Founded in 2021, Dallas-based E8 Funding is a relatively new player on the prop trading market. The firm offers three account types and a three-phase onboarding program ,after which traders can secure up to $300,000 in funding, with additional scaling options available up to $1 million.

The minimum funding amount available for E8 traders is $25,000 and the firm’s maximum drawdown limitation is 8%.

While the safety features of the firm are a bit bare, it makes up for it in available assets and intuitive platform functionality.

This review of E8 Funding will look at the terms and features offered by the prop firm and aggregate an overall score on a scale of 1 to 5.

Pros & Cons Of E8 Funding Proprietary Trading Firm

Pros

- Access to MT4 and MT5

- Ability to scale up to $1 million in funding

- No restrictions on trading style

- Maximum leverage of 1:50

- 5 different instruments available for trading (stocks, indices, commodities, currencies, crypto)

- Can hold positions overnight and on weekends

- Intuitive and user-friendly E8X Dashboard

Cons

- Does not have a long operational track record

- Data on the management team is scarce

- E8 Funding does not have a call center

- Does not provide information about brokers

E8 Funding Quick Overview

| FPA Score | NOT RATED (4.7 on Trustpilot, 1.3k reviews) |

| Year founded | 2021 |

| Headquarters | Dallas, Texas, United States |

| Minimum audition fee | 138 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 300,000 USD |

| Allowed daily loss | 5% |

| Profit target | 8% (Phase 1), 5% (Phases 2 and 3) |

| Maximum trailing drawdown | 8% |

| Profit sharing (Payouts) | 80% |

| Account base currencies | USD, EUR, GBP |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Currencies, commodities, indices, equities, crypto |

Safety of E8 Funding – 1.5

E8 Funding is not rated on the FPA, but maintains a Trustpilot score of 4.7, based on over 1.3k reviews.

The prop firm also does not offer a regulated brokerage to traders, which docks some points in the Safety department.

E8 Funding was founded in 2021, which means that the firm has been around for longer than 2 years, but does not have a very long track record of operations.

The lack of regulated brokerage and an absence of FPA reviews gives E8 Funding a low 1.5/5 when it comes to safety, as the prop trading market is a saturated one and the firm does not offer any extra security features, other than two-factor authentication and standard KYC procedures. All traders in E8 Funding are subject to Deel’s biometric verification process in order to obtain funding.

Reliable data on the management team behind E8 Funding is also scarce to find, which could raise concerns for some traders.

