Funding Traders was established in 2023 and has been offering funded accounts ever since. The firm is young and lacks experience in the industry. It offers several funding options in one-step and two-step evaluation audition phases. Funding Traders prop trading firm has a minimum audition fee of 50 USD which is a super competitive fee. In our Funding Traders review, we are going to examine the firm and conclude whether it can be trusted as your reliable partner.

Pros & cons of Funding Traders Prop firm

Pros

- Ability to withdraw with $0 fees

- Offers a range of funding from 5k to 500k, with special Pro, Elite, and Apex plans for higher funding

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Provides both 2-step and 1-step evaluation options

- Offers access to Forex, indices, commodities, and crypto markets

- Features a scaling plan with a potential 25% growth every 3 months

- Most payment options are free and instant

Cons

- Lacks industry experience (established in 2023)

- Imposes stringent rules on position sizing and risk management

- Does not offer educational resources for traders

- Provides only virtual assistance and email support

- Charges fees for each funding option and challenge enrollment, without offering a free trial

Safety of Funding Traders — 1.5

Funding Traders reviews are lacking on the FPA platform. There are no evaluations or comments. When we review prop firms, we place a strong emphasis on the FPA score as a critical part of the firm’s safety. Other important factors are whether the firm provides trading through a regulated broker and the firm’s experience of more than 2 years in the industry. Funding Traders is partnered with CBT, which is a technology solutions provider for brokers and prop firms, but does not act as a broker, does not offer financial advice, or engage in brokerage activities. The firm loses legitimacy in these criteria as well, as CBT is not a broker. They also claim to be offering trading services through Blueberry Markets, which is a regulated Forex and CFDs broker. The firm was also established in 2023 meaning it has less than2 years of experience in the industry. The firm gets a 1.5 score in the safety section as they only meet one requirement out of three and the FPA has the highest safety points.

