FTMO is a well-known prop firm that has amassed a high reputation and has a multitude of positive comments on various reputable online platforms. The firm has been around since 2015 and has amassed a robust reputation among traders and investors. It offers two funded account types: normal risk and aggressive risk. For each funded account type, the requirements, and limitations are slightly different. Normal risk-funded accounts offer funding between 10 – 200,000 USD. Aggressive risk funded accounts can get between 10 to 100k USD for trading. Before a trader can become a full member of FTMO they have to complete a challenge that comes with certain requirements and limitations.

Let’s take a look at the FTMO prop firm and all the crucial details before you can sign up with them.

Pros & cons of FTMO proprietary firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5, and cTrader

- Competitive spreads and commissions for trading

- Most payment options are free and instant

Cons

- Offers no stocks for trading

- Higher total loss limits at 10%

FTMO Quick Overview

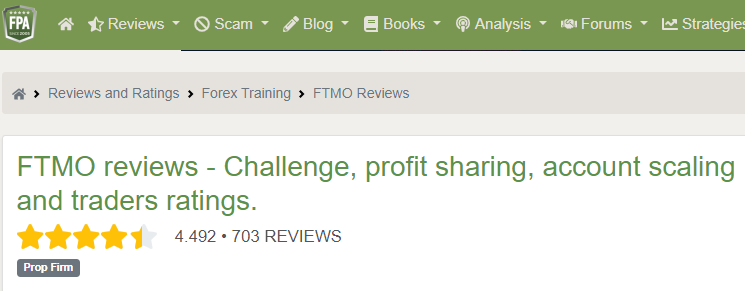

| FPA Score | 4.49, 703 REVIEWS |

| Year founded | 2015 |

| Headquarters | Prague, Czech Republic |

| Minimum audition fee | 164 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 200,000 USD |

| Allowed daily loss | 5% |

| Profit target | 10% |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | 90% |

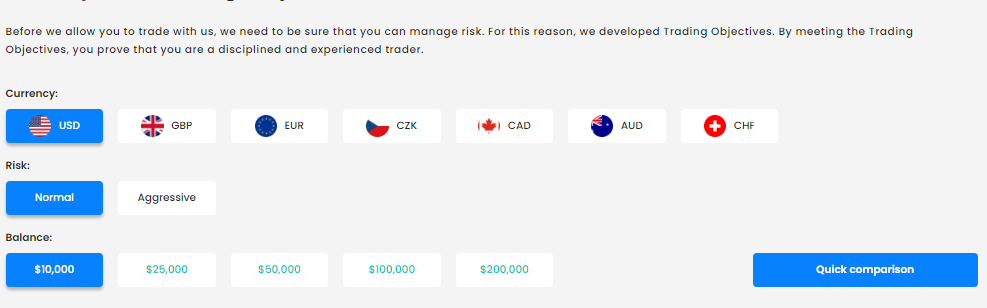

| Account base currencies | USD, EUR, GBP, CAD, CZK, CHF, AUD |

| Trading Platforms | MT4, MT4, cTrader |

| Available trading markets | Forex, indices, commodities, cryptos |

Safety of FTMO – 5

There is no doubt about FTMO’s legitimacy, as the prop firm has very positive reviews on almost all online platforms. On the FPA, FTMO got almost a 4.5 rank score, which is more than enough. The same story is on the Trustpilot platform. The firm has a 5-star rating with over 6000 traders recommending it for funded account trading.

FTMO has been around for years, which indicates the company is actually very serious about its business. This is good news for traders as it indicates a long-term relationship is possible with FTMO.

Overall, the prop firm seems absolutely trustworthy and a go-to destination for traders who want to trade on larger accounts.

Funding and maximum capital allocation – 3

The minimum funding amount a trader can get from FTMO starts from 10,000 USD. While this number may seem low, the firm has a diverse funding package to appeal to all traders. The maximum funded account with normal risk trading is 200,000 USD, and 100,000 USD for aggressive risk management. This allows traders to select between two risk modes and choose a more suited option to their trading style and method. The exact list of funding amounts and respective fees for getting a normal risk funded account are as follows:

- 10,000 USD – 164 USD (or equivalent in EUR, CZK, GBP)

- 25,000 USD – 265 USD

- 50,000 USD – 366 USD

- 100,000 USD – 572 USD

- 200,000 USD – 1,145 USD (Only for normal risk funded account types)

Aggressive accounts have slightly higher fees for each funding and maximum funding is capped at 100,000 USD.

FTMO lost 2 scores for not offering lower funded amounts of 1,000 USD and higher funding of 1 million USD and more. So we give it a 3 score in this section.

Assets – 4

With FTMO’s maximum allowed leverage of 1:100 it is possible to control large trading positions with relatively small funded accounts. This is higher than the majority of prop firms’ leverage, which usually limits the leverage levels at 1:10.

