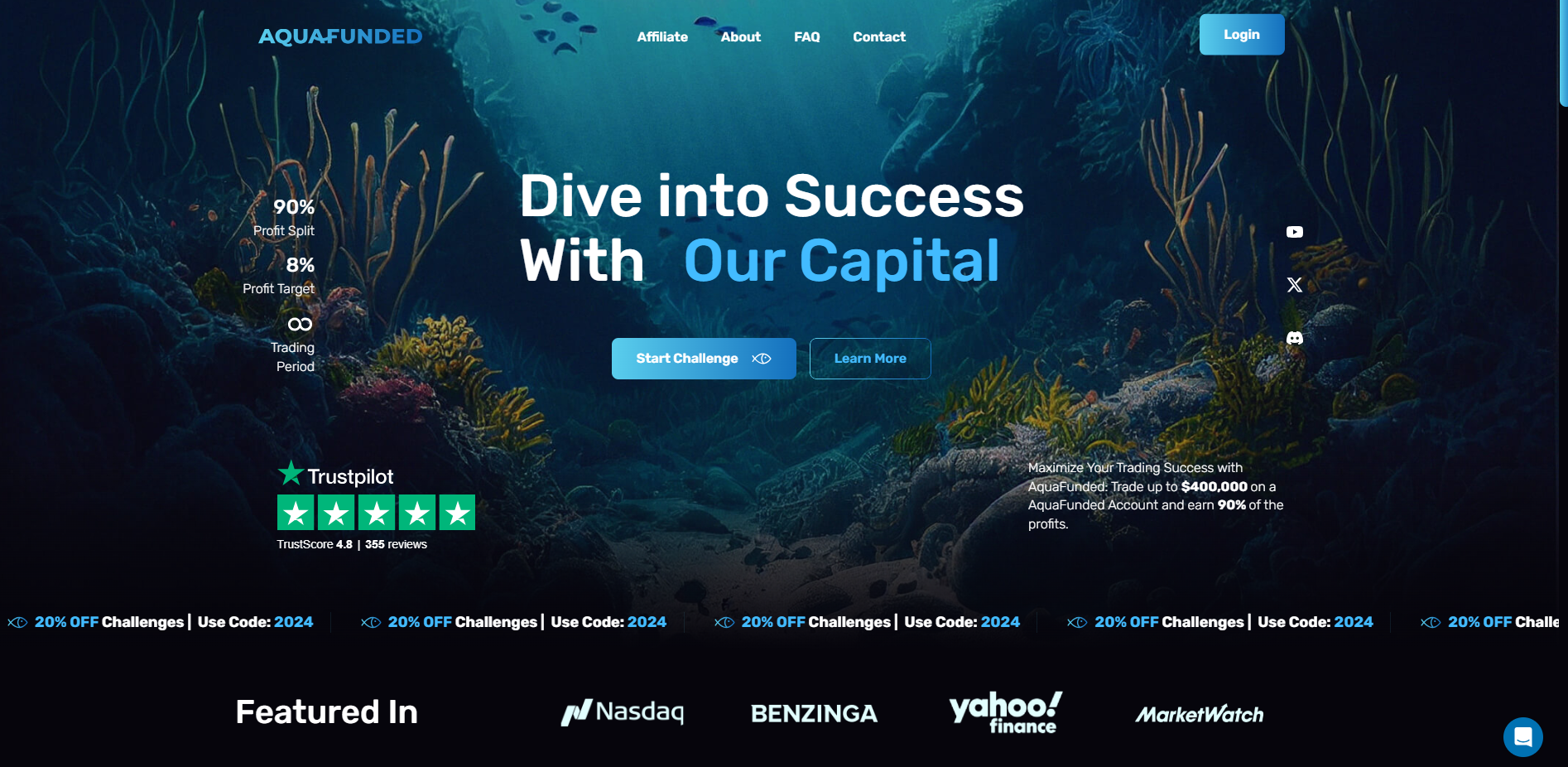

Headquartered in Dubai, the United Arab Emirates, AquaFunded offers account funding plans to traders that can successfully complete the prop firm’s challenges. The funding options range from 10,000 USD to 200,000 USD. However, successful traders can increase the account balance to a maximum of 400,000 USD.

The company was founded in 2023, and is inexperienced. However, the prop firm is partnered with well-regulated Forex broker, Purple Trading, which increases safety levels. Let’s delve into challenge details, safety, available assets, profit-sharing ratios and more. Our goal is to aid you in the prop firm selection process.

Pros & cons of AquaFunded prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, and cTrader

- Fast and digital account opening/verification

- Offers access to currency pairs, commodities, indices, and CFDs (Contracts for Difference) on crypto

- Lower profit target of 5% (and 3% target for 1-phase plan users)

- No pressure trading. Traders can take as long as they want to hit trading goals

- Offers professional customer service

- High profit split ratio is offered. Traders get to keep 90% of their profits, and 10% remains with the company.

- Traders have the option to choose between 2-phase and 1-phase funding plans.

- 5 account funding options are available from 10k USD to 200,000k USD.

- Up to 100:1 leverage is available with AquaFunded, which is higher than what most competitors are offering.

Cons

- Traders are not allowed to trade shares as CFDs despite the fact that the prop firm’s partner broker offers company shares for trading

- Traders from Cuba, Iran, North Korea, Syria, Pakistan, Vietnam, Kenya, or Maynmar cannot participate in AquaFunded’s challenges.