Funding and Maximum Capital Allocation – 3

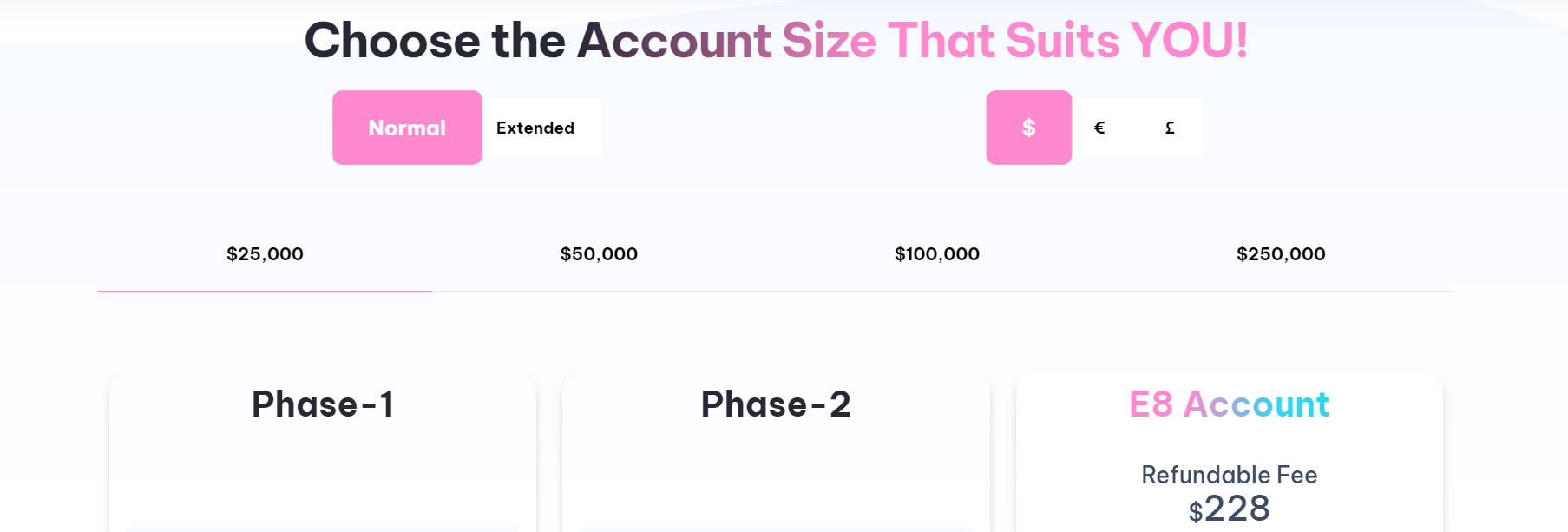

Funding at E8 starts at a minimum of $25,000 and goes up to $300,000, based on the account type.

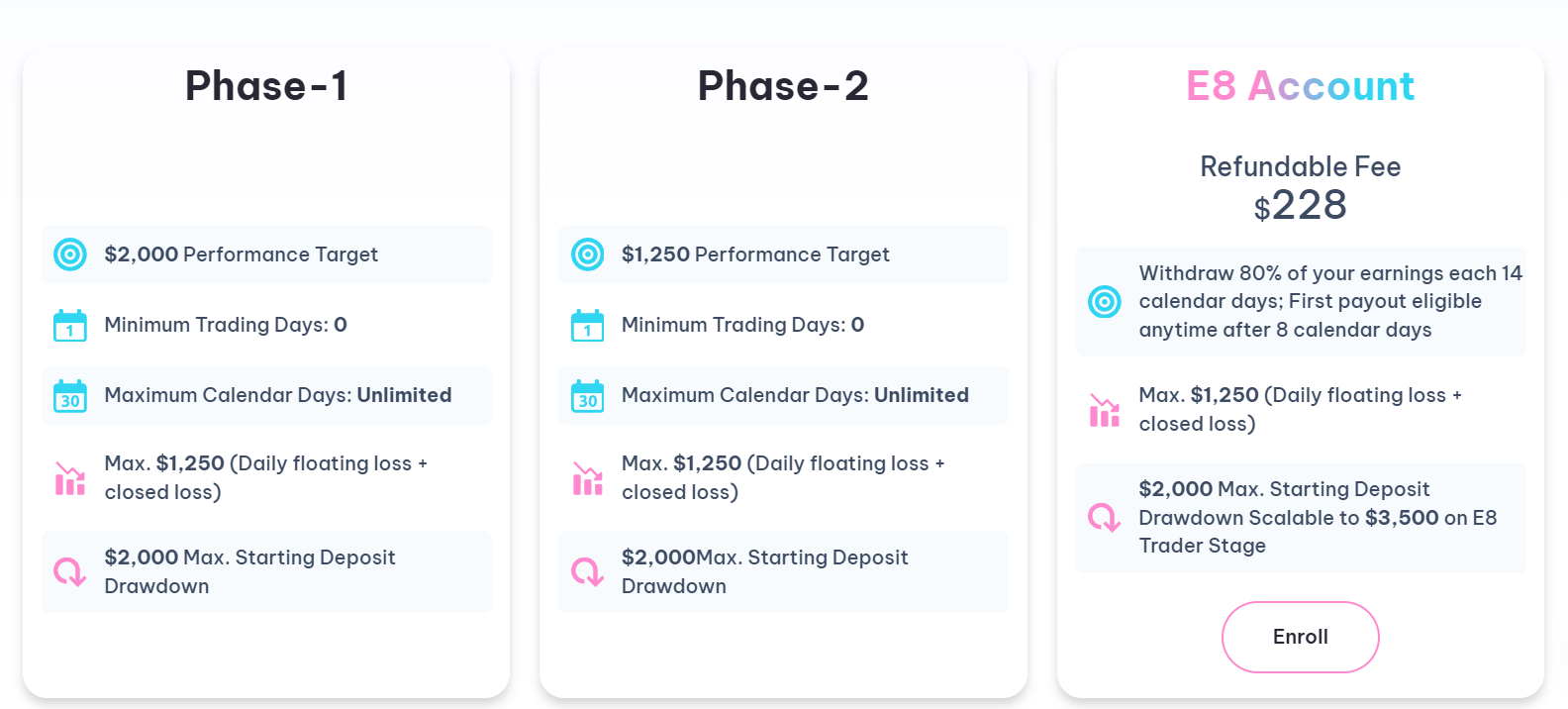

Accounts are divided into two categories, Normal and Extended, and offer different performance targets, with Phase 2 having a lower 5% performance target.

