Apex Trader Funding is a Forex proprietary firm offering funded accounts to online financial traders. The company aims to offer low-cost flexible contract plans with minimal rules to assist traders in maximizing their performance. The founder is an ex-funded trader who wanted to develop a prop firm that offered better terms to all traders. As a result, the firm does not prohibit news trading or trading during holidays. There are no daily drawdown limits or scaling requirements, which seem super attractive. Since the firm seems top-notch with its flexible and trader-oriented conditions, we decided to take a closer look at all important aspects and will provide detailed information in this unbiased review below.

Pros & cons of Apex Trader Funding prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to NinjaTrader and Tradovate

- Fast and digital account opening/verification

- Offers access to diverse trading assets within futures

- No daily drawdown limitations

- Lower profit target of only 6%

- 100% of profits can be withdrawn up to 25,000 USD and 90% profit split after that

- Allows trading during news and holidays

- Most payment options are free and instant

Cons

- All tradable instruments are futures

Apex Trader Funding Quick Overview

| FPA Score | Not yet available |

| Year founded | 2021 |

| Headquarters | Austin, Texas, USA |

| Minimum audition fee | $137 per month |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 300,000 USD |

| Allowed daily loss | No limits |

| Profit target | 6% |

| Maximum trailing drawdown | None |

| Profit sharing (Payouts) | 100% for the first 25,000 USD, 90% |

| Trading Platforms | Tradovate, NinjaTrader |

| Available trading markets | Futures for interest rates, commodities, indices, FX pairs, cryptos |

Safety of Apex Trader Funding – 3

The firm has no evaluations and comments on the FPA, even though it has been around for a while now. Despite this, there are plenty of positive comments and evaluations on Trustpilot. The firm has a 4.8 score, which is super impressive. Getting a 4.8 score from 4200 traders on Trustpilot really requires offering them real value and flexible terms. This is understandable as the company was established by an ex-funded trader who understands exactly what a trader needs when operating a funded account.

The only reason Apex did not receive a 5 score in safety is the lack of FPA reviews and comments.

Funding and maximum capital allocation – 5

All the funding options are cheaper than competition and have very easy rules to follow. The minimum funded account traders can get starts from m25,000 USD which is totally fine for futures trading in the USA.

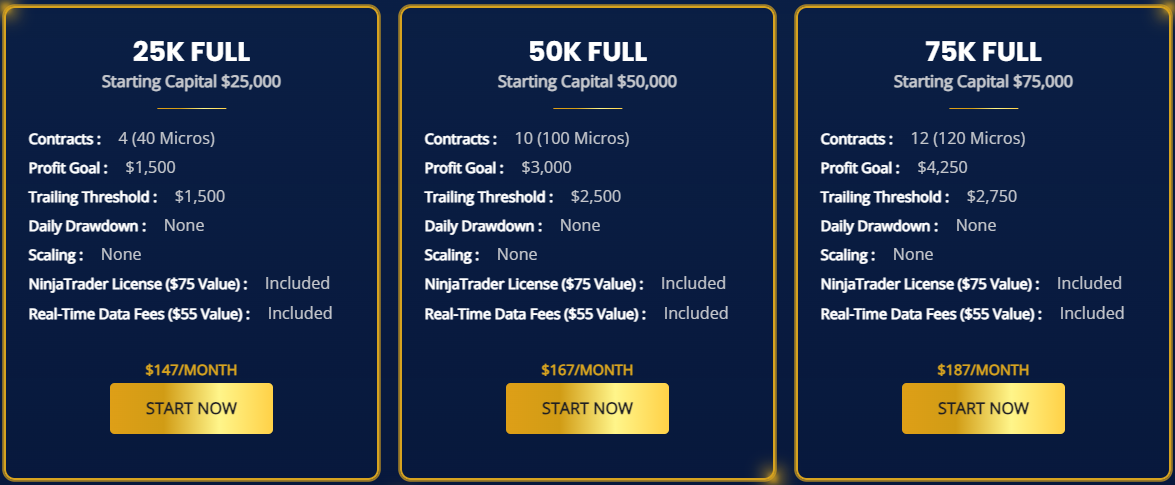

Below are the specs for each one of the funded account options.

25k Full:

- Starting capital – 25,000 USD

- Contracts – 4 (40 micros)

- Profit target – 6%

- Daily drawdown limit – No restrictions

- Scaling – Not required

- Fee – 147 USD per month

50k Full:

- Starting capital – 50,000 USD

- Contracts – 10 (100 micros)

- Profit target – 6%

- Trailing threshold – 5%

- Daily drawdown limit – No restrictions

- Scaling – Not required

- Fee – 167 USD per month

75k Full:

- Starting capital – 75,000 USD

- Contracts – 12 (120 micros)

- Profit target – 6%

- Trailing threshold – 5%

- Daily drawdown limit – No restrictions

- Scaling – Not required

- Fee – 187 USD per month

100k Full:

- Starting capital – 75,000 USD

- Contracts – 14 (140 micros)

- Profit target – 6%

- Trailing threshold – 5%

- Daily drawdown limit – No restrictions

- Scaling – Not required

- Fee – 207 USD per month

150k Full:

- Starting capital – 150,000 USD

- Contracts – 17 (170 micros)

- Profit target – 6%

- Trailing threshold – 5%

- Daily drawdown limit – No restrictions

- Scaling – Not required

- Fee – 297 USD per month

The similar specs are for the remaining accounts of 200k, 250, 300k, and 100k static accounts.

