FundedNext prop firm offers several funding accounts and monthly challenges. The firm has been around since 2022 which makes it a very young prop firm. The firm has its own brokerage services and offers MT4 and MT5 trading platforms. This makes FundedNext also a broker that is not regulated by any authority, raising serious concerns about its safety. FundedNext scaling plan allows traders to get larger funding. The firm offers various attractive products, and we decided to check its legitimacy in our review below.

Pros & cons of FundedNext prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to Forex, cryptos, indices, and commodities

- Lower audition feed from 49 USD

- Higher overall loss limit of 10%

- Most payment options are free and instant

Cons

- Offers brokerage services and is unregulated

- Suspicious activities have been detected by this firm on the FPA platform

- Possible unethical and unfair approach toward clients

- High profit target ranging from 10-25%

FundedNext Quick Overview

| FPA Score | 0 |

| Year founded | 2022 |

| Headquarters | Ajman, United Arab Emirates |

| Minimum audition fee | 49 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 6,000 USD |

| Maximum funded amount | 200,000 USD |

| Allowed daily loss | 5% |

| Profit target | 10-25% |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | 90% |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, cryptos, indices, and commodities |

Safety of FundedNext – 0

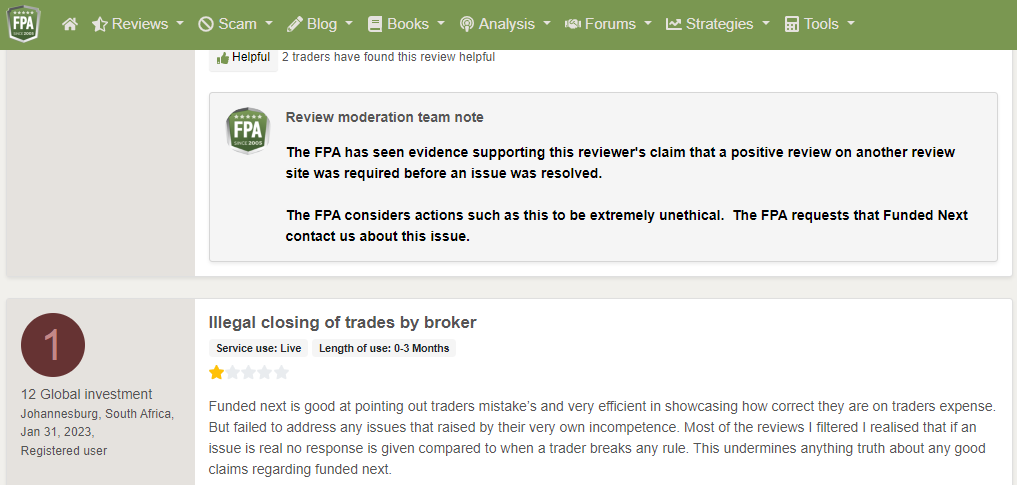

There are two negative comments about the FundedNext prop firm on the FPA platform. Supposedly, the firm required the trader to leave a positive review on another platform to get his issues resolved. This is very unethical and since the FPA is the most reputable platform, these claims seem legit. As a result, we assume the FundedNext scam could be going on, and we strongly advise our readers to stay away from this prop firm. We do not consider FundedNext reviews on Trustpilot strong enough to increase the safety of the firm.

The firm gets a 0 score in this section.

