Founded in 2016, Earn2Trade is a recognizable name in the prop trading market. The prop firm offers two account types – the Career Path and the Gauntlet Mini, which gives traders the ability to secure funding up to $400,000 using the TCP 50 of the Career Path, with an ability to keep 80% of the profits generated.

The prop firm is focused on the commodity futures market, with traders having access to the Chicago Mercantile Exchange.

The primary regulated brokerage Earn2Trade is partnered with is EdgeClear, and the firm also has trading partnerships with the likes of Finamark and NinjaTrader.

Traders can also access analytics platforms, such as Journalityx and Rithmic using their Earn2Trade accounts.

Pros & Cons Of Earn2Trade Proprietary Trading Firm

Pros

- Partnered with an internationally regulated brokerage

- Access to the Chicago Mercantile Exchange

- The most affordable live account is often offered at a discount ($45/month, instead of $150)

- Ability to use a LiveSim account after the evaluation phase

- Fixed drawdown for the $200,000 and $400,000 funding tiers

- The management team is transparent and listed on the website

- Plenty of educational materials

Cons

- Focus on commodities futures, other assets (forex, stocks, bonds) are not available

- Funding starts at $25,000

- Maximum funding below $1 million

- Low drawdowns for the Career Path and the Gauntlet Mini

- Minimum trading of at least 15 days

- No overnight and weekend trades

Earn2Trade Quick Overview

| FPA Score | NOT RATED |

| Year founded | 2016 |

| Headquarters | Sheridan, Wyoming, United States |

| Minimum audition fee | $150 (TCP25) on sale for $45 |

| Fees on withdrawals | 10% (below $500) |

| Minimum funded amount | $25,000 |

| Maximum funded amount | $400,000 |

| Allowed daily loss | 2.2% |

| Profit target | 7% (TCP25) 6% (TCP50) |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 80% |

| Account base currencies | USD |

| Trading Platforms | NinjaTrader, Finamark, R Trader Pro |

Safety of Earn2Trade – 3

Earn2Trade is partnered with regulated liquidity providers and brokerages, with its primary broker, Edge Clear, being licensed and regulated by the CFTCA and the NFA.

NinjaTrader and Finamark are also regulated by some top-tier regulatory agencies, such as the CFTC.

Earn2Trade also has a comprehensive KYC procedure in place to ensure the legitimacy and security of their clients.

While the prop firm does not have ratings from the Forex Peace Army (FPA), it does have broker regulations and over 2 years of experience backing it.

