Finotive Funding prop firm was established in 2021 and offers trading through its in-house brokerage firm, which is unregulated. As a result, we decided to take a closer look at the company to define if a Finotive Funding scam is possible or not. The firm offers diverse funded accounts and industry average requirements. However, the lowest audition fee starts from 60 USD, which is one of the smallest in the industry. This lack of regulated brokers raises red flags about the company’s legitimacy and reliability.

Read our Finotive Funding review to find out more about the important details for this prop firm.

Pros & cons of Finotive Funding prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 5

- Fast and digital account opening/verification

- Offers access to 100 tradable instruments

- Lower profit target of 5%

- High maximum funded amount at 3.2 million USD

- Most payment options are free and instant

Cons

- Offers trading through an unregulated broker

Finotive Funding Quick Overview

| FPA Score | Not yet ranked |

| Year founded | 2021 |

| Headquarters | Budapest, Hungary |

| Minimum audition fee | $50 |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 2,500 USD |

| Maximum funded amount | 3.2 million USD |

| Allowed daily loss | 4-10% |

| Profit target | 5-10% |

| Maximum trailing drawdown | 7.5-10% |

| Profit sharing (Payouts) | 75% (up to 95% with scaling plan) |

| Trading Platforms | MetaTrader 5 (MT5) |

| Available trading markets | Forex, indices, commodities, cryptos |

Safety of Finotive Funding – 1.5

The broker has only 2 comments on the FPA, which is not enough to get an evaluation score. As for the broker, Finotive Funding offers an in-house brokerage called Finotive Markets, which is an unregulated broker. This makes it risky to trade with the broker and ultimately with this prop firm. As for the Trustpilot ranking, Finotive Funding reviews are 270 in total, giving the firm a 4.3 score.

The firm gets a 1.5 score in this section due to the reasons mentioned earlier.

Funding and maximum capital allocation – 4

The minimal funding at Finotive Funding prop firm starts from 2,500 USD and can reach up to 200,000 USD amount. However, there is a Finotive Funding scaling plan that allows traders to scale up their accounts to a staggering amount of 3.2 million USD.

There are several account types for funded programs including Classic Challenge Account, One Step Challenge Account, Instant Funding (Standard), and Instant Funding (Aggressive). With these diverse accounts with slightly different conditions, traders can select the most suitable one for their financial goals. The Finotive Funding Challenge account is the most suited one for beginners to start small and learn along the way.

The funding gets Finotive Funding a solid 4 score.

Finotive Funding Assets – 3.5

There are around 100 tradable instruments in diverse asset classes at the Finotive Funding prop firm. These assets include Forex pairs, indices, cryptos, and commodities.

There are no stocks for trading, and total asset numbers are also moderate. Still, 100 tradable instruments are more than enough for most traders. All Finotive Funding funding assets are offered through the broker of Finotive Markets and allow the firm to offer low spreads.

The lack of stocks and other assets gives Finotive Funding a 2.5 score in this secretion.

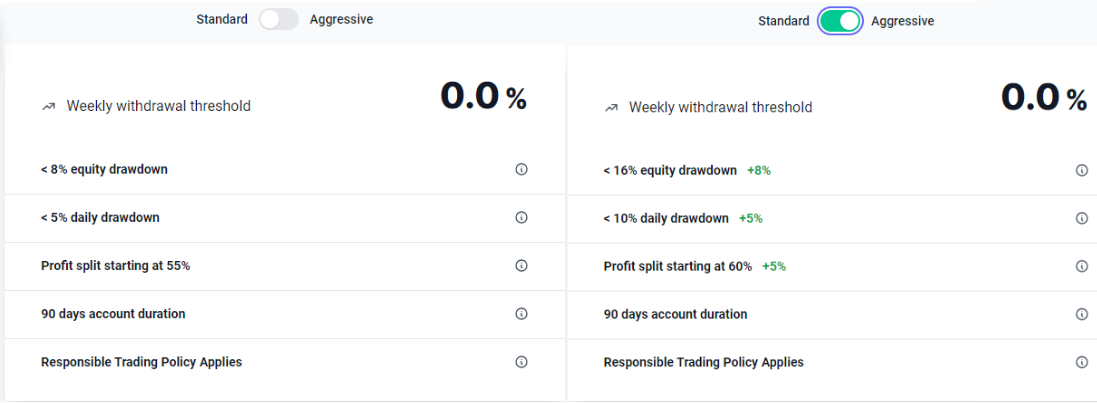

Finotive Funding Trading rules and limitations – 3.7

The most important part of the prop firm is its rules and requirements. Finotive Funding rules are flexible and trader-oriented.

The challenge consists of two phases with slightly different targets and requirements. Phase 1 comes with a 7.5% profit target, unlimited duration, 5% daily drawdown, 10% total drawdown, and responsible trading policies. The responsible trading policies prohibit traders from risking 100% of their drawdown in any open position. Risking more than 50% drawdown on individual trades across open trades is also prohibited by this rule. Phase 2 has a reduced profit target of 5%, unlimited duration, a 10% equity drawdown limitation, a 5% daily drawdown, and a responsible trading policy. After the trader completes two phases they become a funded trader with a profit split of up to 95% (Standard is 75%), unlimited duration, 10% total loss limitations, 5% daily drawdown limits, and responsible trading policy. The lack of profit target for funded accounts is very useful to start withdrawing profits after the first profits are made.

For the One Step Challenge, the requirements are a bit different. For the evaluation phase, the profit target is at 10%, there are no time limits for the duration, a 7.5% equity drawdown is allowed, a daily drawdown is at 4%, and once again the responsible trading policy applies. The requirements are exactly the same after the trader gets the funded account.

Automated trading or EAs are all allowed, together with hedging on all funded accounts. EAs also will have to abide by the limits and rules the firm has for manual trading.

