Alphachain is a proprietary forex trading firm offering capital funding for trading. The firm offers several educational courses where traders can learn and become funded traders. The company has been in the business since 2019 and seems a legit company. However, there is no direct way to buy a funded account, rather traders must complete any trading courses offered by the firm. This makes the firm an expensive prop firm, but a competitive trading education provider. While 1,950 GBP is very expensive for a funded account of 10,000 USD, it is a very attractive price for getting quality trading education.

Let’s dive into Alphachain’s services and rules and find out if you can trust them together.

Pros & cons of Alphachain prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 5

- Fast and digital account opening/verification

- High maximum leverage of 1:100

- Offers access to FOrex, cryptos, indices, and commodities

- There is no daily loss limit, but weekly

Cons

- Super how fees for getting funded accounts

- There is no direct way to buy a funded account

- Withdrawals take up to 7 working days

- The profit split is only 50%

Alphachain Quick Overview

| FPA Score | Not available |

|---|---|

| Year founded | 2019 |

| Headquarters | London, UK |

| Minimum audition fee | 1,950 GBP |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 20,000 USD |

| Allowed weekly loss | 5% |

| Profit target | 10% |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 50% |

| Trading Platforms | MetaTrader 5 |

| Available trading markets | Forex, cryptocurrencies, commodities, indices |

Safety of Alphachain – 3

There is no review or ranking score on FPA about Alphachain, so we checked the Trustpilot to find out what other traders were saying about the company. The comments and reviews are mostly positive and indicate the company is fair and offers good quality services to its traders.

The firm gets a 3 score in this section as there are no reviews and ratings on major reputable platforms like the FPA.

Funding and maximum capital allocation – 1

The funding is offered through diverse programs and courses. There is no combined page to show different funding details such as maximum and minimum funding, fees, and other details, which is a huge disadvantage. It is therefore complicated to find exactly what you are looking for on the Alphachain website. We have researched the website of the firm and will offer all the necessary details to our readers.

There are in total three funded program types: professional programs, specialist programs, and post-training membership. The post-training membership will cost traders 140 GBP per month to get benefits such as access to live data feeds, trading platform, 24/5 platform maintenance, 1-2-1 mentoring with the CEO and Head of Trading Academy, daily webinars, global community, and live squawk service.

The global trader programme fee is 3,420 GBP and after taking the course trader receives a 20,000 USD trading account.

The algorithmic trader programme has also 20,000 funded accounts and costs 3420 GBP.

The crypto algorithmic trader program costs 3,950 GBP and the trader gets a 20,000 USD trading account after the course completion.

The smallest funding account starts from 10,000 USD and requires a fee of 1,950 USD for the training course. This funding account combines a training program accredited by CPD and after course completion the trader receives a 10,00 USD trading account.

The next program is called the cryptocurrency trader program, which is similar to the Forex trader program. It has a fee of 2,250 GBP and offers a 10,000 USD trading account after the course has been completed.

Because there are no diverse funding accounts, we only can give the firm 1 point in this section. The firm could have gotten a higher score if it had at least 100,000 USD funded accounts.

Alphachain Assets – 3.5

The prop firm offers several trading assets including Forex pairs, commodities such as metals and oils, popular major indices, and a multitude of cryptocurrencies. Alphachain has numerous dedicated course programs with a funded account specifically designed for both manual and automatic crypto trading. Up to 35 digital currencies can be traded including Bitcoin, Ethereum, Bitcoin Cash, Ripple, etc.

The firm gets high scores for its diverse asset classes but loses some points due to a lack of stocks and other assets like futures.