Safety of AquaFunded trading – 1.5

AquaFunded is a fresh company opened in December 2023, and it has not been rated by the FPA (Forex Peace Army) yet. However, the company operates through a licensed broker, which means the company can be trusted. AquaFunded is partnered with Purple Trading. The international branch of Purple Trading, is accepting AquaFunded traders and is operated by AXSE Brokerage Ltd. AXSE Brokerage Ltd. is licensed and regulated by the Seychelles Financial Services Authority (SFSA), with the license number SD041.

Funding and Maximum Capital Allocation at AquaFunded – 3

The company offers 5 funding plans. And traders have the option to use 1-phase, or 2-phase challenge models. Each plan comes with different terms and conditions, and traders are required to deposit different one time fees to be allowed to participate in the challenge. It should be mentioned that the participation fees are fully refundable upon successful completion of the trading challenge.

The fees we display are regular participation costs. Often AquaFunded offers discounts to its clients.

| Funded account balance | 10, 000 US Dollars | 25, 000 US Dollars | 50, 000 US Dollars | 100, 000 US Dollars | 200, 000 US Dollars |

|---|---|---|---|---|---|

| 2-phase challenge participation fee (fully refundable) | 67 US Dollars | 187 US Dollars | 287 US Dollars | 487 US Dollars | 967 US Dollars |

| 1-phase Challenge participation fee (fully refundable) | 97 US Dollars | 197 US Dollars | 297 US Dollars | 497 US Dollars | 997 US Dollars |

Assets – 3.5

Available assets for trading are currency pairs, indices, commodities, and cryptocurrencies as CFDs. Unfortunately, traders are not offered shares for trading.

It’s worth mentioning that the commodities, cryptocurrencies, and indices offered are all CFDs (Contracts for Difference). The main advantage of trading CFDs is that they are specially designed for market speculations. CFDs are best for short and medium term trading, while real or also known as physical assets such as crypto coins, real company shares, and physical precious metals are utilized for long term investing.

CFDs enable traders to use leverage. Up to 100:1 leverage is available with AquaFunded, which is higher than what most competitors are offering. In addition, traders can go long or short and benefit from even bear markets. Furthermore, CFDs are more liquid than underlying asset markets and therefore provide tighter spreads to traders.

Trading Rules and Limitations – 3.4

AquaFunded is one of the few companies that doesn’t have any restrictions on which trading styles their clients use. Traders are allowed to trade news, use martingale, or hedging strategies. Traders are also allowed to keep trades open for weekends.

For challenge rules and limitations, let’s take a look at the table below. Keep in mind that the rules are the same for all funding plan users, from 10K USD accounts to 200K USD accounts.

| Challenge type | 2-Phase challenge | 1-Phase challenge |

|---|---|---|

| Trading Period | Unlimited on each phase | unlimited |

| Minimum Trading Days | 0 days on each phase | 0 days |

| Maximum Daily Loss | 5% on each phase | 3% |

| Maximum Loss | 8% on each phase | 6% |

| Profit Target | 8% on first phase, 4% on Second phase | 9% |

Fees – 5

AquaFunded has one of the lowest fees in the industry. There are no withdrawal fees from the broker’s end when traders are withdrawing profits. The AquaFunded’s partner company, Purple Trading broker, offers spreads from 0 pips. And audition fees start from 67 US Dollars. In addition, AquaFunded often offers audition fee discounts to its clients.

Platforms – 5

Purple Trading, which is AquaFunded’s partner Forex broker, offers MetaTrader 4 (MT4), and cTrader trading platforms to its clients. The platforms are suitable for desktop, mobile, and web trading devices. The mobile versions of MT4 and cTrader are suitable for iOS and Android users. Both platforms have algorithmic trading features and capabilities. MT4 uses MQL4 coding language, while cTrader uses #C.

cTrader is more modern looking and comes with more preinstalled indicators and time frames than MT4. MT4 is the most popular Forex trading platform and has the largest pool of custom-built trading algorithms. Both platforms are highly reliable and provide traders with all the tools necessary to conduct proper market analysis and execute trades efficiently.

Profit-Sharing and Withdrawals – 5

AquaFunded offers industry leading profit-sharing ratios. Traders get to keep 90% of their profits, while the company keeps only 10%. Most competitors of AquaFunded offer 80/10 or lower ratios.

Education at AquaFunded prop firm – 0

Access to quality education is critical for any trader, especially for beginners. Traders need to prepare themselves accordingly to participate in the financial markets first, before opening a trading account. It’s crucial for traders to be able to manage their emotions, risks, plan their trades and trade their plans, and have clear and achievable goals. Unfortunately, we couldn’t find any educational material on the prop firm’s main page. AquaFunded is a fresh company and hopefully tools for market research and educational e-books, market analysis blogs, webinars, and seminars will be added to the offerings in the future.

Customer Support at AquaFunded – 3.6

Customer support plays an important role for every customer oriented company. AquaFunded provides traders with professional customer support accessible via email, over the phone and using a live chat.

Frequently Asked Questions

Is it hard to successfully pass the AquaFunded challenge?

Is AquaFunded legit prop firm?

How does AquaFunded profit slip work?

Are there any geographical restrictions for traders that wish to participate in the AquaFunded challenge?