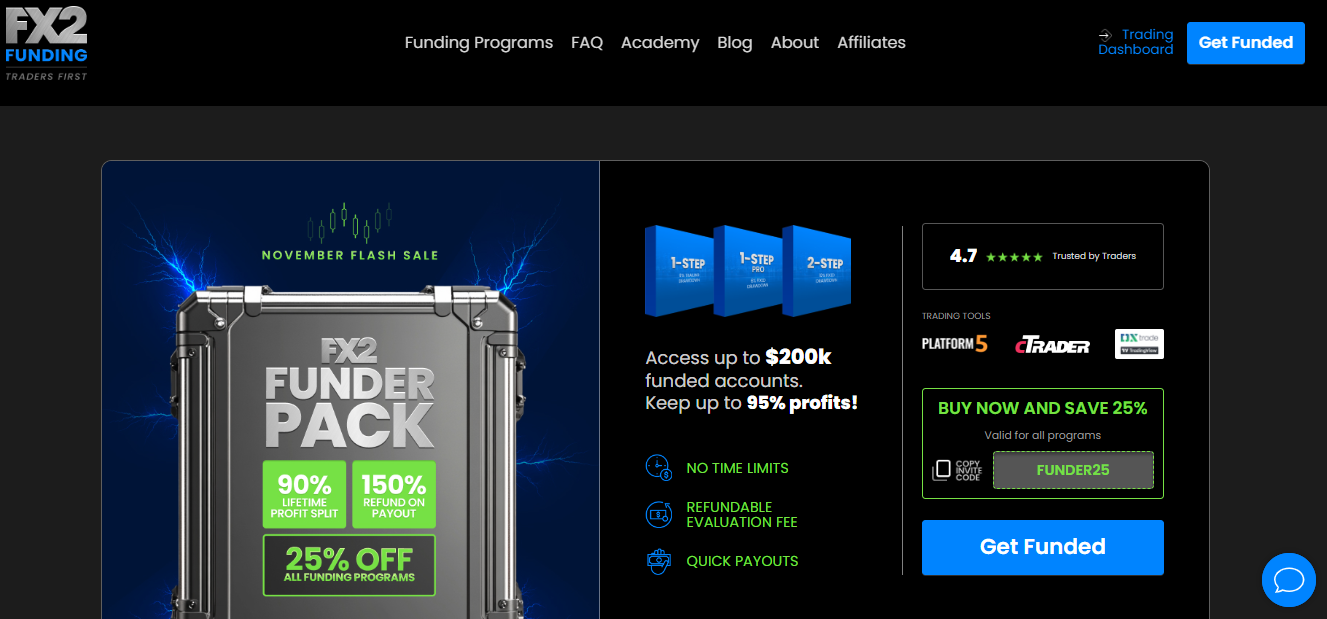

FX2Funding prop firm offers funded challenge accounts where traders have to pass the valuations to get funded and trade for profits. The firm promises up to 95% profit share, which is a bit of a red flag as it is too much profit share. The firm also promises to pay 100 USD if withdrawals are not processed within 48 hours. The 1-step challenge by FX2Funding offers the highest funding range from 10k to 200k USD, while other accounts only allow up to 100k in virtual funding.

In today’s FX2Funding review, we will assess the firm’s most critical features, including safety, rules, funding options, fees, platforms, assets, support, and more.

Pros & cons of FX2Funding prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 5, cTrader, and DXTrade

- Fast and digital account opening/verification

- Most payment options are free and instant

- Offers up to 95% profit split, though it starts at 80%

- Does not offer a scaling plan

- Support is only available in the English language

Cons

- Low total loss limit of 6%

- Limited reviews and complaints of manipulation on Trustpilot

- Strict Rules: Daily loss limit of 4% and a 10% profit target; news trading prohibited

- Only BTC and ETH for cryptos, no stocks offered

- Challenge fees are slightly higher compared to some competitors

Safety of FX2Funding – 0

FX2Funding reviews are lacking on the FPA (Forex Peace Army) platform, which is a red flag. This indicates there are no sufficient trader reviews about this prop firm to summarize overall trader experience. The firm was established in 2023, which makes it very young and inexperienced in the prop trading industry. All funded challenges are virtual accounts and traders only trade on demo accounts even after they get funded. Traders on Trustpilot are complaining about the firm manipulating daily loss limit rules and forcing them to breach rules and fail the challenge. Additionally, the firm promises up to 95% profit share, which is a red flag.

