Funded Trader or funded-traders.com is a Forex prop firm that allows traders to trade live trading accounts on funded accounts without large budgets. There are several trading accounts for both FX and stock trading and offer diversity to clients. However, the minimum deposits seem high and profit targets for some accounts go up to 25%.

In our comprehensive Funded Trader review, our readers will get all the necessary information to define if this firm is worthy of partnership.

Pros & cons of Funded Trader prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to diverse markets of stocks, Forex, indices, and commodities

- Most payment options are free and instant

Cons

- Expensive minimum deposit requirements of 300 USD for funded accounts

- The website is not user-friendly

- Higher profit targets of 5-10%

- Low profit split of 60%

Funded Trader Quick Overview

| FPA Score | Not yet reviewed |

| Year founded | 2019 |

| Headquarters | Bury St. Edmunds, United Kingdom |

| Minimum audition fee | 300 USD required deposit |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 240,000 USD (Up 1.2 million USD with scaling plan) |

| Allowed daily loss | 5% |

| Profit target | 10-25% |

| Maximum trailing drawdown | 5-7% |

| Profit sharing (Payouts) | 60% |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, indices, commodities, stocks |

Safety of Funded Trader – 1.5

There are several issues we have found with the firm. The most obvious one is the firm has been in the prop firm space since 2019 and still has not managed to create a responsive and well-designed website. The website feels clunky and heavy and requires some time to get loaded. The structure for funding and fees are not transparently shown and require complex searches and digging to find out all the details. We evaluate the prop firms depending on the three main criteria such as FPA score, years of experience, and if the firm offers trading through regulated brokers. Despite being on the scene since 2019 the firm only offers a little feeling of safety as it lacks FPA reviews and comments. This is even more so as the firm has more than 13,000 reviews on Trustpilot with a 4.5 rank score. The majority of their views are positive, and some traders report issues with long processes of verification and bad website experience, which are in line with our findings about the firm.

Trustpilot Funded Trader reviews are not enough for us to give the firm a high score in the safety section. Since the firm does not disclose information about the brokerage firm and there is no live chat to get the information, we assume the brokerage is unregulated.

The firm gets a 1.5 score in this section.

Funded Trader Funding and maximum capital allocation – 3

Funded Trader funding programs are divided into two packages, FX Funding Packages and Stock Funding Packages. FX funding package is called the Flexi challenge and is divided into beginner, intermediate, and professional (I, II, and III) accounts.

Flexi Beginner accounts have a funded amount of 10,000 USD, a drawdown of 5%, and a profit target of 10%. The minimum deposit is 300 USD.

Flexi Intermediate funded accounts start from 30,000 USD funding, 1 4% drawdown, and 10% profit target. The minimum required deposit is 600 USD for an intermediate account.

The professional account has similar specs and starts from a minimum deposit of 1,200 USD.

The Funded Trader scaling plan can be activated for all trading account types mentioned earlier and offers the ability to scale trading to over a million dollars.

There is also a Funded Trader free trial program where traders can participate and prove their trading abilities for free. This will require account opening and filling in the required information to get started.

The firm gets a 3 score in this section.

Funded Trader Assets – 3

The firm offers a good range of assets including stocks, FX pairs, commodities, and popular indices. Stock trading is allowed from anywhere in the world, which is very advantageous. If the minimum deposit requirements were not expensive and had no security concerns, a Funded Trader would be our recommendation for funded stock trading.

The firm gets a 3 score in this section.