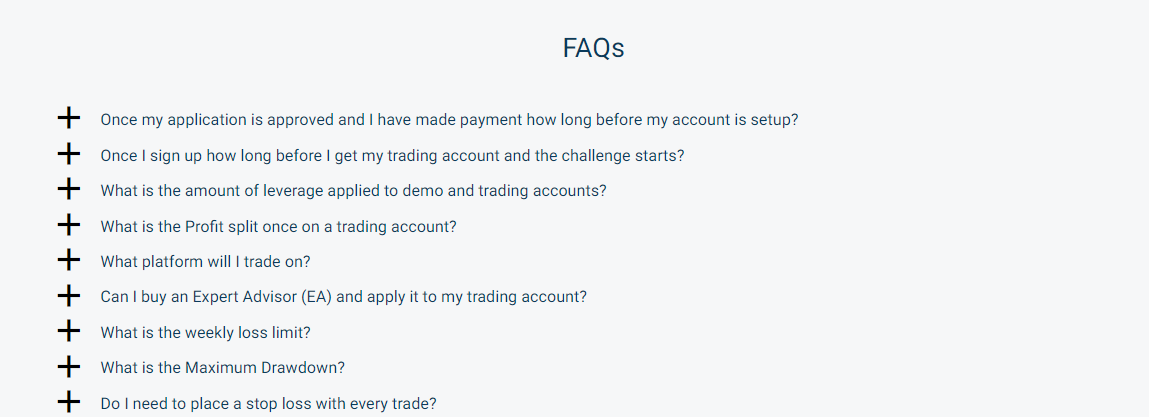

Trading rules and limitations – 1.1

At least 30 active trading days are required for the evaluation of the funded accounts. The profit target is 10% and once hit the maximum drawdown limit goes up to 10% from 5%. The way active trading day is defined is similar to other prop firms. After opening a trading position on a certain day, that day is an active trading day. Even if a trader holds the position for several days, the active day’s count stays 1 day, unless they open positions on other days as well. This is an important detail to complete the profit target and get profits.

Mobile trading is not permitted. Trading positions must be made through Windows or macOS MT5.

Traders can not hold open positions during weekends, but there is no restriction for holding traders overnight.

All trading positions must be closed during news and major data release hours and can only be reopened after 30 minutes.

One good thing is, traders are not liable for losing trades.

For payments, traders will wait for around 7 working days and send a payment invoice to Alphachain. This is a rather unnecessarily complicated process.

If the trader breaks any of these rules, their account will be closed.

Because of how restrictive the firm is it only gets 1.1 points in this section. Alphachain prohibits mobile trading, which is a major downside.

Alphachain Fees – 2.5

The fee structure is expensive for each trading course and funded account. Traders can not just pay and get a funded account at Alphachain, they have to pay for educational courses instead. Because of this, the fees start from 2,250 GBP, which is not a small amount. While the courses are usually expensive for financial trading, the fees for funded accounts are usually much lower with prop firms.

Fees are expensive on Alphachain and it only gets half the maximum score.

Alphachain Platforms – 1.5

The main trading platform provided by Alphachain is MetaTrader 5. The platform comes with 1:100 trading leverage and is provided by the partner broker. Alphachain MT5 is superfast and offers lower spreads and commissions due to top-quality liquidity providers. The platform is available for all devices, desktop, and mobile, but trading is only permitted on the desktop version of the software.

Despite their being MT5 available, traders are not allowed to use any of its advanced features, resulting in a very low score.

Profit-Sharing – 0

The prop firm offers up to 50% profit split between the firm and the trader. This is much lower than popular prop firms such as FTMO which offer up to 90% profit share. Since each trading account comes with the trading course which is also, we do not think Alphachain is competitive in this section. You have to pay at least 2,250 GBP to get a 10,000 USD trading account and only get 50/5 of profits made through trading. This proposal is not simply competitive enough, and we hope the company addresses these issues.

This is the worst profit-sharing policy we have seen so far, 0 points here. If the company offered at least 60% profit share and withdrawals within 1 day, the picture would be radically different.

Education and trading tools at Alphachain – 5

Education is the primary focus of Alphachain with its diverse trading courses varying from manual Forex and crypto trading to algorithmic trading of these markets. Thereby, the courses are CPD accredited and offer full educational coverage from basics to advanced. At the end of the course, traders receive a funded account depending on the course. The funded accounts and courses are combined and come as a trading course plus a funded account after the competition.

Can we say that Alphachain is primarily a trading educational firm with the added bonus of a funded account? Probably yes, as traders get full training from experts. During each course, traders also receive tested trading strategies that were developed by Alphachain experts. Unfortunately, we were not able to check the performance of those strategies.

A well-deserved 5 score in this metric, as the firm is mainly an educational institution.

Customer Support at Alphachain – 2.6

Customer support is only available through email support. There is no dedicated live chat or option offered by Alphachain which is its downside. There is no fast way to quickly connect with the broker and resolve issues, which is very inconvenient. However, there is a phone number on the website which can be used to contact the firm.

Lack of support options and languages prohibit us from ranking the company higher than 2.6 in this section.

Frequently Asked Questions on Alphachain

Is Alphachain a good prop firm?

What are the main trading rules and limitations at Alphachain?