Bulenox is a financial proprietary firm focusing on trader development. As its main focus, the firm offers trading challenges and funded accounts. This unique combination of learning and then starting to trade without risks on live accounts gives traders a chance to make a living by spending a little capital. However, it is crucial to dive deep and find out details of how safe the Bulenox firm is and if its services are worthy of our reader’s effort and attention. Let’s find out together.

Pros & cons of Bulenox prop firm

Pros

- Ability to withdraw with $0 fees and 100% profits for the first 10,000 USD

- The profit split is 90% after the first 10,000 USD

- Offers access to NinjaTrader

- Fast and digital account opening/verification

- Offers access to a multitude of futures for trading

- Lower profit target of 6%

- Very low monthly audition fees of 125 USD for a 50,000 USD account

- Most payment options are free and instant

Cons

- Trading assets are limited to futures on various assets

- No reviews and rank on the FPA

- Traders must control their drawdown closely

- Is a young company from 2022

Bulenox Quick Overview

| FPA Score | Not yet available |

| Year founded | 2022 |

| Headquarters | Wilmington, North Carolina, United States |

| Minimum audition fee | 125 USD per month |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 150,000 USD |

| Allowed daily loss | 6% |

| Profit target | 6% |

| Maximum trailing drawdown | 6% |

| Profit sharing (Payouts) | 90% after the first 10,000 USD withdrawals |

| Trading Platforms | NinjaTrader |

| Available trading markets | Futures on Forex, cryptos, commodities, and indices |

Safety of Bulenox – 1.5

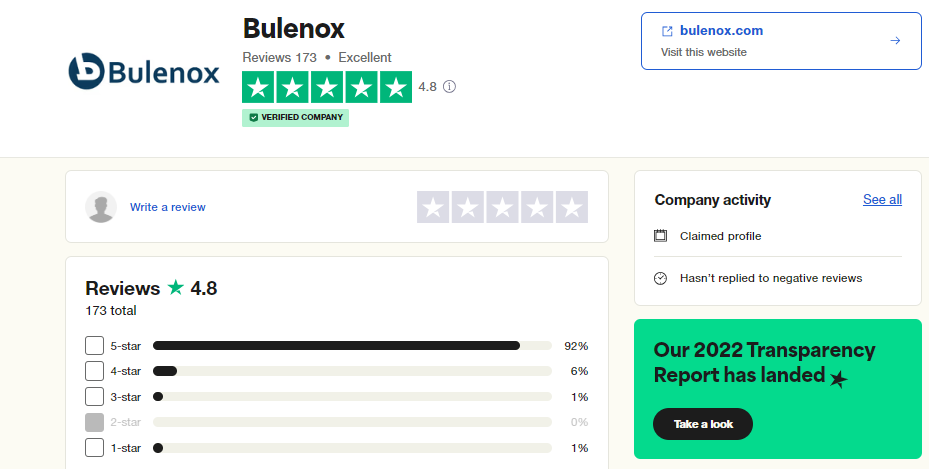

Bulenox was established in 2022 making it a relatively young company in the proprietary trading space. As a result, the company does not have an FPA score and evaluations yet. Despite this, Bulenox has amassed an impressive 4.8 rating on Trustpilot and has more than 170 reviews. The majority of comments are positive from current customers and traders.

The firm gets a 1.5 score in this section.

Bulenox Funding and maximum capital allocation – 3

Bulenox offers two accounts for funded trading. The first one is called a Qualification Account and is targeted to demonstrate the skills of a trader. Qualification account allows users to register an account, choose the preferable account size, and start trading to show results. Master accounts are for traders who want to start a substantial trading account without the need to invest their capital. It allows traders to get the first 10,000 USD account without commissions and earn up to 90% profits. The accounts are divided into different tiers.