FundedNext Funding and maximum capital allocation – 3

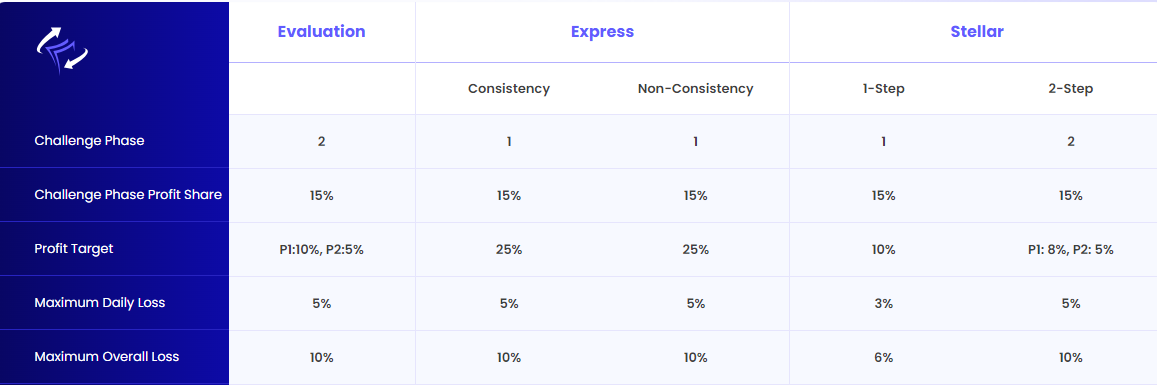

FundedNext provides three different types of challenges to get funded: evaluation, express, and stellar. The minimum funded amounts start from 6,000 USD and are capped at 200,000 USD. Traders can select between different funding amounts in this range including 15k, 25k, 50k, and 100k USD accounts. This adds to flexibility, but the minimum funding amount is still high. There is no FundedNext free trial, but a monthly free challenge that continues for the whole month every month.

The firm gets a 3 score in this section.

FundedNext Assets – 3

The firm offers access to Forex pairs, cryptos, indices, and commodities for low spreads and competitive fees. While these assets are diverse, there are no stocks or other assets offered at the moment. FundedNext prop trading may seem attractive, but we advise caution when dealing with them.

The firm gets a 3 score in this section.

FundedNext Trading rules and limitations – 2.2

The most important part of any prop firm evaluation process is to discuss their limitations and rules. The rules are slightly different for each account.

Here are the important rules for the Evaluation account type:

- Challenge phases – 2

- Profit split during the challenge phase – 15%

- Profit target – 10% (Phase 1), 5% (Phase 2)

- Profit target – 10% (Phase 1), 5% (Phase 2)

- Maximum daily loss limit – 5%

- Maximum overall loss limit – 10%

- Drawdown calculated – based on balance

- Time limits: Phase 1: 4 weeks, Phase 2: 8 weeks

- Minimum trading days required – 5

- Commissions – 3 USD per lot

- Profit split – 90%

- Maximum leverage – 1:100

- News trading – Allowed

- Weekend holding – Allowed

- EAs (Expert Advisors) – Allowed

- Trade copier – Allowed

- Reset discount – 10%

- Consistency rule – None

- First payout – Monthly

- Subsequent Payouts – Twice per week

Consistency rule is a tricky one to follow, it supposedly means to trade consecutively without breaking any rule. If the active trading days are five, then traders will have to trade every day consecutively for at least 5 days, by opening at least one trading position each day.

Express account type has several hard-to-achieve rules, including a 25% profit target. It prohibits news trading. Traders will not be able to hold positions over the weekends for the first phase of express account evaluation. The reset discount is 20% which is 10% higher than the other two accounts.

Stellar account comes with 3% daily loss restrictions for the first step and allows up to 5% daily loss on the 1 and 2 phases of the second step. Maximum overall loss is also lower for step one at 6% and increases to 10% for the 2nd step. Step 1 of the stellar account has only 1:30 leverage, and it also improves to 1:100 for the 2nd step.

Of the three accounts, the evaluation account is by far the easiest to follow and complete, as it offers the most balanced rules and requirements.

We evaluate FundedNext rules with a 2.2 score.

FundedNext Fees – 5

The spreads are low as the broker is not adding markup to the spreads provided by liquidity providers. This enables the prop firm to offer 0 spreads on swap-free or Islamic accounts.

FundedNext fees are also low, with 3 USD per lot round turn on Currency Pairs & Commodities, and 0 USD per lot round turn on Indices.

As for the funding fees for each account type and amount, we have checked their dashboard and collected all the prices and fees.