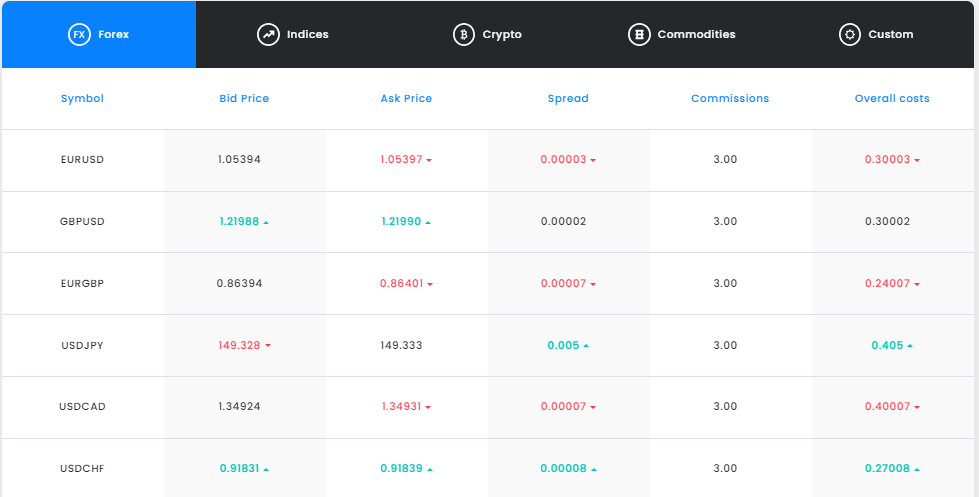

FTMO offers traders access to Forex pairs, commodities, indices, and cryptos. Spreads on Forex pairs start from 0.5 pips, which is super competitive and will allow traders to implement even scalping strategies. The trading commission is 3 USD per lot round turn, which is also much lower than the industry average of 7 USD.

FTMO indices can be traded with the spreads from 0.20 and commissions are zero. Cryptos start from 0.00005 spreads and are also commission-free. The commodities come with varying commissions and spreads as low as 0.00005.

FTMO gets a 4 score in assets because it offers all asset classes except for stocks, where it loses 1 point.

Trading rules and limitations – 4.8

When signing up for a funded account challenge, the most important thing to consider is the rules and constraints on trading activities. These rules are key and will make a difference between winners and losers. FTMO has similar limitations to other popular prop firms.

FTMO has no limitations for holding positions through weekends or trading during the macroeconomic news. These terms are super competitive, as most prop firms do not allow news trading.

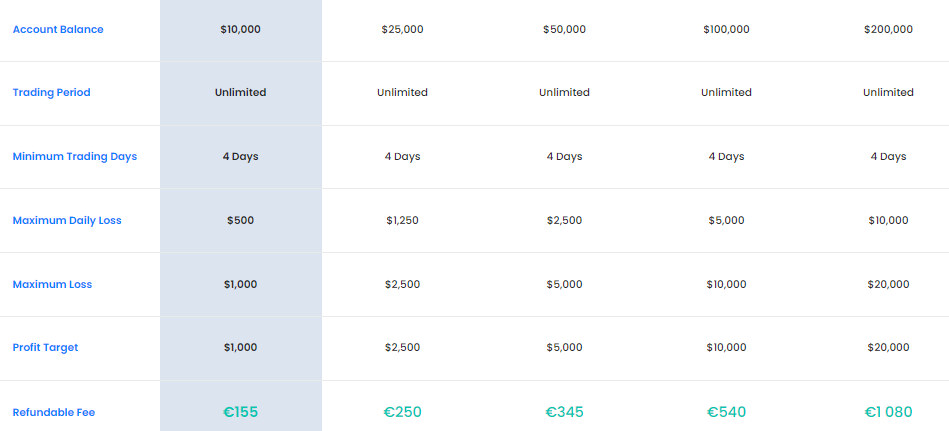

Let’s discuss the requirements for getting a funded trader on a 10,000 USD account. These requirements are similar to funded accounts with higher balances.

The trading period is not limited at FTMO, meaning traders can trade as long as they like to achieve profit goals. This is super helpful to reduce the stress of online financial trading.

The minimum trading days are set at 4 for steps one and two, meaning traders need to trade at least for 4 days during the current cycle. At least one trading position must be opened during the trading days.

The maximum daily loss is set at 500 USD and is calculated by Current daily loss = results of closed positions of this day + result of open positions.

At no time during the trading cycle is the trader allowed to lose more than 10% of the initial trading balance. If the account falls below 90% of the balance, the trader loses the FTMO challenge. This is calculated as the sum of both closed and opened positions.