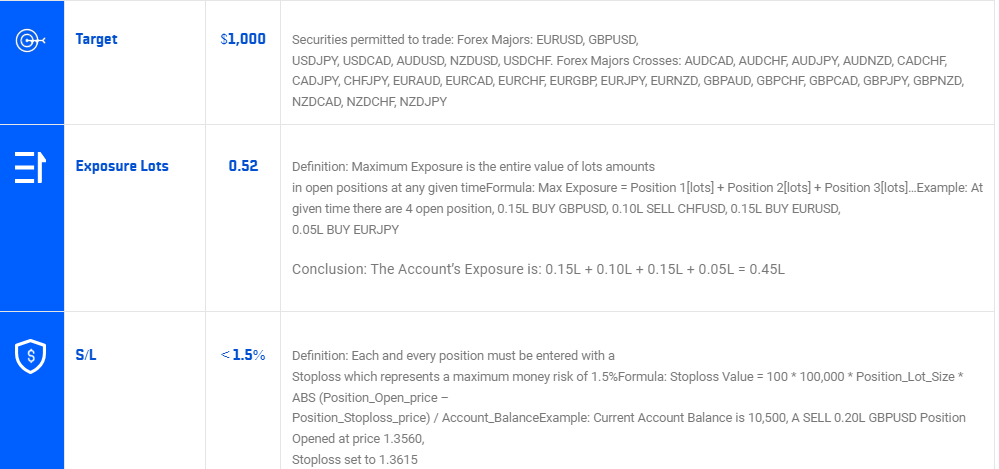

Funded Trader Trading rules and limitations – 1.6

Funded Trader rules are must-follow guidelines that every funded trader will have to follow and monitor carefully. A required stop loss of 1.5h is a must-have rule. This risk rule is the same for all accounts.

The firm allows hedging as a risk-managing measure, which is very advantageous. EAs and trade copiers are allowed for all Funded Trader challenge programs. However, if a trader uses the same strategy from the same provider for multiple accounts, they will have to use only one trading account.

The daily drawdown limits are at 5% and the time drawdown is also 5%. The profit target is dynamic and changes from 10 to 25%.

Funded Trader funded programs are accessible from all countries around the world, but there is a little exception. Funded stock trading accounts are not available for the citizens of the USA.

For having high-profit targets and tight daily and absolute loss limits, together with several other restrictive rules, the firm only gets a 1.6 score in this section.

Funded Trader Fees – 1.5

There are no monthly fees charged for any evaluation programs. All funded accounts require only one one-time fee to become a participant in each program.

Funded Trader prop trading for any of their accounts requires a minimum deposit. Meaning, that traders must have a minimum amount of money deposited on their trading balance to start the evaluation process. These deposits are not small and might make trading on Funded Trader accounts difficult and costly.

Funded Trader free repeat is only accessible for paid traders who have purchased funded accounts, and does not apply to free trial accounts. If a trader who has started a free challenge breaks the rules, they will have to pay a fee to reset their account.

Trading at Funded Trader is expensive, and we give the firm only a 1.5 score.

Funded Trader Platforms – 5

The firm allows traders to trade on either MT4 or MT5 advanced trading platforms and offers full functionality. Traders can use EAS or trade copiers and custom indicators. Both platforms come with fully automated trading capabilities.

Both MT4 and MT5 with all the functionality give the firm a 5 score in this section.

Funded Trader Profit-Sharing – 3

Funded Trader profit split is 60% paid once per month after the evaluation period is completed with the relative profit target. This is true for all FX Flexi and stock trading accounts from beginner to professional traders. 60% is a low-profit split for prop firm space industry standards, as popular prop firms offer up to 85-90% split. The policy of withdrawing profits once per month is also restrictive and takes away the flexibility to withdraw anytime. These restrictions make trading at a Funded Trader prop firm more like a normal job with a per month salary, which is not attractive.

Traders can withdraw profits even during the evaluation period.

The 60% profit-sharing policy gives the firm a 3 score in this section. There are no 90% profit split options and withdrawals are once per month.

Education and trading tools at Funded Trader – 1

There are no educational courses or resources available at Funded Trader at the moment, only a blog. The firm does not provide any market research tools either, only a prop trading account for certain deposits.

From the standpoint of education, Funded Trader gets only 1 score.

Customer Support at Funded Trader – 2.6

There is no live chat, which is disappointing. The live chat is designed so that traders can only send messages to the support team and lacks a live conversation function. This is a form of email support rather than a proper live chat. So, the firm offers email support and phone support. The existence of phone support is a positive sign and reduces Funded Trader scam chances slightly.

Since the live chat is actually email support, the firm only gets a 2.6 score in this section.

Frequently Asked Questions

Is Funded Trader legit?

What are the key advantages of a Funded Trader?

What are the main disadvantages of a Funded Trader?