trading platform offered by Inspire Funding is in line with most of its competitors and does not offer much else that stands out.

Inspire Funding profit sharing – 3

The share of profits a prop trading firm promises to its prospective clients is one of the primary decision making factors for traders.

Typically, proprietary firms keep 10% of the profits generated, while the trader gets to keep the remaining 90%. Inspire Trading is no different in this regard, as the firm also offers a 90% profit split across all three evaluation programs.

For this reason, Inspire Funding gets a decent rating when it comes to profit-sharing. However, it also does not stand out from the competition in this regard, as numerous other prop firms also offer a 90% profit split to their clients.

Education and trading tools at Inspire Funding – 1.3

Prop firms often provide additional free educational resources for beginner traders to help them better understand some of the terms and strategies that are commonly used in proprietary trading.

This may include webinars, blogs, various articles, as well as more technical tools, such as economic calendars, news digests, performance tracking software and more.

Unfortunately, Inspire Funding does not offer any additional educational resources to prospective clients, which makes the firm less accessible for beginner traders.

While MetaTrader 4 does have a decent selection of helpful technical tools, Inspire Funding offers little to no added value in this regard and gets a low score for education and trading tools.

Customer support at Inspire Funding – 3.6

The customer support team of Inspire Funding is available to contact using the live chat function, a support email and a hotline as well.

The official website also features a contact form where interested parties can inquire for multiple reasons, such as any issues regarding their accounts or payments.

The FAQ section also answers plenty of common questions prospective and new users may have in regards to what they can trade, what strategies they can employ, as well as a host of features offered by Inspire Funding.

FAQ on Inspire Funding prop firm

Is Inspire Funding a legit prop trading firm?

Inspire Funding is a prop trading firm that is based and registered in the United Kingdom. However, due to the fact that prop firms are not subject to regulation, the firm and its security features raise many questions for prospective clients.

Therefore, the question of the firm’s legitimacy remains an unanswered question, which is further exacerbated by the lack of relevant reviews and ratings.

Is Inspire Funding a licensed FX broker?

No, Inspire Funding is a proprietary trading firm and is not a licensed or regulated brokerage.

The firm offers funded demo accounts where clients can trade forex pairs, metals, commodities, equity indices and commodities.

The firm partners with GH Market to facilitate live price feeds and trading for its clients.

What can I trade at Inspire Funding?

Inspire Funding is a prop trading firm that offers funded accounts to traders who can use the funds to trade currency pairs, metals and commodities, equity indices and cryptocurrencies using MetaTrader 4.

The spreads for each instrument offered by the firm may vary considerably.