Traders4Traders prop trading was founded by an experienced trader with over 30 years of experience as a professional trader. At least, that’s what the firm claims. The firm was launched back in 2009 as a trading educational provider company and grew to include proprietary trading as well. Funding options from Trader4Traders range from 100k to 1 million USD but lack lower funding options which is unfortunate.

In this Traders4Traders review, we are going to focus on the firm’s safety, assets, fees, rules, and many more. Our unbiased review will make it clear whether you can trust this prop firm or not.

Pros & cons of Traders4Traders prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to diverse markets of Forex, Equities, Stocks, Crypto, Commodities & Metals

- Experienced firm from 2009

- Lower fees for 25k accounts from 125 USD

Cons

- 1.9 score on the FPA

- Lacks multilingual support

- Tight daily loss limits at 2.5%

- Lower starting profit split of 75%

Quick rating of Traders4Traders and its features

| FPA Score | 1.907 (21 reviews) |

| Year founded | 2009 |

| Headquarters | Derbyshire, United Kingdom |

| Minimum audition fee | 125 USD |

| Fees on withdrawals | None |

| Minimum funded amount | 25,000 USD |

| Maximum funded amount | 1,000,000 USD |

| Allowed daily loss | 2.5% |

| Profit target | 8% |

| Maximum trailing drawdown | 5% |

| Profit sharing (Payouts) | 80% |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, Equities, Stocks, Crypto, Commodities & Metals |

Safety of Traders4Traders – 3

Traders4Traders reviews are mostly negative on the FPA, resulting in a low score of 1.9, indicating serious inefficiencies in the services. From the reviews. It seems the firm has a small team of few representatives, and it takes considerable time to connect with the personnel. So, in the FPA metric, the firm definitely loses points. It has to be noted, that FPA is a very reputable and honest platform and comments indicate the firm may not be as truthful as it seems at first glance. As for the experience and partner broker, Traders4Traders has been around since 2009. The main partner broker is EightCap which is a regulated broker, earning the firm some points.

Overall the firm gets a 3 score in safety which is a good score despite having serious negative comments on the FPA.

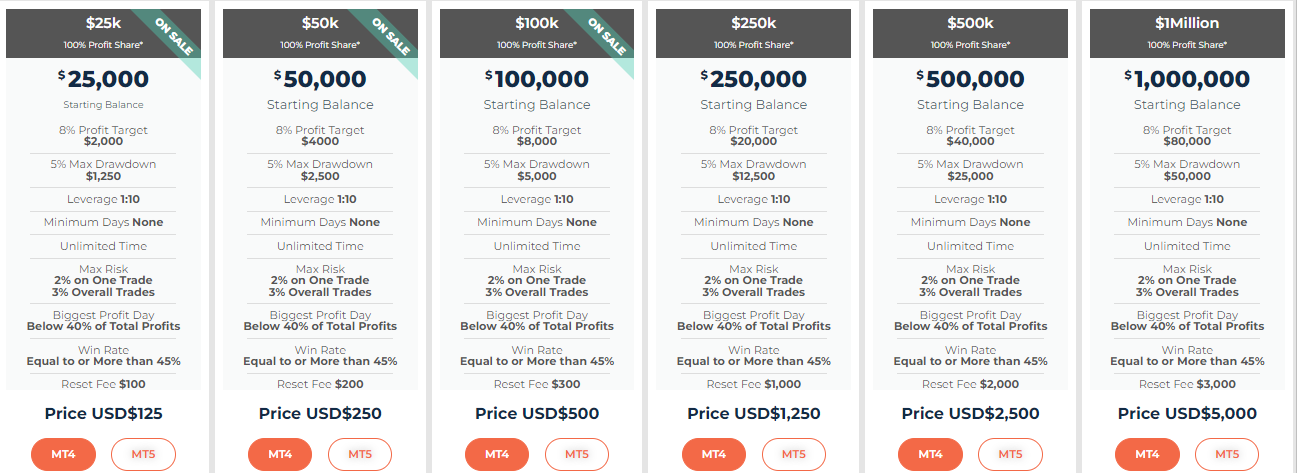

Traders4Traders Funding and maximum capital allocation – 3

Traders4Traders funded programs consist of three steps: practical assessment challenge, trading on a live account, and scaling the account up to 1,000,000 USD. The minimum Traders4Traders funding starts from 25,000 USD, which is a moderately high amount and there are no lower options for funding. The first stage of practical assessment to get the funded account requires traders to meet all the criteria and show their performance. After this phase, it is possible to start trading on the live account.

Traders4Traders challenge seems not different from the majority of prop firms and requires similar risk control limits, which we will discuss in more detail below.

Traders4Traders prop firm is not offering attractive minimum funded options as there are no 1, 5, or 10k funded accounts, but 25k accounts are cheap at 125 USD.