Funding Traders Funding and maximum capital allocation — 4

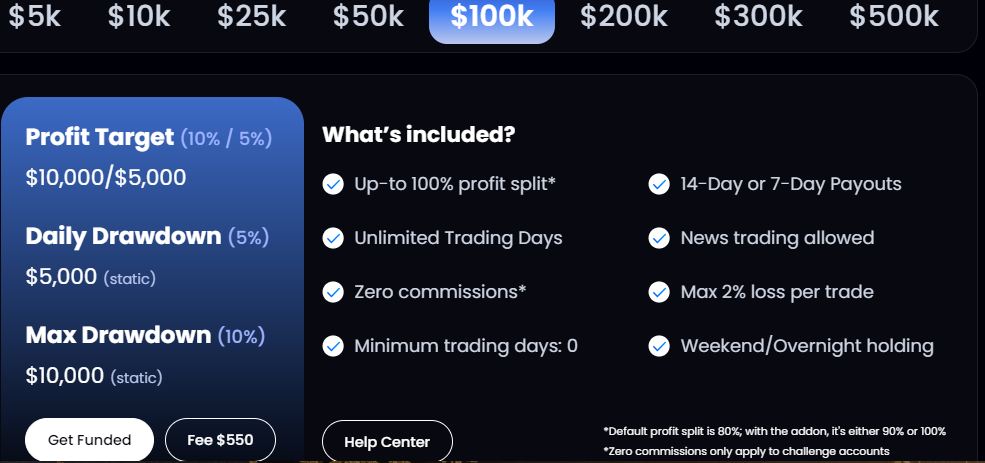

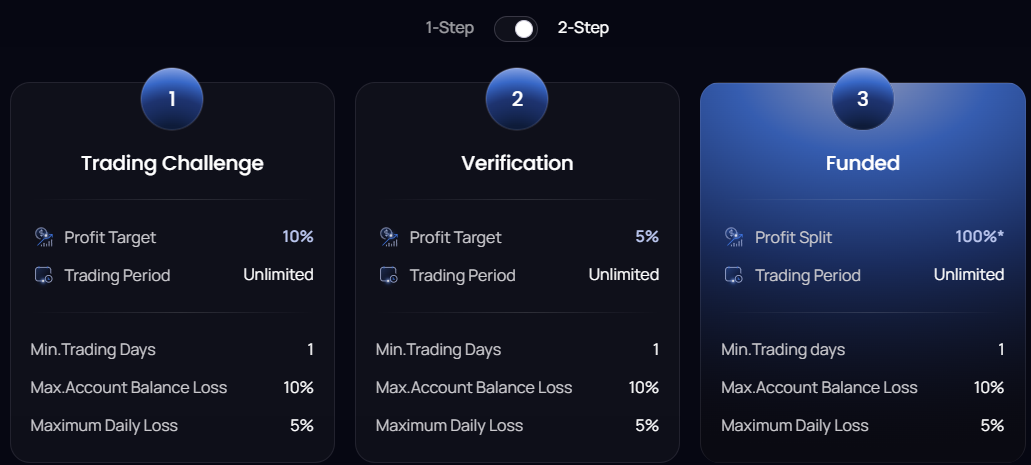

Funding Traders funded programs consist of 2-step and 1-step evaluation phases, allowing traders to select a comfortable audition method for their funded trading career. The funding range for both Funding Traders challenges ranges from 5k to 500k.

Funding Traders funding programs also offer traders Pro, Elite, and Apex plans that offer higher funding from 500k. The Pro plan has a 500,000 USD-funded account and costs a 2,500 USD one-time fee. The Elite and Apex accounts are dedicated only to extremely talented and profitable traders.

Funding Traders scaling plan offers 25% growth every 3 months if the profits at the end of 3 months are 10% of the starting account.

Since Funding Traders only lacks a 1,000 USD funded account, it gets a 4 score in this section.

Funding Traders Assets — 3.5

Funding Traders offers mainly Forex pairs for trading, but indices, gold, and cryptos are also provided. The leverage is different for each trading asset class with Forex capping at 1:100, indices, and Gold at 1:50, and cryptos at 1:5. As we can see, Funding Traders does not provide stock trading or any other assets but still has a decent selection of trading assets.

For not offering diverse enough assets, Funding Traders gets a 3.5 score.

Funding Traders Trading rules and limitations — 2.1

Funding Traders rules are strict when it comes to position sizing and risk management. The firm has no lot size restrictions but has a consistency rule to protect both the trader and the firm’s capital. The consistency rule is applied to position size, and position sizes or lot sizes must be consistent for all trades. The firm restricts sudden increases in position sizes or equity curves.

The daily loss limit is 4% for all funding challenge types, and the maximum drawdown is set at 5%. Traders can not lose more than 4% of their initial funding account balance in any single day, and 5% of the account overall. These are slightly more restrictive than other popular prop firms, as industry industry-accepted standard for daily loss limit is 5% and the max drawdown can be between 8-10% (usually it is 10%). Funding Trader’s firm is strict and does not allow traders to gamble, which seems fair as all firms want to protect their capital. There is a trailing overall drawdown of 4% as well, meaning traders can not lose more than 4% overall.

From other critical rules:

- Trading days — unlimited

- News trading — allowed

- Holding positions over the weekend — allowed

- EAs or trading robots — not allowed

- Copy trading — not allowed

The maximum loss is different for 2-step evaluation and is set at 10%, while for 1-step it is 5%. Maximum daily loss is also 5% for 2-step, while it is 4% for 1-step evaluation account. A similar tendency is true for profit targets, which is 10% for 2-step and 5% for 1-step evaluation. No signal provision for third parties is allowed unless approved by the Funding Traders risk team, meaning it is not allowed to use trading signal services.

The firm encourages traders to exercise a responsible trading approach and be consistent, not risk more than 2% on any single trade.

Shared accounts are not allowed, only one trading account per individual is accepted. Funding Traders gets a 2.1 score in the rules sections as it has tight risk tolerance and does not allow EAs.

Funding Traders Fees — 2.5

Funding Traders free trial is not available and traders have to pay every time they want to sign up for a challenge. The funding fees for each funding option are:

| 1-step | 2-step | |

|---|---|---|

| 5,000 USD | 50 USD | 50 USD |

| 10,000 USD | 100 USD | 100 USD |

| 25,000 USD | 200 USD | 200 USD |

| 50,000 USD | 300 USD | 300 USD |

| 100,000 USD | 550 USD | 550 USD |

| 200,000 USD | 1,000 USD | 1,000 USD |

| 300,000 USD | 1,500 USD | 1,500 USD |

| 500,000 USD | 2,500 USD | 2,500 USD |

Funding Traders free repeat is not possible and traders will have to sign up from the beginning and pass the challenge. There is an ongoing discount event to start the challenge for 24% off and a 90% profit split. The firm gets a 2.5 score in the fees section.