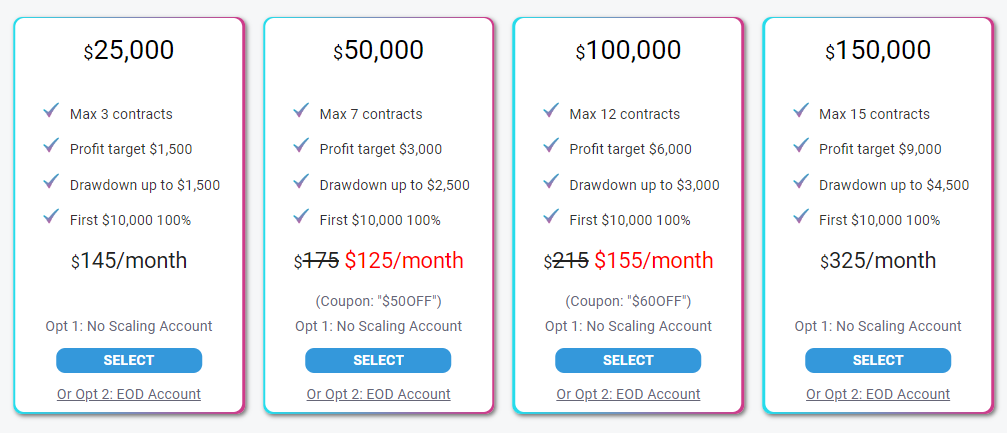

There are four tiers in total, with increasingly large funded amounts.

The first tier is 25,000 USD, a maximum of 3 contracts can be traded for each instrument, the profit target is 1,500 USD or 6%, the drawdown allowed is also 1,500 USD or 6%, and the profit split is 100% for the first 10,000 USD. The monthly fee for operating this account is 145 USD per month.

The second tier funded account is a 50,000 USD account with slightly different specs. The maximum number of contracts is 7, the profit target is 6%, drawdown is 2,500 USD. The profit split for the first 10,000 USD withdrawn is 100%. At the moment, the monthly payment is just 125 USD instead of the usual 175 USD. To get the discounted price, traders will have to use coupon code: “$50OFF”.

The 100,000 accounts will require 155 per month instead of 215 super attractive USD. Max contracts are 7, the profit target is 6,000 USD (6%), the drawdown is up to 3,000 USD (3%), and a similar profit split policy is active for the first 10,000 profits withdrawn. To buy this account for the monthly discounted price, the coupon code is: “$60OFF”

The fourth tier is a 150,000 USD funded account, which will cost 325 USD per month to operate. The profit target is 9,000 USD, max contracts are 15, and the drawdown allowed is 4,500 USD.

Bulenox Assets – 3

When it comes to trading assets, Bulenox provides access through its pattern brokers to a multitude of futures on Forex, indices, commodities, and cryptos. Futures include both Micro and E-Mini futures, together with physical futures on some agriculture and energy products. This can be super beneficial for traders who want to start a futures trading career but lack the required budget for it. The minimum monthly fee with a discount being 125 USD for a 50,000 USD funded account is a super spicy offer at the moment.

Bulenox Trading rules and limitations – 4

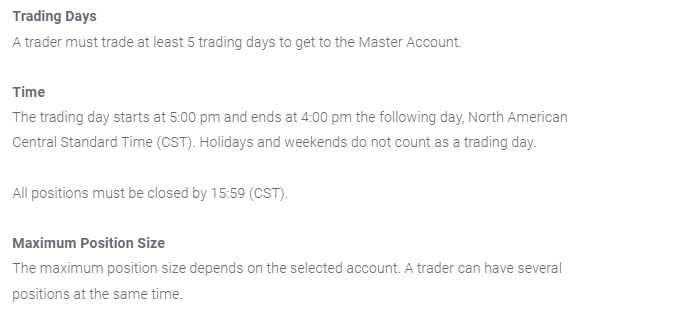

There are important rules and limitations when using funded accounts at Bulenox which every trader must know before signing up. The one rule is about the maximum drawdown policy and principle. Trailing drawdown follows the current balance in real-time, which is equal to the trader’s profit. Hence, the drawdown is recorded in real-time during the trading day, including commissions. In case the balance decreases, the drawdown remains unchanged and is calculated including the unrealized maximum profits and losses. In case of breaching the maximum allowed drawdown, the account gets blocked, and the trader can only reset or create a new account for the fee.