The firm offers a scaling plan, but the profits are included in the funding amount when the trader requests a scaling. Traders4Traders scaling plan is activated once the trader reaches 15% profits, and they request a scaling. This 15% is not withdrawable and is part of the scaled amount. There are several levels for achieving the maximum funded ceiling of 100k.

The firm gets a 3 score for not offering any lower funded accounts.

Traders4Traders Assets – 4.5

As the partner of the regulated Forex and CFDs broker EightCap, Traders4Traders also offers diverse trading assets including FX pairs, stocks, cryptos, commodities, and indices.

For offering diverse assets, we assess this section with a 4.5 score. The leverage is capped at 1:10 which is low.

Spreads are low at EightCap from 0 pips on EURUSD and commissions are also low, making it an attractive trading environment for funded traders.

Traders4Traders Trading rules and limitations – 2.4

Traders4Traders rules are similar to industry standards:

- Profit target – 8%

- Maximum drawdown – 5%

- Minimum trading days – None

- Time limits – None

- Maximum allowed risk on any one trade – 2%

- Max allowed risk on overall trades – 3%

- Biggest profit day – below 40% of total profits

- Minimum allowed win rate – equal to or above 45%

- Daily loss limit – 2.5%

- EAs allowed – Allowed

- Holding position over weekends – Not allowed

As we can see, risk limits and rules are tight and require significant effort from traders to pass the challenge and start trading for profits. All positions are required to have a stop loss for risk control. The 45% win rate requirement suggests that traders will have to win at least 45 trades out of 100 profitably, or they will have to reset the account.

Overall, Trader4Traders gets a 2.4 score in this section.

Traders4Traders Fees – 4

The fees for all funded amounts are as follows:

- Funded amount: 25,000 USD – One-time fee: 125 USD – Reset fee: 100 USD

- 50,000 USD – 250 USD – 200 USD

- 100,000 USD – 500 USD – 300 USD

- 200,000 USD – 1,000 USD – 800 USD

- 250,000 USD – 1,250 USD – 1,000USD

- 400,000 USD – 2,000 USD –1,600 USD

- 500,000 USD – 2,500 USD – 2,000 USD

- 800,000 USD – 4,000 USD – 3,200 USD

- 1,000,000 USD – 5,000USD – 3,000 USD

These fees may sometimes change or vary slightly depending on the policies but are generally very accurate.

Traders4Traders free repeat is only available for the live accounts and not the evaluation or challenge phase. If a trader wants to reset after breaking rules during the evaluation period, they will still have to pay a fee, while they can reset for free on live accounts at any time they request.

Traders4Traders free trial is not available as all challenges require fees, but the fees are low at 125 USD for 25k accounts.

The firm gets a 4 score in the fees department.

Traders4Traders Platforms – 5

The firm is a partner of EightCap and offers both MT4 and MT5 platforms. These platforms come with full functionality of manual and automated trading and are super popular among Forex traders. EAs are allowed and traders are free to install or develop their trading robots. They are also available for both desktop and mobile devices.

There is also a dashboard for each funded trader that helps to monitor risks and profit targets.

For offering full trading and performance measure capabilities, the firm gets a 5 score in this section.

Traders4Traders Profit-Sharing – 3

Traders4Traders profit split is 75%. The first 5% of profits are paid out with a 100% profit share for traders, and the split decreases to 75% after that. This percentage is possible to increase using a scaling plan. For the level 1 account the profit share is 75%, for level 2 it is increased to 80%, level 3 gives an 85% profit split, and finally, level 4 sets the profit share to 90%. Traders will have to achieve a 15% profit target to be eligible for scaling, which is not a low amount.

Payouts are given once a month and must be requested on the last working day of the month, and the firm will process and send payment on the first working day of the month.

Although there is the possibility of getting a 90% profit share, it will be extremely difficult to meet the requirements.

The firm gets a 3 score in this section.

Education and trading tools at Traders4Traders – 3

The firm offers trading masterclass courses both free and paid. Paid courses are more advanced and complete, provided by experienced traders. As the firm claims, they are searching for successful traders to give them findings and enable them to trade with much larger budgets. There is also a Forex fundamentals 101 course and trading blog. The free resources are not enough for beginners to start from zero. Traders will have to purchase courses to start learning from the beginner stages.

Other than trading courses, the firm also offers mentoring and coaching services. There is also a comprehensive FAQ section covering all the important concepts of FX trading.

There are no educational videos, but there are plenty. The trader’s dashboard offers some tools for tracking the performance of the trader.

Overall, we give the firm a 3 score in this section.

Customer Support at Traders4Traders – 3.6

The firm provides its traders with 24/5 support that includes email support, live chat, and phone support. Phone support increases the firm’s legitimacy, as many obscure firms usually do not offer their number.

Both the website and all forms of support are only provided in the English language, which is a downside.

The firm gets a 3.6 score in this section, losing points for lacking multilingual support.

Frequently Asked Questions

Is Traders4Traders legit?

What are the minimum and maximum funding options at Traders4Traders?

What is the profit-sharing structure at Traders4Traders?