Audacity Capital is a globally recognized prop firm that was established back in 2012. Since then, the firm has become a brand funding talented traders in more than 140 countries. The firm emphasizes values of transparency, respect, and fairness. The firm has an aim of establishing a long-term partnership with its traders.

Audacity Capital offers account doubling once the 10% profit target is hit, up to 480,000 USD. Starting from 15,000 USD funded accounts, successful traders can quickly find themselves managing half a million dollar trading accounts. Since Audacity Capital seems this attractive, we decided to conduct an unbiased full review to find out how the company is up to its claims.

Pros & cons of Audacity Capital prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to Forex pairs, indices, commodities

- Account funding doubles after every 10% profit milestone

- Higher daily loss limit of 10%

- Most payment options are free and instant

- Accepts direct crypto transactions

Cons

- High MT4 setup fees from 405 USD

Audacity Capital Quick Overview

| FPA Score | N/A |

| Year founded | 2012 |

| Headquarters | London, UK |

| Minimum audition fee | 129 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 480,000 USD |

| Allowed daily loss | 10% |

| Profit target | 10% |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | 50-85% |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Available trading markets | Forex, indices, commodities |

Safety of Audacity Capital – 3

Audacity Capital is well-reviewed on Trustpilot and has years of experience in the industry. The only downside is that there are no reviews and user rankings on the FPA platform. Other than FPA, the company is legit. From over a thousand reviews, 95% of traders agree that the company deserves a 4.6 ranking, which is a legit excellent score.

We give a 3 score to Audacity Capital in safety because of the lack of FPA review and ranking.

Audacity Capital Funding and Maximum Capital Allocation – 3

There are four different funding programs at Audacity Capital including the funded trader program, ability challenge, flex trader program, and pro trader program.

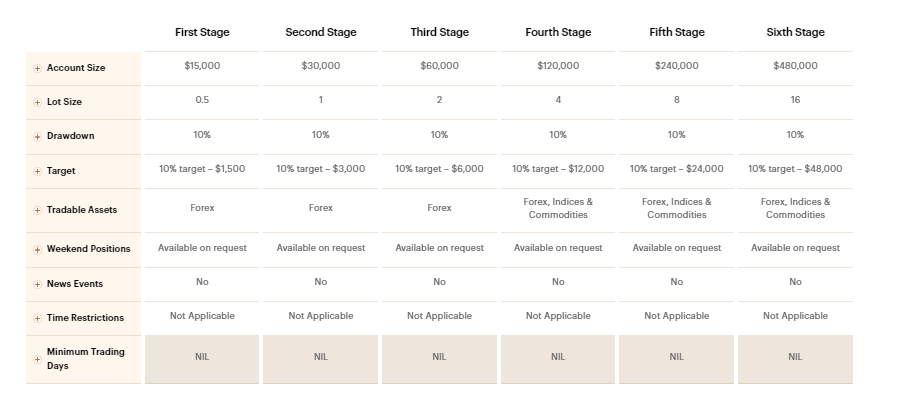

Funded trader program specs:

- The minimum audition fee for funding account –

- Account size 15,000 USD – 480,000 USD

- Lot Size – 0.5 lots every 15,000 USD on the account up to 16 lots

- Drawdown – 10% for all funded accounts

- Profit target – 10% on all funded accounts

- Tradable assets – Forex, indices, and commodities

- Weekend positions – available on request

- News events trading – Not allowed

- Time restrictions – No restrictions

- Minimum trading days – No restrictions

- Profit split – 50/50

- No liability for losses

- No commissions or swaps

Ability Challenge rules and conditions:

- The path to funding – Enter the challenge, verify, become a trader

- Maximum daily drawdown during the challenge phase- 7.5%

- Maximum daily drawdown during verification – 5%

- Maximum daily drawdown with a live account – 5%

- Minimum trading days – 4

- Maximum absolute drawdown – 10%

- Period – Unlimited

- Profit share only for live account – up to 85%

- Refundable fee – 129 USD

- Funded amount range – 10,000 – 240,000 USD

Flex Trader Program Specs:

- Minimum funded amount – 15,000 USD

- Maximum funding amount – 480,000 USD

- Audition fee – 372 USD

- No time restrictions on active trading days

- Account doubles every time trader reaches 20% profit

- Absolute drawdown – 20%

- Daily drawdown – 7.5%

- Weekend positions – subject to approval from risk management

- Major news event trading – Not allowed

- Profit withdrawals – can be withdrawn after 20% profit

Pro Funding Program conditions:

- Minimum funded amount – 30,000 USD

- Maximum funded amount – 480,000 USD

- Profit target – 10%

- Account doubles every 10% profit milestone

- The absolute maximum drawdown – 10%

- No commissions or swaps

- Lot size restrictions – 1 lot for every 30,000 USD account

- Weekend positions – subject to approval by the risk management team

- Major news event trading – Not allowed

- Payout processing time – within 48 hours after reaching 10% profit target

- Minimum audition fee – 372 USD

Audacity Capital searches for traders who can show at least 3 – 6 months of profitability live trading profitability to ensure consistency and long-term relationships. Once profit targets are reached, traders can double their funded account if they request.

