FunderPro prop firm is based in Malta and was launched in 2023, making it a very young company. The firm offers various discounts and promos as a young company to attract traders. The basic value proposition includes funded options of up to 200,000 USD with an 80% profit share and a scaling plan of 5 million USD. Traders are free to employ any trading strategy without time limits and fast trading platforms. FunderPro offers free trial periods for testing their services and spreads, which is super nice for any prop firm. Since the firm is young and could be a very attractive company, we decided to review it on our platform.

In our FunderPro review readers will understand the critical specs of the firm such as safety, funding options, risk rules, assets, and many more.

Pros & cons of FunderPro prop firm

Pros

- Ability to withdraw with $0 fees

- The trading platform offers TradingView charts

- Fast and digital account opening/verification

- Offers access to diverse markets including Forex pairs, metals, indices, commodities, and digital currencies

- Lower profit target of 0% for funded accounts

- Higher daily loss limit of 10%

- Most payment options are free and instant

- Offers all popular support channels including live chat, email, hotline, 24/7

Cons

- There are minimum trading day limits

- No rating and trader reviews on the FPA platform, which was founded in 2023

- Does not offer trading services through a regulated broker

- Does not provide access to advanced trading platforms and mobile apps

- Higher profit target during challenge phases of 8-10%

- Fees are high from 249 USD and the minimum funding amount starts at 25k

Safety of FunderPro – 0

FunderPro reviews are lacking on the FPA (Forex Peace Army) platform, as the firm is young and has not been added to the platform. This deducts points from its safety score. Another important aspect of safety is the experience of the prop firms, and FunderPro was established in 2023 making it a super young prop firm. Naturally, the firm loses points in this metric as well.

The firm offers trading services using liquidity providers, accessing financial markets directly. As a result, the firm does not have a partner broker and loses points in this third metric as well. Prop firms are not required to get a license as brokers do. Offering trading services without a regulated broker exposes traders to the risk of losing their one-time fees because they are not trading the live markets. This is a serious red flag for FunderPro, and we advise traders to exercise extra caution when dealing with this firm.

The firm gets a 0 score in this section as it has no reviews, no regulated broker, and is a young firm.

FunderPro Funding and maximum capital allocation – 3

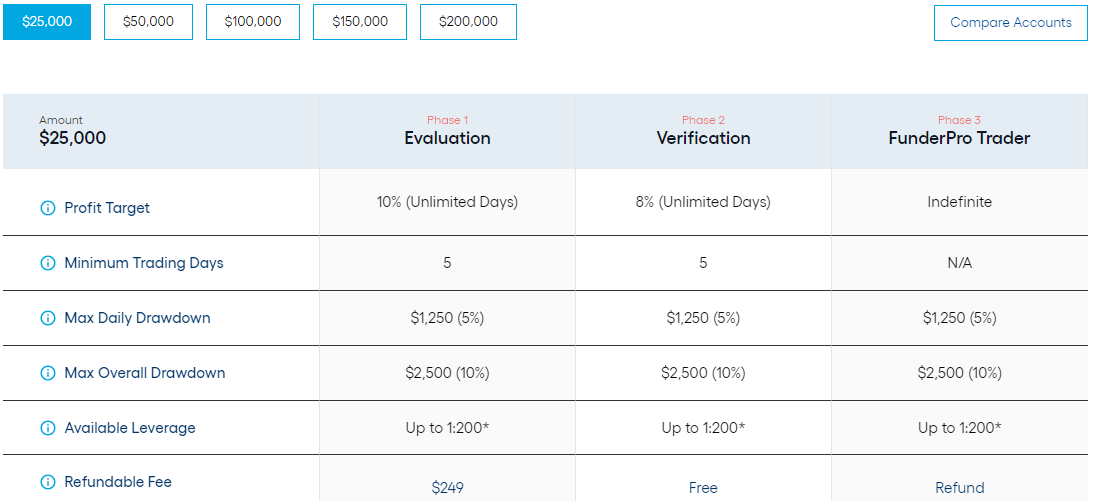

FunderPro funded programs are not diverse, as the firm only offers single funded accounts with limited funding amounts. FunderPro funding options range from 25k to 200k and include accounts with 25k, 50k, 100k, 150k, and 200k USD.

