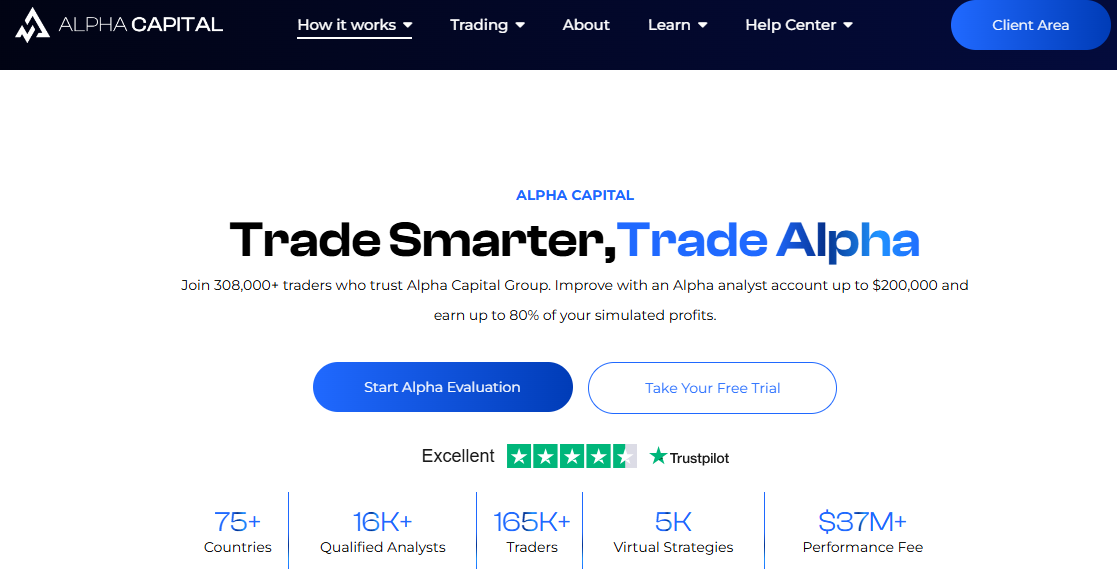

Alpha Capital Group prop firm offers simulated funded challenges of up to 200,000 USD and has a profit sharing of 80%, which is competitive. The firm promises zero commissions and an institutional trading environment. The firm only has one challenge account type, which is a 2-step evaluation account.

In this Alpha Capital Group review, we are going to put all the claims by the firm to the test, including crucial features such as safety, rules, funding options, assets, platforms, support, education, and more.

Pros & cons of Alpha Capital Group prop firm

Pros

- Offers up to 80% profit split

- Allows for free trial

- Provides live chat support

- Limited to blog resources, without in-depth educational content

- Customer support lacks a phone option

Cons

- Lacks safety and positive trader reviews

- Only offers a custom web platform with basic features

- Swing accounts are pricier and come with lower leverage options

Safety of Alpha Capital Group – 0

Alpha Capital Group reviews are lacking on the FPA, which is always a red flag. On Trustpilot, the firm has 12% of 1-star reviews, indicating a significant number of traders are not satisfied with the firm’s services. Add to this, Alpha Capital Group is not backed by any regulated broker, which is also a red flag, leaving room for price manipulations. Overall, the safety of Alpha Capital Group seems questionable, and we advise our readers to exercise caution when dealing with prop firms that have this many negative reviews.

The firm gets a 0 score in this section for lacking important safety features.

Alpha Capital Group Funding and Maximum Capital Allocation – 3

Alpha Capital Group funded programs offer only two variations of the 2-step challenge model, Alpha Pro, and Alpha Swing. The lack of other funded account challenge types like 1-step and instant is a big downside of the firm. Alpha Capital Group funding options are exactly the same for both variations of the 2-step challenge and include 5k, 10k, 25k, 50k, 100k, and 200k USD amounts.

Alpha Capital Group challenges are all simulated trading accounts with virtual funds, meaning traders only access demo trading and never have an opportunity to trade with real money on live markets.