If a trader breaches the rules there is no Finotive Funding free repeat, and they will have to pay fees all over again, an important rule to take into account for all traders who want to sign up.

A well-deserved 3.7 score in this section for offering flexible limitations.

Finotive Funding Fees – 3

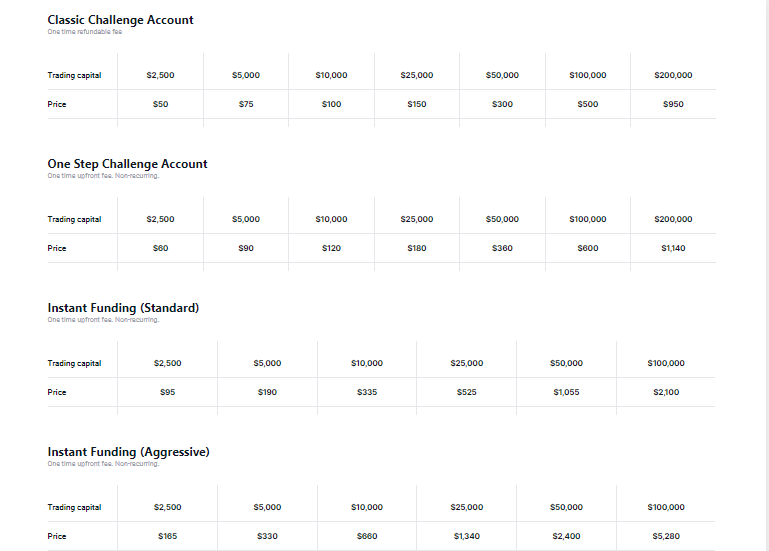

The Classic Challenge Account offers the following funding and fee structure:

- $2,500 funded account – $50 audition fee

- $5,000 – $75

- $10,000 – $100

- $25,000 – $150

- $50,000 – $300

- $100,000 – $500

- $200,000 – $950

The fee to funding structure for the One Step Challenge Account is:

- $2,500 – $60

- $5,000 – $90

- $10,000 – $120

- $25,000 – $180

- $50,000 – $360

- $100,000 – $600

- $200,000 – $1,140

For other accounts, the standard starts from 95 USD and scales up to a 2,100 USD fee for 100,000 USD accounts, and Instant Funding (Aggressive) accounts vary from 165 USD to 5,280 USD respectively.

Spreads on major Forex pairs start from 0.2 pips, which is more than enough to implement any trading strategies, including scalping ones.

Finotive Funding Platforms – 5

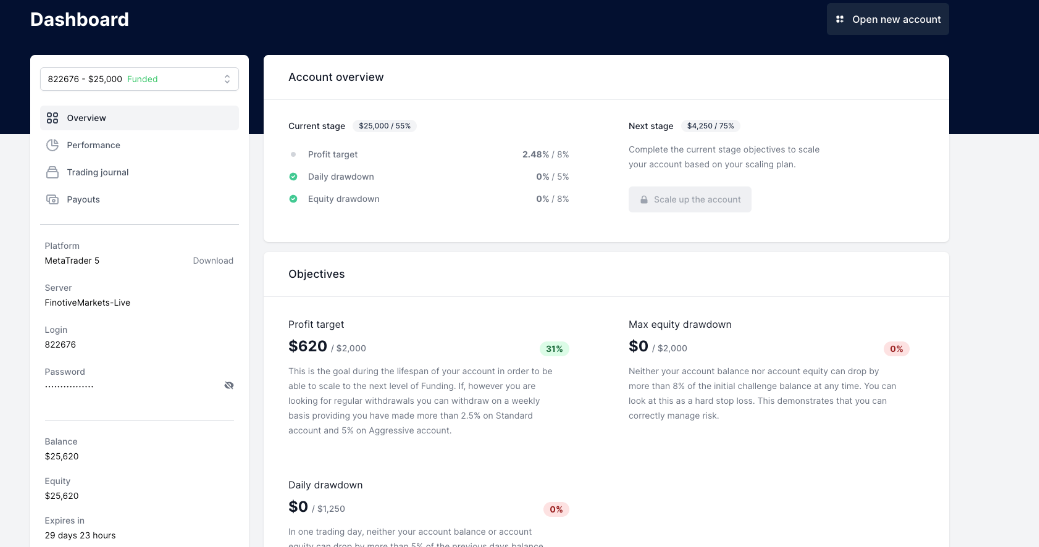

Finotive Funding offers access to the MetaTrader 5 platform. MT5 is an advanced trading platform. The firm also has an advanced dashboard for traders to track their performance easily. The dashboard offers real-time trading data monitoring functionality.

Finotive Funding Profit-Sharing – 3

The Finotive Funding profit split starts from 75% and goes up to 95% depending on the scaling amount. The higher the scaled account, the higher the profit split. Even the 75% profit share as a starter is very attractive for trading FX on funded accounts, and the 95% possibility is even more so.

Education and trading tools at Finotive Funding – 1

There are no educational resources on the Finotive Funding firm website, but the prop firm offers some tools to assist traders. There is a FAQ section, but it can barely be considered educational material. An advanced dashboard is useful to track performance and control risks, which is super helpful for funded trading.

As a result, the firm only gets a score in this section.

Customer Support at Finotive Funding – 2.4

Similarly to the majority of prop firms we have reviewed on this platform, there are several support channels, including email support and live chat. There is no phone support available. It has to be noted that this lack of phone support is widespread among prop firms. The live chat comes with an in-built automated bot that has a menu to quickly browse common questions and topics.

Frequently Asked Questions

Is Finotive Funding legit?

What is the minimum audition fee to join Finotive Funding?

How does the profit-sharing work at Finotive Funding?