Traders can open their accounts in three base currencies – USD, EUR, and GBP.

The prop firm also offers scalability options, with the E8 Account being able to reach up to $1 million in total funding. Scalability is based on performance and traders can scale up in accordance with their profit percentage.

The Extended Account does not increase the funding limit, but comes with identical performance targets as the Normal Account.

The E8 Track account offers similar terms, with maximum funding up to $250,000.

While the prop firm does offer 4 different funding levels, the minimum starts at $25,000, which might not be the most beginner-friendly starting tier. Unlike many other prop firms, E8 Funding also does not have a $10,000 tier.

Assets – 4

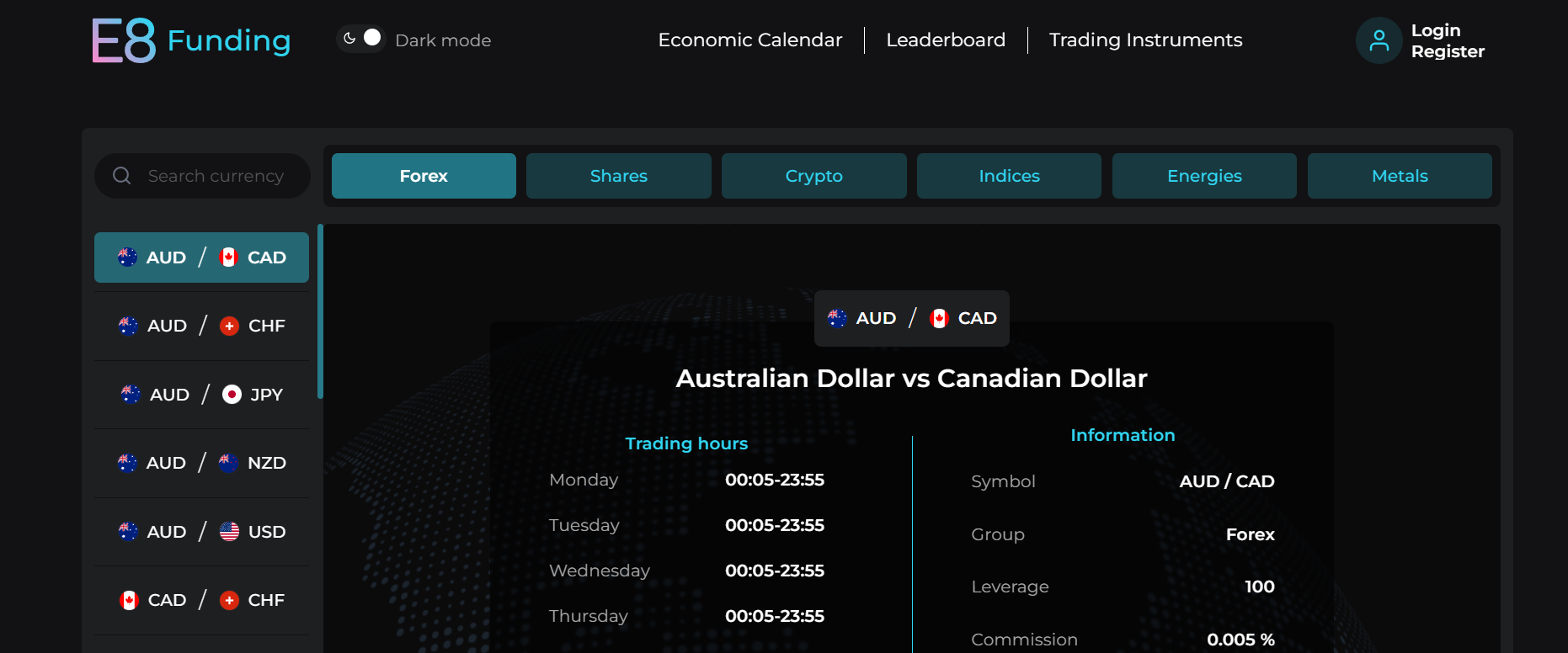

E8 Funding comes with a relatively diverse offering of asset classes, but with a limited individual count. The firm offers instruments, such as forex, shares, crypto, indices, energies, and metals.

There are a total of 39 currency pairs available for trading on E8 Funding, with a maximum leverage of 1:50 for major and exotic currency pairs.