For the stellar account, the fee structure for funding is as follows:

- 6,000 USD funded account – 59 USD one-time fee

- 15,000 USD – 119 USD

- 25,000 USD – 199 USD

- 50,000 USD – 200 USD

- 100,000 USD – 519 USD

- 200,000 USD – 999 USD

One-time fees for the evaluation and express account types:

- 6,000 USD funded account – 49 USD one-time fee

- 15,000 USD – 59 USD

- 25,000 USD – 199 USD

- 50,000 USD – 299 USD

- 100,000 USD – 549 USD

- 200,000 USD – 999 USD

59 USD for a 15,000 USD account is a very low fee. If we had no concerns about this firm’s safety, we would recommend them to our readers.

FundedNext challenge, which is a monthly event, maybe a good way to test the firm’s ability to pay profits to traders.

We evaluate the fees for FundedNext with a 5 score.

FundedNext Platforms – 5

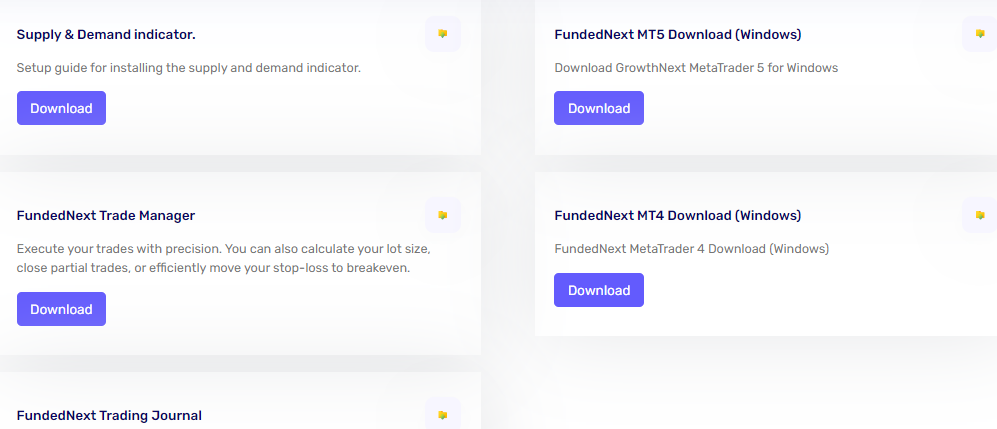

When it comes to trading platforms, FundedNext offers MT4 and MT5 advanced platform software. Both MT4 and MT5 are some of the best platforms in the world and offer full trading functionality, including manual and automated trading capabilities. EAs trading is allowed, which makes these platforms even more attractive. The prop firm also offers several indicators and tools, which we will describe in more detail in the education section.

The platforms section is one of the strongest sides of the FundedNext prop firm, and we give it a 5 score here.

FundedNext Profit-Sharing – 3

FundedNext has a flexible approach to profit sharing. Traders can get 15% of profits during their evaluation or challenge period before they become funded traders. This is very advantageous for motivating traders to sign up with the broker. However, as mentioned earlier, the safety of FundedNext is obscure and almost non-existent, and we strongly advise traders to exercise extra caution.

FundedNext profit split is up to 90% for all funded accounts including evaluation, express, and stellar.

The firm gets a 3 score in this section.

Education and trading tools at FundedNext – 1

There is a huge lack in the educational department of FundedNext as the firm does not provide any educational materials. There are no FAQs or help centers either. No courses are offered, only funded accounts and challenges. There are videos, but they only focus on clickbaity topics and do not provide any trading training or manual. There is also an e-book about prop trading secrets, which once again is not very useful for absolute beginners.

As for trading tools and indicators, there are several useful tools available on the dashboard. There are supply and demand indicators, FundedNext Trade Manager, and FundedNext Trading Journal.

Since there are no educational resources for beginners, the firm gets a 1 score in this section.

Customer Support at FundedNext – 2.4

The prop firm offers a live chat and messenger to connect with them quickly. They are also available on Discord and Facebook. Both the website and live chat are multilingual and support more than 5 different languages. There is also email support available. However, the firm lacks phone support, which is a minor red flag.

FundedNext support can be evaluated with a 2.4 score for lacking phone support.

Frequently Asked Questions

Is FundedNext a good prop firm?

What are the funding options at FundedNext?

Does FundedNext provide educational resources for traders?