Funding Traders Platforms — 3.9

The platform is not clearly given on the website of the firm, indicating it could be some type of web trading platform with limited functionality. Since the firm claims to be offering trading through CBT and Blueberry Markets, we assume they offer MT4 or MT5 advanced platforms. The broker allows mobile trading and the firm also supports it.

The firm gets a 3.9 score in this section as it offers a MetaTrader platform for both desktop and mobile.

Funding Traders Profit-Sharing — 3

Funding Traders profit split is set at 80% and can reach up to 100% as the firm claims. Paying 100% profits to traders is suspicious and raises red flags, as prop firms are supposed to make money from a small portion of profits. It is possible to reach a 90% profit split by purchasing extra add-ons.

The minimum allowed withdrawal is 50 USD. The firm gets a 3 score in the profit sharing section for offering a 90% profit split.

Education and trading tools at Funding Traders — 0.5

When it comes to education, Funding Traders does not offer any educational resources for beginners, meaning traders will have to learn everything elsewhere. While it has a help center and FAQs page, the firm still fails to offer anything useful in the education department. The firm gets a 0.5 score as it only offers a dashboard to track traders’ performance and accounts.

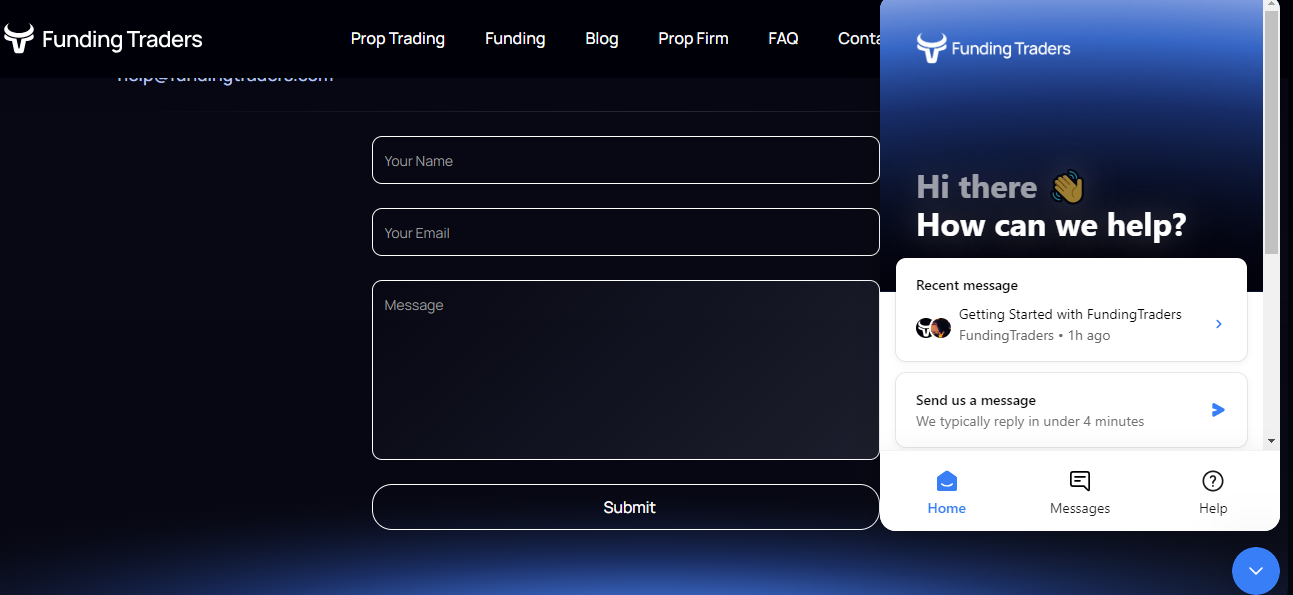

Customer Support at Funding Traders — 1.5

The firm has a live chat application that is built-in into the website, but there is a major issue. The chat only offers virtual assistance, and it’s impossible to connect with the customer support representative. The plugin has a help center and FAQs section built-in providing quick support for general questions, but lacks actual helping possibility for traders who might need help from the firm’s personnel. From other support options, there is only email support available in an online form. For lacking both the full live chat and phone hotline support, the firm gets a 1.5 score in this section, as there are no multiple languages available.

Frequently Asked Questions

Is Funding Traders a good prop firm?