So, how does exactly this allowed drawdown work? Bulenox explains it with an example. If a trader has a 100,000 USD account, they have an unrealized profit on the current open position. This profit is around 800 USD, and the maximum drawdown that can be made is 97,800 USD. If a trader closes this trade for 500 USD profit, the drawdown remains at 97,800 USD. So, the drawdown follows the maximum profit the trader has made on the opened trading positions.

What this means is that traders have to be extremely careful when operating funded accounts at Bulenox not to miss their maximum drawdown levels.

Bulenox Fees – 4

There are commissions for different types of assets, ranging from 0.5 for E-Micro assets to 2.36 for futures trading.

Equity indexes commissions:

- E-mini S&P MidCap 400 Futures 2.09

- E-mini S&P 500 Futures 2.09

- E-mini Russell 2000 Futures 2.09

- E-mini NASDAQ 100 Futures 2.09

- Micro E-mini S&P 500 Futures 0.61

- Micro E-mini Nasdaq 100 Futures 0.61

- Micro E-mini Russell 2000 0.61

Cryptocurrencies commissions:

- Micro Bitcoin Futures 2.76

- Micro Ether Futures 0.46

Interest rates for futures trading:

- Eurodollar Futures – 2.01

Forex futures trading commissions:

- Australian Dollar Futures 2.36

- E-micro Australian Dollar Futures 0.5

- British Pound Futures 2.36

- E-micro British Pound Futures 0.5

- Canadian Dollar Futures 2.36

- Euro FX Futures 2.36

- E-Micro Euro FX Futures 0.5

- Japanese Yen Futures 2.36

- Mexican Peso Futures 2.36

- New Zealand Dollar Futures 2.36

- Swiss Franc Futures 2.36

Some commodities commission:

- Feeder Cattle Futures 2.86

- Lean Hog Futures 2.86

- Live Cattle Futures 2.86

- Crude Oil Futures, 2.26

- Micro Crude Oil Futures 0.76

- Natural Gas (Henry Hub) Futures 2.26

- E-mini Natural Gas Futures 1.26

- E-mini Crude Oil Futures 1.96

- Gasoline Physical Futures 2.26

The firm is very transparent and gives all the details about all commissions and fees on the website. Traders can see all the commissions for trading and account operating activities.

Traders can fund their accounts using a credit card, debit card, PayPal, or Crypto.

Bulenox Platforms – 5

Bulenox traders can initiate their trading positions using the NinjaTrader advanced platform. The platform is very suited for futures trading and offers all the needed functions that traditional Forex platforms like MT4 and MT5 lack.

Bulenox Profit-Sharing – 5

Bulenox has a very attractive profit split policy. It encourages traders by giving 100% of the profits for the first 10,000 USD to attract successful traders to its platform. After the initial 10,000 USD withdrawal, there is a profit split policy of 90%, meaning traders can get the majority of the profit share.

Education and trading tools at Bulenox – 3

There are no educational resources at the moment, but the firm offers a blog with live market updates and a comprehensive help center. These resources can help traders stay ahead of the curve and always be informed when something important happens related to US markets and futures.

Customer Support at Bulenox – 3

Bulenox has a live chat which is operational during the working hours of the trading week. This may seem like a slight inconvenience, but traders should get help during trading days in a quick manner. Both the website and support are multilingual and support three languages in total. Email support is available, but there is no phone support. All in all, we evaluate Bulenox support as acceptable.

Frequently Asked Questions

Is Bulenox a good prop firm?

What are the safety measures in place at Bulenox?