Funding and Maximum Capital Allocation – 2

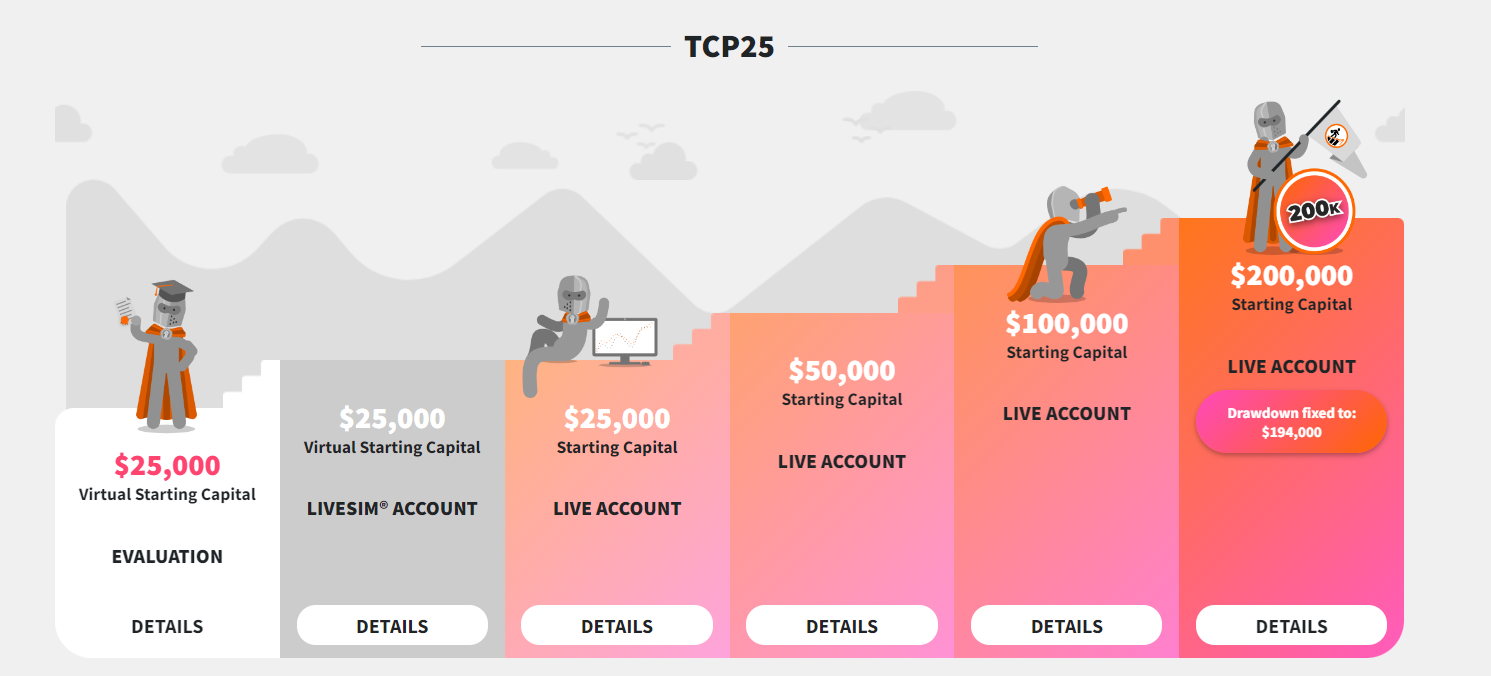

When it comes to funding availability, Earn2Trade’s offerings are divided into the Career Path and the Gauntlet Mini accounts. The Career Path itself is divided into the TCP25 and TCP50 packages. The TCP25 offers funding from a minimum of $25,000, to a maximum of $200,000, while the TCP 50 starts with $50,000 and a maximum of $400,000.

The Gauntlet Mini account is also divided into four funding tiers – $50,000, $100,000, $150,000, and $200,000. The Gauntlet Mini has stringent requirements regarding the performance of traders – while the profit goals are low at 6-7%, the maximum daily and overall drawdowns are also low, which places constraints on traders.

Each of the funding methods and accounts come with a progression ladder, which traders can view on the prop firm’s official website.

Assets – 1.5

The variety of assets available for trading on Earn2Trade is rather scarce and is limited to futures on commodities, such as metals. Traders have access to the securities and commodities exchanges, such as:

- The Chicago Mercantile Exchange (CME)

- The New York Mercantile Exchange (NYMEX)

- The Chicago Board of Trade (CBOT)

- COMEX

Micros asset trading is also available. Earn2Trade no longer offers crypto as a viable option for the completion of the Career Path and Gauntlet Mini challenges.

The proprietary trading firm does not offer any additional assets, such as stocks, CFDs, forex, crypto, etc, which can be inconvenient for some traders.

Trading Rules and Limitations – 1.8

To understand the trading rules and limitations, it is best to look at each account type and funding option individually.

Earn2Trade has progression ladders you can check out to see how the process works.

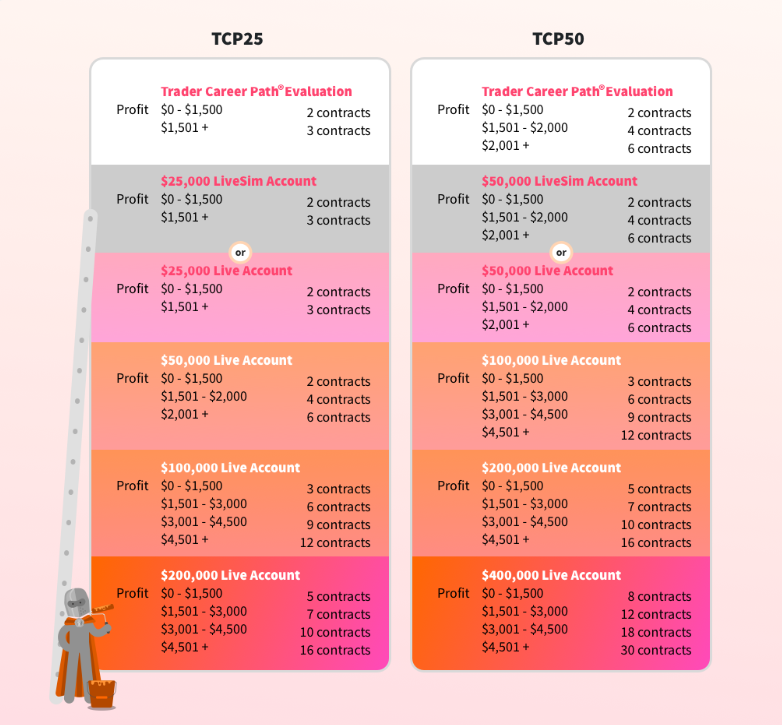

The Career Path is divided into TCP25 and TCP50.