In terms of its crypto offerings, E8 has a relatively limited lineup of BTC/USD, ETH/USD, LTC/USD, and XRP/USD. Maximum leverage offered for crypto trades is 1:5.

Users can also trade indices, such as US100, US30, US 500, and GER40, as well as WTI Crude Oil CFDs. XAG/USD (silver) and XAU/USD (gold) are also available. The maximum leverage for commodities and indices is 1:50.

It must be noted that while shares are mentioned on the list of instruments, the individual shares available are not specified.

Trading Rules and Limitations – 3.4

Trading rules and limitations are crucial for funded accounts. When it comes to the rules upheld by E8 Funding, it is important to note that the firm does not restrict any type of trading approach, rather, it has quite user-friendly drawdown limitations.

For example,the maximum total drawdown starts at 8%, but traders can gradually increase maximum drawdown up to 14%, which scales up after successful withdrawals.

On the contrary, the daily loss limit offered by E8 Funding is considerably more stringent at 5%.

E8 Funding does not have a maximum trading day limitation, while the Phase 2 of the Extended E8 Account comes with a 5-day minimum restriction.

Furthermore, the overall drawdown limit increases from 8 to 10% on the Extended E8 Account.

When it comes to the daily drawdown limit, E8 Funding caps it at 5% for all of its accounts.

The profit target is also quite friendly at 8% for Phase 1, which falls down to 5% for Phase 2 of the E8 Account, as well as for Phases 2 and 3 of the E8 Track.

The refundable fee for Phase One is $228 and is fully refunded when the Phase 2 of the E8 Account has successfully concluded.

The usage of EAs and automated trading, as well as weekend and overnight trades is fully permissible.

Platforms – 5

E8 Funding is not a brokerage and is not directly affiliated with regulated brokers. Rather, it provides simulated market conditions for traders using its E8X Dashboard, which comes with an intuitive design and a decent selection of tradable instruments.

Traders on E8 Funding have access to MetaTrader 4 and MetaTrader 5, two of the most popular forex and commodities trading platforms on the market.

The E8X Dashboard offered by E8 Funding comes with a few interesting features, such as an economic calendar and a leaderboard, where traders can compete with each other and are ranked in terms of performance, which adds a gamified element to the experience.

The E8X is available as a web-based platform, as well as a mobile application.

Aside from the leaderboard, E8 also offers the Anovo feature, which provides traders with an in-depth analysis of trading volume on the market.

While E8’s platforms allow for EAs, high-frequency EAs are prohibited, nor is the usage of the same EA by multiple traders.

Profit-Sharing and Withdrawals – 3

When it comes to profit-sharing, E8 has a fixed agreement of up to 80% of generated profits. There are no options for increasing this threshold for traders, who can withdraw their first profits after 8 days of opening a live account.

Withdrawals on E8 Funding can be finalized within 1-2 business days and can be done via wire transfers, credit/debit cards, crypto, and e-wallets, such as PayPal and Skrill, among others.

Fees – 2.5

The fee structure for each of the four funded account levels is as follows:

- $138 for the $25,000 account

- $208 for the $50,000 account

- $358 for the $100,000 account

- $598 for the $250,000 account

- Maximum $988 after account scaling (up to $1 million)

The refundable minimum audition fee is $228.

E8 Funding charges different commissions based on the asset of choice. The commissions and spreads can be broker down as follows:

- 0.005% commission on forex trades, with no lot limitations

- 0.005% commission on commodity trades

- No commission charges on indices

- 0.2% commission on crypto trades

- 0.3% commission on stock trades

Education and Trading Tools at E8 Funding – 1.8

The educational materials offered by E8 Funding are rather bare. The prop firm offers an economic calendar, which traders can use to highlight some key market updates and news releases to time their trades adequately.

In terms of additional educational features, such as webinars and blogs, E8 Funding is lacking some core features.

The E8X Dashboard offers performance measurement solutions for traders to easily evaluate their trades and track progress in real time.

Customer Support at E8 Funding

The customer support features include an English-language live chat, as well as a support email address.

Users can also send mail to the firm’s office. However, a hotline feature is lacking, as well as a multilingual support feature.

The live chat is fast and responsive and available from 4 am to 4 pm CST Monday-Friday, and 8 am to 1 pm CST on weekends.

Frequently Asked Questions

Is E8 funding a good prop firm?

What is the maximum drawdown at E8 Funding?

How much profit can you keep at E8 Funding?