The profit target is 10% for the standard and 20% for the aggressive funded accounts. It is set at 1,000 USD for the first step and 500 USD for the second step. For the verification, this profit target is set at 5% and 10% for normal and aggressive funded accounts respectively.

The fee is reimbursed to the trader together with a profit split after they become a funded trader at FTMO.

FTMO is an industry flagship with highly competitive rules and limitations. However, it lost a tiny score for having trading lot limitations.

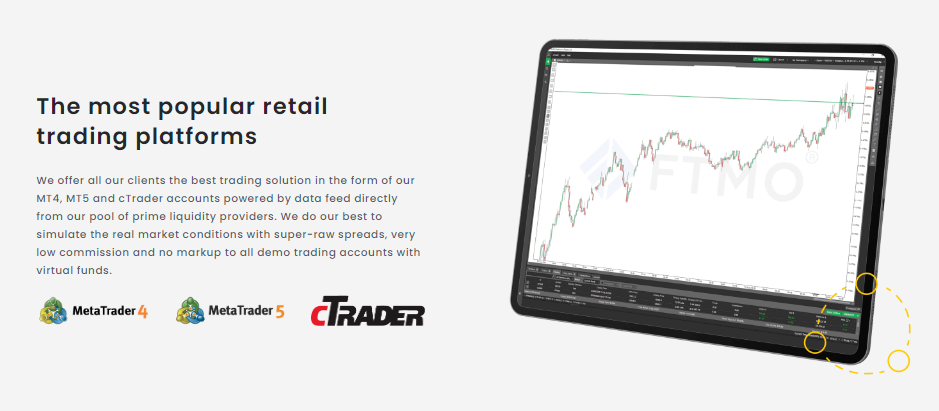

Platforms – 5

FTMO provides traders access to advanced trading platforms MT4, MT5, and cTrader. On FTMO platforms, traders can enjoy raw spreads, low commissions, and no markup on all demo accounts. The firm offers top-rated liquidity providers’ data feed to their traders.

Apart from advanced trading platforms, FTMO offers multiple apps for statistical analysis of trading performance and financial markets as well. Traders can use these apps to ensure they monitor their performance wisely. These apps include Account MetriX, Account Analysis, Statistical App, Trading Journal, Mentor App, and Equity Simulator.

Account MetriX is a web-based application that monitors a trader’s progress toward becoming a funded FTMO trader. This app serves all traders who are in the process of using the Challenge, Verification, or Free Trial.

Account Analysis app provides detailed metrics of trading results. This app takes trader’s performance data and provides indicators to allow them to improve their trading strategies.

Statistical App offers real-time market behavior and aims to help traders make better trading decisions.

Trading journal is another useful app, offering the ability to insert all trading activities and later analyze them. A trading journal is key in any trader’s performance analysis, and FTMO helps traders use a more refined trading journal.

Another tool from FTMO is called the Mentor App, which assists traders in becoming more disciplined. It tries to force traders to follow their risk management and rules and comes with many useful features.

Advanced platforms with mobile and web trading capabilities plus a multitude of apps earn 5 scores to FTMO in the platforms section without a doubt.

Profit-Sharing and Fees – 5

In case the trader is successful, FTMO will increase the account balance by 25% every 4 months.

Traders can get up to 90% of profits made in trading at FTMO. This number is excellent and more than many other popular prop firms offer. With 90% of profits available for traders, trading with a funded account feels super attractive for experienced traders who can make profits on online financial markets. With average withdrawal processing times being around 8 hours, withdrawing from an FTMO funded account is faster than what other prop firms have to offer.

With 90% of profits shared and the lowest fees in the industry, FTMO is more than worthy to get a 5 score in this section.

Education and trading tools at FTMO – 5

FTMO excels with its trading educational resources and even offers trading coaches to its clients. FTMO Academy is the place for beginners to start their trading journey. Lessons are divided by difficulty and start from basic concepts of trading. Trading analysis and FTMO challenge steps are also taught at the academy.

However, the academy is not only about learning, the firm also gives rewards for the completion of each course. Traders have a progress bar and get rewarded for achieving 40%, 70%, and 90% of education, which is checked by a final exam.

We gave FTMO 5 in education, as it offers every type of educational material traders may ever need.

Customer Support at FTMO – 3.6

Customer support at FTMO is as you would expect from the flagship firm of the industry. Live chat can be accessed via the website, and WhatsApp is also available. It is available in English and German languages, making it a multilingual support. As for other support channels, there is email support and phone support provided. Live chat is the most convenient way of getting needed assistance from the firm’s personnel.

For its excellent support, FTMO gets a 3.6 score. If the support and the website were both in more than five languages, the firm would get a 5 out of 5 score.

Frequently Asked Questions

Is it a good prop firm?

What are the minimum and maximum funding amounts at FTMO?

How much profit-sharing do traders receive at FTMO?