The Alpha Capital Group scaling plan allows traders to grow their virtual capital to up to 2 million dollars. Traders have to achieve at least 10% profit of the initial balance and request scale. Trailers have to add reasons for requesting their scaling, and they should be eligible for profit withdrawals.

Overall, Alpha Capital Group gets a 3 score in the funding options section for offering slightly above-average experience.

Alpha Capital Group Assets – 2.5

Alpha Capital Group prop trading assets include Forex, metals, cash indices, and commodities such as energies. The leverage is different for each funded account variation. Alpha Pro 2-step challenge allows for up to 1:100 leverage on Forex pairs, and Alpha Swing only allows 1:30. The Swing account has no commissions for trading, while the Pro account requires 2.5 USD per lot commission and offers lower spreads. The firm does not offer stocks or any other assets, which is a minor downside.

Overall, the firm gets a 2.5 score in the assets section for offering average experience.

Alpha Capital Group Trading rules and limitations – 1.5

Alpha Capital Group rules include a 10% and 5% profit target for phases 1 and 2 on both challenge types, including Pro and Swing. Both funded accounts have a 10% maximum drawdown and a 5% daily drawdown limit. There are no maximum trading days, but minimum trading days are 3. News trading and holding over the weekend is allowed as well. There is a catch; however, only swing accounts can hold positions on weekends when they get funded. This rule has the potential to frustrate many traders who need to be more careful reading the rules.

Overall, the firm gets a 1.5 score in the rules department for offering strict evaluation rules.

Alpha Capital Group Fees – 2

The fees seem competitive at Alpha Capital Group. Let’s list all of them to compare clearly.

The 2-step Alpha Pro funding one-time fees are the following:

- Funded amount: 5,000 USD – One-time fee: 50 USD

- 10k USD – 97 USD

- 25k USD – 197 USD

- 50k USD – 297 USD

- 100k USD – 497 USD

- 200k USD – 997 USD

The 2-step Alpha Swing one-time fees:

- Funded amount: 5,000 USD – One-time fee: 70 USD

- 10k USD – 147 USD

- 25k USD – 147 USD

- 50k USD – 357 USD

- 100k USD – 577 USD

- 200k USD – 1097 USD

As we can see, swing accounts are slightly more expensive but offer lower leverage. Also, the 25k and 10k USD swing challenge costs 147 dollars.

Alpha Capital Group free trial is available and can test the firm’s conditions and platforms before starting the real challenge.

Alpha Capital Group free repeat is not available, as traders have to purchase new challenges if they fail.

Overall, the firm gets a 2 score in the fee section.

Alpha Capital Group Platforms – 0.9

Alpha Capital Group only produces a proprietary trading platform that is inferior to advanced platforms like MT4 and MT5. This can make it very tricky for traders to conduct a comprehensive analysis and make informed trading decisions. There are all basic features available to set stop loss and take profit, but the list of indicators is limited, and there are no custom indicators or automated trading capabilities.

Overall, the firm gets a 0.9 score in this section for providing only a web trading platform with limited features.

Alpha Capital Group Profit-Sharing – 1

Alpha Capital Group profit split is 80% which is competitive, but there is no possibility to go for a higher profit split such as 90%. Traders can start withdrawing profits once they get funded.

A minimum of 100 USD must be made for withdrawal eligibility.

Trailers can request payouts once every two weeks, allowing for only 2 profit withdrawals per month, which is not attractive.

Overall, the firm gets a 1 score in this section.

Education and trading tools at Alpha Capital Group – 1.2

When it comes to education, the firm offers blogs, media, and interviews with top-performer traders. However, these resources can not be used to get a proper education and become a successful trader. There are some tools for useful performance measures, but overall the educational resources need to be increased.

The firm gets a 1.2 score in this section for offering only blogs as educational resources.

Customer Support at Alpha Capital Group – 2.4

Support options of Alpha Capital Group include live chat and email options. The live chat is built inside the website, which is good and allows fast response. The firm does not offer phone support which is always a red flag and the language support is only English for both website and support options. Because of these inefficiencies, the firm only takes 2.4 scores in the support section and loses several points.

Frequently Asked Questions on Alpha Capital Group

Is Alpha Capital Group legit?

Is Alpha Capital Group a good prop firm?