The company is not offering 1 million trading accounts nor 1,000 USD accounts and gets 3 points here.

Audacity Capital Assets – 3

The firm offers three main classes of assets for trading, including Forex pairs, indices, and commodities. All tradable instruments within these classes are provided by top liquidity providers, ensuring low spreads and commission-less trading.

There are no stocks and cryptos for trading and the firm gets a bit lower 3 score in this section.

Trading rules and limitations at Audacity Capital – 4.3

Traders are not personally liable for losses, with a maximum drawdown of 20% to protect their equity. 20% is more than the majority of other prop firms and is super attractive. Any profitable traders can achieve this maximum drawdown rule without an issue. The daily drawdown is very flexible at 10% allowing traders to employ more aggressive risk management strategies. There are no time restrictions, taking away psychological pressure from traders.

For flexible and trader-oriented trading rules and limitations, we give the firm a 4.3 score in this section.

Audacity Capital Fees – 3.5

There is a setup fee for opening a funded trading account, which is around 247 USD. The account itself costs 125 USD, but since there is no option to start trading without an account set up, the total cost for the starter pack is 372 USD for the funded trader program on the MT5 trading platform. This fee is higher for getting an MT4 account and is 405 USD for a 15,000 account. The Ability Challenge account is the cheapest from 125 USD, which is super attractive for any prop firm at the moment.

A 3.5-point score in this section for Audacity Capital. If the company starts offering promos and discounts in the future, this score will be improved.

Audacity Capital Platforms – 5

The firm offers both MT4 and MT5 advanced trading platforms through its regulated partner brokers. Both platforms can be used on any device including mobile and Desktop and offer unparalleled trading functionality. The broker also offers tutorials and guides on how to use these platforms, making it accessible even for beginners.

We give the firm a 5 score in this section for offering top-notch trading platforms with advanced functionality and a multitude of device support.

Audacity Capital Profit-Sharing – 3

The profit split can be different depending on the funded account type. The minimum profit split starts from 50% and can reach 85% on the ability to challenge funded accounts. The 85% profit split is very competitive and places Audacity Capital among the top prop firms currently on the market.

Education and trading tools at Audacity Capital – 5

When it comes to education, Audacity Capital offers professional training programs to help beginners transform into professional traders. There are several programs in this section such as the hidden talent program, introduction to trading course, advanced trading, and combined course. Together with specialized paid courses, there is an educational section on the website offering an abundance of educational resources and trading tools. Free education also includes beginner forex trading courses and popular Forex strategies.

The hidden talent course has been around for more than 10 years, which is not a short time for any prop firm. This course teaches technical and fundamental analysis, intermarket analysis, trading psychology, and risk management.

The introduction to trading course costs 650 GBP and includes a 5-day in-house trading course in London. The fee for 5 days may seem expensive, but sitting with experienced traders, learning, and seeing what they are doing every day may be an experience worth the money.

Similarly to the introduction to the trading course, the advanced trading course is also a 5-day course in London conducted by expert trainers. This course is aimed at already experienced traders and offers to improve their skills even further. Traders will learn Audacity Capital’s unique Fibonacci-based trading strategy together with advanced risk management, psychology, and fundamental analysis concepts. This course can be taken in conjunction with the introductory course mentioned earlier for beginners.

The combined course is a combination of several courses and includes 10-day in-house training in London, where Audacity Capital’s headquarters are located. The course costs 999 GBP and aims at offering maximum value to beginner traders who want to get high-quality education about financial markets trading. The course also includes an MT4 platform tutorial. The combined course can be taken in conjunction with the advanced trading program 5-day course.

As we can see, Audacity Capital has two main business models, one is funding the experienced, and successful traders and another is creating profitable traders with its advanced and beginner trading courses. This is why the firm deserves a 5 rank score in the educational section.

Customer Support at Audacity Capital – 5

Customer support is provided through various channels at Audacity Capital including live chat, email support, phone support, and offices in London for local traders. All support forms including the website are provided in more than 5 languages, which is excellent for foreign traders who want to get a better experience for both trading and support.

We give Audacity Capital a 5 score in this section as well, and all the forms are offered in multilingual format.

Is Audacity Capital a good prop firm?

What are the funding and capital allocation options at Audacity Capital?

How does Audacity Capitals profit-sharing work?