BrightFunded prop firm offers traders demos and simulated trading environments for their trading practices. The firm was launched recently in 2023, and it also claimed its Trustpilot account in the same year. Not allowing traders to access real markets and only providing them with a simulated trading environment raises some serious safety concerns, and we decided to look at the firm’s services closer. The firm is also very young and has not been tested over time for its reliability. Additionally, 15% of reviews on Trustpilot are 1-star evaluations, solidifying our safety concerns.

In today’s BrightFunded review, traders will learn about BrightFunded’s safety, assets, technology, education, rules, and more. After reading their review, you should know whether to trust this prop firm.

Pros

- Fast and digital account opening/verification

- High maximum trailing drawdown of 10%

Cons

- Low daily limit of 5%

- Only offers simulated accounts, does not allow traders to access live markets

- Does not offer access to MetaTrader 4, MetaTrader 5

- Extremely limited web-based trading platform

- Claims up to 100% profit-split

- No educational resources

- Offers a limited number of trading instruments

Quick rating of BrightFunded and its features

| FPA Score | Not yet rated |

|---|---|

| Year founded | 2023 |

| Headquarters | Amsterdam, The Netherlands |

| Minimum audition fee | 55 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 5,000 USD |

| Maximum funded amount | 200,000 USD |

| Allowed daily loss | 5% |

| Profit target | 8% |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | 80% (100% after scaling, red flag!) |

| Trading Platforms | Custom |

| Available trading markets | Forex, commodities, indices, cryptos |

Safety of BrightFunded — 0

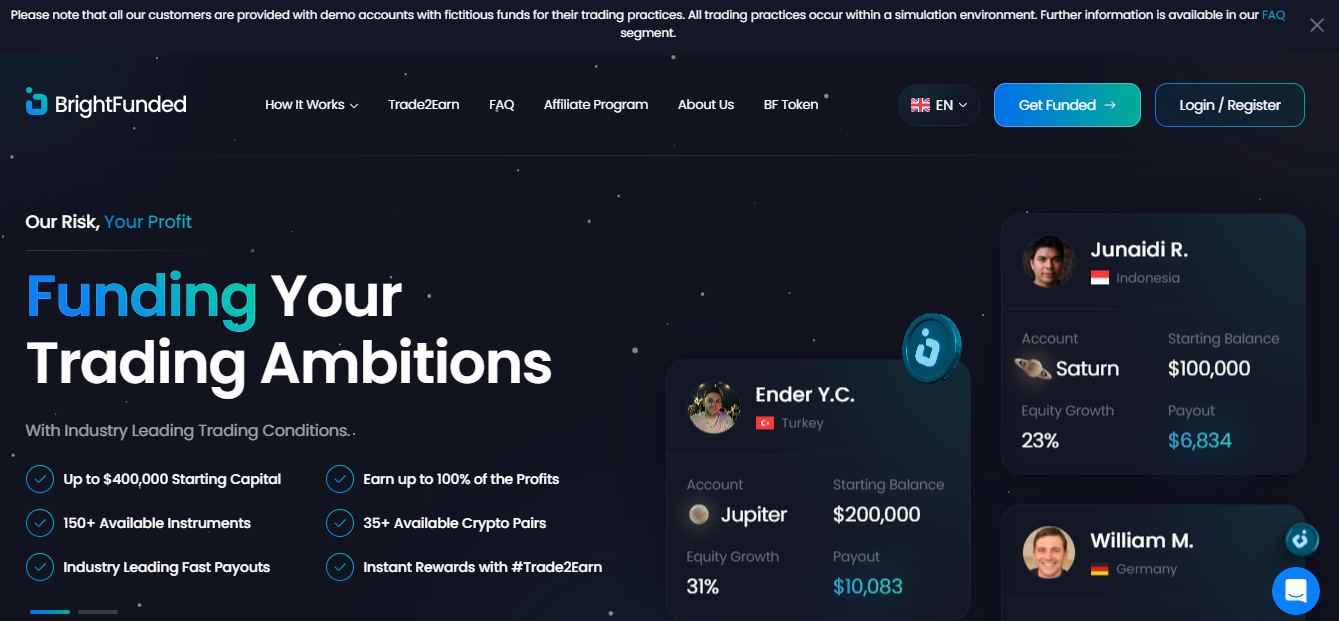

BrightFunded reviews are lacking on the FPA, as the firm was launched very recently and has lower online coverage. The brand awareness is low for BrightFunded and there are only 151 reviews on Trustpilot, of which 15% are 1-start assessments. The firm has lost points in both FPA and experience, and we decided to check if it offers trading services through the regulated broker. Unfortunately, the firm only provides a simulated trading environment meaning it has almost full control over the trading environment, which is never a good thing. The website is laggy and overcrowded with animations and different visual elements, which in the end worsen the experience of a user.