The smallest monthly fee is for a 100k static account 137 USD per month.

Apex Trader Funding deserves a 5 score in this section for its excellent packages.

Apex Trader Funding Assets – 3

Apex Trader Funding offers futures of all kinds and types. The list of some of these futures is as follows:

- Equity Futures – E-mini S&P 500, Nikkei NKD, E-mini NASDAQ 100, Mini-DOW, etc

- Interest rate Futures – Micro 10 Year Yield futures, 2-Year Note, 5-Year Note, etc

- Currency Futures – AUD, GBP, CAD, Euro FX, JPY, etc

- Agricultural Futures – Lean Hogs, Live Cattle, Feeder Cattle, Corn, Wheat, etc

- Energy Futures – Crude oil, Mini Crude oil, Natural Gas, etc

- Metal Futures – Gold, Silver, Copper, Platinum, palladium, E-mini silver, E-mini gold

- Micro futures – Micro E-mini futures of indices (S&P 500, Dow Jones, Nasdaq-100, etc.)

- Cryptocurrencies—Micro Bitcoin, Micro Ethereum

We have to give the firm a 3 score here due to a lack of other assets for trading. Despite this low evaluation the firm still offers a multitude of assets in the form of futures.

Trading rules and limitations at Apex Trader Funding – 5

The firm allows for 23 hours a day of trading from between 6 PM one day to closing all positions and orders by 4:59 PM ET the next day ET. This will enable traders to freely conduct trading activities and do not care about time restrictions. Trading during major news events and holidays is also allowed at Apex Trader Funding.

There are no daily drawdown limits, either, making trading at Apex compelling. It feels like trading on your account with your money, as there are no complicated restrictions and rules to knock traders down.

There is only one evaluation step of 7 days trading and after that traders are free to operate their funded accounts with little rules.

If a trader trades more than the allowed contracts, the platform automatically rejects the additional trade without closing the funded account.

All trading strategies and methods are allowed as long as the trader sets a trailing stop loss.

With all that said, Apex Trader Funding gets a well-deserved 5 score in this section.

Apex Trader Funding Fees – 4

The fees are low and transparent. The smallest monthly fee for operating a 100k static account starts from 137 USD per month. Traders can reset accounts if they break the rules for 80 USD. There are no other hidden fees and commissions for trading, and Apex Trader Funding seems one of if not the best prop firms out there for futures trading.

We evaluate Apex with a 4 score in the fees section.

Apex Trader Funding Platforms – 5

Apex Trader Funding offers two trading platforms, NinjaTrader and Tradovate. Both platforms are an excellent choice for futures trading and since Apex offers only futures in diverse asset classes, these platforms are suitable. There is no MT4 or MT5, but it is fine as none of them are suitable for futures trading.

There is no functionality traders can not find with NinjaTrader and Tradovate when trading futures, a 5 score here as well.

Apex Trader Funding Profit-Sharing – 5

Apex has one of the best profit-sharing policies on the market right now. For the first 25,000 USD withdrawals, the company gives 100% profits to traders and only picks 10% after that. What this means is that the trader can start earning serious money and get 90% of profits after the first 25,000 USD. In the reality of Forex prop firms, this is quite a rare occasion.

There is no other prop firm allowing 100% profits withdrawal on the first 25,000 USD profits. This is a huge encouragement for beginner traders to become even more successful, and Apex seems to be targeting a long-term relationship with this approach, adding to its legitimacy. A well-deserved 5 score in this section for sure.

Education and trading tools at Apex Trader Funding – 5

There are plenty of technical tools and services offered that are fully aimed at making traders’ lives easier. It is even possible to open multiple funded accounts and manage them with just one click using trade copier services.

Apart from tools, there is a free education, tools, and trade room available allowing traders to learn along the way.

Apex is focused on attaining longtime successful traders and does so by offering top-notch services, tools, and educational resources.

There is also a comprehensive FAQ section available, which is both an advantage and a downside of the firm. Much information that is crucial for opening and setting up an account comes in the FAQ section. The pricing and other details are also available in this section.

Every metric for getting a 5 score in the educational section has been met by the firm.

Customer Support at Apex Trader Funding – 5

One of the many reasons why Apex Trader Funding got 4.8 points on Trustpilot is its excellent customer support services. So, we checked and evaluated this section in detail.

There is an advanced live chat option that allows accessing quick FAQs and also contacts the broker representatives. Here is also an option for leaving a message, which is advanced email support. Surely, email support and phone support are both operational. Both the support and website are multilingual and available in a multitude of languages.

We evaluate Apex Trader Funding with 5 points in the support section as well.

Frequently Asked Questions

Is Apex Trader Funding a good prop firm?

What are the fees associated with Apex Trader Funding?

Can I trade cryptocurrencies with Apex Trader Funding?