FXIFY is a prop trading firm that aims to provide traders with best possible trading experience by providing real time analytics. The company is based in London. FXIFY was founded in 2023 and has not earned a rating from FPA (Forex Peace Army) yet. The company offers account funding from 15 K USD to 400 K USD. And traders can start participating in the challenges from as little as 99 USD. FXIFY is one of the few prop trading firms that allow grid trading and use of Martingale strategy. In this review, we’ll discuss important topics for traders such as safety features, rules and limits, fees, trading platforms, profit0sharing, customer service, education, and more.

Pros & cons of FXIFY prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5, cTrader

- Fast and digital account opening/verification

- Offers access to over 300 tradable instruments

- 50:1 available leverage

- Most payment options are free and instant

- Allows grid trading and use of Martingale strategy

Cons

- Low daily loss limit 5%

- Low Max Trailing Drawdown 6%

- The profit split is 75% by default but you can upgrade it to 90% during checkout.

Safety of Smart Prop Trader – 1.5

When choosing a proprietary firm, it’s important to make sure that the company is legit. As already mentioned, FXIFY was founded in 2023 and the company is not yet rated by the FPA (Forex Peace Army), which means that the firm lacks experience. However, it should be mentioned that FXIFY is partnered with FXPIG. FXPIG is regulated by the Vanuatu Financial Service Commission (VFSC) with a Principal’s License (No. 14578) for dealing in securities.

