This prop is not considered safe

We do not advise you to start a prop trading challenge with this firm.

Founded in 2018 by a group of traders in Cyprus, Fidelcrest has become one of the most recognizable names in the global proprietary trading market.

With a variety of funding options divided into two risk categories – Normal and Aggressive, as well as Micro accounts, Fidelcrest has something for every type of prop trader,

The rules and requirements at Fidelcrest are reasonable and the platform does not charge monthly membership fees for its accounts, rather, it uses a one-time payment system, which saves costs for traders.

Fidelcrest offers a rich selection of asset classes, such as CFDs, crypto, forex, futures, and more.

Beginner traders at Fidelcrest can also access a fairly comprehensive lineup of beginner tools and educational materials.

This review will look at the various terms and features offered by Fidelcrest and will score the prop firm based on a range of different criteria.

Pros and Cons of Fidelcrest Proprietary Trading Firm

Pros

- Up to $2 million in funding available

- One-time subscription fees, as opposed to monthly fees charged by other prop firms

- Maximum leverage of 1:100

- Accounts divided in terms of risk level

- A wide range of asset classes (forex, CFDs, metals, commodities, indices, crypto)

- MetaTrader 4 available

- A variety of withdrawal methods supported (including PayPal, Neteller, Skrill, credit cards, bank transfer, and crypto)

Cons

- Automated trading (EAs, robots) are not available

- Technical support is only available on weekdays

- USD is the only available account currency

Fidelcrest Quick Overview

| FPA Score | NOT RATED |

| Year founded | 2018 |

| Headquarters | Nicosia, Cyprus |

| Minimum audition fee | EUR 99 ($15,000 Micro Trader Normal) |

| Fees on withdrawals | None |

| Minimum funded amount | $15,000 |

| Maximum funded amount | $1 million (scaling to $2 million) |

| Allowed daily loss | 5% (Normal) 10% (Aggressive) |

| Profit target | 5-20% (Pro, Micro, Normal/Aggressive) |

| Maximum trailing drawdown | 10-20% |

| Profit sharing (Payouts) | 80-90% |

Safety of Fidelcrest – 3

Fidelcrest is registered in Cyprus, but is not a brokerage itself, which is why it does not need to obtain a brokerage license in the country.

The prop firm is not rated by the Forex Peace Army, which is a reliable ratings aggregator for brokerage and prop firms, which docked 2 points from Fidelcrest’s safety score.

Fidelcrest has a reputation of being a reliable prop firm and having opened in 2018, has a decent track record of operations.

The primary trading platforms used by Fidelcrest traders are MetaTrader 4 and 5,

The firm is partnered with FCA-regulated brokers, such as TradeView, IC Markets, XM, Pepperstone, RoboForex, Blueberry Markets and Purple Trading.

Funding and Maximum Capital Allocation – 3

When it comes to funding and capital allocation, Fidelcrests’ accounts can be divided into two types – Pro and Micro accounts, which are then dividend based on their risk levels, into Normal and Aggressive profiles.

In total, there are four distinct accounts traders can use, which also vary in available funding. These accounts are:

- Micro Trader Normal – Deposits of $15,000, $30,000 and $60,000, respectively. The maximum daily loss is 5%, with a trailing drawdown of 10%. The profit target for Phase 1 is 10% and 5% for Phase 2

- Micro Trader Aggressive – Same deposit sizes as the Micro Trader Normal. The maximum daily loss is 10%, with a trailing drawdown of 20%. The profit target for Phases 1 and 2 is 15%

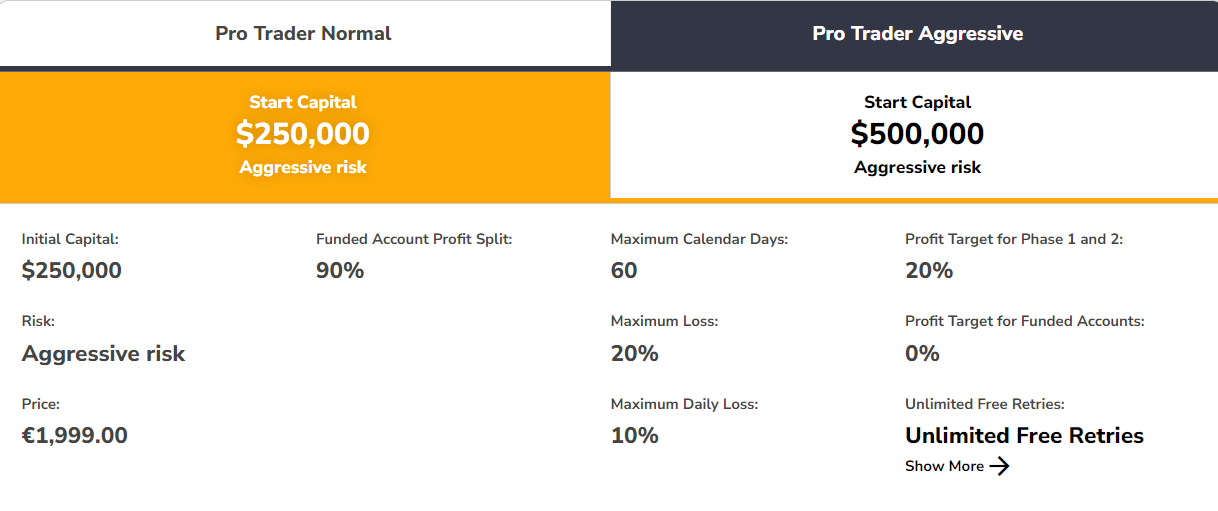

- Pro Trader Normal – Deposits of $250,000, $500,000, and $1,000,000, respectively. The maximum daily loss is 5%, with a trailing drawdown of 10%. The profit target for Phases 1 and 2 is 10%

- Pro Trader Aggressive – Deposits of $250,000 and $500,000. The maximum daily loss is 10%, with a trailing drawdown of 20%. The profit target for Phases 1 and 2 is 20%

Fidelcrest offers some of the most affordable and relaxed drawdowns among prop traders, which comes at a higher profit target. However, the firm’s lowest funding tier starts at $15,000, which comes with a fee of EUR 99, which might not be as convenient for some traders.

