Bespoke Funding Program prop firm is a young proprietary company established in 2022. The firm offers two account types for funding and each of them requires 2 phase evaluation completion to get funded. The lowest funded amount starts from 10k USD and reaches 400k. The firm offers a scaling plan to increase the funded account to 2 million USD, and spreads are 1.2 pips for FOREX pairs. The minimum refundable fee is 99 USD for 10k accounts and the profit target ranges between 5-8% which is fairly achievable with a decent trading strategy. The firm has only one comment on the FPA, and it is negative. Since the offering of the firm seems attractive, we decided to take a closer look at its crucial features.

In our unbiased Bespoke Funding Program review, we will discuss the safety, fees, funding options, rules, and many more.

Pros & cons of Bespoke Funding Program prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to FX pairs, commodities, indices, and cryptos

- Offers up to 2 million USD-funded accounts through scaling plans

- Most payment options are free and instant

Cons

- Lacks rating on the FPA and is a young firm

- Does not offer stocks

- Does not allow EAs

- Payouts are available only every 14 days

- Lacks educational materials

- There is no option for 1k USD-funded accounts

Quick rating of the Bespoke Funding Program and its features

| FPA Score | Not yet rated |

| Year founded | 26 September 2022 |

| Headquarters | United Kingdom |

| Minimum audition fee | 99 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 400,000 USD (2,000,000 through scaling plan) |

| Allowed daily loss | 5% |

| Profit target | 5-8% |

| Maximum trailing drawdown | 8-10% |

| Profit sharing (Payouts) | 80% |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, cryptos, indices, and commodities |

Safety of Bespoke Funding Program – 1.5

Bespoke Funding Program reviews are lacking on the FPA. There is only one comment that negatively assesses the firm’s customer services and emphasizes how the firm terminated a profitable account citing an EA trading rules breach. While the trader claims they did not use any algorithmic software. We advise our readers to exercise caution when dealing with this firm as seeing such negative comments while may not be enough can still indicate possible unfair action from the firm’s side. The firm recently changed the broker from EIghtCap to ThinkMarkets which is also a regulated broker. The firm has a 4.5 score on Trustpilot, but 10% of traders have rated the firm with 1 star. The firm was established in 2022 and is very young and loses points in this component.

The firm gets a 1.5 score in this section.

Bespoke Funding Program Funding and maximum capital allocation – 4

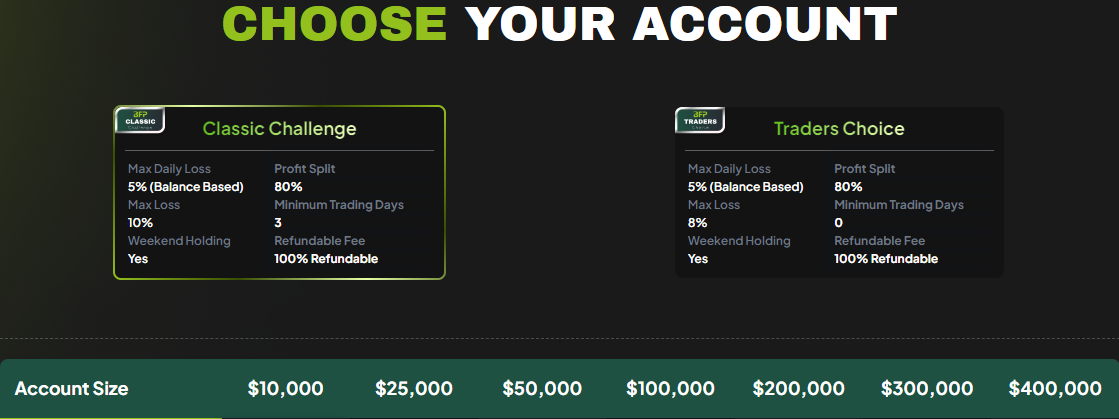

Bespoke Funding Program funded programs are offered through two funded account types, Classic Challenge and Trader’s Choice. Both accounts offer the same funding structure of 10k, 25, 50k, 100k, 200k, 300k, and 400k USD.

While Bespoke Funding Program funding options are the same for both accounts, the pricing and limits differ, making it possible to select a more suitable one depending on the strategy. Classic challenge has higher loss limits and costs more because of easier rules. `

Bespoke Funding Program challenges consist of 2 phases, after which a trader becomes a funded trader and can make and withdraw profits. Trades are closed automatically when traders reach profit targets. While this may seem great, it can limit maximum profits and traders’ performance.

The Bespoke Funding Program scaling plan is activated if the trader receives a payout of 8% or more within 4 months of trading, and at least 3 of those months were profitable. The original account balance is increased by 40% every time the scaling plan is activated. The maximum funding amount via scaling is capped at 2,000,000 USD.

The firm gets a 4 score in this section for offering diverse funding options.