The firm gets a 0 score in this section for providing 0% of reliability.

BrightFunded Funding and maximum capital allocation — 3

BrightFunded funded program is not diverse and the firm has only one funded account type which offers funded options ranging from 5k to 200k. The funded account is a 3-step evaluation model, which makes it a super lengthy and frustrating process for the trader.

BrightFunded funding options include 5k, 10k, 25k, 50k, 100k, and 200k US dollars.

BrightFunded challenges have also minimum trading days, meaning traders can not get virtual funding right away if they are good traders, as they need at least 5 days of trading to progress to the next stage. The 3rd stage is the funded stage, where traders can trade in a simulated market environment and withdraw profits, but we could not confirm the firm allows traders to withdraw their virtual profits. This is a serious red flag, as BrightFunded won’t allow traders to get real funding and trade on real markets, which should be the main idea of prop trading. It is more like gaming or gambling than trading with BrightFunded and this defeats the purpose.

BrightFunded scaling plan offers traders the ability to increase profit split to 100% which is ridiculous. Prop firms make money by splitting profits with traders, and BrightFunded seems to be more of a charity than a prop trading firm. Not recommended!

The firm gets a 3 score in this section for offering funding options between 5k to 200k and not 1k to 1 million USD.

BrightFunded Assets — 2.5

Traders can trade on several virtual asset classes at BrightFunded including Forex pairs, indices, commodities, metals, and cryptos. The firm offers all these assets on its proprietary web trading platform, which is severely limited to truly catch serious price movements. The firm gets a 2.5 score in the assets department.

BrightFunded Trading rules and limitations — 0.8

BrightFunded rules are forgiving if the firm is not this suspicious. The daily loss limit is 5%, the maximum drawdown is 10%, and the profit target is 8%. The firm has hidden rules as it is difficult to find other hard breach rules, making it very risky to apply to its funded accounts.

BrightFunded gets a 0.8 score in the rules section.

BrightFunded Fees — 1.5

BrightFunded free trial is not available at the moment and traders have to pay to sign up and purchase the funded accounts.

BrightFunded prop trading firm has competitive fees for its funded accounts from 55 USD, but since the firm does not provide traders access to real capital, it is not worth investing.

BrightFunded free repeat is not available, but traders can get refunds if they succeed in a 3-step evaluation process and won’t get frustrated along the way. The firm gets a 1.5 score in this section for offering a low initial funding fee.

BrightFunded Platforms — 0.9

The firm offers its proprietary trading platform, which is built inside the trader dashboard. The platform, however, is severely limited to only basic features, and analyzing and trading markets is not possible. Since the firm does not allow traders to access real markets, the absence of advanced trading platforms is understandable. BrightFunded gets a 0.9 score in this section for only offering the web-based platform with limited functionality.

BrightFunded Profit-Sharing — 3

BrightFunded profit split starts at 80% and after traders are profitable use a scaling plan capped at 100%. This is a serious red flag, along with the fact that the firm won’t allow traders to access real markets. Prop firms should be making money by splitting traders’ profits and not by their fees. We strongly recommend traders to stay away from BrightFunded. This 100% profit sharing is more of a marketing gimmick, as most of the traders won’t even pass the stage 1 evaluation. The firm gets a 3 score in this section.

Education and trading tools at BrightFunded — 0

BrightFunded does not offer any educational experience unless we consider its whole simulation trading thing as an educational resource. However, traders still need to pay for these simulated accounts, which is not sufficient as many prop trading firms offer superior education for free. The firm is not focused on education at this moment at all, so it gets a 0 score in this section.

Customer Support at BrightFunded — 2.4

The firm offers mail and live chat support channels for users. There is no hotline support, which is a drawback and also a red flag. The website is multilingual, but the support is only in the English language. The support is available 24/7.

The firm gets a 2.4 score in this section for only offering live chat and email support and not a hotline with a multilingual option.

Frequently Asked Questions

Is BrightFunded legit?

Is a BrightFunded good prop firm?