The firm gets a 0 score in this section, as the firm lacks all the safety features that are crucial for reliability.

FX2Funding Funding and maximum capital allocation – 3

FX2Funding funded programs include three different types of challenges, 1-step evaluation, 2-step, and 1-step pro options. The 2-step and 1-step pro challenges have funding options ranging from 10k to 100k USD, while the 1-step account offers up to 200k USD in funding.

FX2Funding funding options include 10k, 25k, 50k, 100k, and 200k USD options which are diverse, but the firm lacks smaller accounts and bigger challenges. The firm is not suitable for beginners as it does not offer 5k and below funding options.

FX2Funding challenges also lack higher funding options including 1 million dollars, which makes it not suitable for experienced traders either.

FX2Funding scaling plan is not offered, which is a downside as traders won’t be able to grow their accounts.

In the end, the firm gets a 3 score in this section.

FX2Funding Assets – 2.5

FX2Funding prop trading assets include Forex pairs (majors and minors), commodities, spot metals, indices, and cryptos (BTC and ETH only). Each asset comes with different leverage limits. FX pairs have 1:100, spot metals 1:30, commodities 1:10, indices 1:25, and cryptos 1:2. There are commissions for spot metals and Forex pairs, 4 USD per lot roundtrip.

The firm does not offer stocks and other popular assets, and only two crypto pairs are provided. Overall, it gets a 2.5 score in this section for a limited range of assets support.

FX2Funding Trading rules and limitations – 0.8

FX2Funding rules are slightly different for each funded account the firm offers. The daily loss limit is 4%, the maximum drawdown is 6%, and the profit target is 10%. Rules slightly vary for different challenges, but this overall average percentage. News trading is prohibited but holding positions overnight and over the weekends is allowed.

Overall, the firm gets a 0.8 score in this section for offering strict rules.

FX2Funding Fees – 2.5

The pricing by FX2Funding is average and starts at 80 dollars for the 10k USD challenge of 2-step evaluation. Let’s compare pricing for all three challenges.

The 1-step FX2Funding challenges have the following one-time fees:

- Funded amount: 10,000 USD – One-time fee: 95 USD

- 25k USD – 190 USD

- 50k USD – 285 USD

- 100k USD – 475 USD

- 200k USD – 925 USD

The 2-step FX2Funding challenges have the following one-time fees:

- Funded amount: 10,000 USD – One-time fee: 80 USD

- 25k USD – 195 USD

- 50k USD – 330 USD

- 100k USD – 550 USD

The 1-step pro FX2Funding challenges have the following one-time fees:

- Funded amount: 10,000 USD – One-time fee: 135 USD

- 25k USD – 260 USD

- 50k USD – 385 USD

- 100k USD – 650 USD

These fees are slightly on the expensive side, as many reliable firms offer more competitive pricing.

FX2Funding free trial is not available and the FX2Funding free repeat is not offered either, which is a downside.

Overall, the firm gets a 2.5 score in this section for offering mediocre experience with fees.

FX2Funding Platforms – 4

FX2Funding allows traders to access several advanced platforms, including MetaTrader 5, cTrader, and DXTrade. The firm allows EAs on cTrader and MT5, and these platforms also allow custom indicators. Mobile trading is available using mobile apps of these platforms.

For offering advanced trading platforms, the firm gets a 4 score in this section.

FX2Funding Profit-Sharing – 3

FX2Funding profit split is 95% which is a red flag. The starting profit sharing is 80%, and it rises to 95% later after consistently profitable trading. After the profit withdrawal is confirmed by the firm, the processing time takes under 48 hours.

FX2 offers guaranteed payouts within 48 hours of payment approval or promises to pay 100 USD. There are no fees for withdrawals.

Overall, the firm gets a 3 score in this section.

Education and trading tools at FX2Funding – 4

The firm offers educational training courses. There are three paid courses costing 27 USD and traders can purchase a package for 49 USD that companies all three courses. These courses include fundamental and technical analysis. There is also a trading blog that offers posts about interesting Forex trading facts, which are not useful for education but interesting to read.

In the end, the firm gets a 4 score in this section for offering diverse training courses but lacking video guides.

Customer Support at FX2Funding – 3.6

Customer support at FX2Funding includes phone support, email, and live chat support. Both the website and support options are only available in the English language, which is a downside.

The firm gets a 3.6 score in this section for offering three channels for customer support.

Frequently Asked Questions on FX2Funding

Is FX2Funding legit?

Is FX2Funding a good prop firm?

What is the minimum FX2Funding fee?