TCP25:

- Evaluation – $25,000 in simulated funds, daily loss limit $550, EOD drawdown up to $1,500, up to 3 contracts

- $25,000 LiveSim account – daily loss limit of $550, EODdrawdown of $1,500, up to 3 contracts

- $25,000 Live account – daily loss limit of $550, trailing drawdown of $1,500, up to 3 contracts

- $50,000 Live account – daily loss limit of $1,100, trailing drawdown of $2,000, up to 6 contracts

- $100,000 Live account – daily loss limit of $2,200, trailing drawdown of $3,500, up to 12 contracts

- $200,000 Live account – daily loss limit of $4,400, fixed drawdown to $194,000, up to 16 contracts

TCP50:

- Evaluation – $50,000 in simulated funds, daily loss limit of $1,100, EOD drawdown of $2,000, up to 6 contracts

- $50,000 LiveSim account – daily loss limit of $1,100, EOD drawdown of $2,000, up to 6 contracts

- $50,000 Live account – daily loss limit of $1,100, trailing drawdown of $2,000, up to 6 contracts

- $100,000 Live account – daily loss limit of $2,200, trailing drawdown of $3,500, up to 12 contracts

- $200,000 Live account – daily loss limit of $4,400, drawdown fixed to $194,000, up to 16 contracts

- $400,000 Live account – daily loss limit of $8.800, drawdown fixed to $380,000, up to 30 contracts

Other limitations and rules include:

- Trade a minimum of 15 days

- Do not rich or dip below the daily loss limit

- Follow the progression ladder and its position sizes

When it comes to the Gauntlet Mini, Earn2Trade has the following tiers and limitations in place:

- GAU50 – $1,100 daily loss limit, $3,000 profit goal, $2,000 EOD drawdown, up to 6 contracts

- GAU100 – $2,200 daily loss limit, $6,000 profit goal, $3,500 EOD drawdown, up to 12 contracts

- GAU150 – $3,300 daily loss limit, $9,000 profit goal, $4,500 EOD drawdown, up to 15 contracts

- GAU200 – $4,400 daily loss limit, $11,000 profit goal, $6,000 EOD drawdown, up to 16 contracts

Earn2Trade’s offerings come with stringent limitations. Traders cannot hold positions overnight and on weekends. While the profit targets are low, drawdowns are also low, which limits traders.

Platforms – 3.5

Traders on Earn2Trade have access to NinjaTrader and Finamark, who are regulated trading platforms with plenty of features and user-friendly design.

The primary partner broker of Earn2Trade is Edge Clear, which is licensed and regulated by the CFTC, which is one of the best-regarded regulatory agencies in the world.

Aside from the primary brokerage account, traders also have a 60-day free access to Journalityx, which offers trade journaling software to individual and prop trading clients.

While Earn2Trade may not offer MetaTrader, this is less of an issue, as the prop firm does not offer forex trading.

As a prop trading firm focused on commodities futures, Earn2Trade is relatively well-equipped to gives traders a satisfactory trading experience.

Profit-Sharing and Withdrawals – 1

Eanr2Trade gives 80% of the generated profits to traders. This is true for both Career Path and the Gauntlet Mini accounts.

The firm processes withdrawals once a week and the minimum withdrawable amount is $100.

No fees apply to withdrawals above $500, and a $10 fee is applicable to withdrawals below $500.

The withdrawal methods available on Earn2Trade include:

- Bank wire

- PayPal

- Payoneer

- Revolut

- Wise

- Crypto (via Coinbase)

Withdrawals are passed through Deel and may be charged additionally by individual brokerages/wallets.

Fees – 2.5

The fees offered by the Earn2Trade prop firm can be broken down into two categories – subscription fees and commissions.

Subscription fees for the Mini Gauntlet accounts range from $170 to $550, while the Career Path subscriptions start at $150/month and up to $550. The $25,000 account regularly goes on sale and is currently offered for $45/month.

As for the commissions, here are the general fees charged on Earn2Trade:

- Default commissions of $2.02 on all sides for all trades (both mini and micro assets)

- For micro traders, the price may vary, ranging from $0.82 to $1.08 in most cases

- For traders using the Rithmic platform, a $0.10 fee is charged per side

- The NFA fee per side is $0.02

Education at Earn2Trade – 4.5

For beginners looking for some educational content, Earn2Trade offers webinars and guides, as well as a comprehensive blog with various articles regarding prop trading and the firm’s specific terms and features.

The Beginner Crash Course includes all educational materials available on the platform, including fundamental and advanced educational packages.

The package includes 60 6-10 minute videos explaining the basic concepts and trading strategies. Once completing the course, traders have lifetime access to the materials included in the Crash Course.

Additionally, Earn2Trade offers a partnership with Universiapolis International University of Agadir in Morocco, which helps develop the contents of the Crash Course.

Customer Support at Earn2Trade – 5

Customer support details are easily accessible on the Earn2Trade website. The firm has a support hotline and email address, as well as a comprehensive FAQ section on its website, where answers to dozens of questions related to the firm’s features and services can be found.

The Help Center is available in 5 languages – English, French, Portuguese, Spanish, and Arabic.

The live chat function is also fast and responsive.

Frequently Asked Questions

Is Earn2Trade legit?

How much funding can I get on Earn2Trade?

Is Earn2Trade regulated?