Registered in the British Virgin Islands, Maven trading is a proprietary trading firm that offers funding accounts ranging from $2k to $200. To get the access to the $2,000 funded account, traders need to pay as little as a $35 fee. The company operates through Blueberry Markets Forex broker, which is regulated and highly trusted among traders.

Maven offers a wide range of virtual tradable pairs in the evaluation period. The company has unique 1-step and 2-step challenges programs to evaluate traders. In this review of Maven trading we’ll discuss major features such as safety, challenge conditions, prices, customer support, available instruments, and more in detail.

Pros & cons of prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to 400+ assets

- Lower profit target of 5% (and 9% target that gets you funded faster)

- No pressure trading. Traders can take as long as they want to hit trading goals

- Request Payouts Anytime After 14 Days And 1% Profit

- Offers professional customer service

Cons

- Standard profit split ratio is low compared to Pro accounts.

- Traders get to keep 80% of the profits they make compared to Pro’s 85%.

Quick rating of Maven and its features

| FPA Score | NOT RATED |

| Year founded | November 2022 |

| Headquarters | Maven is registered the British Virgin Islands |

| Minimum audition fee | 35 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 2,000 USD |

| Maximum funded amount | 200,000 USD |

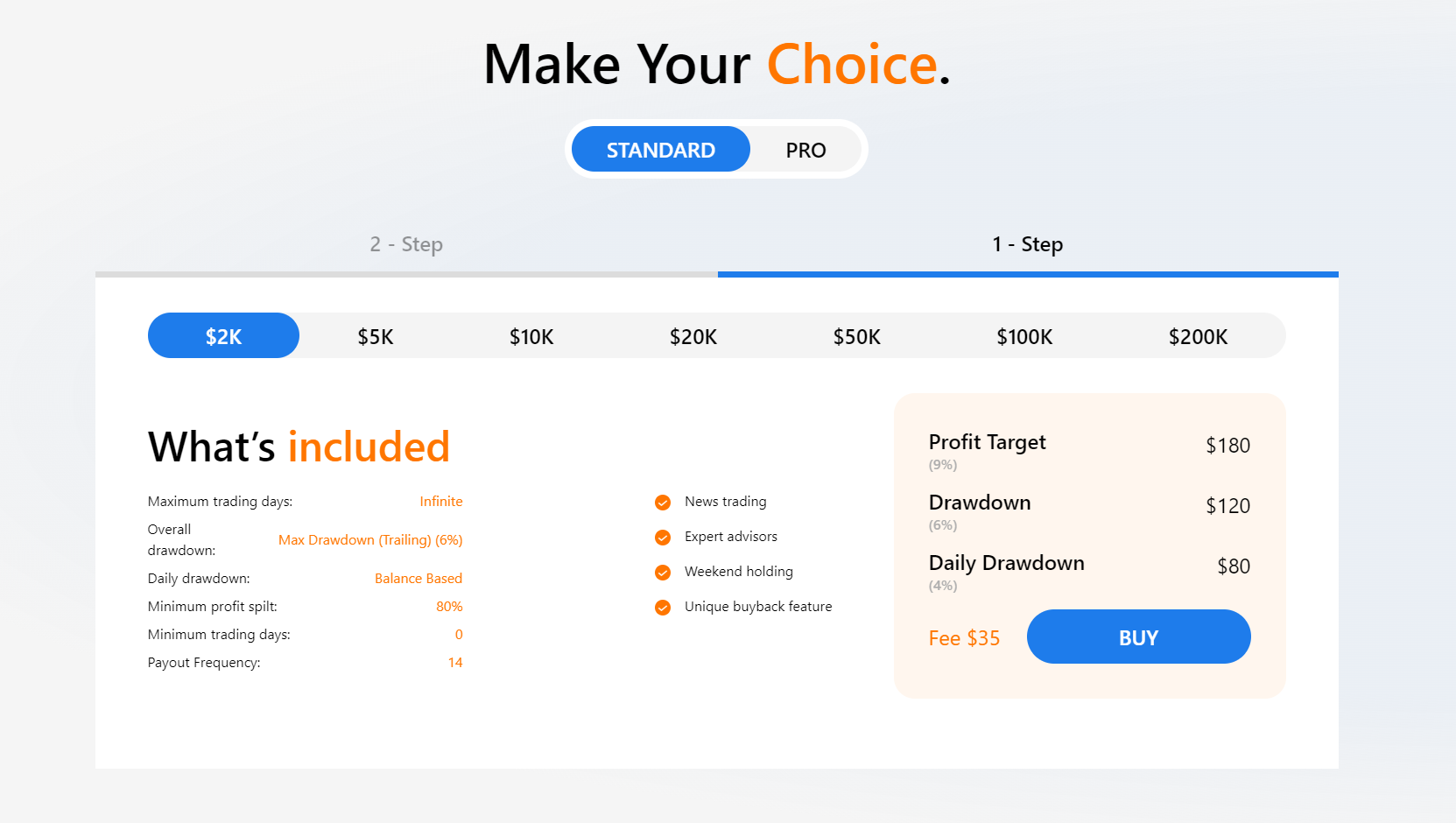

| Allowed daily loss | 4% for Standard; 5% for Pro accounts |

| Profit target | 9% |

| Maximum trailing drawdown | 9% Max Trailing Drawdown on Standard account, 11% Max Trailing Drawdown on Pro account |

| Profit sharing (Payouts) | 80/20 for Standard account, 85/15 for Pro accounts |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Available trading markets | Over 400 instruments are available, including: Forex, Shares, Cryptocurrencies, Commodities & Metals, Indices |

Safety of Maven trading – 1.5

Maven trading was founded in November 2022, and lacks experience in the industry. Furthermore, the company isn’t rated by the FPA (Forex Peace Army) yet. On the other hand, Maven trading offers services through Blueberry Markets broker, which is regulated in 2 jurisdictions. Blueberry Markets is authorized and regulated by the Australian Securities & Investments Commission (ASIC), and the Securities Commission of The Bahamas.