Assets – 4

Fidelcrest offers a solid selection of assets for trading, such as forex, crypto, stock CFDs, commodities futures including metals, and indices.

In total, there are over 175 tradable instruments available on Fidelcrest, which is more than many other prop firms can offer.

Due to a wide selection of tradable instruments, Fidelcrest gets a 4 out of 5 in Assets, as the platform does not offer real stocks.

Trading Rules and Limitations – 3.2

While trading limitations may vary between funding levels, the general provisions of Fidelcrest apply to all accounts, irrespective of their funding levels. These provisions include:

- Overnight trading is allowed for all accounts, as well as copy trading

- Automated trading, such as Expert Advisors and bots, are not permitted on Fidelcrest (unless otherwise specified by the Fidelcrest Risk Team)

- The program consists of three phases, Phase 1, 2 and the Trader account

- Holding positions over the weekends is allowed on Fidelcrest

- Traders can gain leverage up to 1:100 (when trading FX)

- There are no limitations on trading volume

- Maximum 60 calendar day trading on Pro and Micro Trader accounts

- No minimum simulated trading days during Phases 1 and 2, 10 days for the Trader account

- The minimum position size on Fidelcrest is 0.01 lots

Platforms – 3.9

Traders on Fidelcrest can use MetaTrader 4 and 5, as well as cTrader. The firm is partnered with FCA-licensed and regulated brokerage firms, such as XM, Pepperstone, IC Markets, and more.

Fidelcrest also offers a host of additional features, such as an economic calendar, and an automated performance review software that allows traders to easily keep track of their performance in real time.

Since Fidelcrest partners with some of the most recognizable trading platforms and brokerages, traders can easily choose between a web-based, desktop, and mobile application.

The supported account currency for all traders on Fidelcrest is the U.S. dollar.

Profit-Sharing and Withdrawals – 5

Traders can keep up to 90% of their generated trading profits, which they can start withdrawing after 11 days. The withdrawal process generally takes between 1 and 3 business days to complete.

The profit-sharing agreement varies between accounts, with the Pro and Micro Trader Normal accounts paying up to 80%, while the Aggressive accounts pay 90%.

Withdrawals on Fidelcrest are available using a variety of different methods, such as:

- Bank transfer

- Credit cards

- PayPal

- Neteller

- Skrill

- Bitcoin

Traders cannot get a share of their profits during the Challenge stage, which is done using simulated funds.

For traders to be eligible for withdrawals, they must go through the verification process, which includes the provision of documentation, such as:

- A valid ID or passport

- A proof of address that dates back no more than 6 months

- Approval of prior documents before submitting a withdrawal request

Due to fast withdrawal processing times and a lucrative profit-sharing agreement, Fidelcrest scores a 5 on the profit-sharing and withdrawal criteria.

Fees – 4

Fidelcrest stands out from many other prop trading firms thanks to its decisions to not charge monthly fees. Each of the funded account types come with a one-time fee that is refundable.

The fees for each funding tier on Fidelcrest are:

- EUR 99 for the $15,000 Micro Trader Normal account

- EUR 199 for the $30,000 Micro Trader Normal account

- EUR 299 for the $60,000 Micro Trader Normal account

- EUR 199 for the $15,000 Micro Trader Aggressive account

- EUR 299 for the $30,000 Micro Trader Aggressive account

- EUR 399 for the $60,000 Micro Trader Aggressive account

- EUR 999 for the $250,000 Pro Trader Normal account

- EUR 1,899 for the $500,000 Pro Trader Normal account

- EUR 2,999 for the $1,000,000 Pro Trader Normal account

- EUR 1,999 for the $500,000 Pro Trader Aggressive account

- EUR 3,499 for the $1,000,000 Pro Trader Aggressive account

Fidelcrest does not charge any additional fees, other than the ones that may be charged by the brokers and banks during withdrawals. Forex spreads on Fidelcrest start from 0 pips and withdrawals are not charged.

Currently, there are no active discounts on any of Fidelcrests’ funded accounts, which gives it a 4 out of 5 in Fees.

Education at Fidelcrest – 2.8

Fidelcrest offers educational materials to its traders, such as its Knowledge Base, which focuses more on the firm’s terms and services and includes a FAQ section for prospective and existing clients.

Fidelcrest also has a partnership with the NeuroStreet Trading Academy, which comes with trade training courses for FX, futures, and CFDs.

Customer Support at Fidelcrest – 3.6

Fidelcrests’ customer support includes a hotline, a support email, and an online chat. However, the technical support team is not available during weekends, which may be an issue for some.

Fidelcrests’ website also includes a comprehensive Q/A section, which answers some of the most common questions clients may have regarding the firm and its services.

Fidelcrest gets a 3.6 in customer support, as the support feature is not available in many languages.

This prop is not considered safe

We do not advise you to start a prop trading challenge with this firm.

Frequently Asked Questions

How much funding can I get at Fidelcrest?

Is Fidelcrest legit?

What is the maximum drawdown at Fidelcrest?