Bespoke Funding Program Assets – 3.5

The Bespoke Funding Program offers several trading assets including Forex pairs, indices, commodities, and cryptos. The spreads vary depending on asset class and are usually within industry standards at 1.2 pips for major FX pairs. These spreads can be easily checked at the ThinkMarkets website, which is the regulated partner broker of the firm. There are no stocks available for trading, and all offered assets are in the form of CFDs. The firm loses points for not offering any other assets also resulting in a 3.5 score in this section.

Bespoke Funding Program Trading rules and limitations – 2.6

Bespoke Funding Program rules are similar to other prop firms, with average daily and maximum loss limits being within 5-8%. There are two accounts and the rules are slightly different for each of them.

The Classic Challenge accounts have the following limitations and goals:

- Phase 1 virtual profit target – 8%

- Phase 2 virtual profit target – 5%

- Max loss – 10%

- Daily loss limit – 5%

- Challenge leverage – 1:60

- Simulated trading days – unlimited

Traders Choice, on the other hand, has the following rules:

- Phase 1 virtual profit target – 8%

- Phase 2 virtual profit target – 5%

- Max loss – 8%

- Daily loss limit – 5%

- Challenge leverage – 1:100

- Simulated trading days – unlimited

The firm seems to be requiring standard rules and limits similar to many other prop firms, but some traders claim the firm had shut down multiple accounts for trading with EAs and other suspicious claims. We strongly advise traders to exercise extra caution with this firm.

Holding positions over the weekends is allowed. Stop loss is not required. Inactivity is only allowed for a maximum of 30 days. The firm also permits trading the news.

The firm gets a 2.6 score in this section.

Bespoke Funding Program Fees – 1.5

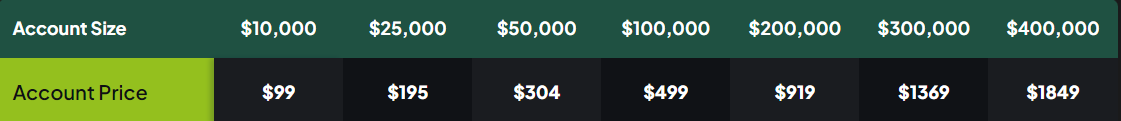

The one-time fees for funded accounts are competitive for both account types. However, the Traders Choice is cheaper as it has tighter rules and is as follows:

- Funded amount:10,000 USD – one-time fee: 99 USD

- 25,000 USD – 195 USD

- 50,000 USD – 304 USD

- 100,000 USD – 499 USD

- 200,000 USD – 919 USD

- 300,000 USD – 1369 USD

- 400,000 USD – 1849 USD

The fees are slightly higher at Classic Challenge:

- Funded amount:10,000 USD – one-time fee: 129 USD

- 25,000 USD – 239 USD

- 50,000 USD – 329 USD

- 100,000 USD – 529 USD

- 200,000 USD – 949 USD

- 300,000 USD – 1409 USD

- 400,000 USD – 1879 USD

Bespoke Funding Program free trial is not available at the moment, as all funded account challenges are purchasable with one-time fees.

Bespoke Funding Program free repeat is also not available and traders will have to pay the fees again to start over in case they break the rules.

The firm gets a 1.5 score in this section.

Bespoke Funding Program Platforms – 1.5

The firm offers MT4 and MT5 advanced trading platforms through its partner broker, ThinkMarkets. Despite being super advanced, there are limits imposed by the firm for traders when using them on funded accounts. EAs are prohibited and trading can only be done on the desktop platform.

For offering limited capabilities, the firm gets only a 1.5 score in this section.

Bespoke Funding Program Profit-Sharing – 1

The Bespoke Funding Program profit split is fixed at 80% and there is no possibility to increase it using any event, discount, or scaling plan.

Withdrawals are possible every 14 days or twice per month, which is not comfortable.

For not offering quick withdrawals and a 90% profit split, the firm gets a 1 score in this section.

Education and trading tools at Bespoke Funding Program – 0.5

Educational resources are lacking on the firm’s website as well, and there are no mobile apps for performance measures. There is a trader dashboard that offers limited capabilities, but not enough to learn anything about trading. No webinars, video tutorials, or trading courses are available, but a trader’s glossary to help newbies understand basic concepts. The firm seems to be targeting experienced traders.

As a result, the firm gets a 0.5 score in this section.

Customer Support at Bespoke Funding Program – 2.4

The firm offers live chat options and email support as the main support channels. Live chat is the quickest way to contact customer support personnel and resolve any issues. Both the website and support forms are available only in the English language, which is a downside of the firm. There is a FAQ section that covers basic topics. Live chat is responsive and the firm responds within a minute of contacting.

Bespoke Funding Program gets a 2.4 score in this section.

Frequently Asked Questions

Is the Bespoke Funding Program legit?

What are the minimum and maximum funding options at the Bespoke Funding Program?