Funding and Maximum Capital Allocation – 3

Funded accounts offered by Maven trading are divided into 7 categories, which is great as traders can get the cheapest 2,000 USD funded accounts from as little as a 35 USD fee. To get access to a funded 200,000 USD Pro account, traders need to deposit 1,150 USD.

Assets – 4.5

Over 400 instruments are available, including: Forex, Shares, Cryptocurrencies, Commodities & Metals, Indices for trading at Maven through Blueberry Markets Forex broker. Keep in mind that to get access to all of the offered instruments, you should choose MetaTrader 5 platform. In case you are focused on trading currencies and other CFDs, you can go for MetaTrader 4.

Trading Rules and Limitations – 3.4

Trading rules and limitations are important topics to consider when selecting a prop trading firm, as these factors are major players in getting funding accounts. Trading rules at Maven differ based on whether you go for a Standard or a Pro account.

You are allowed to trade news events. Leaving trades open is acceptable. However, you cannot open new trades or straddle events in a way that leads to a significant all-or-nothing win, as this is based on pure luck. If your trading results indicate that you would have won without the news event, it’s acceptable. Winning solely due to the news event alone is not permitted.

When it comes to High Frequency Trading (HTF), be noted that bots and scalping strategies that execute trades for only a few seconds or exploit demo delays or arbitrage are prohibited. High-volume scalping is also not allowed.

Martingale trading, that involves increasing positions in losing trades with the hope of recovering losses, is not permitted. You can layer up to 5 positions, but any more will be subject to review. Be informed that grid trading is also strictly prohibited.

In addition, taking advantage of MetaTrader inefficiencies, including High Frequency Trading, Toxic Trading Order Flow, Long/Short arbitrage, reverse arbitrage, tick scalping, or server execution, is strictly prohibited. Be informed that engaging in such activities will result in the termination of your challenge or funded account, including any profits.

Maven prohibits its traders from gambling. Trading with over 75% of trades that lack a stop loss, having a hold time of less than 1 minute for over 75% of trades, or exceeding lot size restrictions in more than 75% of trades is considered gambling and will require a change in your strategies.

When it comes to lot size restrictions, traders are limited to a maximum of ‘account size / 2.5’ lots per pair at any given time. However, you can run as many assets simultaneously as you like. For example, for an account with 100k, the limit is 40 lots (100/2.5 = 40 lots). EAs (Expert Advisors) are allowed as long as they comply with the provided rules. Failure to provide proof of your EA may result in account termination, particularly if the EA engages in High Frequency Trading or hedge zone strategies.

Please be noted that accounts will be placed on pause after 14 days of inactivity. To resume trading, you can contact support. In case you plan to not trade for 28 days or more, it’s best to contact the support to put your account on hold. Accounts flagged for rule violations will need to rerun the challenge.

Fees – 5

When it comes to fees, Maven trading is one of the most affordable, as traders can get a 2,000 USD funded account with as little as a 35 USD fee. However, Pro accounts cost more. To get the 2,000 USD account traders need to deposit 60 USD. Standard 200,000 USD account costs 880, and Pro 200,000 USD account fee is 1,150 USD.

Platforms – 5

Maven trading offers access to the full set of MetaTrader platforms through Blueberry Markets broker. Traders can use desktop, mobile and web based platforms to execute trades and conduct market research. Both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are highly popular and respected among Forex and CFD (Contracts for Difference) traders. It’s important to note that while both platforms are very similar in terms of design and reliability, there are some key differences to take into account.

MT4 was built in 2005 and was primarily made for trading currency pairs. It has a simple design and is incredibly reliable. Most trading algorithms and indicators are built for MetaTrader platforms, which is why these platforms are still super popular. MetaTrader 5 was released in 2010 and has enhanced features and capabilities. MT5 is used for trading not only currency pairs, and CFDs, but also stocks, bonds, and futures. However, MT5 is a bit more complex than MT4.

Profit-Sharing and Withdrawals – 1

When it comes to profit sharing, Maven offers an 80/20 ratio for Standard account holders. And for Pro account holders the ratio is 85/15. It’s worth noting that traders need to wait for 2 weeks for payouts. And profits need to be over 1% of the account to be eligible for the process.

Education at Maven trading – 0

Having a quality education is of paramount importance in trading financial assets. Traders need to learn how to manage their risks and emotions before investing in financial instruments. Furthermore, it’s important to develop a trading system that suits their personality. Maven is very limited when it comes to offering educational material to traders, and for that reason, the firm gets a low rating from us in this section.

Customer Support at Maven trading – 3.8

Professional customer support is important for every trader. Customer support agents help resolve technical issues, provide information related to funded accounts and challenge rules. Maven trading offers a 24/7 online live chat option, which is more active from Monday to Friday, but slow on the weekends. Furthermore, traders can join Maven trading’s discord channel. Overall, customer service at Maven is good.

Frequently Asked Questions

Is high frequency trading allowed at Maven?

Can I use Martingale strategies to trade with Maven?

May I trade news events with Maven?