FunderPro challenge offers limited minimum funding to traders for a considerable one-time fee, which is disadvantageous for traders.

FunderPro prop trading consists of three phases, 2 evaluation phases, and a funded trader phase. This is a lengthy process and requires traders to hit 8% and 10% profit targets, which is not convenient for experienced traders. This might make many traders frustrated, which is never a good thing for a trader.

The FunderPro scaling plan is activated every 3 months, and traders who consistently achieve 10% profit targets are eligible to get an extra 50% fund increase. Consistent traders can get funded up to 5 million USD through this scaling plan.

The firm gets a 3 score for not offering lower funding options such as 1k and 10k accounts.

FunderPro Assets – 3.5

When it comes to tradable instruments, the firm offers several asset classes including Forex pairs, cryptos, indices, and commodities. Forex pairs include major, minor, and exotic pairs and the firm offers live spreads on the website for all assets. From commodities gas, oil, and precious metals can be traded. Indices include DAX, EUSTX50, JPN225, SPX500, and US30.

All trading assets are offered in the form of CFDs, allowing traders to speculate on both directions of price movements. Up to 1:200 leverage can be used for all assets.

Since the firm lacks stocks or any other assets, it gets a 3.5 score in this section.

FunderPro Trading rules and limitations – 2.5

The rules are consistent and within the industry average, with a daily loss being 5% and a maximum drawdown limit capped at 10%. The maximum drawdown is competitive at 10%. The profit target is 10% for phase 1 challenge, 8% for phase 2, and 0% for the live funded account. Minimum trading days are 5 for all phases except the real accounts. For funded live accounts, there are no minimum trading days restrictions. Trading during the major economic news is prohibited. There is no information about the firm’s weekend rules, but since it is prohibited to trade during the News, we assume it is prohibited as well. EAs are not allowed as the firm does not offer advanced platforms that support automated trading.

FunderPro rules include consistency rules that limit traders to make more than 60% of profits from one single trade. These rules exclude lack and promote consistency, which can be potentially beneficial for developing strong trading skills among traders.

Traders can choose comfortable lot sizes as there are no limits. However, they will have to use proper position sizing so as not to break any risk limit rules.

The firm gets a 2.5 score in this section.

FunderPro Fees – 2.5

The firm offers average audition fees for each funding option:

- Funding: 25,000 USD – One-time audition fee: 249 USD

- 50,000 USD – 349 USD

- 100,000 USD – 549 USD

- 150,000 USD – 749 USD

- 200,000 USD – 989 USD

Spreads are competitive on major pairs starting from 0.9 pips for EURUSD which is lower than the industry standard spread of 1 pip for Forex markets. For Gold (XAUUSD) the spreads are super competitive at 0.16. This is one of the lowest spreads for gold right now.

Audition fees are refundable after the trader passes the evaluation phases and becomes a funded trader. There are two evaluation phases, and traders should be careful not to break any rules.

FunderPro free trial is available and traders can sign up for it for an unlimited number. This is especially beneficial for beginners who want to learn and periodically test their skills. It is also possible to convert a free trial account into a live funded account if traders consistently make more than 1% profits. FunderPro free trial lasts for 7 days, after which the trader needs to either purchase a challenge or use another free trial.

FunderPro free repeat is not available if the trader breaks any rules. However, they can get a 15% discount in case a reset request is sent to the firm. This function is accessible from the trader’s dashboard after selecting the challenge the trader wants to reset.

The firm gets only a 2.5 score in the fees section for not offering audition fees of 150 USD and lower and spreads for FX pairs from 0 pips.