Funding and Maximum Capital Allocation – 2

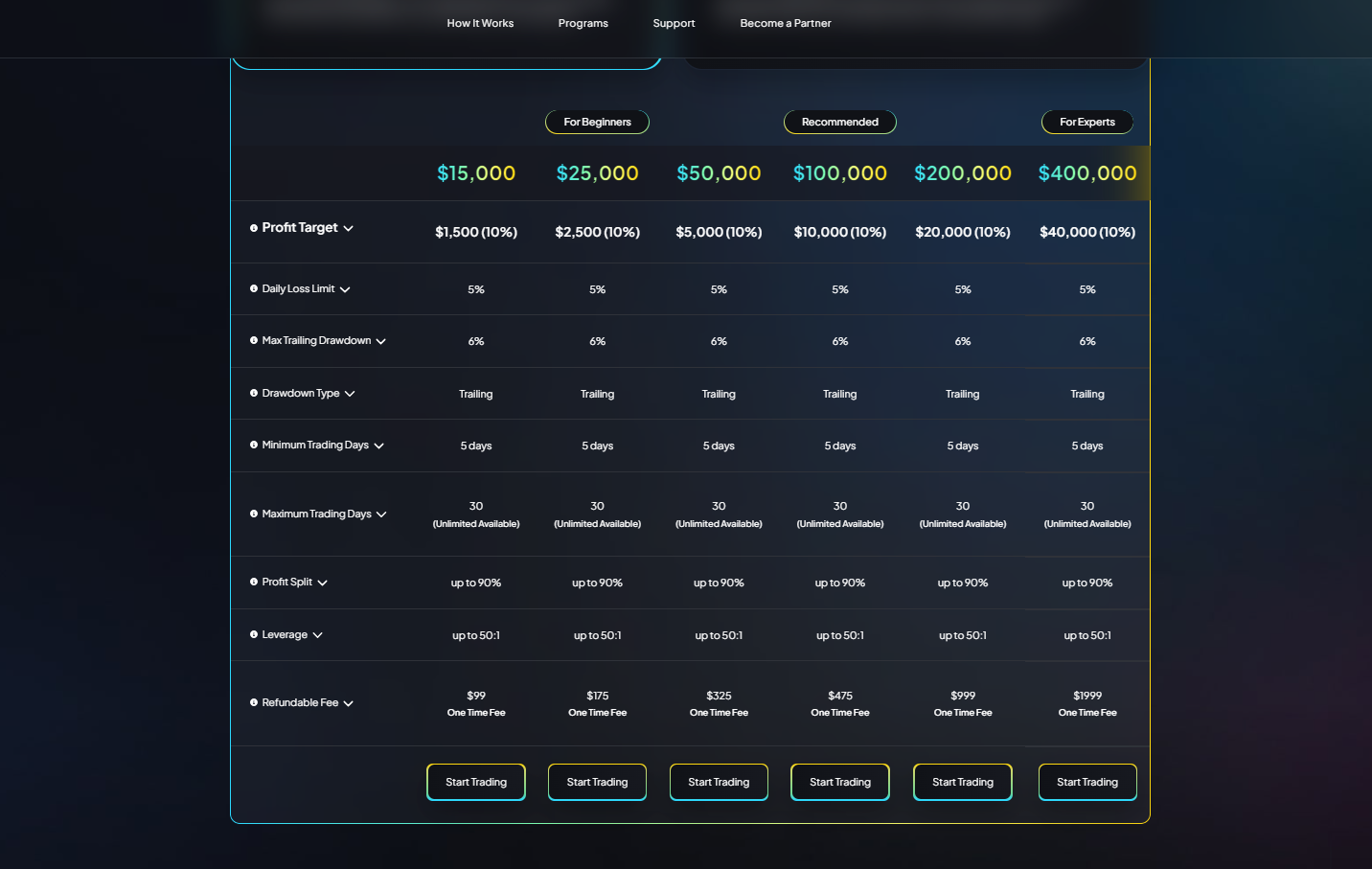

Clients of FXIFY can choose between 6 funding categories. For beginners there are $15K, and $25K accounts. For intermediate traders there are $50,000 and $100,000 accounts. And for experts there are $200,000 and $400,000 accounts. Fees depend on the challenge you choose to undertake and starts from $99 up to $1999. Funding is instant and there are no fees when doing withdrawals from the broker’s end. However, it should be mentioned that the prop firm doesn’t offer smaller than $15,000 funded account options, and there’s no maximum funded account size is $1 million or above, thus FXIFY gets low rating from us in this category.

Assets – 4.5

When it comes to tradable instruments, FXIFY offers access to over 300 instruments through FXpiggy Forex broker. Traders can trade currency pairs, crypto currencies, metals, energies, US Stocks as CFDs, and global indices. And while the range of asset classes is very impressive, there are still lacking bonds, futures, options, crypto tokens, and real stocks, which is why the firm gets 4.5 rating from us.

Trading Rules and Limitations – 3.4

Finding a prop firm that lets you trade using your preferred style is essential for successfully passing the challenge period. FXIFY has a 10% profit target, 5% daily loss limit, and 6% max trailing drawdown. Minimum trading days is 5 days, and maximum days is 30, however, the number of maximum days can be extended upon request. Available leverage is 50:1.

As already mentioned, FXIFY is one of the few companies that allow traders to grid trade and use Martingale strategies. It’s worth mentioning that most prop firms ban use of Martingale as it’s associated with gambling. Martingale is a trading strategy that involves doubling your stake after each losing trade. Winnings recover the losses and leave profits. This strategy is heavily used in gambling and, to a lesser extent, in trading financial instruments. Keep in mind that Martingale is highly risky, as it relies on the assumption that losing streaks will eventually be followed by winning streaks, which is not guaranteed.

FXIFY allows traders to use trading algorithms to automate their trading. However, traders need to make sure that their trading robots conform to the real market conditions and the company can replicate your trades on their live corporate accounts.

Furthermore, there are no limitations on instruments and position sizes that you trade. However, it’s important to note that traders are restricted from sharing accounts or selling funded accounts.

Be informed that FXIFY doesn’t allow High Frequency Trading (HFT). HFT involves the utilization of sophisticated computer algorithms and lightning-fast telecommunications networks to execute an immense volume of trades within mere fractions of a second. HFT is restricted due to its potential for market manipulation, unfair competitive advantages, and market instability. Any trader found involved in HFT will violate the FXIFY Terms of Use, resulting in the loss of trading privileges on our platform.

In addition, traders are restricted from logging in and trading from OFAC-sanctioned (the Office of Foreign Assets Control of the USA) countries.

Fees – 5

FXIFY offers an impressive fee structure. There are no fees when making withdrawals from the company’s end. Challenge fee depends on account size for instance: $99 for a $15k account; $175 for a $25k account; $325 for a $50k account; $475 for a $100k account; and $1999 for a $400K account. It should be noted that the fees are fully refundable. Traders can Receive 100% of the cost of the assessment fee and in addition a 25%. Which is paid out when a trader makes their first withdrawal.

Platforms – 5

FXIFY clients have access to the most popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms were designed by the same company MetaQuotes but there are some key differences. MT4 mainly focuses on Forex trading, while MT5 supports a broader range of asset classes, including stocks, commodities, and cryptocurrencies. MT4 has a wide range of custom made indicators and trading robots available. MT5 offers a better strategy tester. Furthermore, MT4 allows hedging, while MT5 is less suitable for implementing hedging strategies. Furthermore, MT5 offers more timeframes, including 2-minute and 8-hour charts, in addition to those available in MT4. Both platforms have become instantly super popular and still remain first choice for many traders, however, MT4 was created in 2005 and MT5 was released in 2010, which means that there are more algorithms and trading robots available for MT4. It should be mentioned that FXIFY traders have access to desktop, mobile and web versions of MetaTrader platforms.

Profit-Sharing and Withdrawals – 3

The profit split is 75% by default but you can upgrade it to 90% during checkout. When it comes to withdrawals. As already mentioned, there are no fees from the company’s end. However, it should be mentioned that there are only two withdrawal options available at the moment: wire transfer and crypto. While wire transfer can take a couple of days, crypto withdrawals are quicker.

Education and trading tools – Coefficient 1.3

It’s essential to have a quality education for successful trading. Unfortunately, there are no webinars, seminars, and video guides with FXIFY. But traders can access comprehensive trading journals, advanced account metrics, challenge account analysis, and become a part of the company’s discord community.

Customer Support at FXIFY – 3.8

FXIFY offers professional customer support available 24/5 for emails, live chat and WhatsApp. The company is active on social media and it’s best to follow their telegram, discord, twitter, instagram, and facebook pages to never miss exclusive discount codes.

Frequently Asked Questions

Can I trade Martingales with FXIFY?

What can I trade with FXIFY?

Is FXIFY a broker?