FunderPro Platforms – 0.9

FunderPro provides access to the TradeLocker trading platform that is powered by the TradingView charts. It is a web-based trading platform that has no downloadable app. This makes TradeLocker inferior to more advanced platforms such as MT4, MT5, or cTrader.

Traders can change their trading platform if they have not opened any trading position after purchasing the challenge. Otherwise, they will have to trade with the default platform.

The platform is mobile-friendly but has no dedicated app.

The firm gets a 0.9 score in this section for lacking advanced features, including automated trading bots.

FunderPro Profit-Sharing – 3

The FunderPro profit split is capped at 80/20, meaning traders get 80% of the profits made in trading while the firm gets the remaining 20%. Payouts are processed within 24–48 hours. The first profit split is eligible for traders after 8 days of placing a trade on the live STP account.

The firm gets a 3 score in this section for lacking a 90% profit share possibility.

Education and trading tools at FunderPro – 1.5

The sole place for getting anything related to education is the FunderPro blog. It includes market insights, company updates, and trading education. All the types of information mentioned earlier are provided in the form of articles. Trading educational articles provide some basic concepts and tips for trading, but there are no dedicated educational resources to teach beginners financial trading. While entertaining and engaging, these articles are nowhere near providing proper educational materials for beginners.

Despite a lack of educational resources, the firm still offers several tools to assist its traders. The trader’s dashboard is a client area with built-in tools to control the trader’s progress and access various features.

Periodical market insights offer articles with expert analysis of current trends and tendencies.

FunderPro gets a 1.5 score in the education section for not offering proper resources to beginner traders.

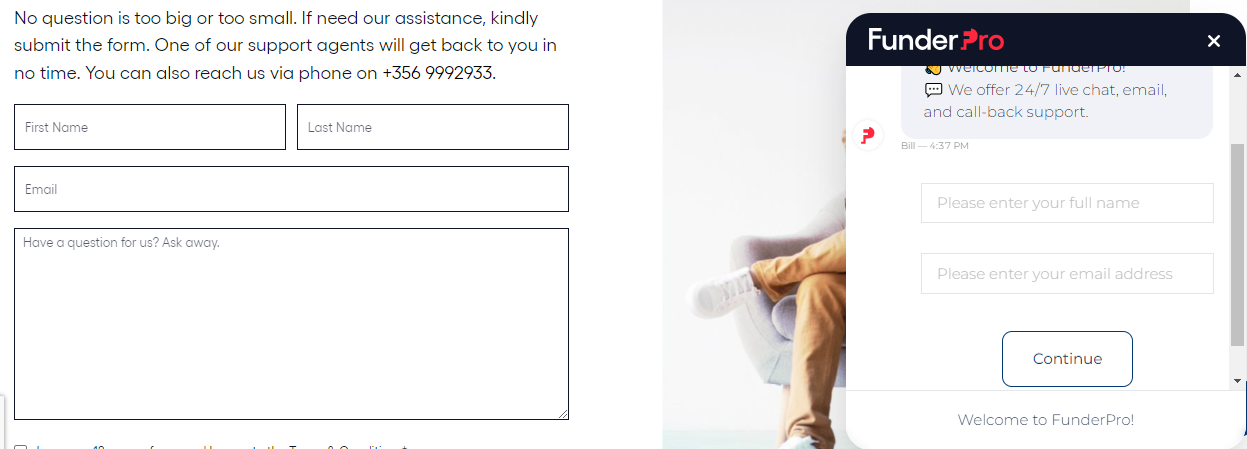

Customer Support at FunderPro – 3.6

When it comes to customer support, FunderPro offers numerous channels including email, phone support, and live chat. The live chat is the fastest and most convenient way of contacting the firm if any issues arise. However, both the website and all forms of support are only provided in the English language, which is a downside. There is also a FAQ section providing answers to some basic questions, which is advantageous for getting details about FunderPro services. The support is available 24/7 which is one of the advantages of this firm.

The firm gets a 3,6 score for support channel diversity but lacks multilingual support.

Frequently Asked Questions

Is FunderPro legit?